David Bassanese

Betashares Chief Economist David is responsible for developing economic insights and portfolio construction strategies for adviser and retail clients. He was previously an economic columnist for The Australian Financial Review and spent several years as a senior economist and interest rate strategist at Bankers Trust and Macquarie Bank. David also held roles at the Commonwealth Treasury and Organisation for Economic Co-operation and Development (OECD) in Paris, France.

4 minutes reading time

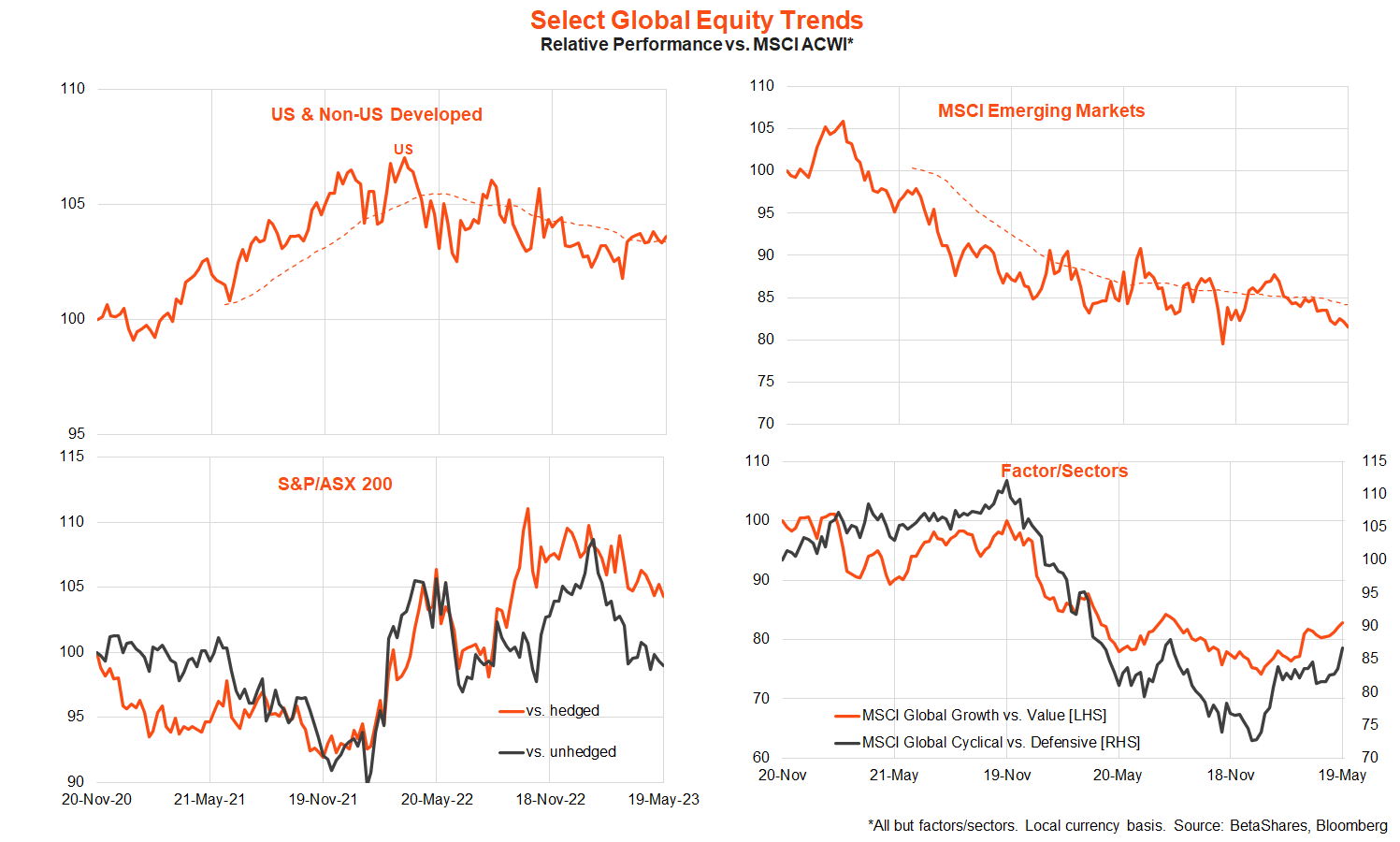

Global markets

Concerns over US debt ceiling negotiations were the primary factor affecting global markets over the past week, with hopes that a deal is close generally helping to support stock prices. The S&P rose 1.6%, tentatively breaking above recent highs of 4,170 in late April and early February. The NASDAQ-100 already broke above its previous resistance levels a few weeks ago. Technically at least, the US market is trending higher from the late October lows!

With the economy not in recession, inflation easing and the Fed close to at least a temporary pause in rate hikes, the US market continues to trade on hopes of a soft landing until the evidence proves otherwise. Indeed, last week’s US economic data remained mixed, while Fed chair Powell importantly on Friday signalled a likely pause in rate hikes at the June policy meeting. Although the Fed still appears uncomfortable with the sticky level of inflation, it concedes a pause is reasonable given lags in policy impact and new uncertainties given the evident tightening of credit conditions. At present, markets attach only a 15% chance of a June rate hike.

US debt ceiling negotiations remain a focus this week, though both sides know a few weeks of haggling/grandstanding is possible before the default risk looms large. US manufacturing and service sector May reports on Tuesday are likely to show a weakened economy but still as yet not in recession. Most important will be Friday’s April private consumption expenditure (PCE) price deflator, which is expected to show core annual inflation holding steady at 4.6%. While the report is likely to show further easing in housing cost inflation, goods inflation (thanks to higher car prices) could show a bounce back, while core-services inflation may also bounce back after an unusually low reading last month.

