David Bassanese

Betashares Chief Economist David is responsible for developing economic insights and portfolio construction strategies for adviser and retail clients. He was previously an economic columnist for The Australian Financial Review and spent several years as a senior economist and interest rate strategist at Bankers Trust and Macquarie Bank. David also held roles at the Commonwealth Treasury and Organisation for Economic Co-operation and Development (OECD) in Paris, France.

4 minutes reading time

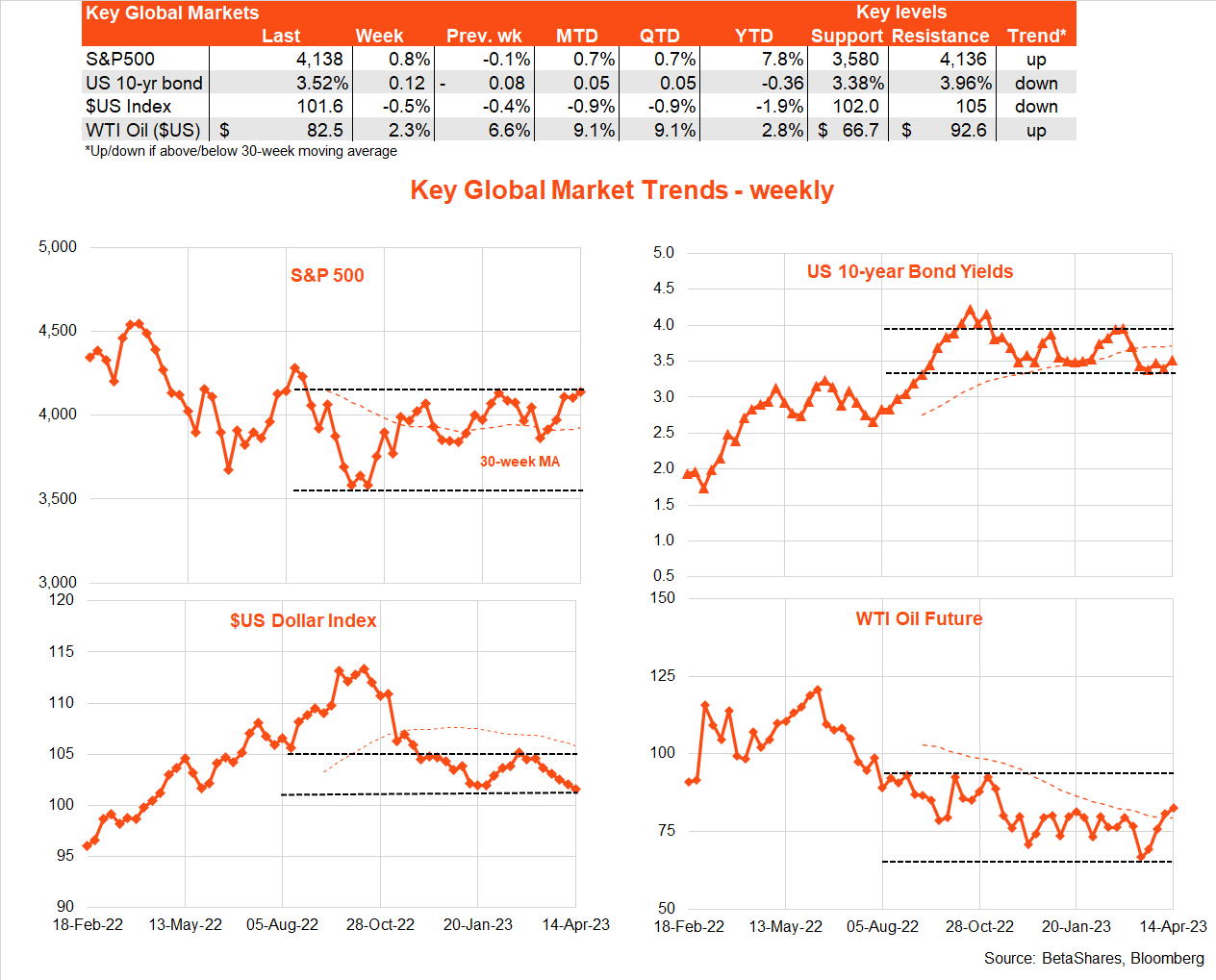

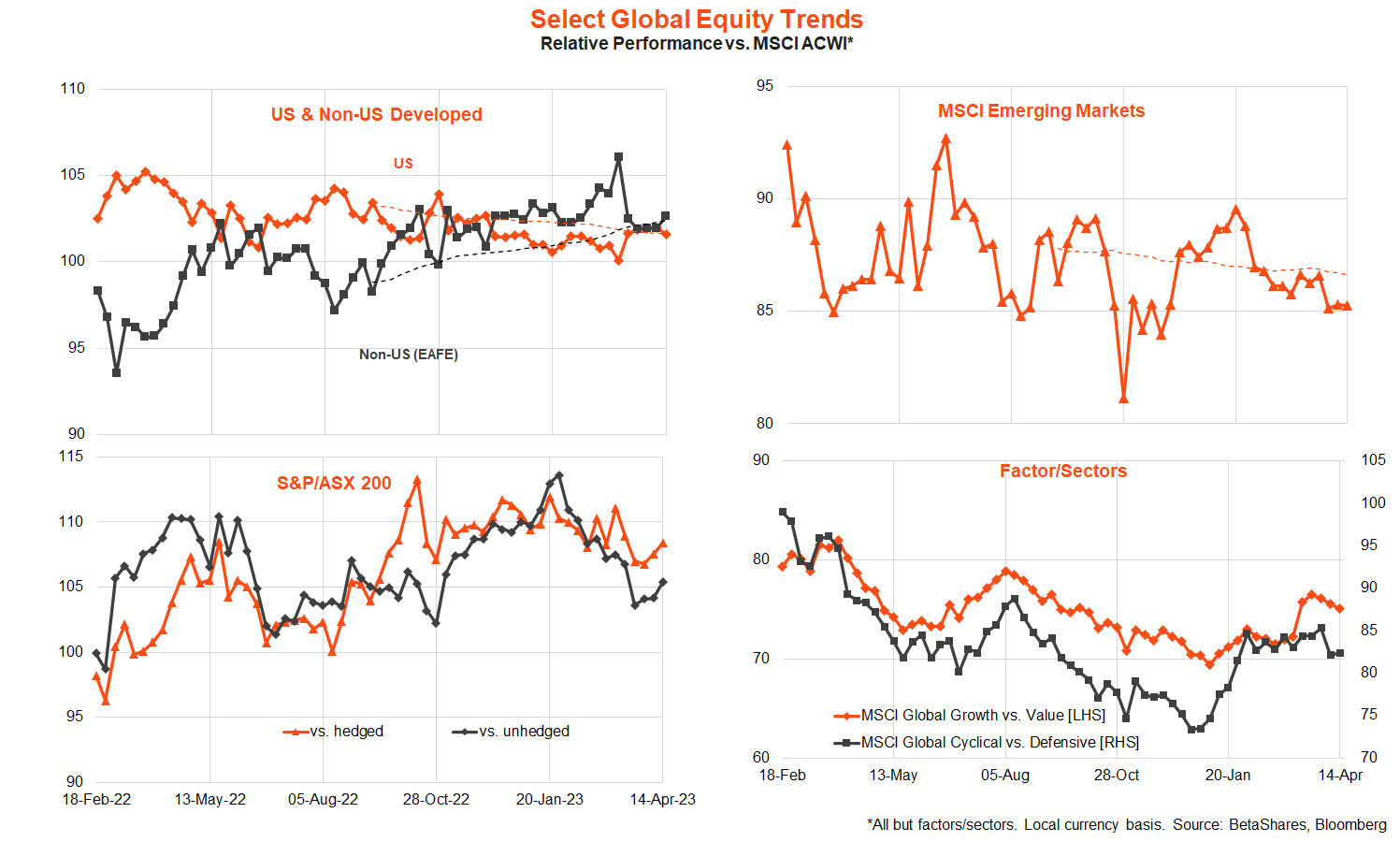

Global markets

Global equities inched further ahead last week – despite a lift in bond yields – as generally mixed economic data kept intact expectations for at least one more US rate hike in early May.

