Royalties historically have been a source of significant value creation. Australia’s richest woman, Gina Rinehart, derived a substantial part of her personal fortune from iron ore royalties, while Forbes lists Michael Jackson and Prince as among the highest paid deceased musicians thanks to ongoing royalty income from their work.

Royalties are paid not just on mining deposits, but also on a range of intellectual property rights such as new drug formulations, patents, trademarks and trade secrets, in technology and even recorded film and music.

Investors can now consider the BetaShares Global Royalties ETF (ASX Code: ROYL), the first in the world to offer investors dedicated exposure to a portfolio of global royalty companies from a variety of industries and sectors.

Royalties: an attractive risk-return business model

Royalty payments are typically revenue-based. They offer investors exposure to the revenue and growth potential of a company or sector using the asset or producing the end product, without also having exposure to their costs – or the broader operational risks associated with deriving a profit, including a large labour force.

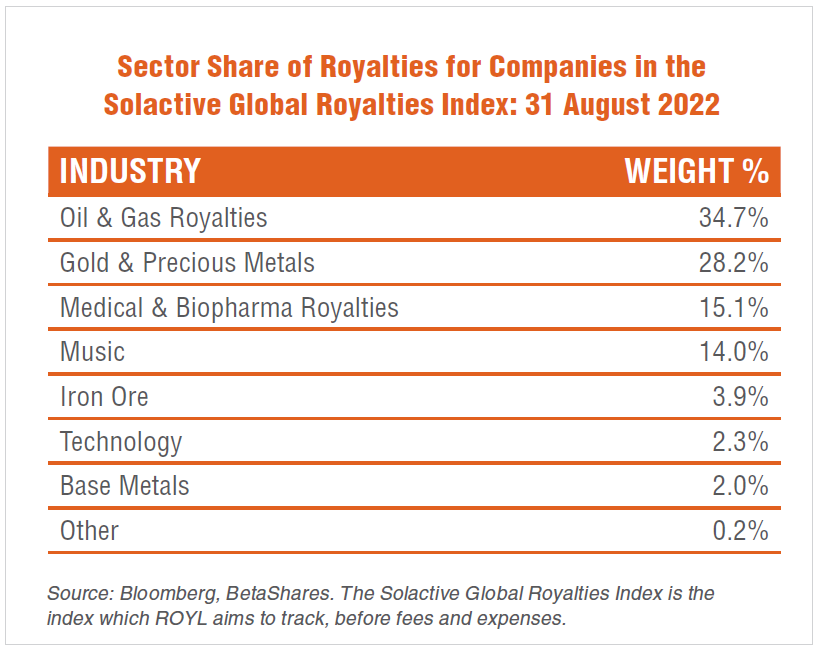

As an alternative to a direct investment in the underlying businesses, the royalty business model can be particularly attractive when it comes to risky and complex business activities such as mining and drug development, with their high capital requirements, operational costs and risks. As evident in the table below, a high percentage of royalties still tends to be derived from these activities.

