5 minutes reading time

If any confirmation was needed that ESG considerations are likely to have an ongoing and increasing effect on the investment landscape, such confirmation came in mid-August. It was reported that, in an email to the Australian Prudential Regulatory Authority (APRA) written in mid-April, AQR Capital Management (AQR), a major US-based investment manager, suggested that its large pension fund clients may increasingly use short-selling to reduce climate risks in their portfolios and to achieve net zero emissions exposure.

Many large investors are now embracing the responsibility of being part of the push towards a zero emissions world. These investors analyse the ethical credentials of the companies or managed funds they invest in, and may also take on an engagement responsibility (more on this later).

The typical ethical investing approach to date has involved employing either negative screens that exclude companies that score poorly on ESG measures, or positive screens that prioritise companies that do well.

However, some investors are coming to the conclusion that simply avoiding high emissions stocks is not enough to achieve environmental goals. Investors such as AQR clearly believe that they need to go further, by short selling companies they think don’t measure up on environmental criteria.

What impact could this have?

Short selling acts as a drag on a company’s share price. If significant levels of short selling are undertaken in high emissions companies, this is likely to weigh down their returns to shareholders – and also naturally gives a relative leg up to ‘clean’ companies.

Should such actions take place, Australia’s sharemarket is one that could potentially be particularly affected, given the significant proportion of the market represented by the mining and energy sectors.

This is yet another reason that ethical investors may wish to go beyond simply committing their money to funds that label themselves ‘ethical’ or ‘responsible’. It’s essential to go deeper, and ensure that the fund is indeed providing an exposure that satisfies their desired ethical criteria.

How can ethical investors evaluate the ethical credentials of a fund?

It’s essential to research the fund’s methodology. If the fund is a passive fund this means researching the methodology of the index the fund aims to track. If it’s an active fund, read up on the manager’s approach. What screens are employed? What levels of exposure are permitted when it comes to things such as fossil fuels?

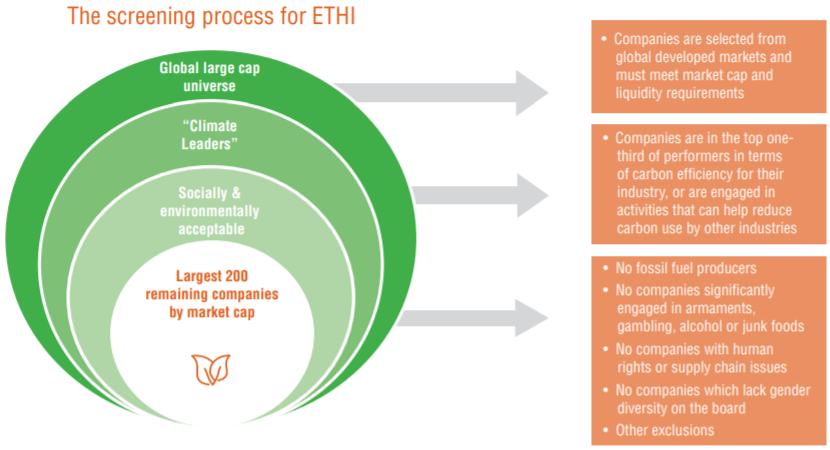

Below, for example, is the underlying index screening process employed within the BetaShares Global Sustainability Leaders ETF (ETHI), the largest ethical ETF on the ASX, with more than $1.7 billion in FUM, as of 26 August 2021.

Another evaluation technique is to check whether there is information – from an independent source – that attests to the fund’s ethical credentials.

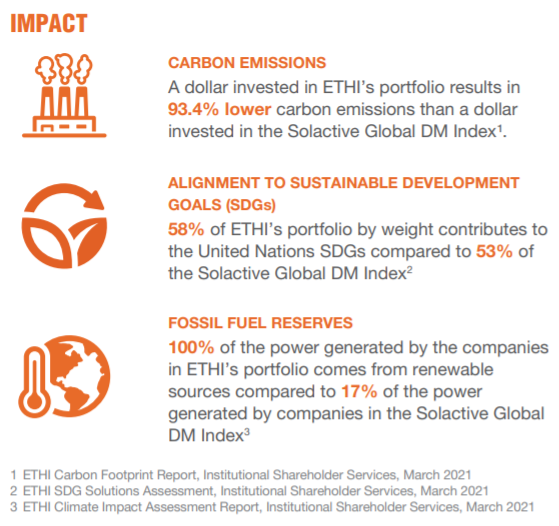

For example, Institutional Shareholder Services (ISS) is one of the world’s leading providers of corporate governance and responsible investment solutions. For each of BetaShares’ equities-focused ethical ETFs, ISS produces:

- a Carbon Footprint Report, which compares the carbon emissions resulting from a dollar invested in the ETF’s portfolio with the emissions from a dollar invested in a relevant broad market index

- an SDG Solutions Assessment, which assesses the ETF’s alignment to the United Nations’ Sustainable Development Goals (SDGs), and

- a Climate Impact Assessment Report, which evaluates how much of the power generated by the companies in the ETF’s portfolio comes from renewable sources, compared to the power generated by a relevant broad market index.

Investors can use these impact metrics to assess the environmental credentials of the ETF. For example, the graphic below shows the impact metrics for ETHI.

Investors can also ask whether a fund has committed formally to any reputable ethical frameworks. For example, in April 2021, BetaShares became a signatory to the Principles for Responsible Investment (PRI), the world’s leading independent proponent of responsible investing. The PRI is supported by the United Nations and works to support the incorporation of ESG factors into investment decisions.

Engagement

While short selling of high emissions stocks is an aggressive addition to the ethical investor’s armoury that is not yet widely employed, a strategy that is already commonly used by fund managers is active engagement with the companies they invest in, and proxy voting.

A fund manager ultimately has the ability to sell out of a company they believe is not performing to a satisfactory ethical standard – however, while selling down a holding can signal the manager’s dissatisfaction with the company’s actions, it also removes the possibility of further influencing the way the company conducts its business.

Some fund managers are increasingly wielding their influence by engaging with company management to achieve change. Engagement refers to how a fund manager seeks information from companies about their business practices, and how it communicates its views and expectations.

In BetaShares’ case, if an issue arises in relation to a portfolio holding in our ethical suite of funds, where our Responsible Investment Committee (RIC) believes there is a potential conflict with the fund’s values, or where the RIC believes a company could improve its ESG performance, delegates from the RIC will engage with the company to try to understand the situation in more detail and, if necessary, advocate for improvement.

If an investee fails to engage, or fails to commit to improvement, the RIC considers additional actions, with the final point of escalation being the removal of the holding from the relevant fund. The approach depends on factors including the company’s track record, how proactive it is in response to the issue, and how willing it is to engage with us.

Proxy voting

Where BetaShares participates in proxy voting, it votes on the ESG resolutions of the companies the fund invests in.

We have adopted a specific set of proxy voting guidelines, designed by ISS to have a strong focus on incorporating ESG considerations, compared to more mainstream benchmark voting policies1.

These guidelines reflect the recognition that ESG factors can present material risks to portfolio investments. Our full proxy voting record is published on an annual basis and is publicly available on our website.

You can find out more about our approach to ESG here.

1. Applicable from 8 March 2021 for the relevant funds that BetaShares votes on.