David Bassanese

Betashares Chief Economist David is responsible for developing economic insights and portfolio construction strategies for adviser and retail clients. He was previously an economic columnist for The Australian Financial Review and spent several years as a senior economist and interest rate strategist at Bankers Trust and Macquarie Bank. David also held roles at the Commonwealth Treasury and Organisation for Economic Co-operation and Development (OECD) in Paris, France.

4 minutes reading time

Week in review

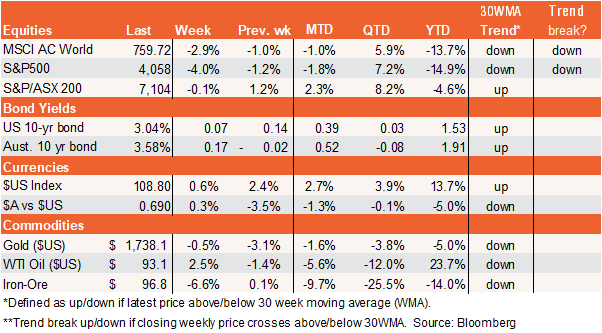

As expected, the market highlight last week was the all-important Jackson Hole speech by Fed Chair Jerome Powell. And he did not disappoint! His speech was short and focused lest there be any further market misinterpretation of his thinking.

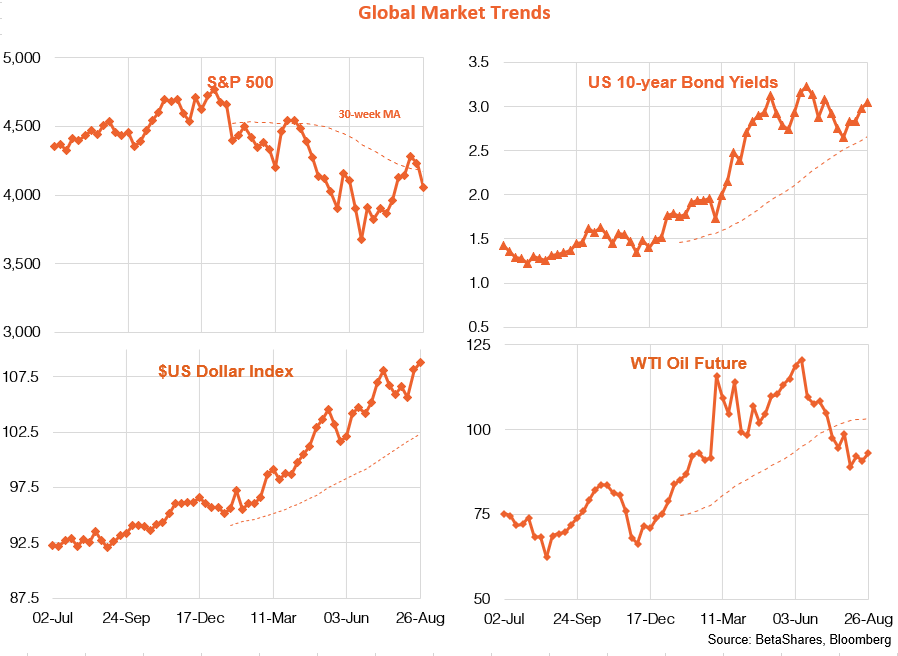

In essence the Fed is resolutely focused on bringing down inflation to 2% before it has a chance of filtering through into inflation expectations – even at the risk of recession. Powell regards the early 1970s period where inflation was allowed to remain high and variable as a terrible policy mistake, and he continues to praise the work of Fed chair Paul Volker in breaking the back of inflation with tough medicine in the early 1980s.

Ominously, Powell suggests getting inflation down to where it needs to be “will take some time” and will likely require a “sustained period of below trend economic growth” brought about by achieving and maintaining a “restrictive policy stance for some time”. Households should expect “some pain” in the months ahead.

It also seems likely the Fed will hike by a further 0.75% at the September meeting, given he indicated a slowing in the pace of increases will only be appropriate “at some point, as the stance of policy tightens further”.

