Bitcoin broke through US$35K and traded higher, along with the broader crypto market over the last seven days to 5 November, marking a fresh yearly high. The bitcoin price rose to US$35,084, with Ethereum outperforming bitcoin, up 5.62% vs bitcoin’s 2.88% increase. Bitcoin’s market capitalisation rose to US$685.2 billion, with the total crypto market cap at US$1.32 trillion. Bitcoin’s market dominance is now 52.2%. Flows moved into altcoins as bitcoin traded in a tight range.

| Price | High | Low | Change from previous week | |

| BTC (in US$) | $35,084 | $35,778 | $34,113 | 2.88% |

| ETH (in US$) | $1,880 | $1,891 | $1,780 | 5.62% |

Source: CoinMarketCap. As at 5 November 2023. Past performance is not indicative of future performance. Performance is shown in US dollars and does not take into account any USD/AUD currency movements.

Source: Glassnode. Past performance is not indicative of future performance.

Crypto news we’re watching

8 to 10 spot bitcoin ETF applications under review

US Securities and Exchange Commission Chairman, Gary Gensler, said there are 8 to 10 filings of possible spot bitcoin ETFs being considered. Over the last two weeks, the price of bitcoin has rallied from US$28K to $35K on reports that a spot bitcoin ETF in the US is imminent. Currently there are only futures-based bitcoin ETFs.

Some of the companies with applications pending are BlackRock, Ark, Bitwise, WisdomTree, Fidelity and Invesco.1

Over $1 billion in daily transactions for JPM Coin

J.P. Morgan’s JPM Coin is a blockchain-powered stablecoin pegged to the US dollar and was designed to facilitate instant payments. Takis Georgakopoulos, Global Head of Payments, recently stated in an interview with Bloomberg TV that JPM Coin now processes over US$1 billion in daily transactions. He indicated that the coin is being used for institutional needs and offers a solution to the drawbacks of existing payment systems, such as low speed, having inconvenient cut-off times, and delays in payments, by providing 24/7 efficiency, cost-effectiveness, instantaneous transactions and programmable payment methods.

Georgakopoulos stated the next step is to offer a retail version of this coin to bring the same efficiencies to consumers.2

Microstrategy now holds 158,400 BTC

According to a press announcement with the firm’s Q3 2023 Earnings Presentation, the firm’s founder Michael Saylor, revealed that it had purchased an additional 155 BTC for US$5.3M in October which takes the company’s total holdings to 158,400 BTC. Holding bitcoin as part of its treasury holdings is part of the firm’s crypto investment strategy. Microstrategy is currently the largest publicly-listed corporate holder of bitcoin.3

Microstrategy Inc provides business intelligence software and related services. The company provides a platform that enables departments and enterprises to deploy web-based reporting and analysis solutions.

Microstrategy Inc is currently held in the Betashares Crypto Innovators ETF (ASX: CRYP).

