Bitcoin made a new all-time high, hitting over US$73K, however could not hold those gains and finished the week lower along with the broader crypto market. Bitcoin was down 6.47%, while Ethereum dropped 12.82% over the last 7 days. Bitcoin’s market capitalisation sank to US$1.27 trillion, with the total crypto market cap at US$2.48 trillion, and bitcoin’s market dominance sitting at 52%.

| Price | High | Low | Change from previous week | |

| BTC (in US$) | $64,957 | $73,650 | $64,957 | -6.47% |

| ETH (in US$) | $3,443 | $4,090 | $3,443 | -12.82% |

Source: CoinMarketCap. As at 17 March 2024. Past performance is not indicative of future performance. Performance is shown in US dollars and does not take into account any USD/AUD currency movements.

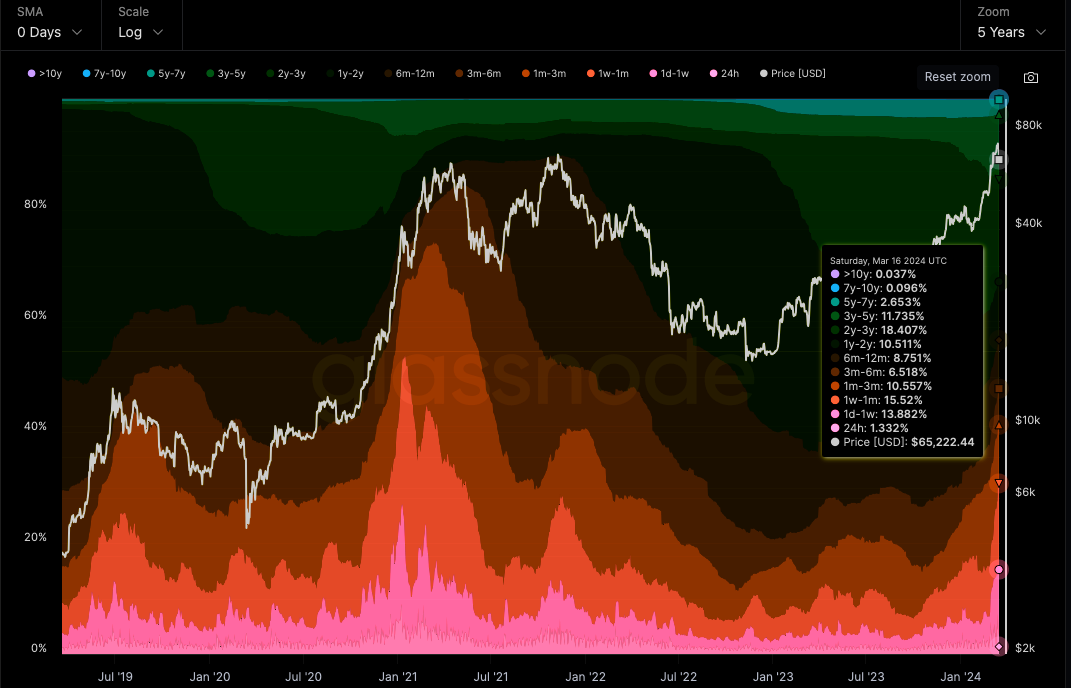

Source: Glassnode. Past performance is not indicative of future performance.

Crypto news we’re watching

Decun upgrade goes live

Ethereum’s latest upgrade officially went live on the mainnet last Thursday. The upgrade, called Dencun, aims to improve Ethereum’s scalability for layer-2 solutions and unlock new use cases. Its primary goal is to lower costs by optimising data usage by introducing a new transaction model known as blobs instead of the expensive call data.

Additional features from the Decun upgrade are transient storage to temporarily hold things like transaction data and programmable staking exits, which allow validators and stakers to exit positions using instructions stored in smart contracts1.

El Salvador stacking bitcoin

According to President Nayib Bukele, El Salvador moved 5,000 BTC worth $411 million at the time, into a cold storage wallet. Previously it was thought that the country had fewer than 3,000 BTC. Bukele claims that the country has been receiving bitcoin from multiple sources such as selling passports, currency conversions for businesses, from mining and from government services, in addition to buying bitcoin.

