Is your portfolio really diversified?

7 minutes reading time

- Fixed income, cash & hybrids

Betashares is an established leader in increasing access to cash and fixed-income markets for Australian investors and their advisers, and bank credit has been a particular area of expertise. Of the $10.5 billion we manage in cash and fixed-income ETFs, approximately $4 billion is invested in bank credit across all levels of the capital structure, making us among the largest managers of bank credit in Australia1.

We are excited to announce BSUB Australian Major Bank Subordinated Debt ETF , our first dedicated subordinated floating rate note (FRN) ETF and the first pure-play Tier 2 bank credit fund in Australia, is now available on the ASX.

BSUB offers investors opportunity for:

- attractive income, paid monthly

- access to a portfolio of high quality Australian denominated Tier 2 bonds

- liquidity, and

- protection against rising rates.

The bank credit market

The $250 billion bank credit market is a well-established part of the broader Australian fixed-income landscape, long supported by Australian and global investors due to the strength of our banking sector, the attractive yields on offer, and the liquidity available across all major levels of the capital structure: senior, Tier 2 (subordinated), and AT1 (‘hybrids’).

This market continues to grow amid the ongoing needs of our banks to access wholesale funding markets and the regulatory environment, which mandates the continued issuance of subordinated bonds to ensure the system’s resilience.

This resilience was recently affirmed by the credit ratings agency, S&P Global Ratings, which raised Australia’s Banking Industry Country Risk Assessment (BICRA) to its lowest ever risk level and upgraded the credit ratings of the subordinated bonds from our major banks (CBA, NAB, ANZ, and Westpac) to A-, a level comfortably within the ‘investment grade’ classification.

Attractive income, liquidity, and protection against rising rates

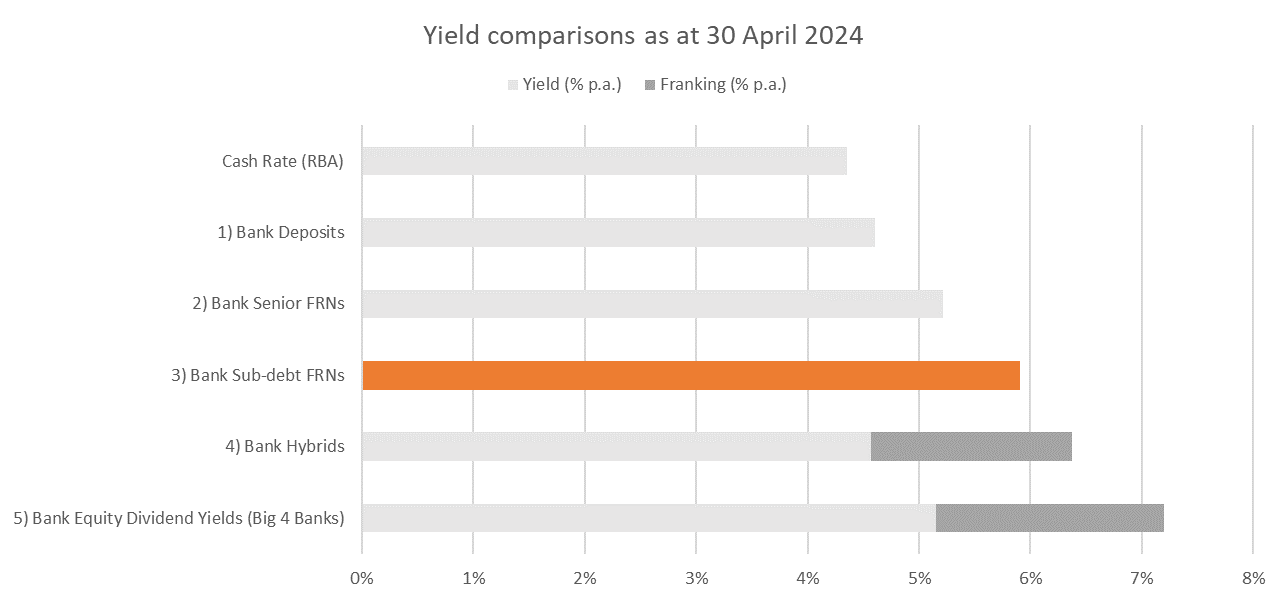

The aggressive rate-hiking cycle of recent times has repositioned liquid investment-grade fixed income as a compelling source of income for portfolios. Australian investors seeking income no longer need to venture into equities or illiquid credit alternatives. Subordinated debt, in particular, has continued to offer very attractive income, delivering around 1.8% above cash deposits and 0.9% above senior bank FRNs (as of 30th April 2024). With cash yields currently close to 6%, major bank subordinated FRNs are now matching or even surpassing the fully franked yields from their respective ordinary shares but with a fraction of the volatility.

Source: Bloomberg, Betashares, RBA. Past Performance is not indicative of future performance. Yield will vary and may be lower at time of investment. Bonds and hybrids have relatively higher risk compared to cash deposits. Yield does not take into account fund fees and costs. Yield will vary and may be lower at time of investment.

