David Bassanese

Betashares Chief Economist David is responsible for developing economic insights and portfolio construction strategies for adviser and retail clients. He was previously an economic columnist for The Australian Financial Review and spent several years as a senior economist and interest rate strategist at Bankers Trust and Macquarie Bank. David also held roles at the Commonwealth Treasury and Organisation for Economic Co-operation and Development (OECD) in Paris, France.

7 minutes reading time

- Currency hedged

- International shares

As the sixth largest economy in the world, with long historical ties to Australia, the UK offers a useful diversification opportunity for Australian investors, providing access to a number of leading businesses listed on one of the world’s largest stock exchanges, the London Stock Exchange (LSE).

What’s more, as in Australia, UK companies tend to offer relatively attractive dividend returns – meaning Australian investors can achieve an element of global diversification without unduly sacrificing income returns.

In order to provide access to these opportunities, Betashares launched the F100 FTSE 100 ETF in July 2019 – the first UK-specific ETF on the ASX. By tracking the UK’s well-known FTSE 100 Index, F100 is designed to provide cost-effective exposure to the 100 largest companies by market capitalisation traded on the LSE.

So as to provide investors with an opportunity to invest in these companies while seeking to minimise the impact of currency fluctuations, Betashares has recently launched the H100 FTSE 100 Currency Hedged ETF .

Well-known leading global companies

First and foremost, F100 offers Australian investors an attractive source of global diversification via access to a portfolio of market-leading businesses, many of which can only be accessed via the UK sharemarket.

F100’s top holdings include 100 global household names listed in the UK such as the world’s largest energy company, Shell; one of the world’s largest financial institutions, HSBC; multi-national pharmaceutical company AstraZeneca; and global beverage brand, Diageo, owner of brands such as Johnnie Walker and Guinness.

FTSE 100 Index: Top-ten weights as at 18 October 2023

| Company Name | % |

| Shell | 9.6 |

| AstraZeneca | 8.6 |

| HSBC Holdings | 6.7 |

| Unilever | 5.2 |

| BP | 4.9 |

| Diageo | 3.6 |

| GSK | 3.1 |

| Glencore | 3.0 |

| Rio Tinto | 2.9 |

| British American Tobacco | 2.9 |

Source: Bloomberg. No assurance is given that these companies will remain index constituents or will be profitable investments.

