The impact of the US Inflation Reduction Act on trade, politics and the global transition to a low-emissions economy.

Sir Winston Churchill once famously said, “You can always count on Americans to do the right thing – after they’ve tried everything else”. The US Inflation Reduction Act (IRA) has nothing to do with inflation and everything to do with climate change, US jobs and votes. It is arguably the most important climate change legislation ever enacted. The bill was signed by President Biden on August 16, 2022, and in the year since, it has completely changed the landscape for investment in clean technology.

What is the Inflation Reduction Act?

Unlike Australia’s Safeguard Mechanism, the IRA adopts a carrot rather than stick approach to emission reductions. It has earmarked a total of US$369 billion to programs to support energy production and reduce greenhouse gas emissions. The major provisions include1:

- Provisions to lower energy costs through consumer rebates, tax credits and grants.

- Financial assistance in the form of loans, tax credits and grants to promote domestic energy production and advanced manufacturing.

- Investments to reduce emissions from a host of high-emitting sectors, with a particular focus on electricity production, transportation, industrial manufacturing, buildings, and agriculture.

- Promoting equity and environmental justice by targeting emissions-reducing investments in historically disadvantaged communities.

- Investments in rural communities to promote climate-smart agricultural practices, wildfire resilient forests, and sustainable biofuels.

Controversially, the IRA did contain some limited support for oil and gas, however it has been estimated that for every ton of new emissions generated by the IRA’s oil and gas provisions, at least 24 tons of emissions will be avoided2.

To understand just how impactful the IRA is, it is probably worth thinking about the example of a hypothetical farmer in the US considering generating a new income stream by installing a 1MW (megawatt) solar farm, which would cost around US$1 million. Panels can be located on frames around 10 feet (3 meters) above the ground which allows cattle or sheep to graze under them. A 1 MW solar farm requires around 6-8 acres (2.5 – 3.2 hectares) of land3.

Overhead view of solar panels on a farm field

Source: Civil Eats

Under the IRA, this investment would be eligible for a 30% transferable tax credit, i.e., if the farmer/developer can’t use the tax credit, it can be transferred or sold. Additionally, if the developer uses components that have 40% US domestic content (or from a country with which the US has a free trade agreement), the project is eligible for an additional 10% tax credit. On top of that, the IRA has introduced a tax credit on solar energy of 2.5 cents/kWh for the first ten years of the project’s life.

For a 1MW solar farm, that equates to around US$500,000 over the life of the project. Effectively, over the life of the solar farm, the IRA will fund 90% of project costs. And finally, if that is not enough, under certain circumstances, the Department of Agriculture (USDA) will provide concessional loans to fund the up-front capital expenditure4. It is little wonder that all over the US, solar projects are being developed as fast as capacity allows.

President Biden signing the Inflation Reduction Act

Source: Mining Technology

Federal subsidies are being supported by state-based incentive packages, as US states compete to secure the green jobs on offer. The state of Georgia offered a US$358 million incentive package to Norwegian battery company Freyr for its US$2.6 billion battery gigafactory, and US$1.8 billion to secure Hyundai-Kia’s first US electric vehicle assembly plant5.

The acceleration in investment in the US clean economy has been astonishing. The American Clean Power Association reports that, over the last year, the private sector has announced investments of over US$270 billion in domestic utility-scale clean energy—surpassing the total investment in US clean power projects for the prior eight years and generating just under 30,000 new manufacturing jobs6. The Solar Energy Industries Association counts over $100 billion in solar investments, and the White House has tracked private investments of more than $70 billion in US manufacturing facilities to support electric vehicle supply chains7. Goldman Sachs estimates the IRA will unlock US$3 trillion in private sector investment over the next decade8.

For clean tech companies, the environment has never been more attractive or conducive to scaling operations.

Global implications

The IRA prioritises the US domestic economy and those countries with which the US has signed a free trade agreement (FTA), which includes Australia. A somewhat unspoken objective of the IRA is to address the dominance of China in several clean technologies and the supply of critical minerals. While no direct reference is made to China, the IRA mentions ‘foreign entities of concern’.