The major highlight last week was a slightly lower-than-expected 0.1% gain in US headline consumer prices in March, though market enthusiasm was dampened by the fact core prices remained stubbornly sticky with a no better-than-expected 0.4% gain. There was some good news in that a long-anticipated easing in housing costs is coming through, though offsetting this was a bounce back in car prices.

Equity markets got some relief from a larger-than-expected decline in US producer prices, which confirmed that goods-related pricing pressure at least remains broadly on the wane. Wall Street also decided to treat a lift in weekly jobless claims as ‘bad news is good news’ to the extent it reduced the need for further aggressive Fed tightening.

Another notable highlight was the minutes from the March Fed meeting, which confirmed the Fed would have raised rates by 0.5% (instead of 0.25%) were it not for the upsurge in banking instability. Also notable was that the Fed’s own staff forecasts were for a ‘mild recession’ starting later this year.

The week ended with better-than-expected bank earnings and a larger-than-expected decline in March nominal retail sales – though the latter partly reflected a drop in energy prices.

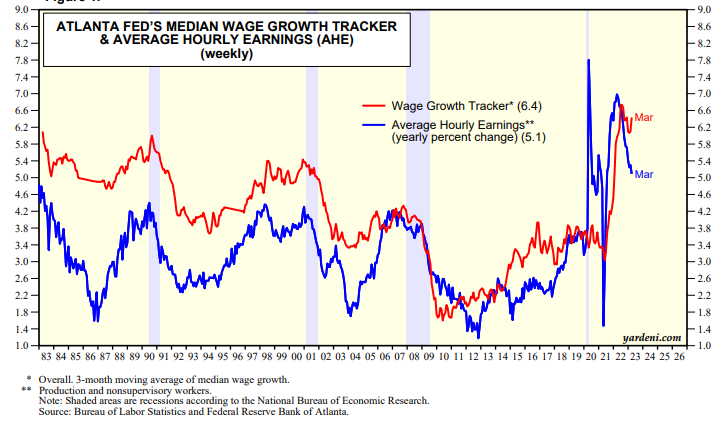

All that said, perhaps the most important data release was the – grossly under-reported – Atlanta Wage Tracker which revealed an uptick in the three-month moving average of annual growth in median hourly wages to a still high 6.4% in March from 6.2% in February. This remains a lot higher than annual growth in average hourly earnings from the monthly payrolls report, and suggests the tight labour market is still keeping wage pressure (and hence service sector inflation) stubbornly high. See a comparison of these wage measures below, courtesy of Yardeni Research.

It’s because of the likely stickiness of wages and service sector inflation that I fear an eventual US hard landing – driven either by the Fed and/or post-SVB credit tightening.

In a data-light week, Wall Street will likely focus on key earnings reports from major financial and consumer firms such as Goldman Sachs, Bank of America, Netflix and Tesla. Overall, I don’t expect much disappointment in coming weeks with market expectations already factoring in a 5% fall in quarterly earnings on year-ago levels. With the US economy still fairly resilient in Q1, it would not surprise if earnings this season again ended up being better than feared.

Markets will also keep an eye on Thursday’s weekly jobless claims, given they are starting to suggest the juggernaut US employment market is finally starting to buckle. An array of Fed speakers are collectively likely to suggest at least one more hike in early May. The week ends with key manufacturing reports for both the US and Europe.

