Equity Markets Quarterly Commentary Q1 2025

6 minutes reading time

- Wealth builder

The Nasdaq 100 index has become a popular investment exposure of choice for many Australian investors, providing access to:

- some of the largest and most innovative companies in the world such as Apple, Microsoft, Google and Nvidia,

- underlying businesses that generate revenue from across the world, providing exposure to economic growth in all geographic regions,

- and diversification benefits when paired with Australian equities, with a complementary sector mix, and potential for higher returns.

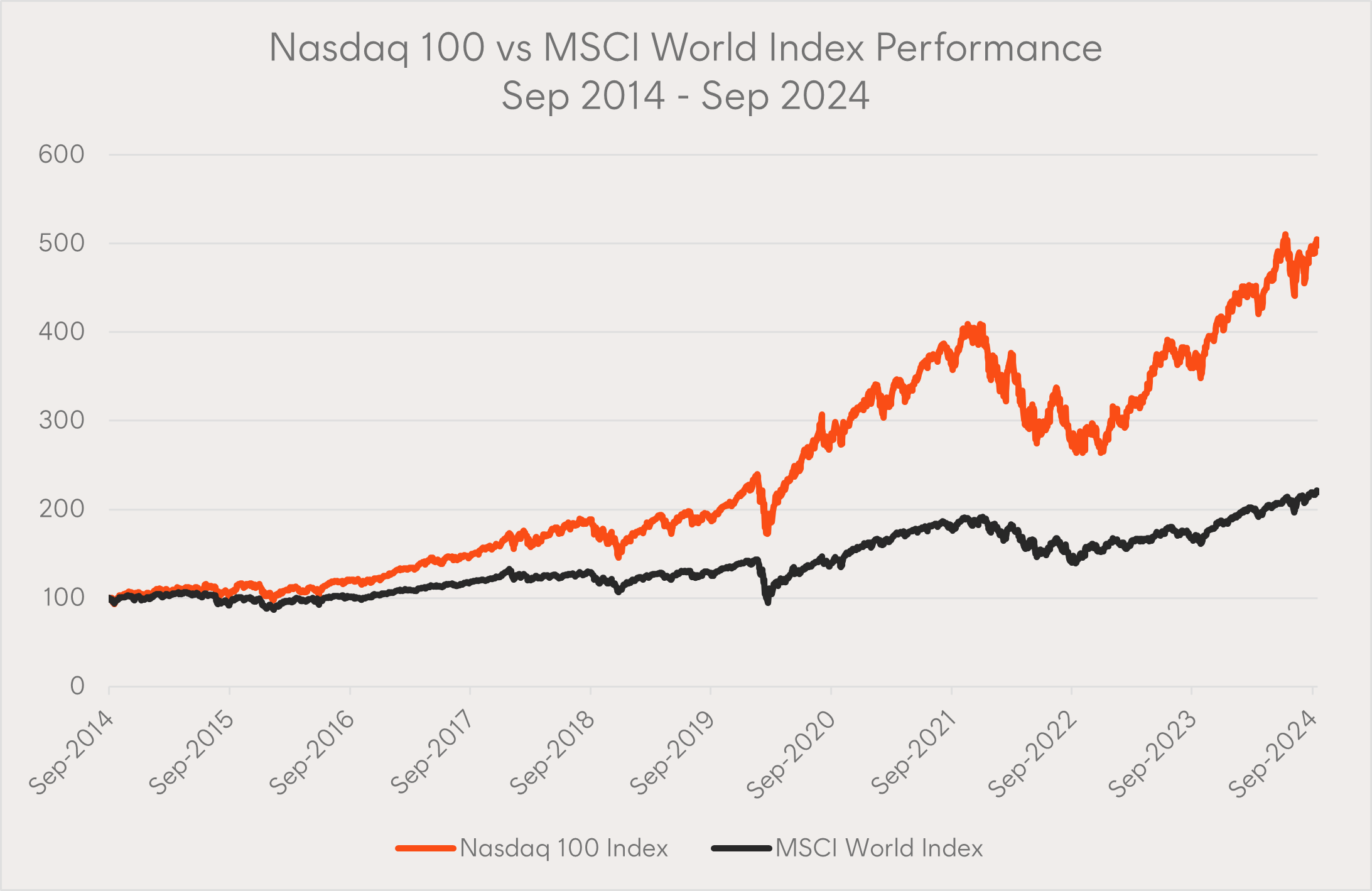

Over the past decade, the index has generated stellar returns which have been supported by strong and consistent earnings growth, rather than expansion in the valuation or price multiple which can often be short-lived.

Source: Bloomberg, Betashares. As at 30 September 2024. Past performance is not an indicator of future performance. Returns shown do not account for any fund management fees and costs. You cannot invest directly in an index.

Indeed, over the ten-year period to 30 September 2024, the Nasdaq 100 returned 18.5% p.a. – establishing it as an exposure of choice for many investors. Of course, past performance is not an indicator of future performance and this return figure does not take into account fund management fees and costs.