Attractive fundamental characteristics

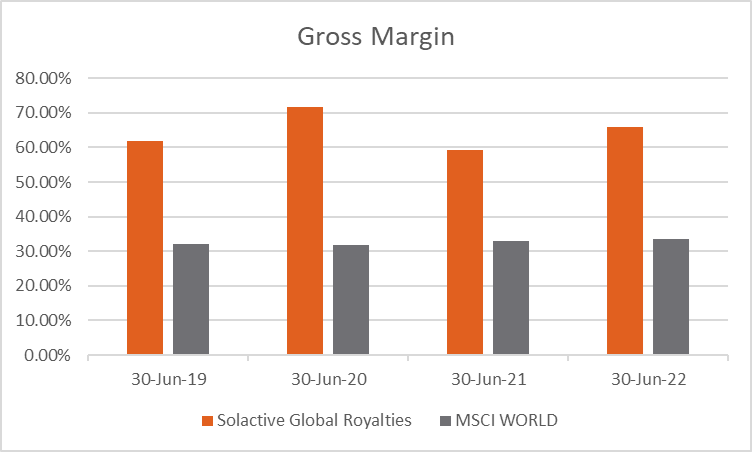

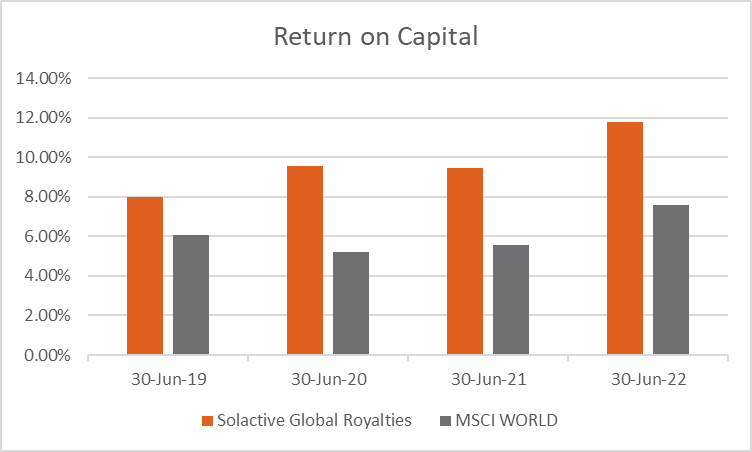

Companies that own and manage royalties tend to have relatively low capital requirements, are able to diversify across different businesses and have generally enjoyed good profitability in recent years. As evident in the charts below, companies covered by the Index which ROYL aims to track have enjoyed higher gross margins and return on capital than those in a global equity benchmark over the four years to 30 June 2022

Source for both charts: Bloomberg. Past performance is not an indicator of future performance. Gross margin and Return on capital figures are calculated based on the companies in the Solactive Global Royalties Index (which ROYL aims to track) as at each year end. You cannot invest directly in an Index. ROYL’s inception date was 9th September 2022.

Potential growth and diversification

Many royalty companies offer the potential to increase both the level and diversity of their revenue streams in the future. Although mining and energy still accounts for the majority of global royalty revenues, royalties earned in the areas of entertainment (music and film) and health care (new drug development) continue to expand.

ROYL provides exposure to companies earning royalties in all these areas. Companies included in ROYL’s portfolio as of 14 September 2022 include:

- Royalty Pharma – a company which owns a portfolio of pharmaceutical royalties for more than 35 drugs and therapies marketed by leading brands like AstraZeneca, Roche, GSK, Pfizer and Johnson & Johnson. These pharmaceutical drugs are helping treat common, chronic and rare illnesses including diabetes, asthma, migraines and a range of cancers.

- Universal Music Group and Warner Music Group – two global music labels which earn royalty income from singers, musicians and other artists. These companies own the back catalogues of leading artists such as Sting, David Bowie, Bob Dylan and Elvis Presley.

- Deterra Royalties – a royalty business that derives its revenue from BHP’s Mining Area C – a project that will form part of the largest operating iron ore hub in the world.

No assurance is given that these companies will remain in ROYL’s portfolio or will be profitable investments.

So-called ‘royalty finance’ has grown in importance in recent years, offering growth and revenue diversification potential for many royalty companies. Under royalty finance agreements, businesses with growth opportunities are able to get up-front financing – without taking on the burden of debt or ownership dilution via new capital – by agreeing to pay a royalty from future revenues. This form of finance is giving rise to royalty revenue streams in not only mining but also the health care sector and beyond.

Advancements in technology and online distribution are making it easier to collect royalties for a widening range of activities – such as music, film and industrial patents. According to Research and Markets, for example, the global market for intellectual property rights and royalty management is estimated to grow from US$8.2 Billion in 2020 to US$16.1 Billion by 2026, implying compound annual growth of 12.2% p.a. over this period1 (actual outcomes may differ materially from forecasts).

Opportunity to benefit from inflationary environments

Another potential benefit of having exposure to revenues rather than costs is that royalty companies may benefit from inflationary environments. Indeed, to the extent that rising inflation tends to increase prices of commodities and other goods which flow to revenues – this would tend to increase royalty payments based on these revenues. At the same time, many royalty companies are less exposed to the negative impact of inflation in the form of rising input costs.

How can Australian investors get exposure to royalties?

Australian investors can access a portfolio of global royalty companies across a range of industries and sectors through the BetaShares Global Royalties ETF (ASX: ROYL). ROYL aims to track an index (before fees and expenses) of companies that earn a substantial portion of their revenues from royalty income, royalty-related income and intellectual property income.

| There are risks associated with investment in the Fund, including market risk, sector risk, royalties related risks, international investment risk and concentration risk. The Fund’s returns can be expected to be more volatile (i.e. vary up and down) than a broad global shares exposure, given its more concentrated exposure. The Fund should only be considered as a component of a diversified portfolio. For more information on risks and other features of the Fund, please see the Target Market Determination (TMD) and Product Disclosure Statement, available at www.betashares.com.au. |

1. Research and Markets: Global Intellectual Property Rights and Royalty Management Market Report 2021-2026: Digital Transformation Drive Augurs Well for Future Growth. February 4, 2022.

Formerly Managing Editor at Livewire Markets. Passionate about investments, markets, and economics.

Read more from Patrick.