On-chain metrics

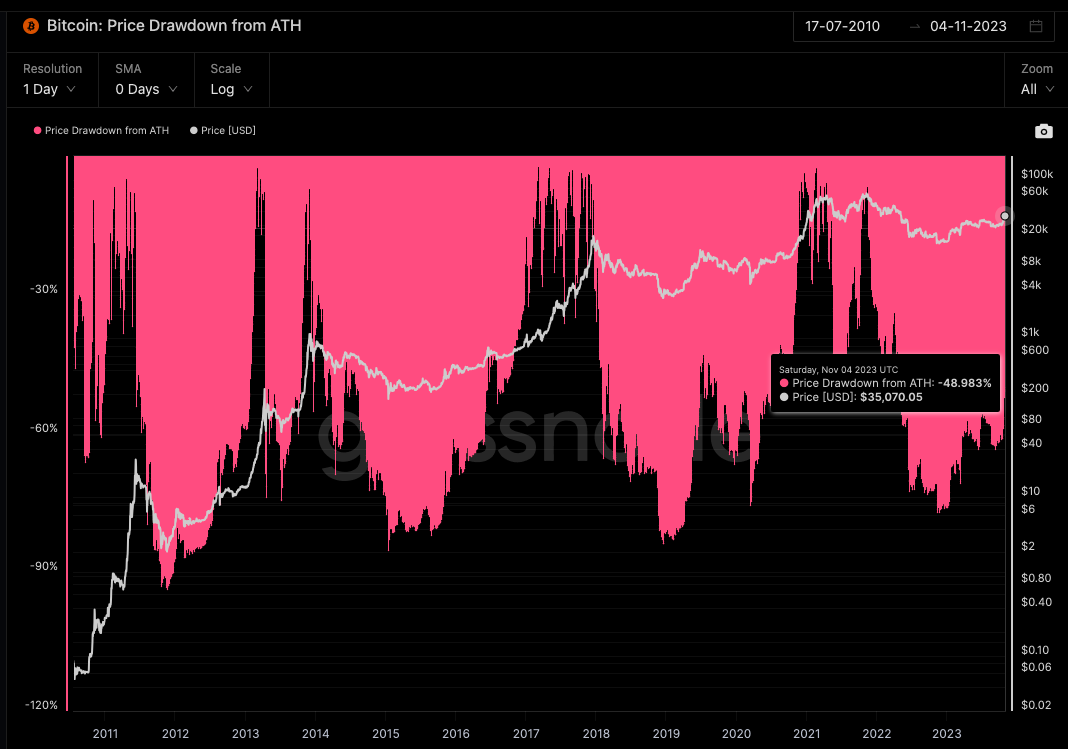

Bitcoin: Price Drawdown from ATH

This metric displays the percentage drawdown of the asset’s price from the previous all-time high.

According to data from Glassnode, after hitting a drawdown of -76% almost a year ago, the price has bitcoin has rebounded and has a current drawdown of -48.9% from the previous ATH.

Source: Glassnode. Past performance is not indicative of future performance.

This metric shows realised price by taking the the realised cap divided by the current supply. The realised cap considers the price at which each coin last moved, making it a useful metric for estimating the true economic weight, or the global wealth stored in the asset.

According to data from Glassnode, realised price is $20,685 placing the majority of holders in a positive position.

Source: Glassnode. Past performance is not indicative of future performance.

Altcoin news

The top-performing Top 20 altcoin over the seven days to 5 November was Solana (SOL), returning just over 28%. Helping push the price higher was the testnet launch of Solana’s scaling solution, Firedancer.

Firedancer is aimed at increasing speed, reliability and validator diversity. The scaling solution could also be a fix for the blockchain’s past network outage problems4. Solana has been dubbed the “Ethereum killer” and is designed to provide smart contract functionality.

Investing in crypto assets or companies servicing crypto-asset markets should be considered very high risk. Exposure to crypto assets involves substantially higher risk when compared to traditional investments due to their speculative nature and the very high volatility of crypto-asset markets.

Investing in crypto assets or crypto-focused companies is not suitable for all investors and should only be considered by investors who (i) fully understand their features and risks or after consulting a professional financial adviser, and (ii) who have a very high tolerance for risk and the capacity to absorb a rapid loss of some or all of their investment. Any investment in crypto assets or crypto- focused companies should only be considered as a very small component of an investor’s overall portfolio.

References:

1. https://www.reuters.com/business/finance/sec-has-8-10-filings-possible-bitcoin-etf-products-gensler-2023-10-26/

2. https://cryptopotato.com/jpmorgans-jpm-coin-processes-over-1-billion-in-daily-transactions-report/

3. https://news.bitcoin.com/microstrategy-expands-bitcoin-trove-total-holdings-now-stand-at-158400-btc/

4. https://cointelegraph.com/news/solana-sol-price-gains-october-firedancer-testnet-goes-live

Past performance is not indicative of future performance.

Off the Chain is published every second Tuesday. It provides the latest news on bitcoin and the rest of the crypto market, along with analysis and insights into the world of crypto.

It provides general information only and is not a recommendation to invest in any crypto asset, crypto-focused company or investment product.

This article mentions the following funds

Written by

Justin Arzadon

Director, Adviser Services & Head of Digital Assets.

C4 Certified Bitcoin Professional (CBP) and Blockchain Council Certified Bitcoin Expert™ with over 18 years’ experience in the ETF market. Passionate about the future of money.

Read more from Justin.