Diversification benefits

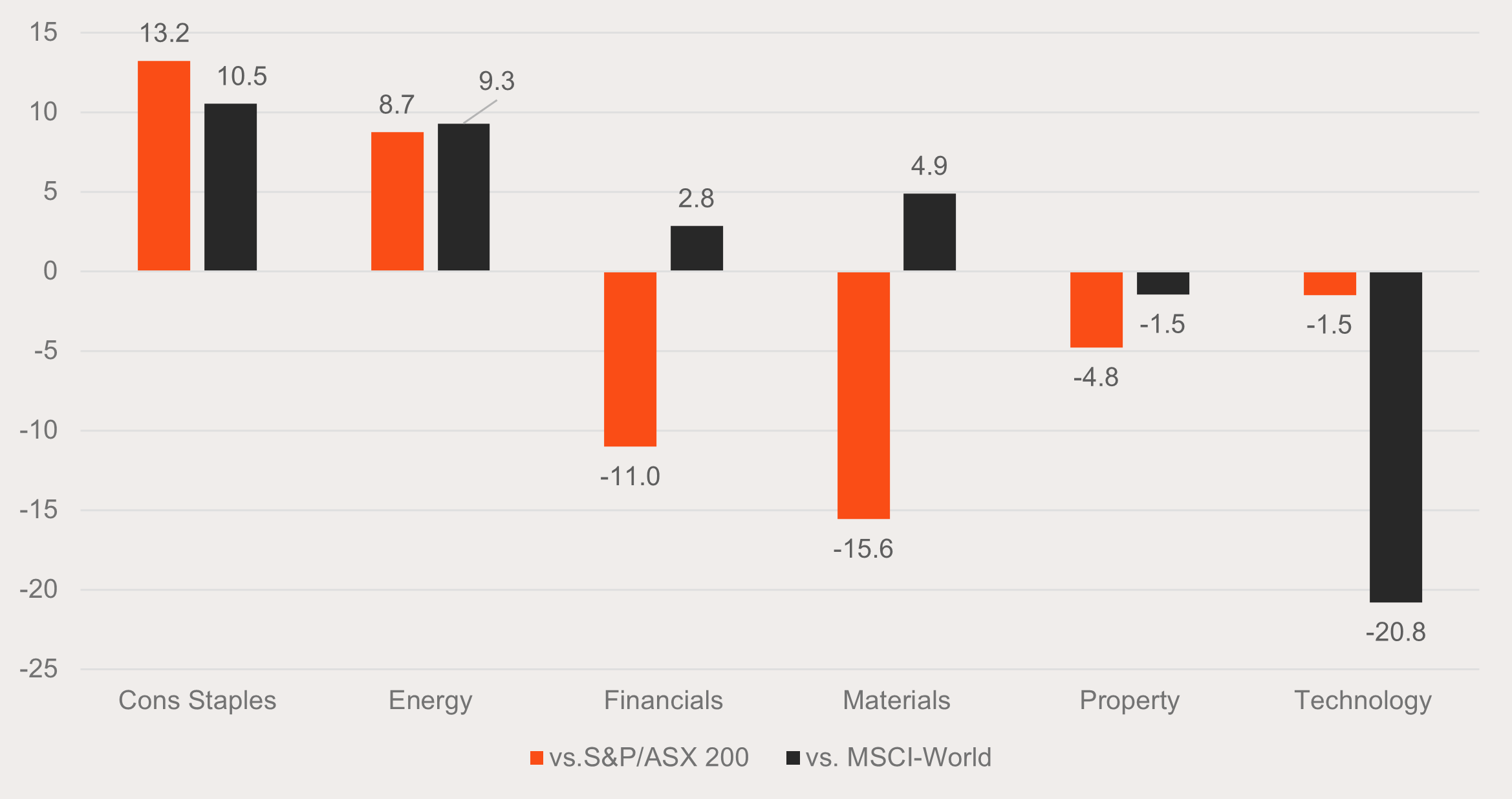

As evident in the chart below, the UK market offers useful elements of sector diversification. Compared to the Australian and broader global market, the UK market tends to have a higher exposure to companies in the consumer staples and energy sectors.

In the case of Australia, this is offset by lower UK exposure to the financials, materials and property sectors – and lower exposure to the technology sector when the UK is compared to the broader global market.

Industry sector weight differences: FTSE 100 Index vs S&P/ASX 200 Index and MSCI Developed World Index: As at 18 October 2023

Source: Bloomberg.