1.‘Bank Deposits’ is represented by the interest rate earned on the ASX: AAA ETF’s bank deposits. Doesn’t take into account ETF fees and expenses.2.‘Bank Senior FRNs’ is represented by the ASX: QPON ETF’s All-in Yield*.3.‘Bank Sub-debt FRNs’ is represented by the All-in Yield* of BSUB’s index, the Solactive Australian Major Bank Subordinated FRN Index (not actual fund performance) to illustrate the historical performance of floating rate Australian denominated subordinated bonds issued by the Big 4 Australian banks (ANZ, CBA, NAB and Westpac). Doesn’t take into account ETF fees and expenses of 0.29% p.a. You cannot invest directly in an index.4.‘Bank Hybrids’ is represented by the ASX: BHYB ETF’s All-in Yield* (inclusive of franking credits where indicated). Not all investors will be able to obtain the full benefit of franking credits.5.Calculated as the average of Big 4 Australian banks’ annualised dividend yields, based on the dividend frequency divided by the current market price, inclusive of franking credits where indicated. Not all investors will be able to obtain the full benefit of franking credits.*See endnotes for explanation of All-in Yield.

The Australian bank bond market, one of the most liquid parts of our credit market, sees substantial daily trading activity from a range of institutional investors, including traditional fund managers, superannuation funds, global institutions, and bank treasury operations. Like senior bonds, the underlying over-the-counter market for subordinated bonds offers ample liquidity, specifically low bid-offer spreads, and the ability to transact in very large volumes. BSUB allows investors to access not only the attractive income potential from these securities but also the liquidity available in this deep secondary market, with the ease of trading via an ASX-listed vehicle with T+2 settlement.

Subordinated FRNs also offer protection against the impact of rising interest rates, a characteristic absent in fixed-rate bonds. Being floating rate, their income stream is indexed to the 3-month BBSW reference rate (plus a spread), which means their interest payments adjust to interest rate fluctuations within three months, a stark contrast to fixed-rate bonds where interest payments remain constant. This makes the capital price of FRNs relatively steady, with low sensitivity to any changes in central bank interest rates or government risk-free yields.

The past three years have been particularly tumultuous for traditional Australian fixed income, with fixed-rate benchmarks experiencing their worst drawdowns in recorded history (-15% in the case of the Bloomberg AusBond Composite). In contrast, the index BSUB aims to track, the Solactive Australian Major Bank Subordinated FRN Index, experienced minimal volatility, with a maximum drawdown during this period of only 2.2%2. Additionally, the day-to-day volatility over this period was roughly one-third that of fixed-rate bonds and one-tenth that of bank shares.

A focus on quality and intelligent indexing

Investing in bank credit, especially further down the capital structure, can involve unique terms of issue and regulatory complexity. Subordination and callability are features of Tier 2 securities that introduce a higher risk level than that of senior bonds. Further, a key feature of the regulatory requirements for subordinated FRNs, being Tier 2 regulatory capital instruments, is that they absorb losses at the point of non-viability of the issuer.

It is for this reason that it’s important to ensure issuers are financially strong.

The Australian major banks remain the foundational pillars of our banking system. The Australian Prudential Regulation Authority (APRA) has strict rules in place for banking capital adequacy, and Australian banks are generally considered some of the best capitalised major financial institutions in the world3. To mitigate regulatory and subordination risks, BSUB only holds these 4 issuers, avoiding lower-rated regional banks and insurers.

At Betashares, we believe that the liability-weighting of traditional fixed income indices is problematic – assigning the largest weight to bonds with the most debt outstanding is problematic, and can result in an unstable risk profile.

BSUB aims to address some of these issues through a combination of issuer-level capping and selecting the longest bonds, while also limiting the maximum remaining term to maturity to 10 years. Further, the Fund can hold a maximum of 16 securities. If there are 10 or more securities, market value weighting is applied with an issuer cap (35% per issuer). However, If there are fewer than 10 securities, equal weighting is applied. As such, this strategy seeks to harvest more yield and other forms of risk premium available from the highest quality issuers, while mitigating single security risk, maintaining high levels of credit quality and liquidity, and delivering a relatively stable volatility profile.

BSUB is now available on the ASX.

* ‘All-in Yield’ refers to the sum of a FRN’s Discount Margin and its reference benchmark rate. The Fund’s all-in yield is the weighted average of its underlying securities’ all-in yields. Discount Margin (DM) refers to the difference or spread between the expected return of a FRN security and that of its underlying index, expressed as a margin above the underlying reference benchmark rate. The Fund’s DM is the weighted average of its underlying securities’ DMs. For AUD FRN securities, the reference benchmark rate is the Bank Bill Swap Rate (BBSW). For securities with optionality, this is the DM to first call, where the calculation replaces the security maturity date with its first call date.

Sources:

1.As at 30 April 2024.

2.You cannot invest directly in an Index. Past performance is not an indicator of future performance.

3.https://www.afr.com/companies/financial-services/the-three-rules-that-make-australia-s-banks-the-strongest-in-the-world-20230330-p5cwk3