Bitcoin and the rest of the crypto market fell slightly over the last week, experiencing some volatility around the US inflation report. The number came in higher than consensus expectations, 8.2% higher than September, 2021.

At the time of writing, bitcoin is trading at around US$19,131. Ethereum underperformed bitcoin for the week, down -2.52% vs bitcoin’s -1.48%.

Bitcoin’s market cap is US$366.9B, with the total crypto market sitting at US$916.8B. Bitcoin’s market dominance is up to 40.03%.

| Price | High | Low | Change from previous week | |

| BTC (in US$) | $19,131 | $19,835 | $18,319 | -1.48% |

| ETH (in US$) | $1,283 | $1,473 | $1,339 | -2.52% |

Source: CoinMarketCap. As at 16 October 2022. Past performance is not indicative of future performance. Performance is shown in US dollars and does not take into account any USD/AUD currency movements.

Source: Glassnode. Past performance is not indicative of future performance.

Crypto news we’re watching

America’s oldest bank to offer crypto custody services

Bank of New York Mellon (BNY), America’s oldest bank, is ready to offer custody for cryptocurrencies. BNY was approved by the New York State Department of Financial Services (DFS) earlier in the spring. The bank will start with bitcoin and ether with select customers, and will store the keys required to access and transfer those assets alongside traditional investments on the same platform.

According to a report by the Wall Street Journal: “It is the first of the eight systemically important US banks to store digital currencies and allow customers to use one custody platform for both its traditional and crypto holdings.”1

Google to make building in Web3 easier

Google has partnered with Coinbase and will reportedly start accepting crypto-based payments for cloud services from customers in the Web3 space starting early next year. Google will also use Coinbase’s custody service Coinbase Prime. The announcement was made last week at Google’s Next Conference. According to the Coinbase website, other parts of the partnership include Web3 developers having access to Google Cloud’s blockchain data through BigQuery – which is powered by Coinbase Cloud’s Node service, and Coinbase selecting Google Cloud as a strategic cloud provider to build advanced exchange and data services.2

Thomas Kurian, CEO of Google Cloud, said: “We want to make building in Web3 faster and easier, and this partnership with Coinbase helps developers get one step closer to that goal.”3

G20 reviewing crypto regulation framework

At a recent G20 meeting on 12-13 October, the OECD presented its Crypto-Asset Reporting Framework (CARF) to G20 Finance Ministers and Central Bank Governors. Back in April of last year, the G20 requested a framework for automating cryptocurrency tax reporting between nations. The concern is that crypto assets are not comprehensively covered by the OECD/G20 Common Reporting Standard (CRS), which makes it likely to be used for tax evasion.

OECD Secretary-General, Mathias Cormann, said: “The Common Reporting Standard has been very successful in the fight against international tax evasion. In 2021, over 100 jurisdictions exchanged information on 111 million financial accounts, covering total assets of EUR 11 trillion. Today’s presentation of the new crypto-asset reporting framework and amendments to the Common Reporting Standard will ensure that the tax transparency architecture remains up-to-date and effective.”4