Value opportunity

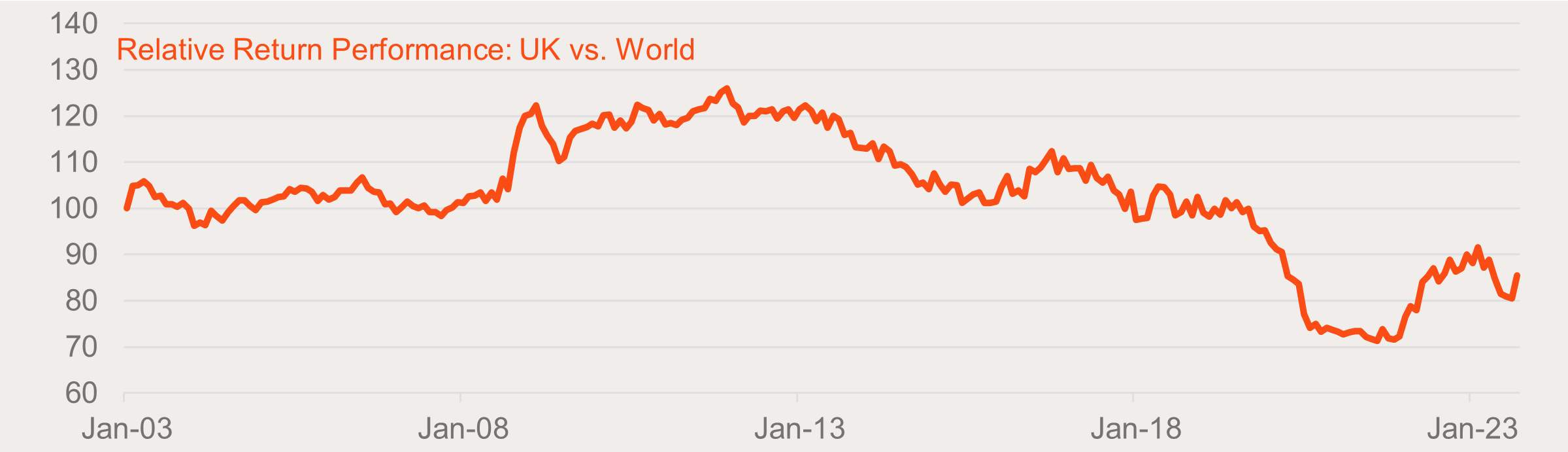

As seen in the chart below, the UK market broadly matched global equity performance over the past decade or so, though has lagged somewhat since the onset of the COVID crisis in early 2020. In turn, this has largely reflected the relatively strong rebound in global technology companies, especially those based in the US. Along with Australia, the UK did enjoy a period of relative outperformance over 2022 when rising bond yields especially hurt the interest-rate sensitive technology sector.

As a value play, the UK market is likely to perform relatively well when and if there is a rotation back to global value stocks over growth stocks. This could arise if the risk of global recession dissipates and there is a period of ‘catch-up’ by relatively cheap global value stocks.

Relative return performance: FTSE 100 Index vs MSCI Developed World Index: Jan-03 to Sep-23*

Source: Bloomberg. *Indices = 100 as at 31-Jan-2003. Shows performance of index, not ETF, and does not take into account ETF’s fees and costs. Past performance is not indicative of future performance. You cannot invest directly in an index.