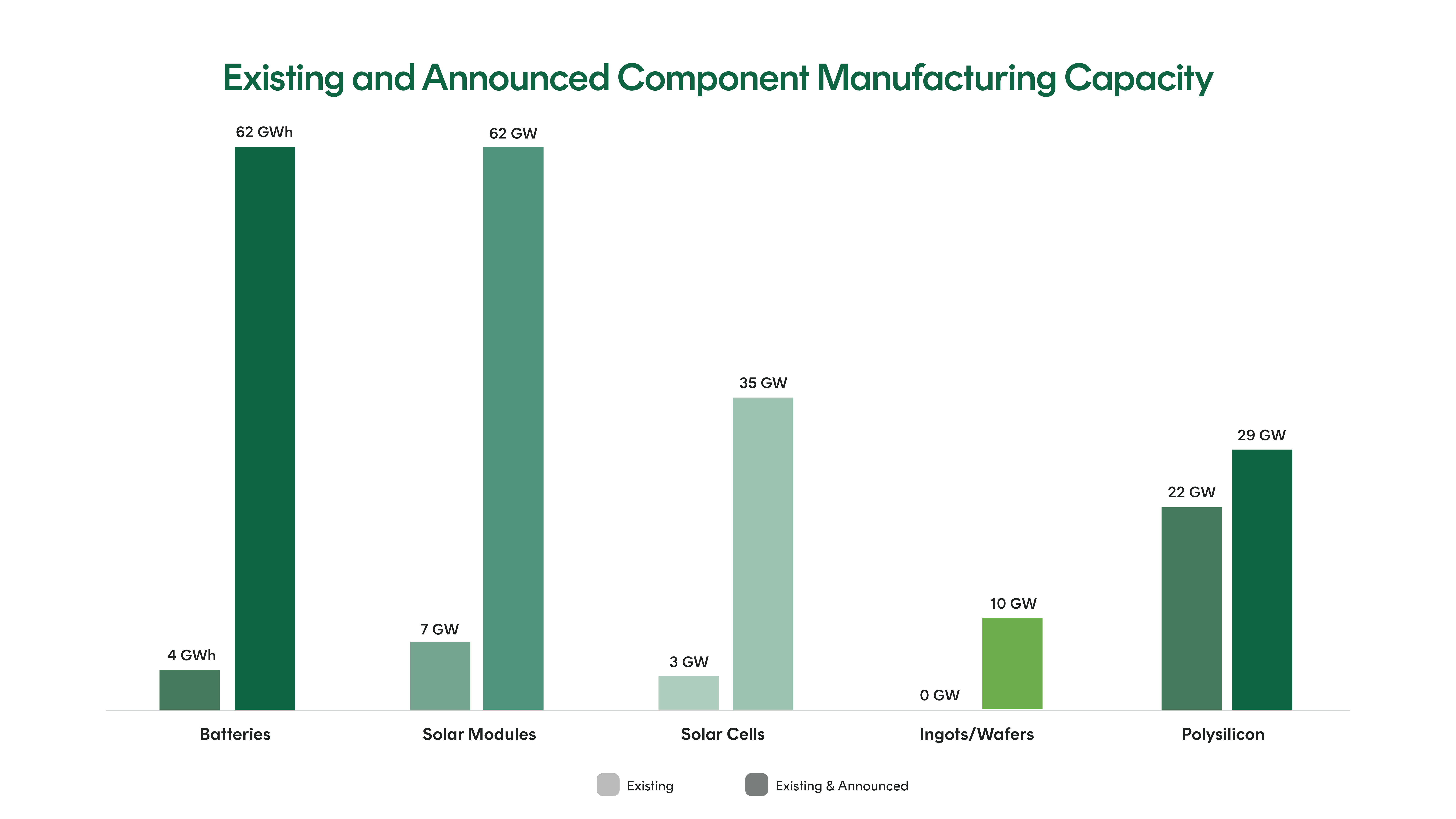

In the 12 months to the end of October 2023 , approvals have been granted for 83 new clean tech manufacturing facilities9. These are expected to see a more than tenfold increase in the US manufacturing capacity for batteries, solar panels, and upstream components such as solar cells, wafers and polysilicon, all areas currently dominated by China. Source cleanpower.org Clean Energy Investing Report

Source cleanpower.org Clean Energy Investing Report

But China is not the only economy impacted by the IRA. In June this year, German Vice-Chancellor Robert Habeck described the IRA as ‘like a declaration of war’10.

