Reading time: 4 minutes

With interest rates expected to stay low over the next few years and bonds delivering negative returns after inflation, traditional asset allocation for retirees may no longer work as well as it has in the past.

While the traditional 70/30 asset allocation split has served retirees, and those still working, well for some time, today’s environment may require a change in strategy.

Recent research1 indicates SMSFs have continued to make substantial changes to their asset allocation throughout COVID-19, with SMSF investors tending to adopt a more aggressive stance than they did in early 2020.

The trend looks set to continue with 49% of SMSFs having expressed an intention (at the time of survey) to reduce their allocation to cash and 42% looking to increase their growth exposure within the next 12 months2.

Picking next year’s winning stocks with any certainty is impossible. The good news is that, with ETFs, you don’t need to. Many equity ETFs can be a ‘one-stop-shop’, delivering instant diversification for an investor looking to increase their growth allocation, and alleviating the need to pick individual investments.

And given the proliferation of new products, including more targeted exposures with high growth potential, in addition to traditional broad market exposures to Australian and global equities, as well as fixed income, we are seeing SMSFs allocating larger portions of their portfolios to ETFs.

There was a 55% increase in the total number of SMSF investors using ETFs from August 2019 to August 20203, which equates to an increase from approximately 135,000 to 210,000 SMSF investors.

Here are some tips on tapping into growth and reviewing core exposures to keep overall portfolio costs low with ETFs.

Tapping into growth

The evolution of the ETF industry’s offerings has made many thematic exposures accessible, allowing SMSFs to access high-growth areas of opportunity that traditionally have only been associated with active managers, such as cybersecurity, robotics, cloud computing and clean energy.

Cybersecurity

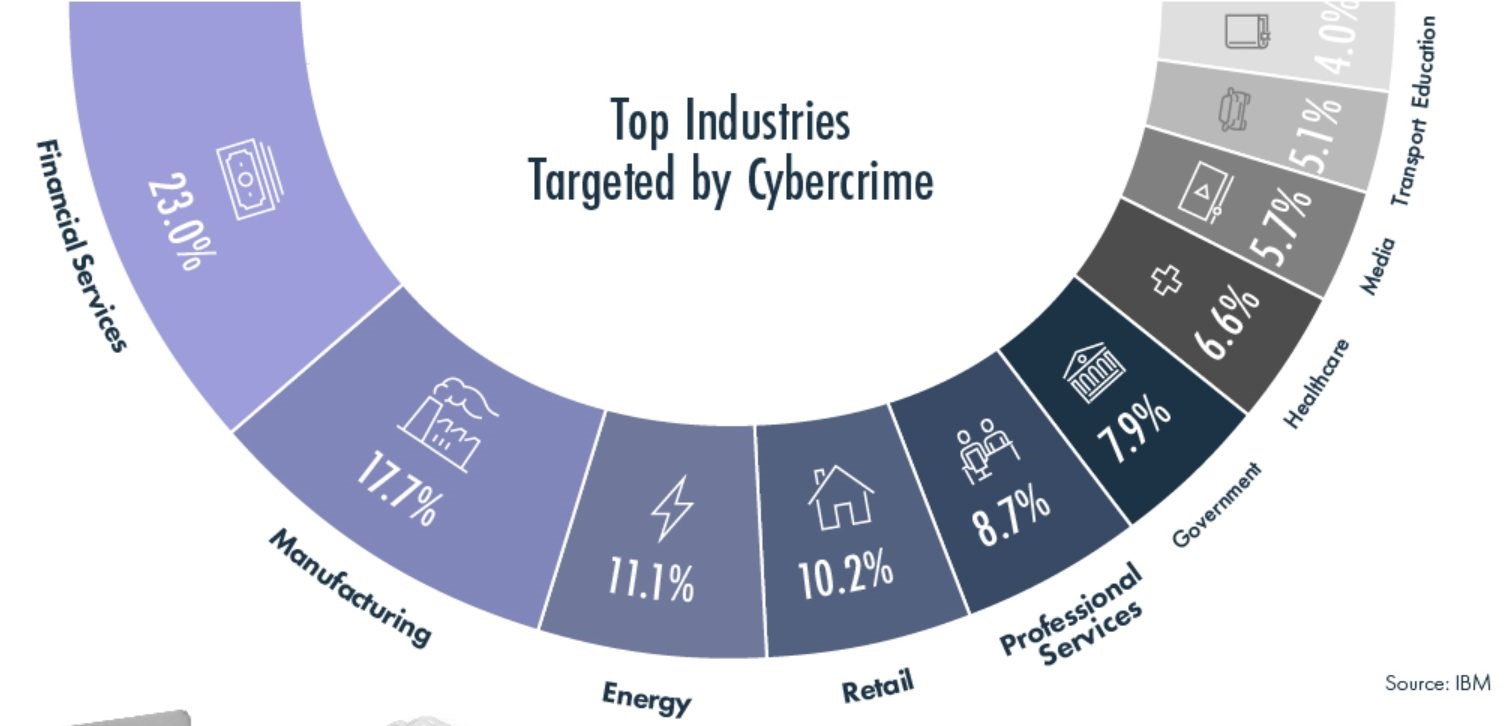

No industry is immune to cyber-attacks. Rising cybercrime and its resulting financial cost for companies has meant that the amount spent on cybersecurity has increased over recent years and is expected to continue to rise.

