David Bassanese

Betashares Chief Economist David is responsible for developing economic insights and portfolio construction strategies for adviser and retail clients. He was previously an economic columnist for The Australian Financial Review and spent several years as a senior economist and interest rate strategist at Bankers Trust and Macquarie Bank. David also held roles at the Commonwealth Treasury and Organisation for Economic Co-operation and Development (OECD) in Paris, France.

4 minutes reading time

Week in review

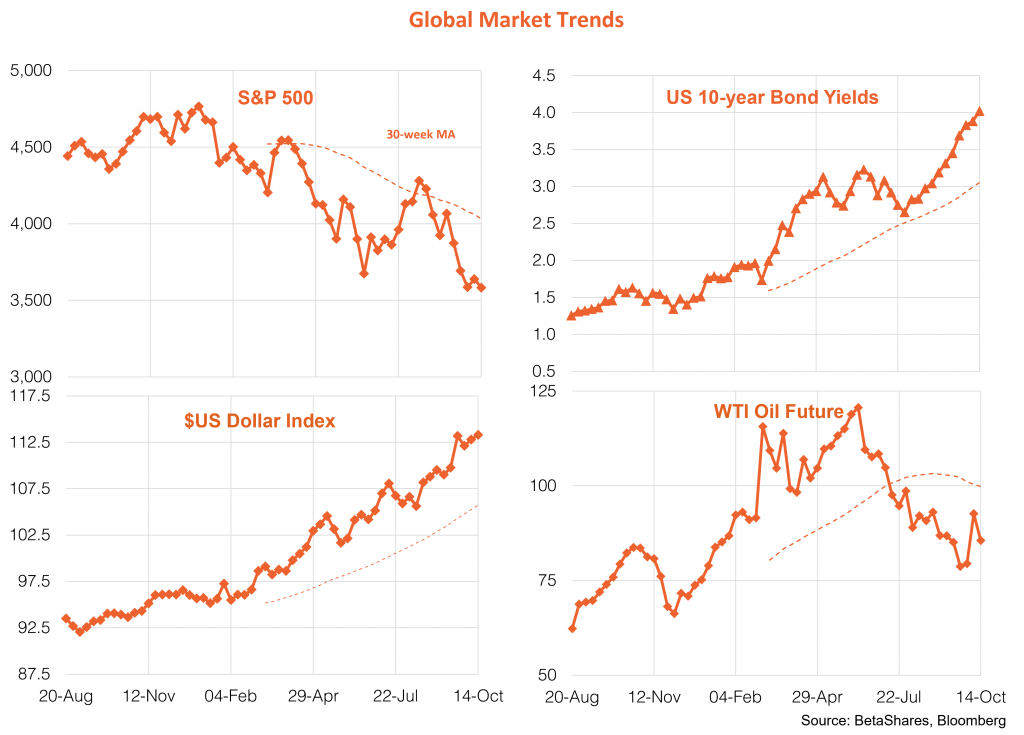

The obvious highlight of the past week in global markets was the higher than expected US CPI result, which has likely cemented the case for yet another 0.75% Fed rate hike at the early November policy meeting. The US market is now toying with the idea that the Fed could take rates as high as 5% by mid-2023.

Headline consumer prices rose 0.4% in September, compared with an expected rise of 0.2%, whereas core (i.e. excluding food and energy) rose 0.6% – or only a touch higher than the 0.5% expected by the market. At 6.6%, core annual inflation stands at a 40-year high.

Although the inflation numbers can be cut and sliced in any number of ways, the essential story is that while goods inflation is subsiding after the past year’s surge, service inflation – which is a far larger part of the CPI – remains sticky, thanks in large part to still strong consumer spending and rising labour costs.

Bond yields moved higher as would be expected, yet in a weird twist equities surged initially after the CPI result – likely reflecting a massive short squeeze in a deeply oversold market. Reality set in by Friday, however, with Wall Street slumping – setting up the Australian market for a likely soggy start to the week.

Bond markets were not helped by further mayhem in the United Kingdom, with markets testing the Bank of England’s preparedness to backstop the market in the face of ongoing uncertainty over the UK budget outlook.

