David Bassanese

Betashares Chief Economist David is responsible for developing economic insights and portfolio construction strategies for adviser and retail clients. He was previously an economic columnist for The Australian Financial Review and spent several years as a senior economist and interest rate strategist at Bankers Trust and Macquarie Bank. David also held roles at the Commonwealth Treasury and Organisation for Economic Co-operation and Development (OECD) in Paris, France.

1 minutes reading time

Market overview

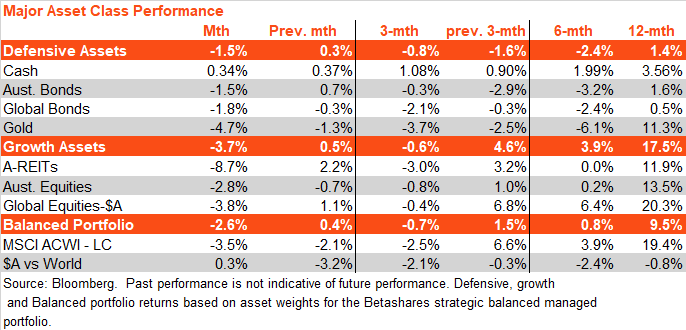

Both defensive and growth assets weakened in September, reflecting a strong further increase in global bond yields. In turn this reflected resilient global economic growth and expectations that policy rates would remain ‘higher for longer’.

Growth assets declined more than defensive assets, with global (hedged equities) down 3.5% and Australian equities down 2.8%. The interest rate-sensitive listed property sector weakened by 8.7%.

Among defensive assets, bonds underperformed cash reflecting the rise in bond yields. Gold prices also weakened, reflecting higher bond yields and a stronger USD.

The full market trends report is available here.

David is responsible for developing economic insights and portfolio construction strategies for adviser and retail clients. He was previously an economic columnist for The Australian Financial Review and spent several years as a senior economist and interest rate strategist at Bankers Trust and Macquarie Bank. David also held roles at the Commonwealth Treasury and Organisation for Economic Co-operation and Development (OECD) in Paris, France.

Read more from David.