With the pandemic dominating the short-term outlook, the longer-term advantages of emerging markets companies become more important in the pursuit of return.

In this guest article, Martin Currie Australia, the investment manager of EMMG Betashares Martin Currie Emerging Markets Fund (managed fund) , discusses five positive trends driving emerging markets, and how investors can look to capitalise on them.

Faster economic growth

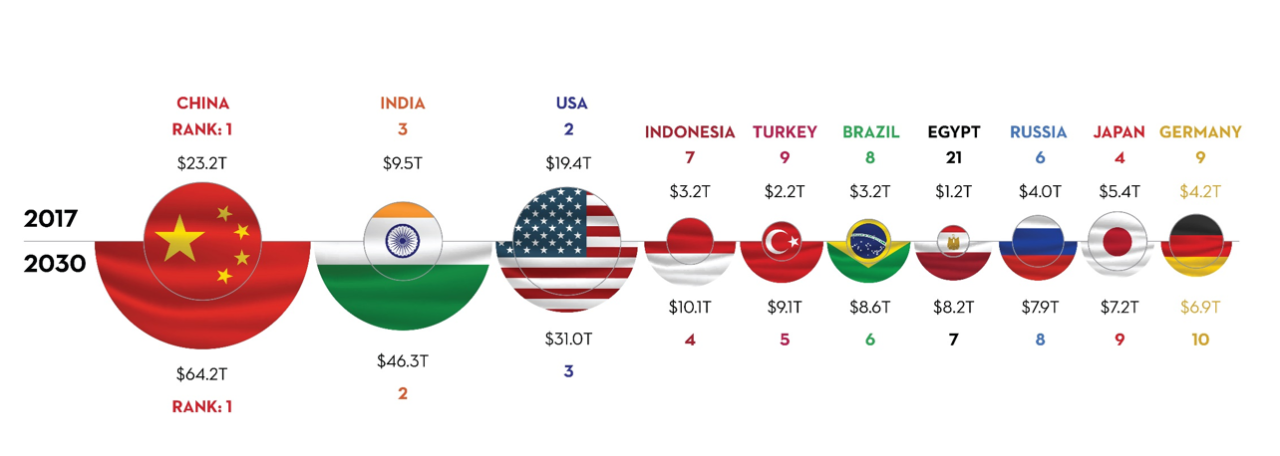

Emerging markets (EM) are forecast to grow almost three times as fast as developed markets over the next five years. EM’s share of global GDP, already at 40.2%1, is expected to rise even higher. Because shares are the asset class most sensitive to earnings growth, sharemarket investors cannot afford to ignore the relative growth rate of economies in selecting their equity allocations.

7 of the world’s 10 largest economies will be “emerging” by 2030

Source: Visual Capitalist. Based on IMF (2017 data), Standard Chartered (2030 projections), Oxford Economics, Brookings Institute.

The rise of megacities

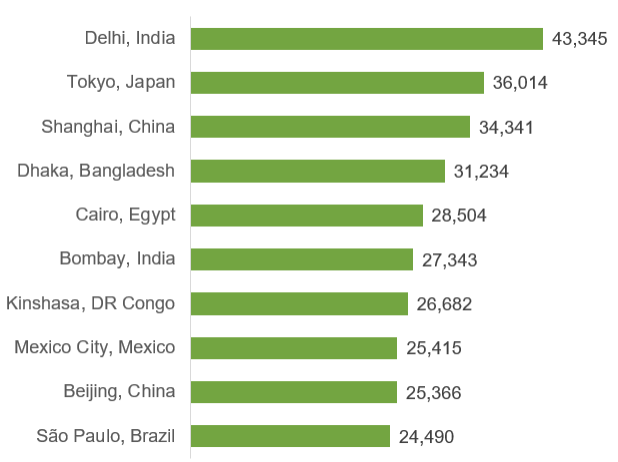

Urbanisation remains a powerful force in emerging markets, with cities swelling in population as jobs migrate from the countryside. There are already 20 ‘megacities’ (i.e. with over 10 million population), and the number is projected to grow to 30 by 2030 – largely within the Asia-Pacific region – and 9 of the 10 largest cities will be in emerging markets2.

Top 10 Cities by Population, 2035 Projection in Thousands

Source: United Nations, Department of Economic and Social Affairs.

This trend is worth noting because people living in cities exhibit different consumption patterns from their rural counterparts. By investing in companies that are positioned to capitalise on these trends, we can better align our portfolios with the fundamental growth drivers of the emerging market economies.