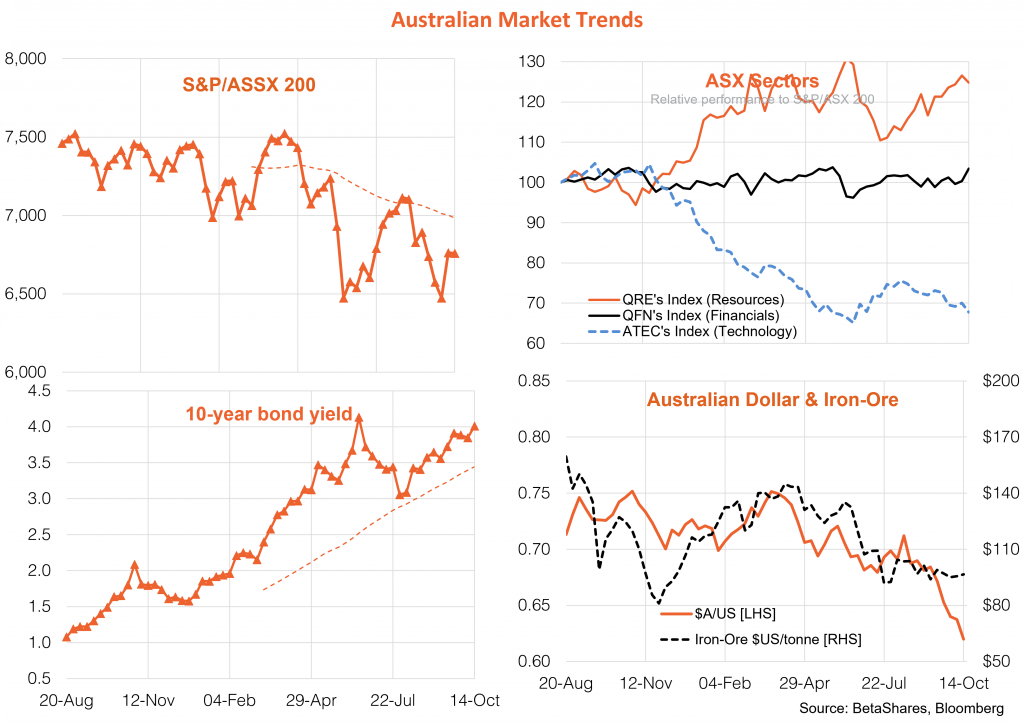

In Australia, the dichotomy between business and consumer confidence continued – with the NAB measure of business conditions remaining strong (underpinned by solid consumer spending) yet the Westpac measure of consumer confidence still reeling under the avalanche of interest rate hikes. The key market development was a further break lower in the $A against a super charged $US.

All up, the past week has only confirmed the view I’ve held for pretty much the whole year – namely US inflation will be slow to fall, meaning the Fed will need to be aggressive in raising interest rates and most likely inevitably push the US economy into recession. That’s bad news for equities market to be sure, but the resilience of the US economy to date in the face of rate hikes has meant the bond sell-off has also dragged on somewhat longer than anticipated. Inevitably, however, the Fed will get its way and the economy will slow – creating a peak in bond yields but likely even further downside in equities.

The RBA is also revealing an unwillingness to follow the Fed toe for toe – which has helped local bonds outperform of late, but pushed the $A (versus the US dollar at least) ever lower. I now suspect the $A will break to at least US 58c over the next three to six months.

Week ahead

The great (near term) hope for stocks is broadening signs of slower US economic growth – as it could at least lessen the risk of further aggressive rate hikes. On that score, housing starts and weekly jobless claims will be closely watched this week. Housing starts are already reeling – with the housing sector the first to show the effect of rising interest rates. But jobless claims also rose a bit more than expected last week and could start to show renewed signs of weakness after easing back somewhat over the middle part of the year.

Adding to market jitters, this week also sees the start of the Q3 US earnings reporting season. While earnings generally have been better than feared so far this year – in line with surprising economic resilience in the face of rate hikes to date – the clock is ticking on how long this can last. This season could also reveal earnings holding up somewhat better than first feared, though there will also likely be greater than usual interest in the outlook statements offered by companies. Key companies reporting this week include Tesla and Netflix.

China’s regular ‘data dump’ also takes place tomorrow -which will provide an update on the extent of ongoing slowing in the world’s second-largest economy.

In Australia, further resilience in the labour market is expected on Thursday, with a September employment gain of around 25k expected after a 33k gain in August. The unemployment rate is expected to hold steady at a low 3.5%. Minutes to the latest RBA meeting – and a speech by Assistant Governor Michele Bullock – are also out on Tuesday, which will provide further colour around the Bank’s recent decision to raise rates by a lower-than-expected 0.25% earlier this month.

Have a great week!

David is responsible for developing economic insights and portfolio construction strategies for adviser and retail clients. He was previously an economic columnist for The Australian Financial Review and spent several years as a senior economist and interest rate strategist at Bankers Trust and Macquarie Bank. David also held roles at the Commonwealth Treasury and Organisation for Economic Co-operation and Development (OECD) in Paris, France.

Read more from David.