El Salvador became the first country to purchase bitcoin as a treasury asset in September 2021, when bitcoin was valued around $52,0002.

Microstrategy buys more bitcoin

Microstrategy now owns 205,000 bitcoin after its most recent purchase of another 12,000 BTC using excess cash and issuing debt through convertible notes which raised $782 million. The bitcoin being held at current prices is worth more than $15 billion. Since the start of the year, Microstrategy has purchased almost 16,000 bitcoin34.

Microstrategy is currently held in Betashares Crypto Innovators ETF (ASX: CRYP)4. The company develops software and offers cloud based services.

On-chain metrics

Bitcoin (BTC): Total Supply Held by Short-Term Holders [BTC]

This metric reflects the total amount of circulating supply held by short-term holders. Long- and short-term holder supply is defined with respect to the entity’s averaged purchasing date, with weights given by a logistic function centred at an age of 155 days and a transition width of 10 days.

According to data from Glassnode, the supply held by short-term holders has spiked and is now at levels not seen since 2021. This is a reflection of the new ETFs that have been steadily acquiring bitcoin.

Source: Glassnode. Past performance is not indicative of future performance.

This metric shows the HODL waves weighted by realised price.

According to data from Glassnode, this metric has started to creep substantially higher for shorter term holders. Visually you can see how the shorter time frames have been increasing going back to mid-January when the US spot bitcoin ETFs were introduced, showing coins moving from longer-term holders taking profits and selling to new holders.

Source: Glassnode. Past performance is not indicative of future performance.

Altcoin news

BNB, which is the native coin of the BNB Chain, remains the third largest cryptocurrency (excluding stablecoins) by market cap. Over the last week, BNB held on to its gains, up 13% and 67% over the last year. The BNB chain introduced an upgrade called Roll-up-as-a-service (RaaS) fostering growth in sectors including decentralised finance (DeFi), artificial intelligence (AI), and more.

According to the Binance website, Raas “marks a significant advancement in the blockchain realm, similar to the Software-as-a-Service (SaaS) model in cloud computing. Specifically designed for decentralised applications (dApps) and blockchain projects, RaaS offers a cost-effective and efficient pathway for building and deploying rollup networks”5.

BNB can be used to pay for goods and services, settle transaction fees on Binance Smart Chain, participate in exclusive token sales and more.

Investing in crypto assets or companies servicing crypto-asset markets should be considered very high risk. Exposure to crypto assets involves substantially higher risk when compared to traditional investments due to their speculative nature and the very high volatility of crypto-asset markets.

Investing in crypto assets or crypto-focused companies is not suitable for all investors and should only be considered by investors who (i) fully understand their features and risks or after consulting a professional financial adviser, and (ii) who have a very high tolerance for risk and the capacity to absorb a rapid loss of some or all of their investment. Any investment in crypto assets or crypto-focused companies should only be considered as a very small component of an investor’s overall portfolio.

References:

1. https://www.coindesk.com/policy/2024/03/15/el-salvador-has-thousands-more-bitcoins-than-previously-known/

2. https://dailycoin.com/heres-what-ethereum-dencun-changes-whats-up-next-for-eth/

3. https://www.cnbc.com/2024/03/13/microstrategy-up-180percent-this-year-after-debt-sale-for-more-bitcoin.html

4. As at 15 March. No assurance is given that this company will remain in the portfolio or will be a profitable investment.

5. https://www.bnbchain.org/en/blog/what-is-rollup-as-a-service

Off the Chain is published every second Tuesday. It provides the latest news on bitcoin and the rest of the crypto market, along with analysis and insights into the world of crypto.

It provides general information only and is not a recommendation to invest in any crypto asset, crypto-focused company or investment product.

This article mentions the following funds

Written by

Justin Arzadon

Director, Adviser Services & Head of Digital Assets.

C4 Certified Bitcoin Professional (CBP) and Blockchain Council Certified Bitcoin Expert™ with over 18 years’ experience in the ETF market. Passionate about the future of money.

Read more from Justin.