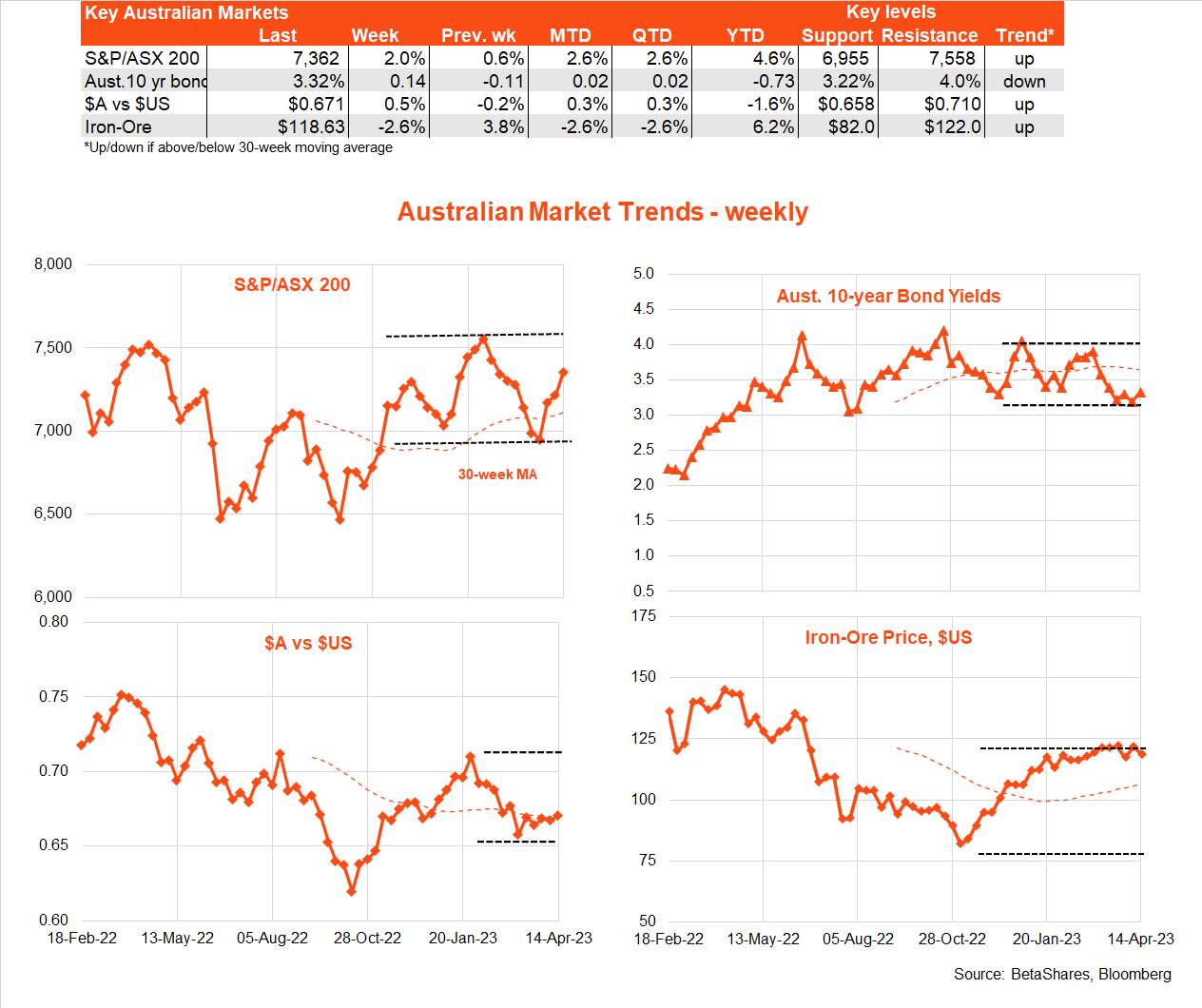

Australia

Last’s week economic data was generally solid, which suggests we can’t yet completely rule out further RBA rate hikes.

As expected, the latest business and consumer confidence reports strengthened last week – reflecting excitement about the RBA rates pause. Solid labour demand also means the recent ramp-up in immigration is being well absorbed – with the estimated number of employed Australians rising by 53K in March, leaving the unemployment rate unchanged at 3.5%.

There’s little local data this week, with most interest likely to focus on Tuesday’s minutes from the recent RBA meeting at which rates were left on hold. How strong is the RBA’s inclination to leave rates on hold? My own view is a rate hike next month is still possible if the Q1 CPI next week is a lot higher than expected, but barring that the RBA rate hike cycle is now likely over.

Have a great week!

David is responsible for developing economic insights and portfolio construction strategies for adviser and retail clients. He was previously an economic columnist for The Australian Financial Review and spent several years as a senior economist and interest rate strategist at Bankers Trust and Macquarie Bank. David also held roles at the Commonwealth Treasury and Organisation for Economic Co-operation and Development (OECD) in Paris, France.

Read more from David.