ETF distributions: frequently asked questions

5 minutes reading time

- Smart beta

In the world of investing, there’s often a trade-off between the simplicity of passive investing and the potential for higher returns through active management.

Smart beta strategies offer a solution by combining the best of both worlds. They provide the cost effectiveness and transparency typically expected of an ETF, while incorporating intelligent indexing measures.

As markets become increasingly volatile, more investors are turning to smart beta ETFs as a smarter way to achieve their financial goals.

What is smart beta?

Smart beta combines the power of both passive and active strategies.

Traditional ETFs follow market-cap-weighted indices (where bigger companies carry the most weight), which can risk an investor’s portfolio becoming heavily exposed to a small number of ‘mega cap’ companies.

Smart beta ETFs, in contrast, seek to track a rules-based factor index—focussing on factors like value, momentum, and quality—that aim to provide investors with excess returns, relative to traditional market cap-weighted indices.

Understanding the factors

Smart beta strategies typically focus on one or more factors that represent well established investment strategies. Some of the most common factors include:

- Value: This factor aims to identify companies that are undervalued relative to their fundamentals.

- Momentum: Momentum strategies look for stocks that are trending upward, under the idea that assets with strong price momentum tend to continue performing well in the short to medium term.

- Quality: This focuses on ‘quality’ companies based on metrics such as a strong balance sheet, high profitability, and low levels of debt – traits that indicate financial health and stability can be particularly important during volatile markets.

