Richard Montgomery

Senior Content Manager - Richard Montgomery brings over 25 years of financial expertise to Betashares, where he steers investor communication. Prior to joining Betashares, Richard worked as a communications consultant for various financial institutions, including the Australian Securities Exchange (ASX).

5 minutes reading time

Reading time: 3 minutes

Many investors go to a lot of effort trying to pick market (or individual share price) lows and highs, in an attempt to time their entries and exits. It’s a strategy that often goes hand-in-hand with a willingness to take investment decisions based on relatively short-term market movements.

This approach is sometimes referred to as ‘market timing’, and it contrasts with a long-term buy and hold approach, where an investor may not be so fixated on price when first investing, and typically buys with the intention of holding for a period of years.

Whilst simple in concept, in practice market timing is not so easy. The problem is that, as an old saying goes, no-one rings a bell at the top and the bottom.

Does timing really matter?

There are many studies, conducted over a range of timeframes and in sharemarkets around the world, showing the impact on investment returns of missing out on the best few days for the market in a given period. These studies consistently show that not being invested on just a few of the big ‘up’ days for the market can have a dramatic impact on your portfolio.

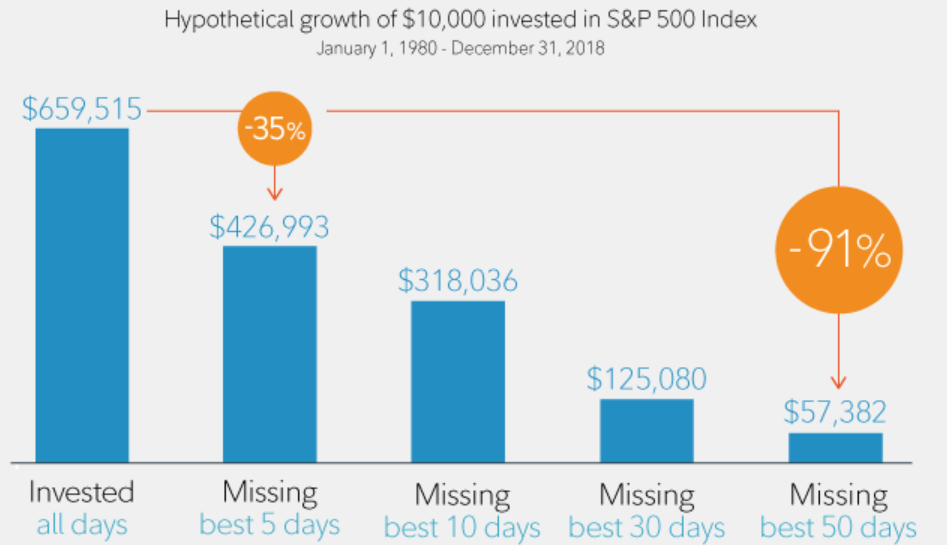

One study looked at the U.S. sharemarket over a period of nearly 40 years, and calculated the impact of missing the best 5, 10, 30 and 50 days in that period.

An investor who hypothetically invested $10,000 into the S&P 500 Index on 1 January 1980 and remained fully invested would have seen their money grow to almost $660,000 by 31 December 2018.

Missing out on just the five best days during that period would have reduced their returns by 35%, while missing out on the 10 best days would have cut returns by more than half.

Source: www.fidelity.com. Hypothetical example provided for illustrative purposes only. You cannot invest directly in an index. Past performance is not indicative of future performance.

Looking at the Australian sharemarket, a hypothetical $10,000 invested into the S&P/ASX 200 Accumulation Index on 30 October 2003 would have turned into $38,002 by 3 August 2020.

Missing the 10 best days during this period would have reduced returns by $15,484, while missing the 20 best days would have reduced returns by $23,0931.

These examples illustrate the risk you take by trying to ’time the market’. Who knows when those good days, that make a disproportionate contribution to long-term returns, will take place?

Actually, there is a partial answer to this exact question that reinforces the problems with attempting to time the market: many of the best days in the market come right after the worst days.

We saw examples of this on the ASX earlier this year when the market was at its most volatile:

- a fall of 9.7% on 16 March was followed by a rise of 5.8% on 17 March

- after the market fell by 5.6% on 23 March to hit its 2020 low, on the following three days it rose by 4.2%, 5.5% and 2.3%

- a fall of 5.3% on 27 March was followed by a rise of 7.0% the next trading day2.

These figures tell us that it is during the very times that markets are at their most stomach-churning, and investors are most likely to be panicked into cashing out of their investments, that the most important up days may be about to occur. These are the days that make outsized contributions to your long-term returns.

Of course, remaining invested means you also remain exposed to the market’s bad times.

What is the lesson?

The key lesson is that it is almost impossible to consistently time the market over the long term.

While everyone’s circumstances and goals are different, conventional wisdom is that most investors are best-advised to play a long game, get their asset allocation right, and ensure they are well-diversified.

ETFs are well-suited to this investment approach. They provide a convenient, cost-effective way to get exposure to all the major asset classes, including Australian and global equities, fixed income, cash and commodities.

You can use ETFs to build the core of your portfolio – investments that will provide your portfolio foundation over the long term, through the market’s up and down cycles. For example, A200 Australia 200 ETF provides exposure to the largest 200 companies on the ASX at an annual management cost of just 0.04%3.

So should I ever attempt to time the market?

By now it should be clear how difficult it is to time the market – and the risks you run if you get it wrong.

However, that’s not to say that you should ignore market valuations, and adopt a ‘100% invested, 100% of the time’ approach.

Just as some fund managers take an ‘overweight’ or ‘underweight’ approach according to their market view, you can also adjust your exposure. Rather than selling everything when you think the market is getting ‘toppy’, you may consider banking some profits by selling a portion of an investment. Similarly, when the market has suffered a significant pullback like we saw earlier this year, if you think that a recovery is likely, you can top up holdings, or take the opportunity to add a new investment to your portfolio.

This is very different from an ‘all in or all out’ approach. If you get the timing right, you can enjoy a boost to your portfolio returns – and if you don’t, at least taking an incremental approach means there won’t be a catastrophic impact on your portfolio.

Of course, the approach you take should ultimately be informed by your personal objectives, financial situation and needs, and you should consider obtaining financial advice before making any investment decision.

You can check out the range of Betashares ETFs here.

1. Source: www.fidelity.com.au. Hypothetical example provided for illustrative purposes only. You cannot invest directly in an index. Past performance is not indicative of future performance.

2. www.asx.com.au, movements in the S&P/ASX 200 index

3. Other fees and costs, such as transactional costs, may apply. Refer to the PDS for more information.

Written by

Richard Montgomery

Senior Content Manager

Richard Montgomery brings over 25 years of financial expertise to Betashares, where he steers investor communication. Prior to joining Betashares, Richard worked as a communications consultant for various financial institutions, including the Australian Securities Exchange (ASX).

Read more from Richard.