Responsible investing has evolved significantly over the last few decades, becoming a cornerstone in the investment strategies of individual and institutional investors alike. At the heart of this evolution is the integration of Environmental, Social, and Governance (ESG) factors into investment decision-making processes. Ethical investing was traditionally focused on excluding sectors that were deemed morally objectionable, such as tobacco or weapons. That approach evolved to include environmental and governance considerations, while the ’Social’ component of ESG was often lower down on the priority list.

However, with increasing awareness of social injustices, labour rights, and community impacts, coupled with rising international conflict, the social component of ESG is evolving from a peripheral concern to a key consideration in investment decision-making. This shift is being driven by a growing body of evidence linking robust social practices to long-term financial performance1, and a broader understanding that sustainable financial returns are inextricably linked to the well-being of the workforce, communities, and society at large.

The ‘what’ – understanding the ‘Social’ in ethical investing

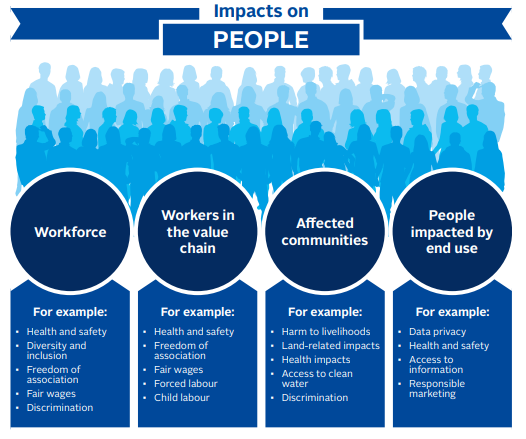

The social dimension of ethical investing refers to a company’s relationship with its employees, customers, and suppliers, as well as its policies and actions impacting the communities within which it operates. This involves assessing a company’s capability to uphold fair labour practices and ensure proper wage payments, uphold stringent standards for employee health and safety, implement diversity and inclusion measures, and determine if their leadership structures are genuinely representative and equitable.

The social dimension also extends to how companies engage with suppliers and communities, underlining the importance of ethical supply chain practices and transparency. It considers consumer protection, focusing on how businesses ensure the safety and integrity of their products and services, while also considering data protection and privacy in an increasingly digital world.

More broadly, the social aspect evaluates a company’s influence in the communities where it operates — whether it contributes positively through engagement, investment, and development initiatives or potentially causes harm, intentionally or not. This includes a company’s impact on policy and regulation through direct lobbying or the actions of industry associations to which it belongs.

Source: PRI – Managing Human Rights Risks: What Data do Investors Need?

The ‘why’ – Making the case for upholding human rights

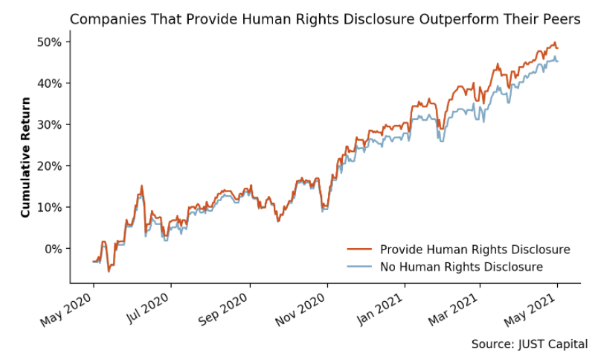

The integration of social issues is more than just aligning with investor values, it’s also about generating better financial outcomes as studies suggest companies with fair labour practices and human rights disclosure outperform their less responsible counterparts over the long term2,3. Firstly, companies that excel in social practices, such as fair labour policies, diversity and inclusion, and strong community relations, tend to foster more resilient and motivated workforces, which, in turn, can lead to enhanced productivity, innovation, and reduced turnover costs, directly impacting the bottom line4,5.

Source: Just Capital

Additionally, the ‘Social’ aspect of ESG investing is crucial for risk management. Companies that neglect their social responsibilities may face significant risks, including legal penalties, regulatory sanctions, and reputational damage. These risks could arise from a range of issues, including poor labour practices, human rights violations, and inadequate customer data protection, each capable of eroding investor returns. As global regulation sharpens its focus on social issues, companies that proactively address these concerns are more likely to avoid potential penalties, compliance costs and disruptions6.

Source: Herbert Smith Freehills

Lastly, the imperative for investors to uphold human rights, as outlined in the United Nations Guiding Principles on Business and Human Rights7 (UNGPs), extends to all facets of their operations. Officially endorsed by the UN Human Rights Council in 2011, the UNGPs have since become a foundational framework, reinforced by their integration into the OECD’s Guidelines for Multinational Enterprises8. While there has been a growing acknowledgement among the investment community of the need to align investment practices with the UNGPs, investors are also increasingly wary of investing in businesses involved in human rights abuses.

