Cameron Gleeson

Betashares Senior Investment Strategist. Supporting all Betashares distribution channels, assisting clients with portfolio construction across all asset classes, and working alongside the portfolio management team. Prior to joining Betashares, Cameron was a portfolio manager at Macquarie Asset Management, Head of Product at Bell Potter Capital, working on JP Morgan’s Equity Derivatives desk and at Deloitte Consulting.

5 minutes reading time

Reading time: 4 minutes

The global push to reduce carbon emissions is driving up demand for renewable energy and the materials needed for its production. Investors have several options to take advantage of this long-term trend through exchange traded funds which can provide cost-effective exposure to companies invested in products and services that help create a more sustainable future.

As the push to cut CO2 emissions intensifies, governments worldwide are adopting renewable energy policies to meet the Paris agreement to reduce global warming. By 2050, the shares of power from renewables globally is expected to rise to 60% fro current levels of around 10% boosted largely by solar, wind, and hydropower. Fossil fuels are expected to shrink from almost 80% of energy supply to about 20%, according to the International Energy Agency’s Net-Zero by 2050 Roadmap.1

Critical minerals are needed to provide the building blocks for this transition to renewable energy production and other climate-friendly technologies. These minerals include lithium, graphite, and cobalt, which can be found in products from computers to household appliances. These minerals are also key inputs in clean energy technologies like electric batteries, electric vehicles (EVs), wind turbines, and solar panels.

The US government has estimated that global demand for these critical minerals will skyrocket over the next several decades, and, for minerals such as lithium and graphite, demand is expected to increase by as much as 4,000%.2 Separately, the International Energy Agency forecasts that demand for minerals used in EVs and battery storage could grow at least thirty times by 2040.3

Australia backs production of critical minerals

While clean energy technologies seek to avoid the need to burn fossil fuels to generate energy, significant raw materials are needed to build the infrastructure for transitioning into clean energy.

Australia is well positioned to benefit from increased demand for these raw materials including the critical minerals outlined above. Australia is the world’s largest lithium producer, and latest figures forecast the value of lithium exports will increase more than 10-fold over two years, from $1.1 billion in 2020-21 to almost $14 billion in 2022-23, and continued growth in future years.4

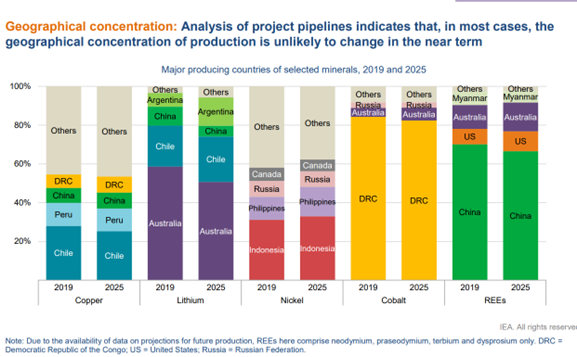

As well as lithium, Australia is the fourth largest producer of rare earths5, the fifth largest producer of nickel6, and the sixth largest producer of copper7.

Source: International Energy Agency. Actual outcomes may differ materially from projections.

Given its importance to clean energy production, the Albanese government is taking action to accelerate the growth of the critical minerals sector. The recent federal budget contains significant provisions covering energy transmission, clean energy, and critical minerals, including $50.5 million over four years to establish the Australian Critical Minerals Research and Development Hub. The government will also allocate an additional $50.1 million over three years to the Critical Minerals Development Program for competitive grants to support early and mid-stage critical minerals projects. This builds on the $49.7 million committed to six key projects across Australia last month.

A new National Critical Minerals Strategy is being developed in consultation with industry and community stakeholders and will complement other government initiatives including the National Battery Strategy and the Electric Vehicle Strategy. The National Reconstruction Fund will include the $1 billion Value Adding in Resources Fund which will work alongside the $2 billion Critical Minerals Facility. These initiatives will expand Australia’s mining science technology capability and help drive growth in the critical minerals sector.

In the US, the federal government is expanding its domestic supply of critical minerals. The US depends on foreign sources for many processed versions of these minerals. China, for example, controls most of the market for processing and refining of cobalt, lithium, rare earths, and other critical minerals, and the US is keen to break a dependence on Chinese imports.

Renewable energy is a priority too. US President Joe Biden’s Inflation Reduction Act incentivises domestic production in clean energy technologies like solar, wind, carbon capture, and clean hydrogen8 as the nation strives to meet the Paris climate agreement.

Investing in the energy transition

BetaShares offers several investment products designed to benefit from the investment needed to transition to clean energy and promote a more sustainable future.

XMET Energy Transition Metals ETFXMET provides exposure to the companies that produce Energy Transition Metals (ETMs) which are essential to the transition to a less carbon-intensive economy. These ETMs include copper, lithium, nickel, cobalt, graphite, manganese, silver, and rare earth elements. Processes such as renewable energy generation, battery storage solutions, and EVs are critically dependent on these ETMs, for which demand is expected to soar.

TANN Solar ETFThe demand for solar powered energy solutions is growing rapidly, reflecting solar energy’s falling cost and its critical role in efforts to combat global warming. TANN provides exposure to a portfolio of leading global companies in the solar energy industry, including panel manufacturers, inverter suppliers, installers and manufacturers of solar powered charging and energy storage systems.

ERTH Climate Change Innovation ETFERTH provides exposure to a diversified portfolio of global companies leading the fight against climate change, including those involved in clean energy supply, EVs, energy efficiency technologies, sustainable food, water efficiency and pollution control. By supporting companies that are leading the fight to create a more sustainable planet, investors of ERTH can be confident that their investment dollars are working towards positive impact.

There are risks associated with investment in the Funds, including market risk, international investment risk, and sector concentration risk. The Funds’ returns can be expected to be more volatile (i.e. vary up and down) than a broad global shares exposure, given their concentrated exposure. Each of the Funds should only be considered as a component of a diversified portfolio given their concentrated exposure. For more information on the risks and other features of each Fund, please see the relevant Fund Product Disclosure Statement and Target Market Determination (TMD) available at www.betashares.com.au.

References:

1. https://www.weforum.org/agenda/2021/12/clean-energy-transition-mining-climate-change/

2. https://www.whitehouse.gov/briefing-room/statements-releases/2022/02/22/fact-sheet-securing-a-made-in-america-supply-chain-for-critical-minerals/

3. https://www.pm.gov.au/media/support-critical-minerals-breakthroughs

4. Ibid

5. https://www.statista.com/statistics/270277/mining-of-rare-earths-by-country/

6. https://investingnews.com/daily/resource-investing/base-metals-investing/nickel-investing/top-nickel-producing-countries/

7. https://www.statista.com/statistics/264626/copper-production-by-country/

Supporting all Betashares distribution channels, assisting clients with portfolio construction across all asset classes, and working alongside the portfolio management team. Prior to joining Betashares, Cameron was a portfolio manager at Macquarie Asset Management, Head of Product at Bell Potter Capital, working on JP Morgan’s Equity Derivatives desk and at Deloitte Consulting.

Read more from Cameron.