November 2022: STRONG MARKETS CONTINUE TO FUEL ETF INDUSTRY GROWTH

Another strong month of performance in global and Australian sharemarkets contributed to continued growth in the Australian ETF industry. Read on for details, including best performers, asset flow categories and more.

Exchanged Traded Funds Market cap

- Australian Exchange Traded Funds Market Cap: $136.1B

- Market cap increase for month: 3.4%, $4.4B

- Market cap growth for the last 12 months: 2.5%, $3.3B

Comment: The Industry’s AuM grew 3.4%, for a total monthly market cap increase of $4.4B. The industry ended the month at $136.1B, edging closer to the all-time record level of $136.9B set in December 2021.

New money

- Net flows for month: +$1.1B

Comment: The sharemarket rally once again contributed the bulk of the industry growth this month, with ~25% of the growth attributable to net flows (net new money), which amounted to $1.1B.

Products

- 312 Exchange Traded Products trading on the ASX.

- 4 new products launched this month, including our Interest Rate Hedged Australian Corporate Bond ETF (ASX: HCRD), the first interest rate hedged ETF in Australia; we also saw the launch of a Copper exposure and two actively managed strategies from JP Morgan, marking the Firm’s entrance into the Australian ETF industry.

- After delisting their crypto equities fund last month, Cosmos delisted their remaining two funds (Ethereum and Bitcoin)

Trading value

- ASX ETF Trading value decreased -9% month on month, for a total of $9.7 billion

Performance

- The “China re-opening trade” caused Chinese and Asian focused ETFs to rally this month, after a very difficult period for performance for this region. As such Asian exposures were the best performers in November – this included China Large Cap, as well as our Asia Technology Tigers ETF (ASX: ASIA) which recorded ~23% monthly performance.*

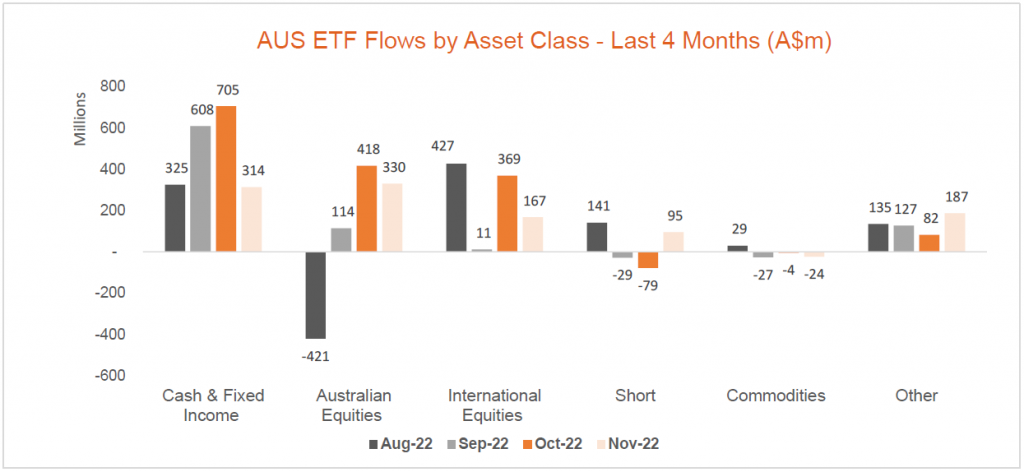

Top 5 category inflows (by $) – November 2022

| Category | Inflow Value |

| Fixed Income | $333,173,072 |

| Australian Equities | $330,121,052 |

| International Equities | $167,183,752 |

| Listed Property | $156,238,013 |

| Short | $95,465,481 |

Comment: Fixed Income was the asset class category recording the highest level of flows this month ($333m in net flows) with investors increasingly perceiving that ‘the worst may be over’ for further yield increases. Australian equities followed ($330m) with continued buying in broad market Australian equity exposures.

Top category outflows (by $) – November 2022

| Category | Inflow Value |

| Commodities | ($23,776,114) |

| Cash | ($19,227,313) |

| Currency | ($2,563,337) |

Source: Bloomberg, Betashares.

Top sub-category inflows (by $) – November 2022

| Sub-category | Inflow Value |

| Australian Equities – Broad | $194,809,769 |

| Australian Bonds | $173,659,034 |

| International Equities – US | $162,812,002 |

| Global Bonds | $153,729,343 |

| International Listed Property | $119,874,320 |

Top sub-category outflows (by $) – November 2022

| Sub-category | Inflow Value |

| International Equities – Developed World | ($105,949,754) |

| Australian Equities – Geared | ($45,214,114) |

| Gold | ($35,114,531) |

| International Equities – Europe | ($23,314,638) |

| Cash | ($19,227,313) |

Comment: Overall net flows at a category level were muted and primarily came from gold and cash outflows.

*Past performance is not an indicator of future performance.

Investor & founder with a Financial Services & Fintech focus. Co-founder of Betashares. Passionate about entrepreneurship and startups.

Read more from Ilan.