Reading time: 6 minutes

When investors think of income from their shares, they typically think of dividends – but that’s not the only way you can seek to generate income from your equity investments. Dividend income can be enhanced by a covered call strategy, a tried and tested options strategy that generates income from shares in addition to dividends, in return for capping the upside potential of the shares.

With this in mind, Betashares developed the Betashares Yield Maximiser Funds, which provide exposure to a portfolio of Australian or US shares (depending on the Fund) along with an active covered call strategy that aims to generate income over and above the dividends paid on the relevant underlying portfolio over the medium term.

Betashares has just launched the Betashares Nasdaq 100 Yield Maximiser Fund (managed fund) (ASX: QMAX), to join the existing Funds in the Yield Maximiser range, the Betashares Australian Top 20 Equity Yield Maximiser Fund (managed fund) (YMAX), and the Betashares S&P 500 Yield Maximiser Fund (managed fund) (UMAX).

QMAX provides exposure to a portfolio of the largest 100 companies listed on the Nasdaq stock exchange, and employs an active covered call strategy that aims to generate income that exceeds the dividend yield from the portfolio over the medium term, but with lower volatility.

Like the other Funds in the Betashares Yield Maximiser range, QMAX does not aim to track an index.

What is a covered call strategy?

The ‘covered call’ strategy is a widely used options-based strategy. It seeks to collect the income from selling (or ‘writing’) options while capping the upside potential of the equity portfolio.

The buyer of a call option has the right to purchase specified shares at a set price (the ‘strike’ or ‘exercise’ price), on or before a fixed date (the ‘expiry date’). For this, they pay a ‘premium’ – the cost of the option.

On the other side of the option transaction, the writer accepts the obligation to potentially have to sell the underlying shares at the strike price, if the option is exercised. For this, the option writer receives the option premium.

QMAX sells (writes) exchange-traded call options over the Nasdaq-100 Index or over securities held in the share portfolio.

It’s important to note that the call writing strategy is taken care of within the Fund. You are not personally writing calls over any shares. You invest in QMAX in a single trade on the ASX.

What are the benefits of writing covered calls?

The main benefit to the writer of the call option is the premium received, which acts as extra income. The premium in a way can be seen as an additional source of income, like an extra dividend, on the shares you hold.

Income payments from QMAX are made quarterly.

As QMAX has been designed for investors who prioritise high income over capital growth, income returns can exceed total returns (i.e. income return plus capital returns) in some circumstances.

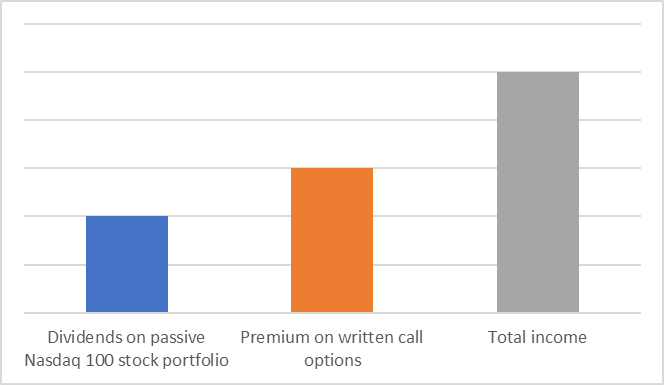

Sources of income from QMAX

For illustrative purposes only.

Another benefit of writing covered call options is that it can reduce portfolio volatility.

Volatility can be thought of as the extent to which an investment fluctuates in value over time. QMAX will typically be less volatile than the underlying portfolio of shares, because the option premium will cushion downside movements by partly offsetting some of the share price decline, while the sale of the call options also limits potential upside of the share position. Therefore, movements both up and down will be less extreme than simply holding a passive share portfolio.

In other words, the covered call strategy can be expected to give you a smoother ride by reducing overall volatility of returns.

It’s important to understand that in a falling market, the capital value of your investment will typically fall in line with the fall in the value of the underlying shares. The ‘cushion’ of the option premium is distributed to you in the form of income.

What type of market is the covered call strategy best suited to?