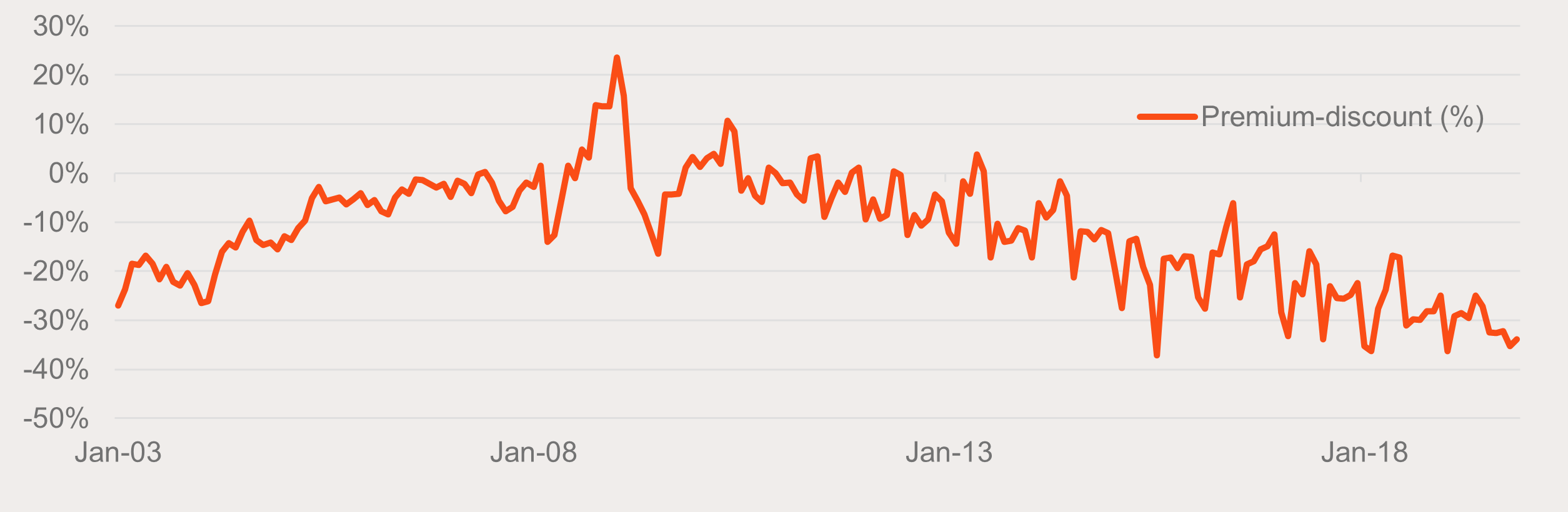

Indeed, the strong performance in global growth over value in recent years has left the UK market historically cheap relative to the overall global equity market. As seen in the chart below, the FTSE 100’s price-to-book value by end-September 2023 was trading at a substantial 34% discount to developed world equities – compared with an average discount since early-2003 of only 17%.

Price-to-book value: FTSE 100 Index vs MSCI Developed World Index – Jan-03 to Sep-23

Source: Bloomberg. Past performance is not indicative of future performance.

