Bitcoin and the broader crypto market ended the week slightly higher after a major rally the previous week, with the total crypto market cap hitting a high not seen in seven months. The major catalyst catapulting bitcoin past $28K recently was the collapse of several major banks.

As at 26 March 2023, bitcoin was trading at US$27,521. Ethereum underperformed bitcoin over the week, down 1.21% vs bitcoin’s 1.84% gain. Bitcoin’s market capitalisation was up to US$531 billion, with the total crypto market cap sitting at US$1.15 trillion. Bitcoin’s market dominance has shot up to around 46%.

| Price | High | Low | Change from previous week | |

| BTC (in US$) | $27,521 | $28,803 | $26,760 | 1.15% |

| ETH (in US$) | $1,753 | $1,853 | $1,716 | -1.12% |

Source: CoinMarketCap. As at 26 March 2023. Past performance is not indicative of future performance. Performance is shown in US dollars and does not take into account any USD/AUD currency movements.

Source: Glassnode. Past performance is not indicative of future performance.

Crypto news we’re watching

Nasdaq to offer crypto custody services

The Nasdaq stock exchange could be launching crypto custody services by the end of the second quarter this year, according to Senior VP and Head of Nasdaq Digital Assets, Ira Auerbach. The exchange is going through the process of obtaining all necessary approvals and laying down the technical infrastructure for the platform.

In an interview with Bloomberg, Auerbach said: “Safekeeping bitcoin and Ether would be the first step to building a broad suite of services for the group’s digital assets division, eventually including execution for financial institutions.” Other crypto custodians currently in the US are BNY Mellon and Fidelity Investments.1

Tether integrated in Telegram Messenger

Tether (USDT) will be able to be sent directly in chats using Telegram’s messenger service. Users can now buy, sell, exchange and transfer USDT free of charge with each other now that USDT has been integrated in the Telegram Wallet bot. Through the bot’s main menu, you can add to your USDT balance by transferring from an external wallet, or by purchasing USDT with a bank card or on Telegram’s peer-to-peer (P2P) market.

In a Telegram post, the wallet service said: “We’re excited to announce the long-awaited integration of USDT into @wllet, making sending stablecoins as easy as sharing a photo.”2

CRYP company spotlight

Coinbase receives SEC enforcement notice

Coinbase announced that it has received a “Wells Notice” from the US Securities and Exchange Commission (SEC) about “potential violations” of securities laws. A Wells notice does not always result in charges or signal that the recipient has violated any law.

In a recent blog post, Coinbase said: “Today’s Wells notice does not provide a lot of information for us to respond to. The SEC staff told us they have identified potential violations of securities law, but little more.”

Coinbase said in a filing with the SEC that it believes any action “would relate to aspects of the company’s spot market, staking service Coinbase Earn, Coinbase Prime and Coinbase Wallet.” The company has until 29 March to advise the SEC whether it intends to rebut the agency’s findings.3

