Max Minack

Associate Director - Adviser Business - Max has been at Betashares since 2018 and services our broking clients, having previously worked with financial planners across the country. Prior to Betashares, Max was an Associate Adviser at Bell Potter and has a Commerce Degree majoring in Economics.

5 minutes reading time

If, like me, you watched ‘The Last Dance’ during Covid-19 lockdown, you will appreciate what an amazing team the Chicago Bulls were during the 1990s. Flashy, charismatic and awe-inspiring – Michael Jordan rightly commanded the spotlight. In contrast, the slow-talking, relatively shy Scottie Pippen never got the recognition he deserved. Despite this, the experts know that MJ could never have done it without Pip.

It may seem like a long bow to draw, but parallels can be drawn to portfolio construction. During bull markets, equities carry the team and contribute the majority of returns, whilst bonds likely contribute much less. However, when the bull market ends and your equity allocation goes and plays baseball for a year, bonds are there to pick up the slack.

Are bonds still a player?

Central banks around the world have dropped interest rates to their lower bounds to stimulate growth and help combat the economic effects of the Covid-19 lockdown. Given the inverse relationship between interest rates and bond prices, questions may be asked about the potential for growth that bonds offer.

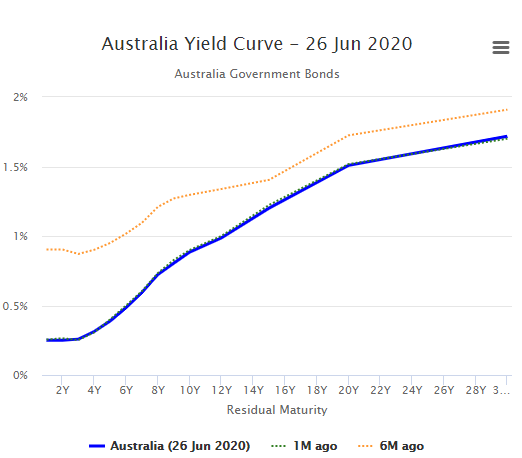

To answer this, it is important to understand the yield curve, which is a line that plots yields (interest rates) of bonds of equal credit quality but differing maturity dates. Simply put, the yield curve can be looked at as three segments based on maturity lengths: short term, medium term and long term1. Short-term rates are dictated by prevailing market interest rates, while long-term rates are dictated by investor expectations of future economic growth and inflation, as well as unconventional monetary policy2.

Short-term interest rates are at their zero lower bound, practically exhausting prospective returns from short-dated bonds. However long-term interest rates have hardly moved in the last six months. This ‘steepening’ of the yield curve is where the potential for strong returns and diversification benefits of bonds lie, and is depicted below:

Source: www.worldgovernmentbonds.com

(Chicago) Bull Flattener

Investor expectations of a future economic downturn, and by extension the expectation of lower corporate profitability, should intuitively cause equities to be sold off. They are also likely to cause long-dated bond yields to fall, pushing their price up3. This means long-dated bonds can offer compelling diversification benefits when paired with equities.

Another factor that may cause long-end bond yields to fall is unconventional monetary policy such as quantitative easing. The RBA has started quantitative easing, which involves buying bonds to put downward pressure on yields. The RBA has already halved the 3-year bond yield from ~0.50% as at late March to 0.25%4. As we can see in the above graph, the long end of the curve still has room to fall, unlike the short end. This flattening of the curve is known as a ‘Bull Flattener’.

Duration and Convexity

Investing in longer-dated bonds will give you a longer duration exposure, all else remaining equal.

In simple terms, duration provides an idea of how sensitive a bond’s price is to changes in interest rates. The longer a bond’s duration, the more the bond will appreciate (fall) in price for a 1% decrease (increase) in interest rates. As mentioned earlier, an increase in expectations of an economic downturn is likely to see both equities and interest rates fall, and under these circumstances having a bond exposure with a longer duration profile should provide greater equity diversification, lowering the volatility of your overall portfolio.

A second order benefit of very long duration bonds is a property known as ‘convexity’. Convexity is a measure of how duration changes with changes in interest rates – a 1% rise in interest rates will not necessarily push the price of a bond down as much as a 1% fall in interest rates pushes it up. Where you have ‘positive convexity’, such as with very long-dated fixed-rate government bonds, you stand to benefit from an asymmetric payoff profile: the upside potential (as interest rates fall) is greater than the downside risk (as interest rates rise)5. This positive convexity further enhances the hedging profile of your long duration bond exposure.

With the high volatility currently evident in the stock market, long-dated bonds can be a key teammate to create a well-diversified portfolio.

Implementation

How can you gain exposure to long duration bonds with BetaShares?

AGVT Australian Government Bond ETF provides exposure to a portfolio of high-quality, income-producing A$-denominated bonds issued by Australian federal and state governments, supranationals and sovereign agencies. It targets bonds 7-12 years from maturity, providing a long duration profile:

| Yield to Maturity* | 1.01% p.a. |

| Average Maturity (yrs)** | 8.79 yrs |

| Modified Duration (yrs)*** | 7.89 yrs |

GGOV U.S. Treasury Bond 20+ Year ETF – Currency Hedged is Australia’s first global ultra-long maturity government bond ETF. GGOV offers the longest duration exposure currently available in Australia via an ETF:

| Yield to Maturity* | 1.07% p.a. |

| Average Maturity (yrs)** | 27.97 yrs |

| Modified Duration (yrs)*** | 21.50 yrs |

As at 26 June 2020.

* Total expected return from the bond portfolio, based on bond prices as at 30 April 2020, and assuming no change in prevailing interest rates. This value will vary over time.

** Average (weighted by market value) length of time until the current bonds in the portfolio mature.

*** A measure of the sensitivity of the portfolio’s value to a change in interest rates. For example, a Modified Duration of 21 years implies that a 1% rise in the reference interest rate will reduce the value of the portfolio by 21.00%.

1. https://www.investopedia.com/ask/answers/041015/what-does-market-segmentation-theory-assume-about-interest-rates.asp, 2019

2. https://www.rba.gov.au/education/resources/explainers/bonds-and-the-yield-curve.html

3. https://www.callan.com/wp-content/uploads/2018/01/Callan-Long-Term-Treasuries-Equity-Hedge.pdf, January 2018

4. https://www.rba.gov.au/statistics/ags-target/

5. https://www.alliancebernstein.com/abcom/Opportunity/Risk/Content/AsymmetricReturns.pdf, July 2018

|

There are risks associated with an investment in the Funds, including:

For more information on risks and other features of the Funds, please see the applicable Product Disclosure Statement, available at www.betashares.com.au. |

Written by

Max Minack

Associate Director - Adviser Business

Max has been at Betashares since 2018 and services our broking clients, having previously worked with financial planners across the country. Prior to Betashares, Max was an Associate Adviser at Bell Potter and has a Commerce Degree majoring in Economics.

Read more from Max.