On-chain metrics

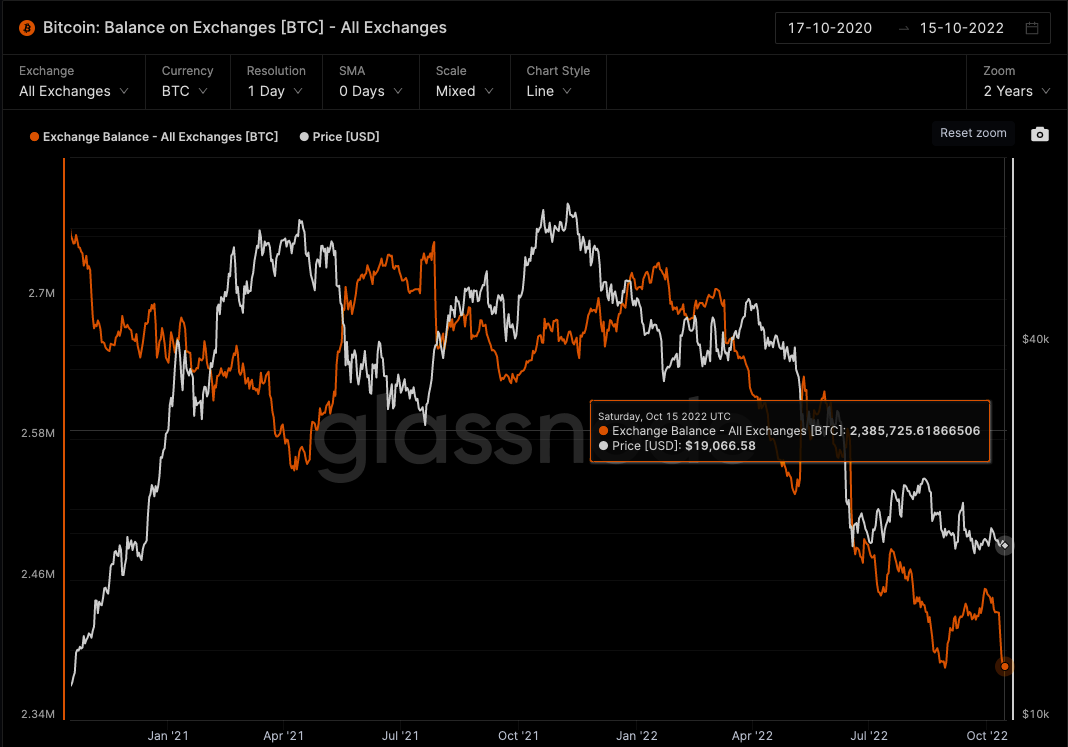

Bitcoin (BTC): Balance on Exchange

This metric provides the total amount of coins held on exchange addresses. Coins moving to exchange is usually a bearish signal as investors could be preparing to sell, while coins moving off exchange is usually a bullish signal, indicating investors are keeping their coins in their own custody.

Looking at data from on-chain analytics company Glassnode, over the last year the number of bitcoin held on exchanges has continued to trend downwards. This suggests the majority of investors in bitcoin may be unfazed by the drawdown in price and may instead be using this opportunity to accumulate bitcoin.

The bitcoin that is being purchased is not being left on exchanges. It is being withdrawn into self-custody, which suggests a lower likelihood of it being used for trading or being sold, at least in the short term.

Source: Glassnode. Past performance is not indicative of future performance.

Bitcoin (BTC): Number of Addresses with Balance >0.01

This metric looks at the number of unique addresses holding at least 0.01 coins. The metric gives us insight into the retail or smaller investor’s sentiment.

According to data from Glassnode, investors with smaller wallet holdings appear to have been using this price drawdown to accumulate more bitcoin. This has continued to decentralise the bitcoin investor base, in addition to increasing the total number of bitcoin users.

Source: Glassnode. Past performance is not indicative of future performance.

Altcoin news

In altcoin news, one of the very few altcoins in the black over the last week, and the best-performing crypto in the Top 50, was Huobi token (HT). The token rallied over 70% after Tron’s founder, Justin Sun, announced his membership on Huobi’s global advisory board. He tweeted: “In the future, there will be many big moves around HT, including brand upgrade, heavy empowerment, and business cooperation.” The plan is to focus on the HT token, similar to the BNB token used for the Binance platform, which is a Top 5 cryptocurrency.

Founded in 2013 in China, Huobi is a cryptocurrency exchange with offices in Hong Kong, South Korea, Japan and the US. In August 2018 it became a publicly listed company in Hong Kong. Last Friday, the exchange announced it has agreed to sell its entire shareholding to Hong Kong-based About Capital Management.4

Investing in crypto assets or companies servicing crypto-asset markets should be considered very high risk. Exposure to crypto assets involves substantially higher risk when compared to traditional investments due to their speculative nature and the very high volatility of crypto-asset markets.

Investing in crypto assets or crypto-focused companies is not suitable for all investors and should only be considered by investors who (i) fully understand their features and risks or after consulting a professional financial adviser, and (ii) who have a very high tolerance for risk and the capacity to absorb a rapid loss of some or all of their investment.

Any investment in crypto assets or crypto- focused companies should only be considered as a very small component of an investor’s overall portfolio.

4. https://financefeeds.com/oecd-to-present-crypto-asset-reporting-framework-at-g20-meeting/

Off the Chain is published every Tuesday. It provides the latest news on bitcoin and the rest of the crypto market, along with analysis and insights into the world of crypto.

It provides general information only and is not a recommendation to invest in any crypto asset, crypto-focused company or investment product.

Written by

Justin Arzadon

Director, Adviser Services & Head of Digital Assets.

C4 Certified Bitcoin Professional (CBP) and Blockchain Council Certified Bitcoin Expert™ with over 18 years’ experience in the ETF market. Passionate about the future of money.

Read more from Justin.