On-chain metrics

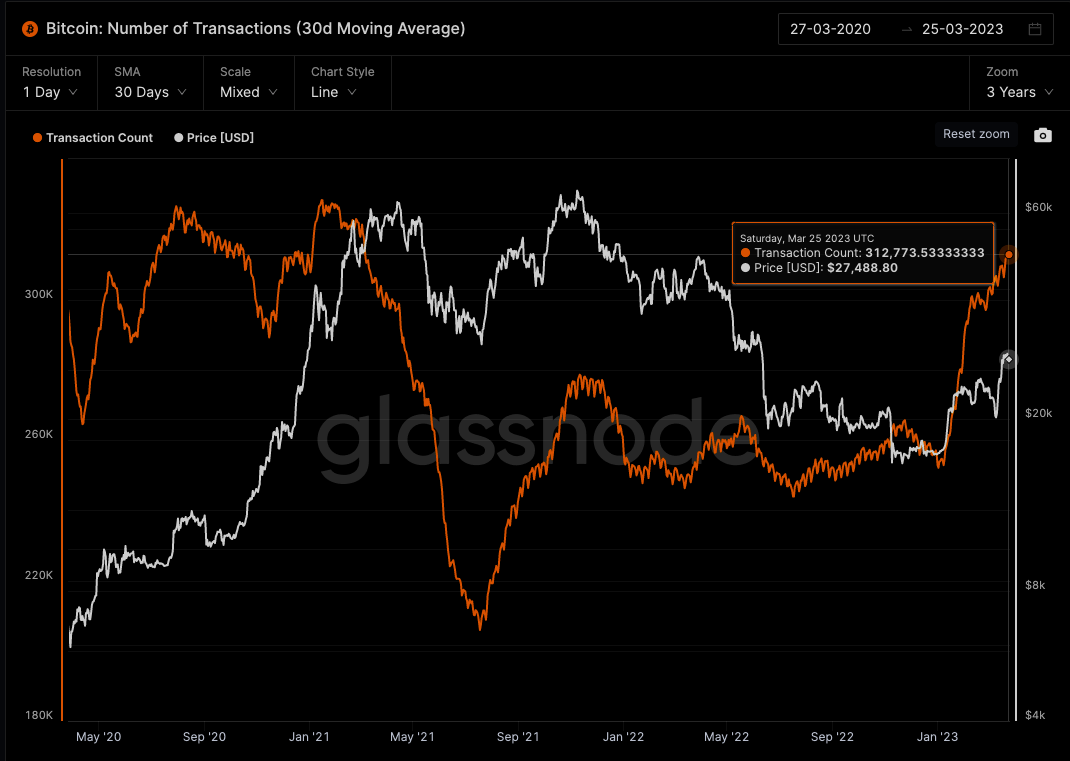

Bitcoin (BTC): Number of transactions (30d moving average)

Number of transactions (30d moving average) shows the total amount of successful transactions in bitcoin.

According to data from Glassnode, as at 25 March, BTC’s monthly average transaction count reached a high of around 309,500 per day last week – its highest level since BTC surged to $64K in April 2021.

Source: Glassnode. Past performance is not indicative of future performance.

Bitcoin (BTC): Number of new addresses (30d moving average)

This metric shows the number of unique addresses that appeared for the first time in a transaction in the network.

Based on data from Glassnode, as at 25 March, the number of new addresses was back to levels not seen since May 2021.

Source: Glassnode. Past performance is not indicative of future performance.

Altcoin news

Top 10 altcoin Cardano (ADA) has risen along with the price of bitcoin, both rising by over 16% to 22 March. The rise in price coincided with the new network upgrade launch for Cardano on 17 March. The upgrade, called dynamic peer-to-peer (P2P) networking, reportedly “enables bidirectional usage of block-producing nodes and relay nodes, which may defend against failures or malicious behaviour.”4

Investing in crypto assets or crypto-focused companies is not suitable for all investors and should only be considered by investors who (i) fully understand their features and risks or after consulting a professional financial adviser, and (ii) who have a very high tolerance for risk and the capacity to absorb a rapid loss of some or all of their investment.

Any investment in crypto assets or crypto- focused companies should only be considered as a very small component of an investor’s overall portfolio.

1. https://www.bloomberg.com/news/articles/2023-03-24/nasdaq-eyes-crypto-custody-launch-by-end-of-second-quarter?sref=6EQWk76O

2.https://news.bitcoin.com/in-chat-tether-transfers-introduced-in-telegram/ 3. https://www.coindesk.com/business/2023/03/23/crypto-exchange-coinbase-shares-tumble-16-after-sec-enforcement-notice/ 4.https://cointelegraph.com/news/why-is-cardano-price-up-today4..https://cointelegraph.com/news/why-is-cardano-price-up-today

Past performance is not indicative of future performance.

Off the Chain is published every Tuesday. It provides the latest news on bitcoin and the rest of the crypto market, along with analysis and insights into the world of crypto.

It provides general information only and is not a recommendation to invest in any crypto asset, crypto-focused company or investment product.

This article mentions the following funds

Written by

Justin Arzadon

Director, Adviser Services & Head of Digital Assets.

C4 Certified Bitcoin Professional (CBP) and Blockchain Council Certified Bitcoin Expert™ with over 18 years’ experience in the ETF market. Passionate about the future of money.

Read more from Justin.