The covered call strategy performs differently in different market environments and is best suited to neutral (or sideways trading markets) to gradually rising markets. It will also be expected to outperform an ‘uncovered’ shareholding in falling markets –the shares you hold will still fall in value, but the option premium serves to cushion some of the loss.

However, in a strongly rising market the covered call strategy can be expected to underperform an uncovered holding of the shares, as you have forfeited the potential upside from your shares once the share price reaches the option exercise price, in return for the option premium.

The Betashares’ Yield Maximiser range:

| ASX Code | Managed fund name | Underlying exposure | Average 12-month net yield (% p.a.) over last 5 years* | Average 12-month gross yield (% p.a.) over last 5 years* |

| YMAX | Australian Top 20 Equity Yield Maximiser Fund | Largest 20 blue-chip shares listed on the ASX | 8.9% | 10.8% |

| UMAX | S&P 500 Yield Maximiser Fund | S&P 500 Index | 5.6% | N/A |

| QMAX | Nasdaq 100 Yield Maximiser Fund | Top 100 companies listed on the Nasdaq stockmarket | Inception date: 4 October 2022 | |

Past performance is not an indicator of future performance. As the Funds prioritise high income over growth, income returns can exceed total returns in some circumstances.

*Calculated as the Fund’s 12-month distribution yield as at each quarter end during the 5 year period to 30 September 2022 averaged over the period, where 12-month distribution yield is the sum of the prior 12-month fund per unit distributions divided by the relevant Fund’s closing NAV per unit as at the end of the relevant quarter. Actual yield will vary with market conditions, including the level of dividends paid by portfolio companies, market volatility and changes in the relevant Fund’s capital value. Yield may be lower at the time of investment. YMAX gross yield is inclusive of franking credits. Not all investors will be able to receive the full benefit of franking credits.

How to use the Yield Maximiser Funds in your portfolio

The Betashares Yield Maximiser Funds may suit investors for whom income is a priority, who are comfortable taking on sharemarket risk, and who are seeking to reduce portfolio volatility.

For more information on the Betashares Yield Maximiser Funds please refer to:

- Betashares Australian Top 20 Equity Yield Maximiser Fund (managed fund) (YMAX)

- Betashares S&P 500 Yield Maximiser Fund (managed fund) (UMAX)

- Betashares Nasdaq 100 Yield Maximiser Fund (managed fund) (QMAX)

There are risks associated with an investment in the Funds including market risk, use of options risk, sector concentration risk and in the case of UMAX and QMAX, currency risk. Investment value can go up and down and returns are not guaranteed. An investment in the Funds should only be considered as part of a broader portfolio, taking into account your particular circumstances, including your tolerance for risk. For more information on risks and other features of the Funds, please see the Product Disclosure Statement (PDS) and the Target Market Determination (TMD), available at www.betashares.com.au.

Betashares Capital Ltd (ABN 78 139 566 868 AFSL 341181) is the issuer of the Betashares Funds. The information in this article is general only, it is not personal advice, and is not a recommendation to buy units or adopt a particular strategy. It does not take into account any person’s financial objectives, situation or needs. Any person wishing to invest should read the relevant PDS and TMD from www.betashares.com.au and obtain financial advice in light of their individual circumstances.

Nasdaq®, Nasdaq-100®, and Nasdaq-100 Index® are registered trademarks of Nasdaq Inc. (which with its affiliates is referred to as the “Corporations”) and are licensed for use by Betashares. QMAX has not been passed on by the Corporations as to its legality or suitability. QMAX is not issued, endorsed, sold, or promoted by the Corporations. THE CORPORATIONS MAKE NO WARRANTIES AND BEAR NO LIABILITY WITH RESPECT TO QMAX.

Standards and Poor’s® is a registered trademark of Standard & Poor’s Financial Services LLP (S&P) and has been licensed for use by Betashares. UMAX is not sponsored, endorsed, sold or promoted by S&P or its Affiliates, and S&P and its Affiliates make no representation, warranty or condition regarding the advisability of buying, selling or holding units in UMAX.

Written by

Betashares