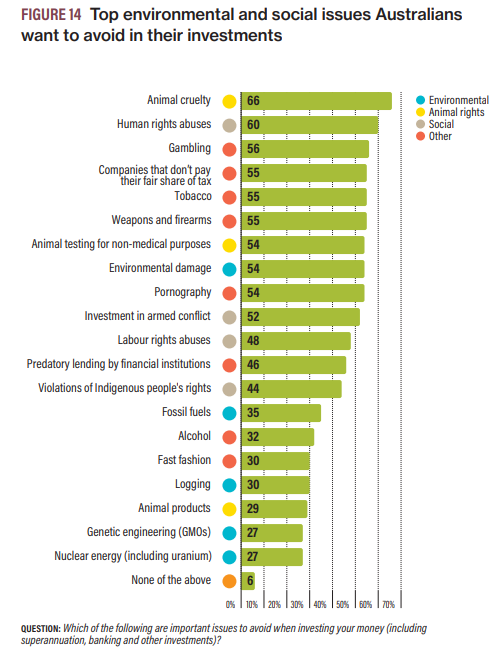

A 2024 survey conducted by the Responsible Investment Association of Australasia indicated that more than 75% of respondents wished to avoid human rights related issues in investing, up from 63% only two years ago. 89% of Australians believe it is important that their super fund or bank commits to protecting human rights, including 24% who say this is extremely important to them. Human and labour rights abuses are the top social issues which Australians want to avoid in their investments9. Neglecting these rising expectations poses a significant risk to the credibility and trustworthiness of the financial community, potentially undermining its social license to operate.

Source: RIAA

The ‘how‘ – Navigating varied approaches to being a socially savvy investor

Integrating social considerations in the investment process involves various approaches, with the key ones highlighted below:

- Screening: This involves screening companies based on their social practices and excluding those that fail to meet predefined social criteria. Screening can be negative, excluding companies involved in controversial practices, or positive, such as favouring companies aligned with UN Sustainable Development Goals (SDGs) focused on human rights10.

- Engagement and advocacy: Investors can promote positive social practices through active engagement with company management on social issues and advocating for improvements by proactively lobbying governments and regulatory bodies. Active engagement can also include filing shareholder resolutions on social topics.

- Impact investing: Impact investing goes a step further by specifically targeting investments intended to generate positive social impacts alongside financial returns. This can include investing in companies or projects addressing social challenges such as affordable housing, education, and healthcare.

- Thematic investing: Under this approach, investors focus on specific social themes aligned with their values or the ones that they believe will gain prominence in the future. This can include investing in companies excelling in gender diversity, support for LGBTIQ+ rights, or those that are leading in labour rights and fair-trade practices.

- Collaboration and collective action: Collaborating with other investors and stakeholders can amplify the impact of social considerations in investing. Investors may participate in investor networks focused on social issues, join forces in engagement activities, or contribute to industry standards and best practices.

The data dilemma: Quantifying the qualitative

One of the most formidable challenges in incorporating social considerations is the inherent difficulty in quantifying qualitative aspects. Unlike environmental metrics, such as carbon emissions, which are measurable, social factors are subjective and less amenable to standardisation. This makes it harder for investors to compare and benchmark the social performance of potential investments, thus complicating investment decisions. In order to adequately evaluate companies on their social performance, investors should rely on a diverse, non-homogenised set of data sources. This includes corporate disclosures, NGO reports, country risk reports, human rights benchmarks, engagement with stakeholders (trade unions and industry bodies), commercial data providers, and mainstream and specialist media reports, in addition to commercial data providers.