Meanwhile, US economic data continued to deteriorate – with a slump in new home sales and weaker than expected manufacturing and service sector indices. All up, it’s no surprise Wall Street slumped on Friday, as barring a surprisingly quick decline in inflation over the next month or so, the prospect of sustained policy restriction and looming below-trend economic growth must weigh on sentiment.

Europe continues to reel from surging inflation and weakening sentiment due to its self-inflicted energy crisis – which has also made European Central Bank officials as hawkish as their US counterparts. China is battling to contain fallout from the implosion in its property bubble – with more support to help builders at least finish the homes they promised to build.

With little data in Australia last week, local markets – as was the case globally – focused on Powell’s end-of-week speech.

Week ahead

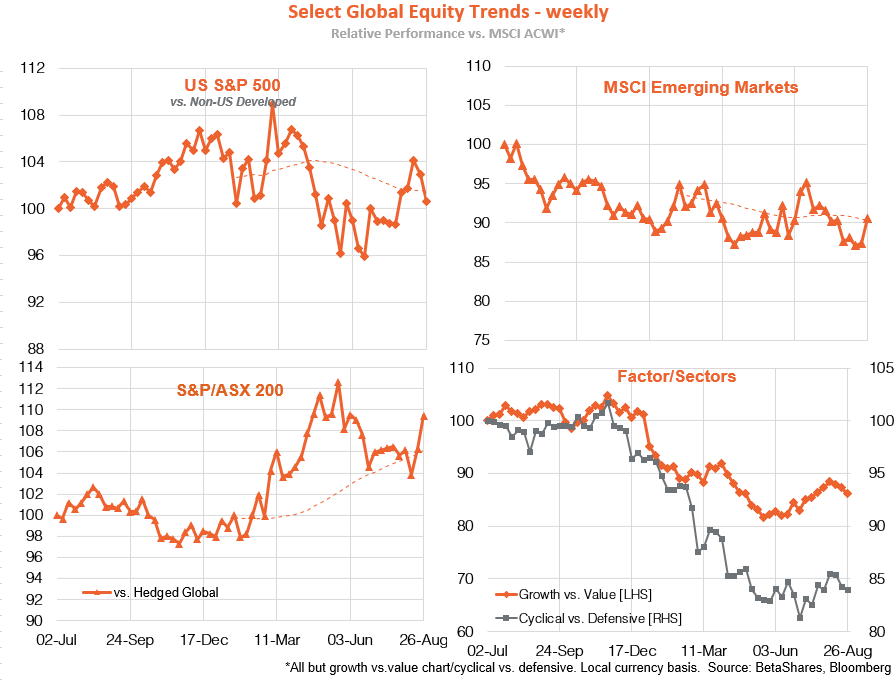

The key focus globally this week will be how Wall Street reacts as it digests the implications of Powell’s uber-hawkish stance. Until we get a few more downside inflation surprises – with nothing of the sort on offer this week – the market really has nothing positive to focus on. That suggests more weakness may well be ahead, especially as the S&P 500 last week failed to clear key resistance levels such as 200-day moving average and the downtrend line from the January peak.

The market will be tested on Friday with the August payrolls report – which is expected to show still firm employment growth (+285k), a still low unemployment rate of 3.5% – and most worryingly still firm annual wage growth of just over 5%. Such a broadly solid result should firm up market expectations for a 0.75% Fed rate hike next month.

In Australia, we get a few important economic updates this week – such as retail sales, building approvals, construction work and the capital expenditure survey. Overall, the data are likely to be somewhat mixed – confirming a progressive weakening in the housing sector, with weakening building approvals and house construction, but likely continued resilience in retail sales and a robust outlook for private capital spending. This should leave markets still attaching a high chance of a further 0.5% RBA rate hike next month, which remains my base case expectation.

Have a great week!

David is responsible for developing economic insights and portfolio construction strategies for adviser and retail clients. He was previously an economic columnist for The Australian Financial Review and spent several years as a senior economist and interest rate strategist at Bankers Trust and Macquarie Bank. David also held roles at the Commonwealth Treasury and Organisation for Economic Co-operation and Development (OECD) in Paris, France.

Read more from David.