David Bassanese

Betashares Chief Economist David is responsible for developing economic insights and portfolio construction strategies for adviser and retail clients. He was previously an economic columnist for The Australian Financial Review and spent several years as a senior economist and interest rate strategist at Bankers Trust and Macquarie Bank. David also held roles at the Commonwealth Treasury and Organisation for Economic Co-operation and Development (OECD) in Paris, France.

2 minutes reading time

Global equities supported by interest rates and solid earnings

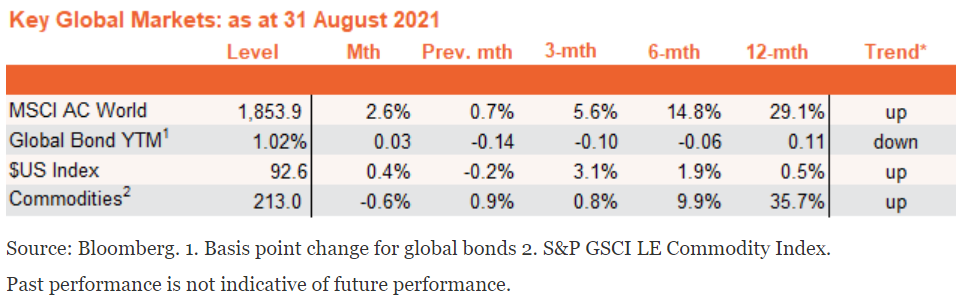

Global equities rose 2.6% in August, and the outlook remains encouraging.

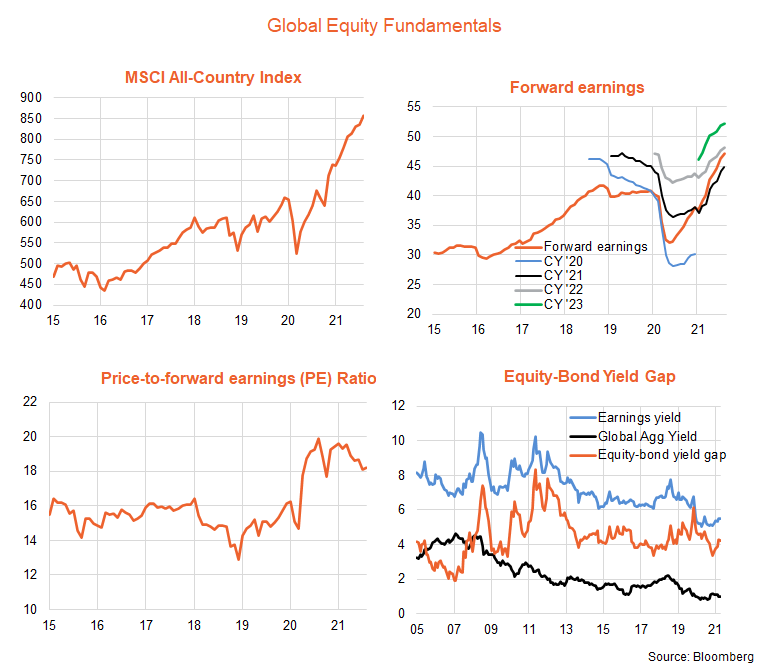

Global forward earnings accounted for most of the increase in equity prices, rising 1.9%. Despite a renewed wave of global COVID cases, rising vaccination rates have meant fewer are ending up in hospital or dying – allowing major economies such as the United States and Europe to avoid a return to lockdowns. Current consensus earnings expectations are consistent with 10% growth in forward earnings by the end of 2022.

Valuations also lifted modestly in August, with the global forward price to earnings (PE) ratio rising from 18.1 to 18.2, despite a small increase in U.S. 10-year bond yields from 1.22% to 1.27%. The equity risk premium eased to 4.2% from 4.3%, which is at the lower edge of its post-GFC range but still above longer-run average levels. The outlook for interest rates and valuations remains benign, with most global central banks still committed to extremely easy monetary conditions until labour markets tighten and a sustainable lift in wage and price inflation seems likely.

Recent signalling from the U.S. Federal Reserve suggests it will announce a gradual tapering of bond purchases in coming months, which now appears well priced into the market.