Historical factor performance: Real world examples

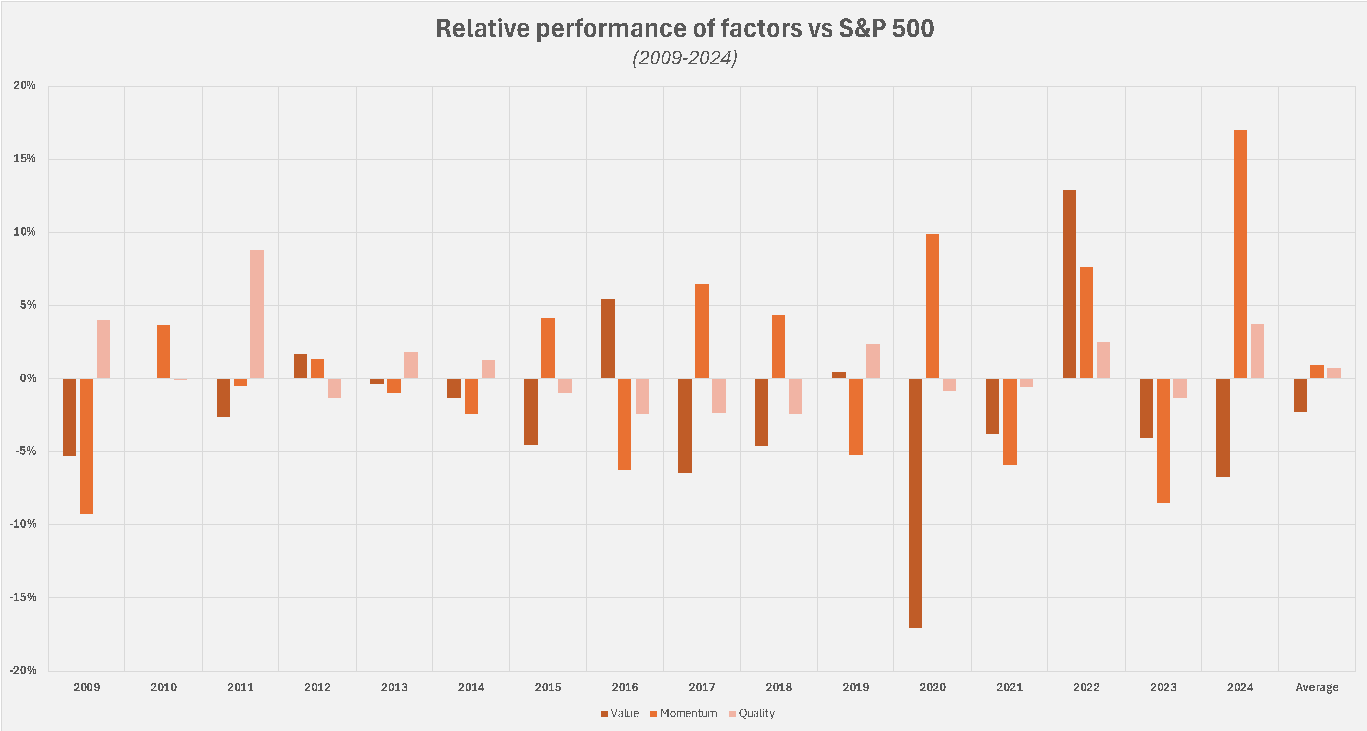

S&P Dow Jones Indices and MSCI, the two largest index providers globally1, both publish data on factor performance. The S&P data only covers the S&P 500 Index, however, with a 15-year performance history, and the importance of the US market, these data provide valuable insights.

The chart below shows the relative performance vs the S&P 500 Index of the three factors discussed above (value, momentum and quality) on a year-by-year basis for the period [month] 2009 to [month] 2024. On average, the quality and momentum factors have provided outperformance relative to the S&P 500 Index over the last 15 years, but value has not fared as well over this period.

Source: S&P Dow Jones Indices. As at 30 September 2024. Based on S&P 500 Index and relevant factor indices. Past performance is not indicative of future returns. You cannot invest directly in an index. Index performance does not take into account any ETF fees and costs.

ETFs to consider

Betashares offers a range of smart beta ETFs for investors who want to customise their portfolio to capture specific factors.

QOZ FTSE RAFI Australia 200 ETF provides access to a “fundamentally weighted” portfolio of 200 large Australian companies, weighted in a way this is reflective of their economic importance, rather than the market capitalisation of its constituents.

QLTY Global Quality Leaders ETF provides diversified exposure to 150 of the world’s highest quality companies. Companies are evaluated based on a combined ranking of four key factors – return on equity, debt-to-capital, cash flow generation ability and earnings stability.

AQLT Australian Quality ETF provides exposure to 40 high quality Australian companies, providing a core quality exposure.

MTUM Australian Momentum ETF invests in a portfolio of Australian companies with above average momentum scores, as measured by risk-adjusted returns. MTUM’s index is purely rules-based, prioritising stocks with strong and consistent momentum, while cutting the worst performers quickly.

Smart beta vs traditional indices

Ultimately, the decision of whether to invest in smart beta or traditional, market capitalisation-based ETFs will be unique to each investor.

Many smart beta ETFs can be used as the core of a well-diversified portfolio, or as a satellite exposure to complement a core of low-cost ETFs. Smart beta ETFs can even be used as stand-alone investments to cover an entire geography or asset class.

Here are a few factors to consider when deciding whether to use smart beta products:

- They may outperform a traditional index, but can also underperform.

- Smart beta ETFs may charge higher management costs than market capitalisation weighted ETFs, but lower costs than actively managed ETFs or funds.

- These funds may help to reduce concentration risk to larger companies with large weights in the index.

- Smart beta ETFs generally aim to track indices that are more complex than market capitalisation weighted ETFs.

Who should consider smart beta?

Smart beta ETFs may suit investors who want to go beyond market-cap investing and take a more strategic approach to portfolio construction. These investors include:

- Intermediate investors who understand the basics of investing and want to dive deeper into specific strategies.

- Those seeking to diversify their portfolio using rules-based approaches that can manage risks while potentially enhancing returns.

- Investors looking to mitigate concentration risks inherent in traditional market-cap-weighted strategies.

Conclusion

Smart beta ETFs offer a balanced approach for investors who want the simplicity of passive investing with intelligent indexing for outperformance potential beyond broad market exposure.

By drawing on academic research, these ETFs provide a rules-based approach that offer the potential for excess returns in the long term while remaining cost effective.

With a range of factor-based strategies available – such as value, momentum, and quality – smart beta ETFs can be a cost-effective way to meet your long-term financial objectives.

There are risks associated with an investment in the Funds, including market risk, non-traditional index methodology risk, security specific risk and concentration risk. Investment value can go up and down. An investment in the Funds should only be made after considering your particular circumstances, including your tolerance for risk. For more information on risks and other features of the Funds, please see the relevant Product Disclosure Statement and Target Market Determination, both available on this website.

Source:

1. Trackinsight – Industry Data – Index Providers. Based on AUM. As at 30 September 2024. ↑