“The [Americans] want to have the semiconductors, they want the solar industry, they want the hydrogen industry, they want the electrolysers,”

Robert Habeck, German Vice-Chancellor

The IRA poses threats to the economies of America’s allies in Europe and Asia. Coming on top of the CHIPS and Science Act , the IRA is perceived as a return to protectionism because it provides incentives for companies to shift manufacturing operations to the United States. In 2022, €135 billion of business investment flowed out of Germany alone, while only €10.5 billion came in. Japanese companies Panasonic, Toyota, Honda, Bridgestone, and others have all announced intentions to develop facilities in the US. This comes at a time when unity in the face of increasing global security concerns is of critical importance.

The EU, Japan and South Korea have all reacted to the IRA by introducing subsidies to their own clean tech and clean energy sectors to protect their own industries and attract new investment. India has made a massive investment in solar capacity and implemented tariffs on imports. The country has committed to achieving 500GW of installed renewable power capacity by 203011.

South Korea, which has close security ties and an FTA with the US, is in a particularly complex position. Manufacturers like Hyundai-Kia, which were gaining EV market share in the US, stand to lose out. Sales of the popular Hyundai-Kia crossover EV SUV, the IONIQ 5/EV6, fell from 37,000 in the first three quarters of 2022 to just 7,400 in the fourth quarter, when incentives on locally manufactured vehicles came into effect in the US12.

Hyundai IONIQ 5

Source hyundai.com

In contrast, Korean battery makers Samsung SDI, LG Energy and SK Innovation will stand to collect an annual subsidy from the US taxpayer of upwards of US$8 billion from the IRA’s “advanced manufacturing production credit” alone.

“Selling wool and buying jumpers” – Australia at a crossroads

In 2022, coal, oil and gas represent around 43% of Australia’s export earnings13. A rapid acceleration in the global transition to low emissions has serious implications for the Australian economy and our standards of living. Australia is a major producer of critical minerals, and in May this year, Australia and the US entered into a pact to share resources and coordination on clean energy policy and investment. Australia and the US will now formally work together to expand and diversify clean energy and develop the supply of critical minerals used in low-emissions technologies14.