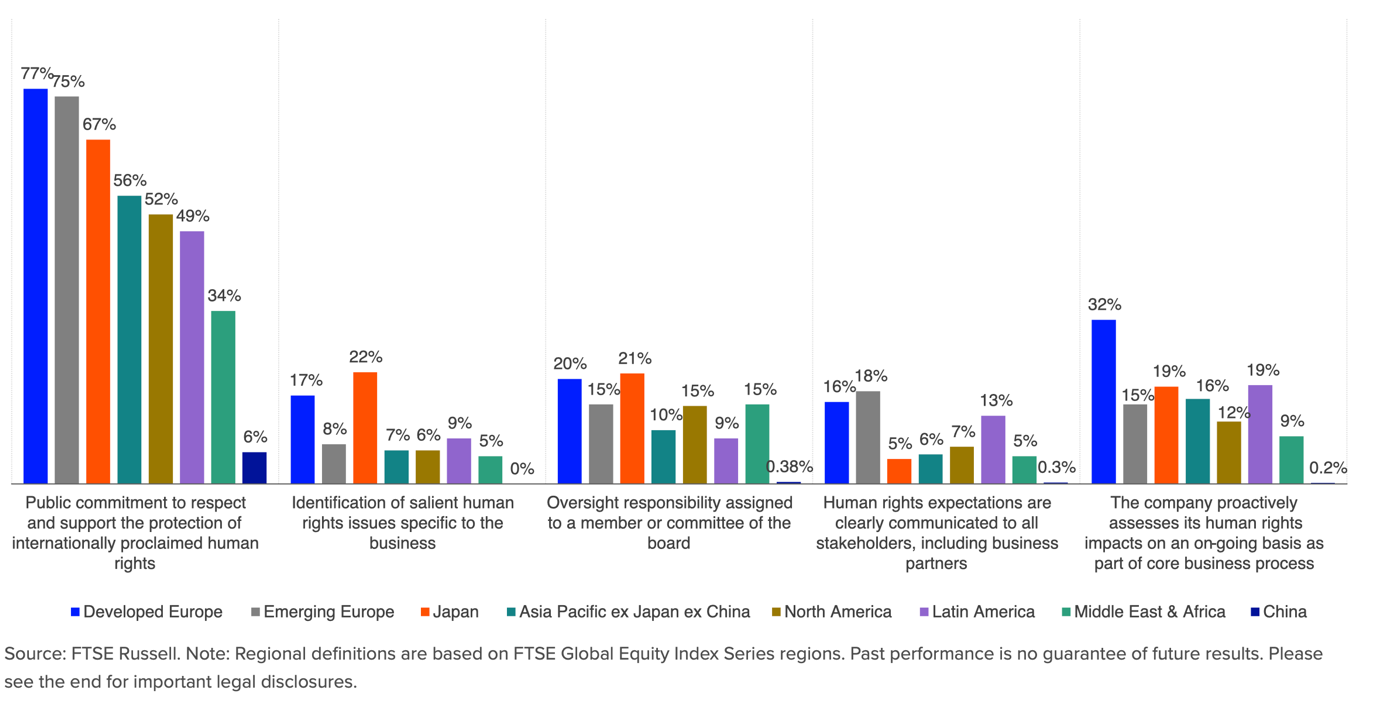

A recent paper from the UN Principles of Responsible Investment (UN PRI) highlighted that investors face ‘gaps in terms of available information and reliable sources. Where this information is available, it can be difficult to access and process at scale11. Regional differences only compound the problem. Companies from developed countries in Europe have by far the most comprehensive disclosures across policy, governance, and quantitative non-financial reporting. Over three-quarters of corporates in the region have a commitment to human rights, while around a third proactively assess human rights impacts12.

Far fewer companies in other regions have similar human rights policies, processes, or governance in place. For example, there are human rights commitments in place for only half of North and Latin American companies and about 5% of Chinese companies13.

Large and Mid-Cap Companies disclosing performance on human rights practices in 2022

Source: LSEG

Putting it all into practice

Examining real-world examples can provide valuable insight into how the ‘S’ factor is integrated into ethical investing. For instance, an analysis of a company that faced backlash due to poor social practices could highlight the risks associated with neglecting the ‘S’ factor. We have highlighted a few examples below:

Source:

1. https://fortune.com/2023/12/17/activision-blizzard-settles-gender-discrimination-lawsuit/

3.https://remake.world/stories/hm-abercrombie-fitch-and-zara-worst-wage-theft-in-fashions-history/

4.https://www.miragenews.com/cleanaways-pay-and-conditions-attacks-spark-982273/

5.https://www.eeoc.gov/newsroom/eeoc-sues-tesla-racial-harassment-and-retaliation

6.https://europe.autonews.com/automakers/tesla-workers-german-plant-turn-union-safety-concerns

7.https://www.hrw.org/news/2024/02/01/china-carmakers-implicated-uyghur-forced-labor

Mapping the interconnectedness of E, S and G in ethical investing

Incorporating social considerations into ethical investing is fraught with challenges, from data scarcity to the intertwined nature of ESG factors and evolving societal norms. For instance, a company’s environmental practices can have significant social implications, from the health and well-being of local communities to the broader social impacts of climate change. Similarly, effective governance practices, including transparency, accountability, and ethical leadership, are crucial in underpinning and reinforcing strong social standards. Yet, these challenges also present opportunities for investors to engage deeply with the companies they invest in, to advocate for positive change, and to contribute to a more equitable and sustainable world.

Activision Blizzard, H&M and Inditex, and Tesla are companies that have been excluded from the ETHI Global Sustainability Leaders ETF on the recommendation of the Responsible Investment Committee under the controversy screen after conducting a thorough analysis of the social risks associated with these businesses.

Cleanaway Waste Management was excluded from the FAIR Australian Sustainability Leaders ETF on the recommendation of the Responsible Investment Committee under the controversy screen after conducting a thorough analysis of the social risks associated with the business.

ETHI aims to track the performance of an index (before fees and expenses) that includes a portfolio of large global stocks identified as “Climate Leaders” that have also passed screens to exclude companies with direct or significant exposure to fossil fuels or engaged in activities deemed inconsistent with responsible investment considerations.

FAIR aims to track the performance of an index (before fees and expenses) that includes Australian companies that have passed screens to exclude companies with direct or significant exposure to fossil fuels or engaged in activities deemed inconsistent with responsible investment considerations.

-

ETHI

Global Sustainability Leaders ETF

-

FAIR

Australian Sustainability Leaders ETF

Written by

Vinnay Cchoda

Manager – Responsible Investments at Betashares, Ex Ellerston Capital and Venture Insights. Startup Founder and Strategy Consultant. Harvard Business School, University of Cambridge, and University of Mumbai. Passionate about climate change, sustainability, investments, and markets.

Read more from Vinnay.