Attractive income opportunity

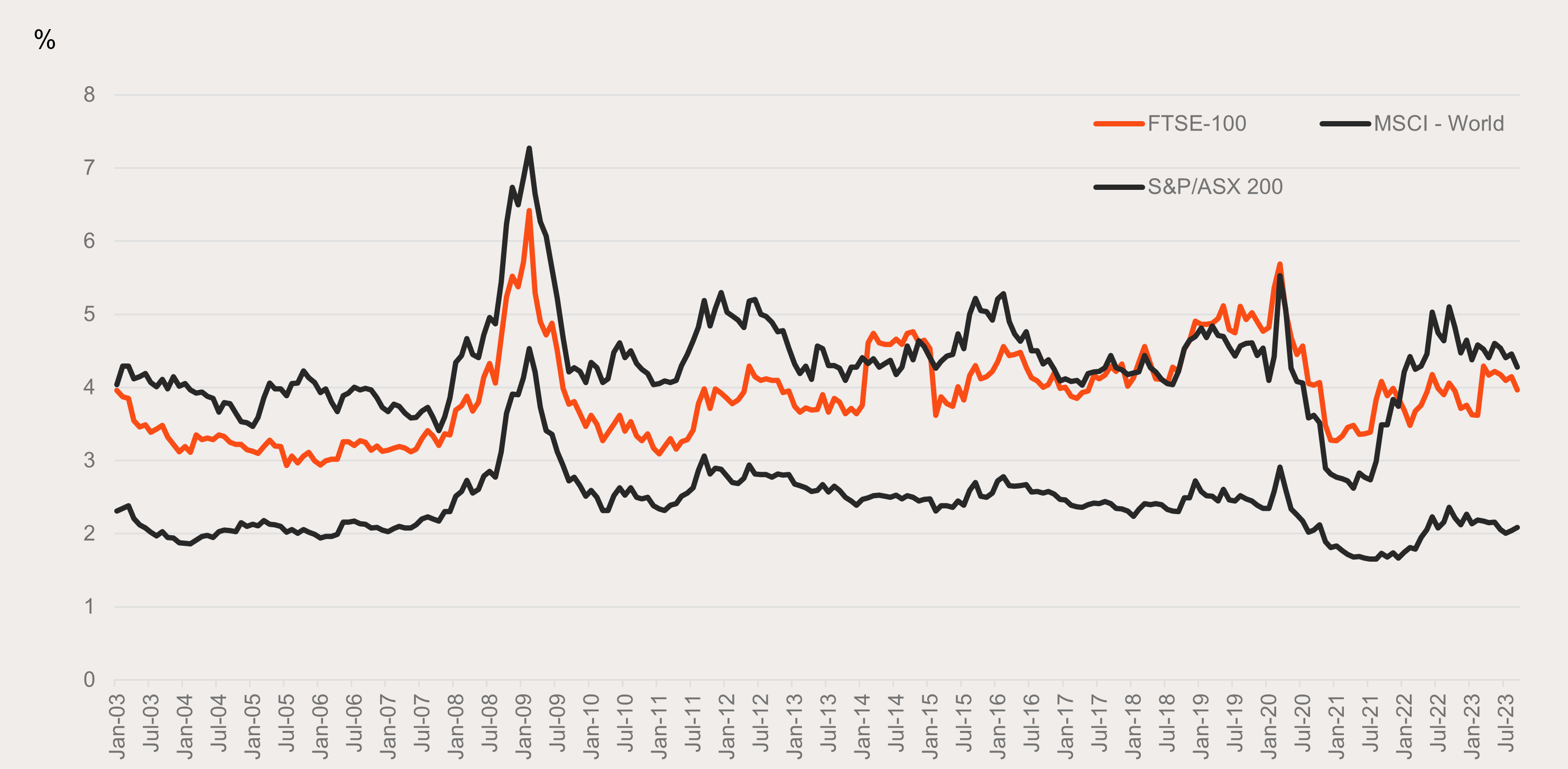

Another notable attraction of the UK market, especially for income-seeking Australian investors, has been its relatively high income returns by global standards. As shown in the chart below, the average annual dividend yield for the FTSE 100 Index was 4.0% for the 20-year period ending September 2023, compared with 4.3% for the S&P/ASX 200 Index and 2.1% for the global MSCI-ACWI benchmark index.

The FTSE 100’s dividend yield has consistently been above that of the global benchmark index, and in recent years has even been competitive with that of the Australian market (before consideration of franking credits).

Net dividend yields: UK, Australia and the world – Jan-03 to Sep-23

Source: Bloomberg. Past performance is not indicative of future performance. You cannot invest directly in an index.

Currency hedged option

While F100 offers exposure to leading UK companies priced in British pounds, its currency hedged equivalent, H100, offers investors the potential to minimise the impact of the currency variable on the investment equation through hedging.

Currency fluctuations can have a significant impact on the returns from an unhedged investment. In periods when the British pound is falling against the Australian Dollar, an unhedged investment may underperform an equivalent currency hedged approach. Equally, in periods when the British pound is rising against the Australian Dollar, unhedged exposures may outperform equivalent hedged exposures.

The main aim of currency hedging is not so much to take a position that the British pound will strengthen (although investors who are of this view can use unhedged investments to express that view), but rather to achieve a ‘purer’ exposure to the performance of the companies in the portfolio, seeking to minimise the influence of exchange rate movements, and substantially reducing a source of uncertainty.

Above: Betashares at the London Stock Exchange.

Conclusion

F100 and H100 offer Australian investors an opportunity to add further global diversification to their portfolios, with exposure to some of the world’s leading companies across a range of sectors. Compared to the Australian and global market, the UK market offers greater exposure to more value-orientated sectors such as consumer staples and energy.

Given its strong exposure to value sectors, the UK market has the potential to benefit from any global rotation back into value over growth stocks.

The UK also offers diversification from an income perspective, historically providing an attractive dividend yield by global standards and not far below that of Australia.

-

F100

FTSE 100 ETF

-

H100

FTSE 100 Currency Hedged ETF

There are risks associated with an investment in H100, including market risk, international investment risk, concentration risk and currency hedging risk. Investment value can go up and down. An investment in the Fund should only be made after considering your particular circumstances, including your tolerance for risk. For more information on risks and other features of the Fund, please see the Product Disclosure Statement and Target Market Determination, both available on this website.

This article mentions the following funds

David is responsible for developing economic insights and portfolio construction strategies for adviser and retail clients. He was previously an economic columnist for The Australian Financial Review and spent several years as a senior economist and interest rate strategist at Bankers Trust and Macquarie Bank. David also held roles at the Commonwealth Treasury and Organisation for Economic Co-operation and Development (OECD) in Paris, France.

Read more from David.

1 comment on this

RECEIVED AND LOOK FORWARD TO MORE.