Rising middle class

In emerging markets, urbanisation generally brings growth of the middle class. The Asia-Pacific region in particular is expected to see middle income growth skyrocket by 2030, with 3.5 billion people in the middle class – over 150% growth in just 15 years3.

This growth is changing consumption habits, and sparking demand for a broader range of goods and services. For instance, insurance is a high-margin service that is uniquely demanded by populations with middle-class incomes. As equity investors, it’s important to consider how this demographic trend will translate into consumer behaviour and what that will mean for the companies we invest in.

Embracing disruptive technologies

Emerging markets are adopting newer disruptive technologies and adapting to digital life faster than developed markets.

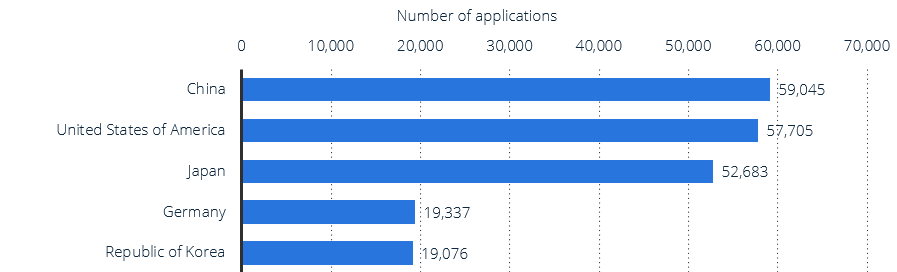

China is now the world’s largest e-commerce market, boasting some of the highest user rates of financial technology services for money transfer and payments, savings and investments, and borrowing4. What’s more, China and South Korea are both on the front lines of future innovation – ranking among the top five countries for total patent applications.

Top Five Countries for Patent Applications

Source: Statista, World Intellectual Property Organisation. Top five ranking of national patent offices with the most patent applications in 2019.

Technological innovation brings with it new types of businesses, and thus differentiated profit pools. This means that if we can identify disruptive businesses, we will have the ability to tap into companies that are fuelled by the dual benefit of differentiated business models and strong underlying economic growth.

A new business landscape

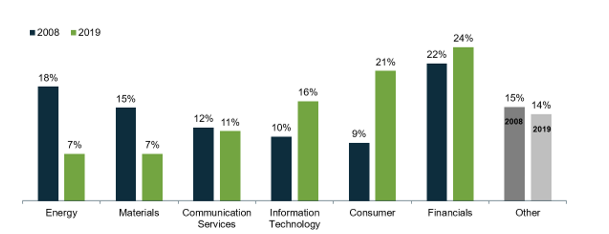

Economic diversification has changed the shape of opportunity in EM. The last decade has seen a major shift away from energy and raw materials and towards consumer, financial and high-tech. This trend has allowed more EM-based companies to act as industry leaders, especially in technology.

MSCI Emerging Markets Index Sector Exposure

Source: Factset and Martin Currie. 2008 sector exposure is as of 1 January 2008. 2019 data is as of 31 December 2019. Other includes Industrials, Utilities, Healthcare and Real Estate.

The combination of large urban centres and demographically young populations allows for innovative companies to scale digital businesses in ways that were previously impossible. For example, Ant Financial Services Group is currently developing artificial intelligence-based tools to more efficiently serve the financial needs of China’s 1.4-billion-person market.

Martin Currie takes an active approach to identifying technological leaders that have the ability to leverage digital scaling and demographics to create world class businesses.

Gaining exposure to emerging markets

Australian investors are able to gain exposure to emerging markets via EMMG Betashares Martin Currie Emerging Markets Fund (managed fund) .

EMMG invests in an actively managed, high-conviction portfolio of emerging market shares. The fund is managed by leading equities manager Martin Currie, a division within Legg Mason Australia, which is a part of Franklin Resources, Inc.

The Martin Currie Emerging Markets Team takes an active approach to selecting countries with attractive economic and demographic trends as well as compelling individual investment exposures.

There are risks associated with an investment in EMMG, including market risk, emerging markets risk, currency risk and market making risk. For more information about risks and other features of EMMG, please see the Product Disclosure Statement, available at www.betashares.com.au.

1. Source: IMF World Economic Outlook, April 2020.

2. Source: United Nations, Department of Economic and Social Affairs. Based on countries in the MSCI AC Asia Pacific ex Japan Index.

3. Ibid.

4. Cornell University – Emerging Marketing Institute.

Written by

Franklin Templeton