Bitcoin and the broader crypto market decreased slightly over the last week. Mastercard and Visa look to end their partnership with Binance. PayPal partners with an Australian crypto exchange and HIVE undergoes a rebranding.

As at 27 August, bitcoin was trading at US$26,072. Ethereum underperformed bitcoin over the week, down 0.24% vs bitcoin’s 0.08% gain. Bitcoin’s market capitalisation sits at US$507 billion, with the total crypto market cap reducing to US$1.05 trillion. Bitcoin’s market dominance fell to 48.2%.

| Price | High | Low | Change from previous week | |

| BTC (in US$) | $26,072 | $26,752 | $25,520 | 0.08% |

| ETH (in US$) | $1,657 | $1,692 | $1,605 | -0.24% |

Source: CoinMarketCap. As at 27 August 2023. Past performance is not indicative of future performance. Performance is shown in US dollars and does not take into account any USD/AUD currency movements.

Source: Glassnode. Past performance is not indicative of future performance.

Crypto news we’re watching

Mastercard and Visa end partnerships with Binance

Mastercard and Visa are ending their card partnerships with Binance, distancing themselves from the troubled cryptocurrency platform. Visa halted new co-branded cards with Binance in Europe in July, and Mastercard will terminate its partnership entirely in September, without citing a reason.

Binance, the world’s largest crypto exchange by trading volume, is under significant regulatory scrutiny globally. It faces legal action from the US Securities and Exchange Commission (SEC) for securities rule violations, and from the Commodity Futures Trading Commission (CFTC) for rule evasion regarding US users’ access.

These moves by Visa and Mastercard further isolate Binance from the traditional financial system and hinder its efforts to enter the mainstream market. In addition to the SEC and CFTC actions, the US Department of Justice is investigating the exchange for potential fraud.

Given these legal challenges, industry experts like Dave Weisberger, CEO and co-founder of CoinRoutes, find Visa and Mastercard’s distancing from Binance unsurprising, as payment processors aim to avoid association with these legal issues1.

PayPal partners with Australian crypto exchange

The CEO of Independent Reserve, an Australian crypto exchange, has partnered with PayPal to counter increasing banking restrictions on crypto transactions. This collaboration allows Independent Reserve’s Australian customers to directly fund, and withdraw from, their crypto accounts with fiat from their PayPal wallet.

Adrian Przelozny, Independent Reserve’s CEO, sees the partnership as providing more choice for Australian crypto investors and reducing potential risks from future banking restrictions. This comes as major Australian banks like Bendigo Bank, Commonwealth Bank, National Australia Bank, Westpac, and ANZ impose various limits and blocks on crypto deposits and withdrawals.

For example, Commonwealth Bank has set a strict $10,000 monthly deposit limit for crypto exchanges, blocked certain ‘high-risk’ payments, and removed instant deposits for crypto exchanges.

Przelozny noted that this partnership between PayPal and a crypto exchange is a pioneering move in the Asia-Pacific (APAC) region and praised PayPal for its positive engagement with the crypto sector2.

CRYP company spotlight

HIVE undergoes rebranding

HIVE Blockchain Technologies Ltd has officially rebranded to HIVE Digital Technologies Ltd. This change reflects the company’s evolving focus on revenue opportunities with Nvidia Graphics Processing Unit (GPU) cards in cloud computing technology and its mission to advance Artificial Intelligence (AI) applications, such as ChatGPT, to support the Web3 ecosystem.

HIVE, a pioneer in cryptocurrency mining since 2017, is shifting its strategy to leverage GPU cloud computing technology for AI, machine learning, and data analysis. While maintaining a presence in bitcoin mining, HIVE plans to use its 38,000 Nvidia GPU fleet for large-scale computational tasks. It intends to offer GPU server cluster rentals through marketplaces and introduce HIVE Cloud, granting users access to single GPUs, bare-metal servers with up to 10 GPUs, or clusters of servers for computing power. HIVE Cloud aims to provide cost-effective alternatives for small and medium-sized businesses, competing with major cloud service providers3.

