Gold’s standing as a precious metal and treasured item goes back millennia – and for good reason; it has a limited supply which helps it retain its value and continue to shine. So, should you be investing in gold?

For those that like it, gold is generally considered an effective hedge against inflation which is something we have seen a lot of in 2022. Yet some of the world’s most successful investors are split on whether investors should hold gold in their portfolios.

One big fan of gold is billionaire investor and founder of one of the world’s largest hedge funds, Bridgewater Associates, Ray Dalio. He believes the precious metal should be part of any investor’s portfolio; its inherent store of value makes it attractive. According to Dalio, “If you don’t own gold, you know neither history nor economics.” He suggests it would be sensible to allocate 10% of an investor’s portfolio to gold.

In contrast, Warren Buffett, chairman and CEO of Berkshire Hathaway, and one of the world’s richest people, doesn’t like gold as an investment. He suggests gold is nothing more than a “hunk of yellow metal”; it is not a productive investment because it does not produce or earn anything like shares, bonds or real estate. Instead, it sits underground or in a vault and doesn’t pay dividends. As a long-term investor, Buffett’s focus is on buying assets that generate an income and can grow in value over time.1

Safe haven status sought by investors

Yet Buffett’s own Berkshire Hathaway has held investments in gold miners at various times, including one of the world’s largest miners, Barrick Gold3. So Buffett too has seen value in gold.

So have retail investors. A recent report from the World Gold Council reveals that amidst rampant inflation and geopolitical uncertainty, demand for gold bars and coins jumped 36% in the third quarter of 2022 from a year earlier4. This strong retail demand has helped to reflect gold’s status as a safe haven asset, when there is uncertainty in the macroeconomic environment.

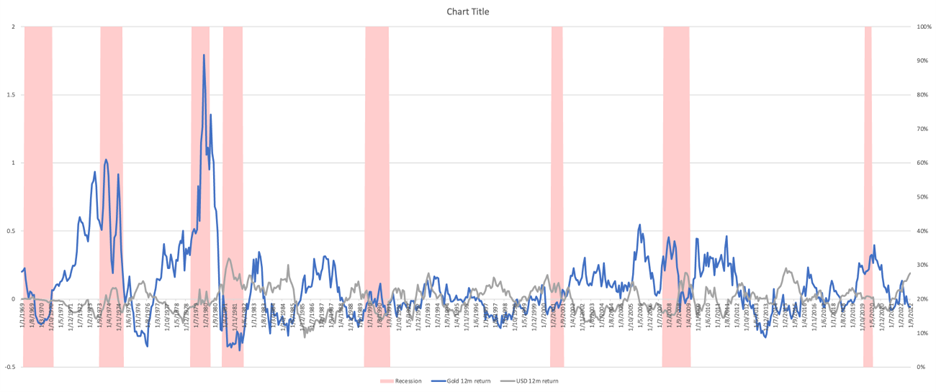

There is good reason for its safe haven status, according to Dalio. Historically, gold has tended to rise when the US dollar has weakened in value and during recessionary times. While it is not foolproof, given this inverse relationship; gold can potentially be used as a hedge against market uncertainty in investors’ portfolios and act as an effective portfolio diversifier.

The chart below displays the inverse relationship between the level of the US dollar and the gold price. While the value of the US dollar has lost purchasing power over time, gold has tended to hold its value over long periods.

Source: Bloomberg, Betashares. Past performance is not an indicator of future performance.

Dalio suggests that adding gold to a portfolio improves balance and reduced risk, “it would be both risk-reducing and return-enhancing to consider adding gold to one’s portfolio,” he says. With government bonds delivering negative real returns and shares unlikely to offer the high returns of recent years, gold may be a good investment alternative. Dalio says, “Those [investments] that will most likely do best will be those that do well when the value of money is being depreciated and domestic and international conflicts are significant, such as gold.”5

So, if you’re an investor looking to hold an asset which historically has had a low correlation to shares and bonds or you are worried about recession in 2023, gold could be a useful addition to your portfolio.

There are many ways to own gold, including via buying gold bullion, jewellery, and funds such as ETFs, which are traded on the ASX. An investment in an ETF has the advantage of being low cost and liquid. The QAU Gold Bullion ETF – Currency Hedged is backed by physical gold bullion bars, which are held in a vault of JP Morgan Chase. Investors can view the gold bar list at any time on Betashares’ website. The ETF offers investors simple access to the performance of gold without the need to directly buy, store and insure physical gold bars.

There are risks associated with an investment in QAU, including market risk, gold price risk and currency hedging risk. For more information on risks and other features of QAU, please see the Product Disclosure Statement.

References:

1. Since 1 August 1971, when the US took their dollar off the gold standard (no longer converting at a fixed rate of US$35/oz), gold has returned 3906.4%, 3801.2% for the S&P 500. Data as at 17 November 2022. Source: https://www.longtermtrends.net/stocks-vs-gold-comparison/.

2. In a 1998 Harvard speech, Warren Buffett famously said that gold has no utility in an investor’s portfolio. “(Gold) gets dug out of the ground in Africa, or someplace. Then we melt it down, dig another hole, bury it again and pay people to stand around guarding it. It has no utility. Anyone watching from Mars would be scratching their head,” he said.

3. https://economictimes.indiatimes.com/markets/commodities/news/berkshire-makes-a-bet-on-gold-market-that-buffett-once-mocked/articleshow/77570056.cms

4. https://www.perthmint.com/news/investor/market-research-and-analysis/gold-market-report–q3-2022/

5. https://www.kitco.com/news/2019-07-17/Investors-Are-Underweight-Gold-With-Markets-on-the-Cusp-Paradigm-Shift-Dalio.html

Written by

Benjamin Smith

Video and Content Executive

Ben brings a unique blend of financial acumen and creative storytelling to his role. With a solid background as a portfolio analyst, Ben possesses a deep understanding of the financial markets, investment strategies, and how ETFs work.

Read more from Benjamin.

2 comments on this

If we compare “returns” of owning gold and owning BH shares in years of explosion of financial crisis we will see that in the USD terms gold “price” change was beating changes of price of BH share percentage wise. So it was better to own gold than BH shares in these years.

Also not everyone has a key advantage that Buffett himself has – living in the US. There is much lesser risk to Buffet that he would have to evacuate his own personal wealth to other country. Gold would be typically the best option to do so as currencies of countries that get invaded are in risk of losing a lot of value. Same for companies – their shares typically plummet in such environment. I don’t think that the US is in any risk of getting invaded or attacked in years to come. But if I’m wrong it would be better for people heavy invested in Northern American shares to own gold.

Also I would rather own portion of my capital in gold than in any FIAT currency over longer period of time. Gold “price” over last 20+ years clearly showed that it was better to own few ounces of gold than hold cash. Even at good bank deposit. Interest rates were laughable during that period of time compared to inflation (expansion of credit plus money printing).

As for speech in 1998 Buffett since then learned that it’s good to own some cash reserves. A lesson that he learned from painful experiences connected to shares BH owned. So even after decades of experience he had to learn new tricks.

The next lesson that life and market might teach him is that owning shiny yellow rocks might be in his best interest if he would have to wait a goooooood few years before deploying some of BH cash reserves in highly inflationary environment. Gold simply has no competitor other than maybe silver in such environments.

Gold is rubbish for individual investors. Gold is not an investment at all, it’s a preservation of wealth and method to extricate it from a failing state when you flee. That’s the only circumstance where it’s useful. If you live in a stable country it’s not an investment at all, just a waste of money that could be earning dividends in a real investment.