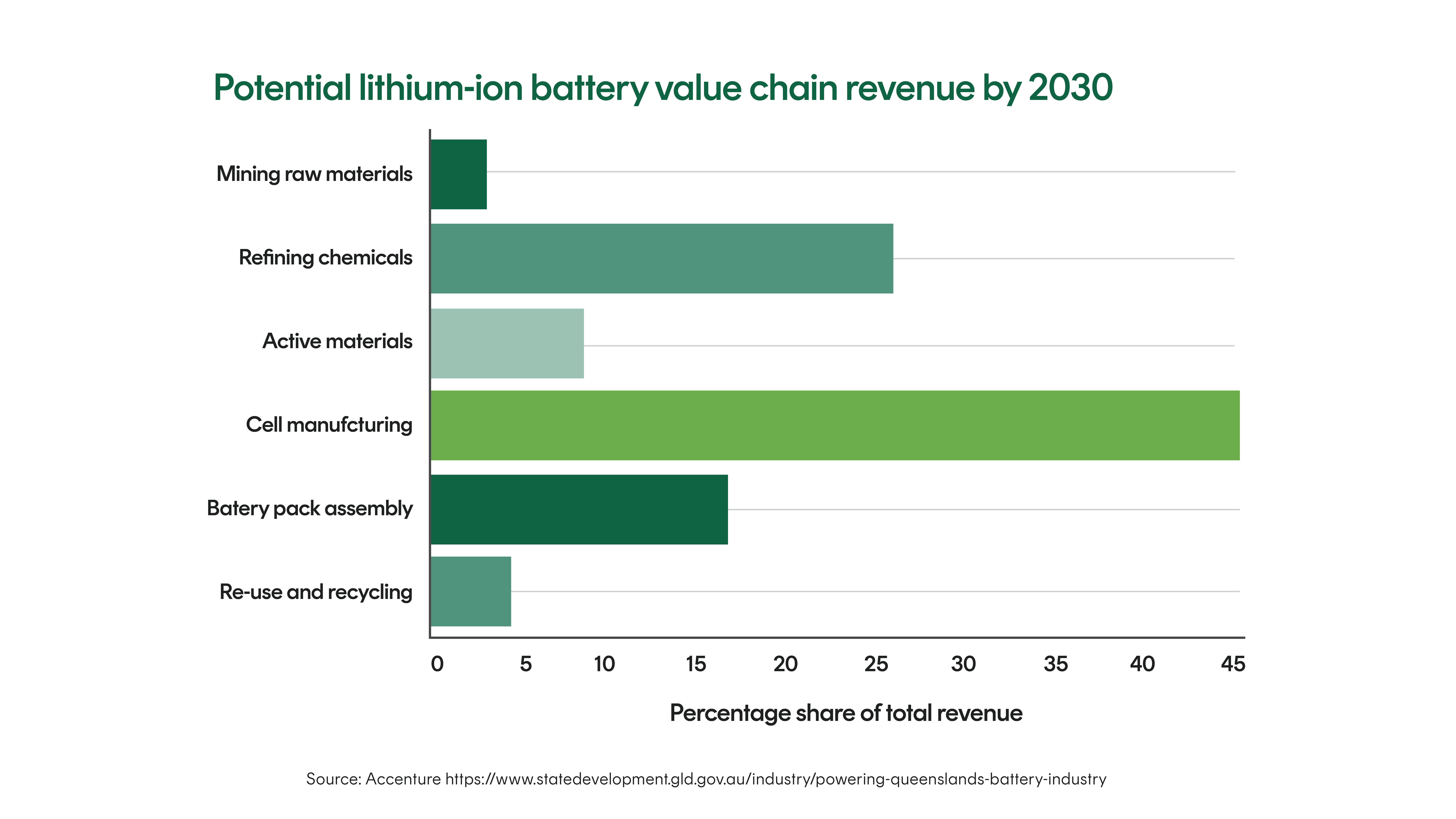

While the IRA and the Critical Minerals and Clean Energy Compact will see increased demand for Australian lithium, cobalt and other battery materials, the export of critical minerals and transition metals alone will not replace Australia’s export earnings from fossil fuels. To do that, Australia must invest in the development of downstream capacity, moving beyond the mining of raw materials to the refining of minerals and the manufacture of battery cells, as well as clean materials such as green steel and aluminium.

Potential lithium-ion battery value chain revenue by 2030

Source: Accenture http://www.statedevelopment.qld.gov.au/industry/powering-queenslands-battery-industry

According to CSIRO principal research scientist Adam Best, once battery manufacturing capacity is established overseas, it will be far more difficult to build here. The window of opportunity to establish these industries is short, and the rest of the world is moving faster than Australia15.

Australia is making some progress. Tianqi Lithium Energy Australia, a joint venture between Chinese based Tianqi and Australian lithium and nickel miner IGO, owns and operates a lithium hydroxide refinery at Kwinana, south of Perth. Having come online in 2022, this is the only facility of its type outside China.

Tianqi Kwinana lithium processing plant

Figure 1: Source Tianqui Lithium

Recharge Industries, an Australian startup owned by US company Scale Facilitation, has plans to build a battery gigafactory in Geelong, Victoria. Those plans may now be under a cloud following raids by Australian Federal Police investigating alleged taxation fraud16</16>.

Australia needs to do much more or risk being left behind in the race for new industries. In September this year, a group of organisations at the Australian Renewables Industry Summit in Canberra called on the Federal Government to commit to a ten-year $100 billion Renewables Industry Package.