On-chain metrics

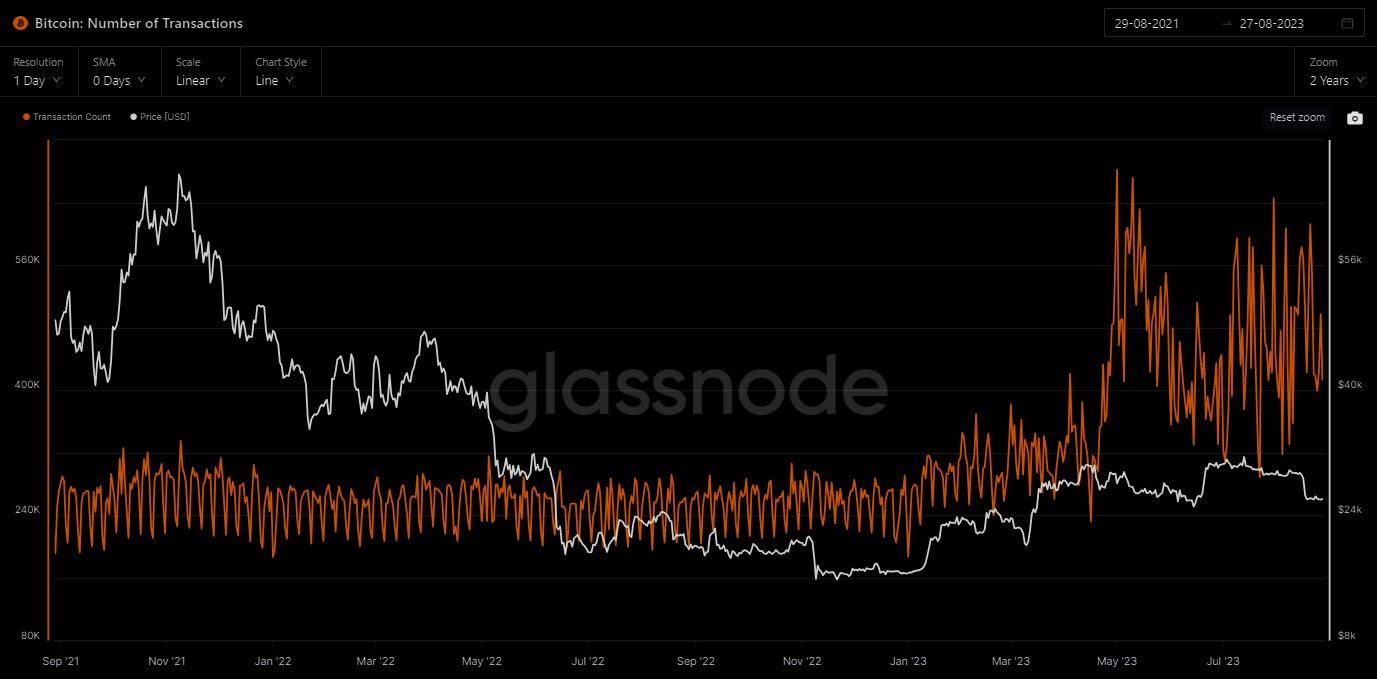

Bitcoin (BTC): Number of Transactions

This metric displays the number of successful BTC transactions over the past two years. Since March 2023, transaction frequency has risen significantly, coinciding with both greater usage of the Bitcoin network, and subsequent increased transaction fees.

Source: Glassnode. Past performance is not indicative of future performance.

This metric shows the number of unique addresses holding at least 10 BTC. Since 30 June 2022, the number of addresses with 10 or more BTC has increased by approximately 10,000, bringing the total to ~158,000. This has coincided with an increase in BTC’s price from US$19,763 to current levels.

Source: Glassnode. Past performance is not indicative of future performance.

Altcoin news

Coinbase has added PayPal’s newly unveiled stablecoin, PayPal USD (PYUSD), to its listing roadmap. This development suggests that Coinbase users may soon have the opportunity to trade this digital asset. PYUSD is designed to maintain a 1:1 peg with the US dollar and operates on the Ethereum (ETH) blockchain.

Coinbase introduced its listing roadmap as part of its efforts to enhance transparency and minimise the potential for front-running its new trading support announcements4.

Investing in crypto assets or companies servicing crypto-asset markets should be considered very high risk. Exposure to crypto assets involves substantially higher risk when compared to traditional investments due to their speculative nature and the very high volatility of crypto-asset markets.

Investing in crypto assets or crypto-focused companies is not suitable for all investors and should only be considered by investors who (i) fully understand their features and risks or after consulting a professional financial adviser, and (ii) who have a very high tolerance for risk and the capacity to absorb a rapid loss of some or all of their investment. Any investment in crypto assets or crypto- focused companies should only be considered as a very small component of an investor’s overall portfolio

References:

1. https://www.bloomberg.com/news/articles/2023-08-24/mastercard-to-end-its-binance-co-branded-card-partnership

2. https://www.afr.com/companies/financial-services/paypal-is-shifting-aussie-dollars-onto-crypto-exchanges-20230822-p5dyhy

3. https://finance.yahoo.com/news/hive-blockchain-announces-rebranding-name-050000554.html

4. https://www.coinbase.com/blog/increasing-transparency-for-new-asset-listings-on-coinbase

Past performance is not indicative of future performance.

Off the Chain is published every second Tuesday. It provides the latest news on bitcoin and the rest of the crypto market, along with analysis and insights into the world of crypto.

It provides general information only and is not a recommendation to invest in any crypto asset, crypto-focused company or investment product.

This article mentions the following funds

Written by

Benjamin Cahill