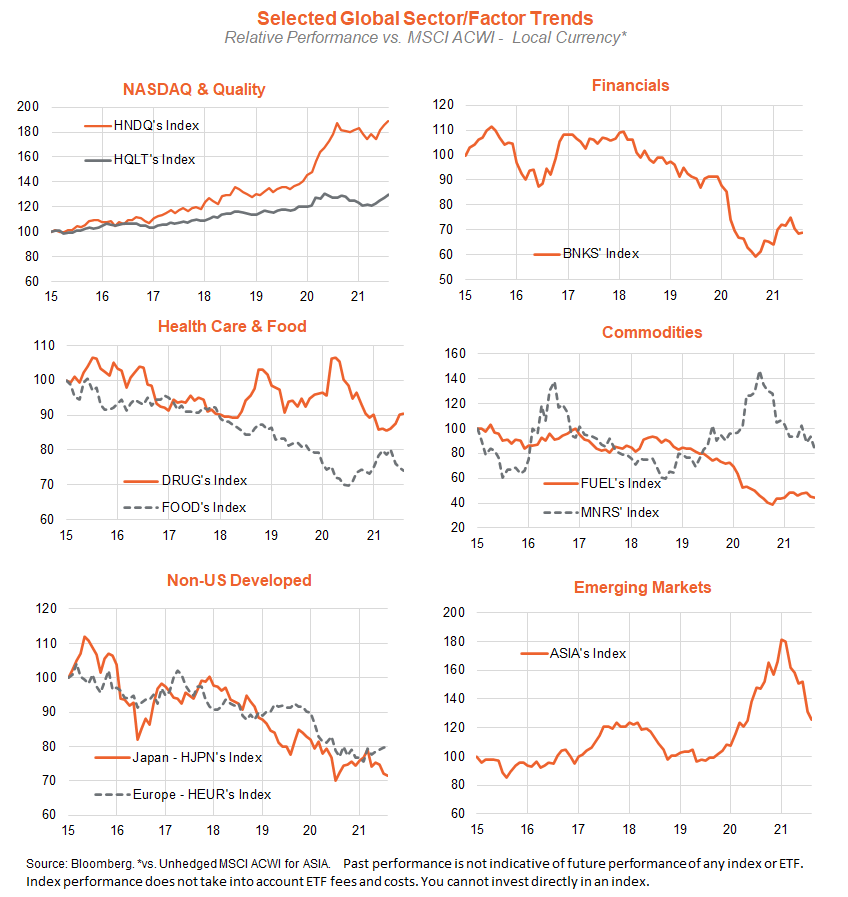

Global equity themes – U.S./growth/technology return to favour

As seen in the charts below, the pullback in bond yields and commodity prices over recent months has been associated with a rotation back to the tech-heavy Nasdaq-100 (HNDQ ETF), global quality (HQLT ETF) and global health care (DRUG ETF) over value exposures such as energy (FUEL ETF) and banks (BNKS ETF).

Emerging markets, meanwhile, continue to be hurt by a shakeout in the Asian technology sector in recent months, and a stabilisation in the U.S. dollar.

Given the relatively strong outlook for the U.S. economy and continued low bond yields, trends favouring the U.S./growth/technology areas could persist for some time. Critical in coming months will be how bond yields react to Fed tapering and whether U.S. inflation does start to moderate after moving higher earlier this year. My expectation is that bond yields will remain relatively well contained, and U.S. inflation will also ease back.

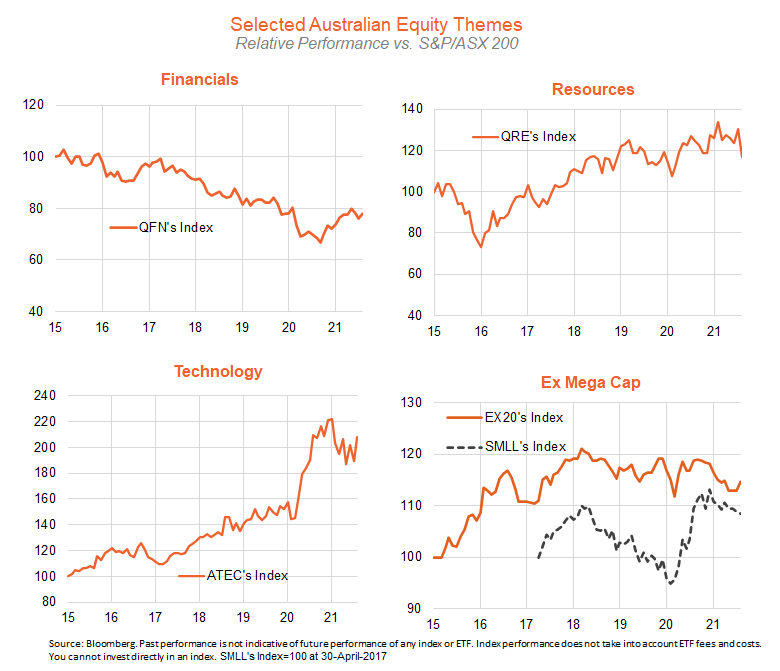

Australian equity themes – a return to tech?

Weaker iron-ore prices saw local resource stocks underperform over August, while the local technology sector surged, helped by the large takeover offer for AfterPay.

With financial sector outperformance waning of late, weaker iron-ore prices weighing on the resources sector, and the growth thematic lifting globally, the local market may soon see a rebound in the relative performance of smaller cap stocks and the technology sector.

Further information on the complete range of BetaShares’ exchange traded products can be found here.

*Trend: Outright trend is up if the relevant NAV return index is above its 10-month moving average and down if the index is below this moving average and the slope of the moving average is negative.

David is responsible for developing economic insights and portfolio construction strategies for adviser and retail clients. He was previously an economic columnist for The Australian Financial Review and spent several years as a senior economist and interest rate strategist at Bankers Trust and Macquarie Bank. David also held roles at the Commonwealth Treasury and Organisation for Economic Co-operation and Development (OECD) in Paris, France.

Read more from David.