“A $100 billion package will help re-industrialise the nation, create hundreds of thousands of jobs, diversify our export base and revenue streams as well as increase local value-added production, secure supply chains and develop sovereign manufacturing capabilities. This is climate policy as economic policy as national security policy – in the 21st century, these are fundamentally linked.”

– Tim Buckley, Founder, Climate Energy Finance.

The US Inflation Reduction Act has changed the world more than any other clean energy government policy in history. For clean tech companies, it provides a once-in-a-generation opportunity to scale operations and will provide a tailwind for investment for the coming decade. It also signals a return to protectionism and national self-interest and will place strains on international relations at a time when tensions are already raised. For Australia, it creates opportunities and risks. The stakes couldn’t be higher.

1. https://www.insideenergyandenvironment.com/2022/07/accelerating-efforts-to-decarbonize-the-economy-and-address-climate-change/

2. https://www.forbes.com/sites/energyinnovation/2022/08/02/the-inflation-reduction-act-is-the-most-important-climate-action-in-us-history/?sh=5b2ae4d7434d

3. https://coldwellsolar.com/commercial-solar-blog/how-much-investment-do-you-need-for-a-solar-farm/#:~:text=A%201MW%20(megawatt)%20solar%20farm,and%20maintain%20than%20solar%20farms.

4. https://www.farmraise.com/blog/solar-power-farmers-new-crop

5. https://www.ft.com/content/61431f7d-06c5-439d-81d8-662419dc4cb4

6. https://cleanpower.org/resources/clean-energy-investing-in-america-report/

7. https://www.whitehouse.gov/briefing-room/statements-releases/2023/08/16/fact-sheet-one-year-in-president-bidens-inflation-reduction-act-is-driving-historic-climate-action-and-investing-in-america-to-create-good-paying-jobs-and-reduce-costs/

8. https://www.goldmansachs.com/intelligence/pages/the-us-is-poised-for-an-energy-revolution.html#:~:text=The%20U.S.%20Inflation%20Reduction%20Act,according%20to%20Goldman%20Sachs%20Research.

9. Source: cleanpower.org Clean Energy Investing Report

10. https://www.ft.com/content/4bc03d4b-6984-4b24-935d-6181253ee1e0

11. https://energy.economictimes.indiatimes.com/news/renewable/india-slashes-solar-imports-from-china-as-domestic-manufacturing-thrives/103649776?action=profile_completion&utm_source=Mailer&utm_medium=newsletter&utm_campaign=etenergy_news_2023-09-14&dt=2023-09-14&em=dGltQGNsaW1hdGVlbmVyZ3lmaW5hbmNlLm9yZw==

12.https://www.latimes.com/business/story/2023-02-28/hyundai-kia-ev-ira-biden-ioniq#:~:text=Under%20the%20act%2C%20only%20electric,signed%20the%20bill%20in%20August.

13. https://tradingeconomics.com/australia/exports-by-category

14. https://www.whitehouse.gov/briefing-room/statements-releases/2023/05/20/australia-united-states-climate-critical-minerals-and-clean-energy-transformation-compact/

15. https://www.abc.net.au/news/science/2023-05-23/how-batteries-are-made-in-australia-mining-to-manufacturing/102356832

16. https://www.innovationaus.com/recharge-industries-gigafactory-plan-remains-under-massive-cloud/

Ex Suncorp, Russell Investments, QIC and Mercer. Past Director of the Investment Management Consultants Institute (IMCA) and Management Committee of the Investor Group on Climate Change (IGCC)

Read more from Greg.

2 comments on this

great article

Terrific article, if only people in ‘high places’ would pay attention.

I grew up in the US and I know once they get started they move really fast and this is no different. I knew when Biden got this IRA through (and when I understood what it was) …another clever move (nobody really knew what it was) …the point is Biden is actually doing what Trump keeps claiming … Biden will make America great again but unfortunately the Americans don’t seem to see it. In addition, WE need to get moving or it will be too late. I love Aus but this is one thing that frustrates me enormously, we are too slow to see the opportunities, and don’t back them when we should.

Denise Watson