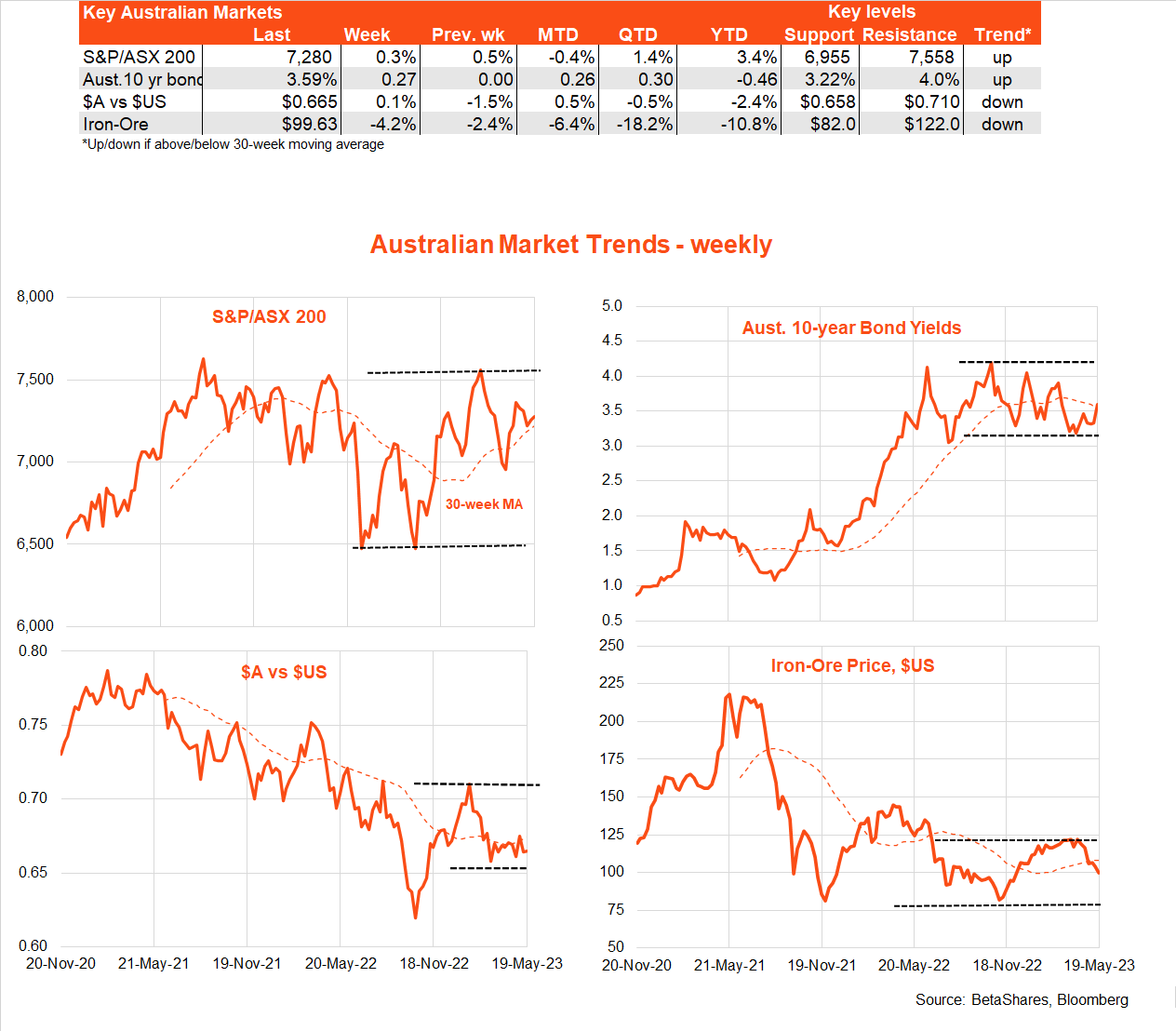

Australian market

As would be expected, the minutes of the RBA’s May meeting – in which it surprised with a rate hike – were fairly hawkish. The Board noted $A weakness, house price strength and pesky global service sector inflation as reasons to raise rates after only a one-month pause. Critically, however, it appears the RBA decided to hold off on a rate hike in April to get updated staff inflation forecasts, which confirmed annual inflation was unlikely to be back in the target band until mid-2025.

If so, it could be that the RBA may use the quarterly inflation updates as the potential opportunity to raise rates further if needed – in which case the next possible move could be in August.

Either way, last week’s economic data did not provide a red flag for a rate rise next month – with still fairly modest growth in the wage price index, a slump in consumer confidence, and a much softer-than-expected employment report. The WPI rose by 0.8%, or just below the 0.9% market expectation, with a step down in private sector wage growth to 0.8% after 1.2% and 0.9% increases over the previous two quarters. In contrast, public sector wage growth picked up last quarter, rising by 0.9%.

Employment, meanwhile, fell by 4.3k in April, despite surging immigration – with the result being a rise in the unemployment rate from 3.5% to 3.7%. Slowing employment demand and rising supply should help ease labour market pressures, albeit as the RBA acknowledged it could add to housing shortages and higher rent inflation.

There is little on the local data front this week apart from preliminary April retail sales on Friday. I suspect the result will be fairly soggy, in line with the slide in sales generally since late last year. This should be consistent with the RBA holding fire again at least next month.

Have a great week!

David is responsible for developing economic insights and portfolio construction strategies for adviser and retail clients. He was previously an economic columnist for The Australian Financial Review and spent several years as a senior economist and interest rate strategist at Bankers Trust and Macquarie Bank. David also held roles at the Commonwealth Treasury and Organisation for Economic Co-operation and Development (OECD) in Paris, France.

Read more from David.