But what if there was an investment vehicle where you could magnify returns, in a moderate manner, to ultimately leverage the sharemarket’s potential to build long-term wealth.

Introducing Betashares Wealth Builder Nasdaq 100 Geared (30-40% LVR) Complex ETF

Betashares recently launched a moderately geared exposure to the GNDQ Wealth Builder Nasdaq 100 Geared (30-40% LVR) Complex ETF which effectively combines investors’ money with borrowed funds and invests the proceeds in the Betashares NDQ Nasdaq 100 ETF .

By using borrowed funds to invest, alongside investor’s capital, one’s overall exposure to the market increases which means that potential gains also increase.

This can be a powerful investment strategy for accumulators, with a suitable risk tolerance, to seek to build wealth over the long term by harnessing the high growth potential of the Nasdaq 100. Innovation has served as a crucial catalyst for the Nasdaq 100’s rapid fundamental growth, which ultimately leads to its strong performance.

GNDQ’s gearing ratio (being the total amount borrowed expressed as a percentage of the total assets of the Fund) will generally vary between 30% and 40% on a given day, equivalent to an exposure of 1.43x to 1.67x.

However, it is important to remember that because gearing increases one’s overall equity market exposure, potential losses are also magnified, especially in the scenario where a market sell-off occurs such as during 2022.

Therefore, one must have a long investment timeframe and be comfortable with the higher risks associated with gearing in order to withstand sharp drawdowns.

About Betashares Wealth Builder Funds

The Betashares Wealth Builder range comprises three ETFs.

| Betashares Wealth Builder Funds | |||

| Exposure | Australian equities | Australian and global equities | U.S. equities |

| Fund | Betashares Wealth Builder Australia 200 Geared (30-40% LVR) Complex ETF | Betashares Wealth Builder Diversified All Growth Geared (30-40% LVR) Complex ETF | Betashares Wealth Builder Nasdaq 100 Geared (30-40% LVR) Complex ETF |

| ASX Code | G200 | GHHF | GNDQ |

| Underlying portfolio | 200 of the largest ASX-listed companies | Diversified basket of Australian and global developed and emerging markets equities | 100 of the largest non-financial companies listed on the Nasdaq market |

| Management fee and costs | 0.35% p.a. of Gross Asset Value | 0.35% p.a. of Gross Asset Value | 0.50% p.a. of Gross Asset Value |

GNDQ forms part of Betashares’ recently created Wealth Builder range of investment solutions created to assist investors to unlock the power of gearing in a more moderate form. The launch of a moderately geared version of the Nasdaq 100 ETF joins similar exposures for Australian shares ( G200 Betashares Wealth Builder Australia 200 Geared (30-40% LVR) Complex ETF ) and an all cap, all world exposure to Australian and International equities ( GHHF Betashares Wealth Builder Diversified All Growth Geared (30-40% LVR) Complex ETF ).

The Funds are internally geared which means the fund enters into the borrowing arrangement itself, ensuring that investor risk is limited to the capital invested, with no possibility of margin calls for investors.

Additionally, due to the structure of the funds, investors benefit from institutional interest rates that Betashares is able to access, which are typically considerably lower than margin loans or those available to individual investors seeking to borrow in their own capacity.

For further details about each Fund’s investment strategy and an explanation of the mechanics of gearing, please refer to the Wealth Builder Brochure.

It’s important to understand that gearing magnifies both gains and losses, and may not be a suitable strategy for all investors. Geared investments involve significantly higher risk than non-geared investments.

The gearing ratio of between 30% and 40% means that GNDQ’s geared exposure is anticipated to vary between ~143% and 167% of its Net Asset Value on a given day. GNDQ’s portfolio exposure is actively monitored and adjusted to stay within this range.

GNDQ’s returns will not necessarily be in this range over periods longer than a day, primarily due to the effects of rebalancing to maintain its daily target geared exposure range, the compounding of investment returns over time, and the impact of fees and costs.

GNDQ’s returns over periods longer than one day may differ in amount and possibly direction from the daily target geared return range. This effect on returns over time can be expected to be more pronounced the more volatile the relevant sharemarket or portfolio and the longer an investor’s holding period.

Due to the effects of rebalancing and compounding of investment returns over time, investors should not expect GNDQ’s Net Asset Value to be at a particular level for a given value of the relevant sharemarket or portfolio at any point in time.

Investors should monitor their investment regularly to ensure it continues to meet their investment objectives.

Gearing magnifies gains and losses and may not be a suitable strategy for all investors. Investors in geared strategies should be willing to accept higher levels of investment volatility and potentially large moves (both up and down) in the value of their investment. Geared investments involve significantly higher risk than non-geared investments. An investment in GNDQ is high risk in nature.

There are risks associated with an investment in GNDQ, including market risk, underlying ETF risk, gearing risk, rebalancing and compounding risk, lender risk, and currency risk. An investment in the Fund should only be made after considering your particular circumstances, including your tolerance for risk. For more information on risks and other features of GNDQ, please see the Product Disclosure Statement and Target Market Determination, both available on this website.