Source: Visual Capitalist, 2020.

The cybersecurity market was estimated to be valued at US$176.5 billion in 2020 and is forecast to be valued at $403 billion by 2027, a compound annual growth rate of 12.5% p.a.4.

Australian investors can access the potential for global growth in cybersecurity through the Betashares Global Cybersecurity ETF (ASX: HACK), which has grown by 81% in total FUM this year to reach $667M at the end of August 2021.

Robotics and A.I

Robots are increasingly emerging in industries as diverse as manufacturing, health care, defence, agriculture and transportation to boost productivity and alleviate supply-chain issues. During the pandemic, robotics and A.I have also played an important role in developing and distributing vaccines at a global scale.

The global commercial robotics market was valued at US$10.91 billion in 2020, and it is forecast to reach a value of US$58.56 billion by 2026, at a CAGR of 33.21%, over the forecast period (2021 – 2026)5.

The BetaShares Global Robotics and Artificial Intelligence ETF (ASX: RBTZ), which has seen a 77% increase in total FUM this year to reach $188M at the end of August 2021, provides a convenient and cost-effective way to invest in many of the leading companies that could benefit from the increased adoption of this rapidly emerging sector.

Clean energy

There’s little doubt that ESG is playing an increasingly important part in the investing landscape, and with the Biden administration giving priority to clean-tech investments such as renewable energy and electric vehicles, the trend looks set to continue.

In 2021, climate change fits the thematic criterion of being a one-off shift that irreversibly changes the world, is long-term in nature, and driven by powerful forces such as disruptive technologies or human behaviour.

Given the dimensions of the climate change challenge, the size of the response and the amount of money needed to be spent on it is correspondingly large.

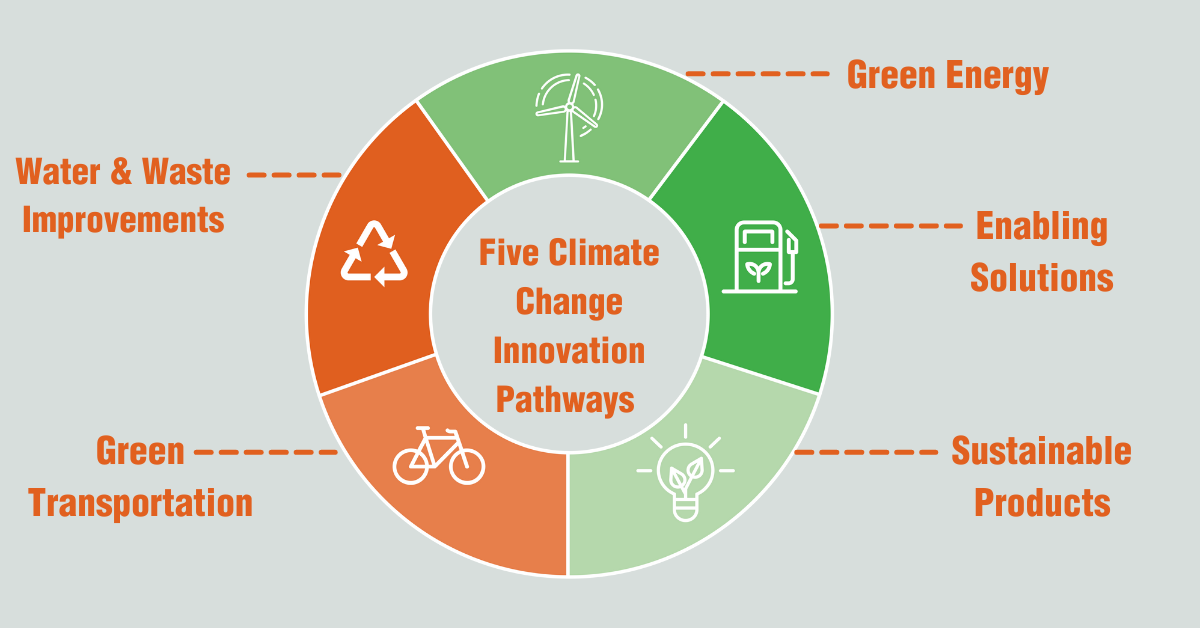

Climate change innovation can be segmented into five key areas where action needs to be taken and that are most likely to benefit from large flows of capital towards decarbonisation initiatives.

Each of these five segments contains either pure play decarbonisation companies or those enabling the transition of others across the entire value chain.

The BetaShares Climate Change Innovation ETF (ASX: ERTH) offers exposure to a broad range of solutions, including clean energy, electric vehicles, energy efficiency technologies, sustainable food, water efficiency and pollution control.

Dialling up ethical allocation with all-in-one multi-asset solutions

For those looking to build greener portfolios, investors can now consider ethical, all-in-one solutions. The BetaShares Ethical Diversified Funds offer passively blended portfolios designed for different risk profiles – Balanced, Growth and High Growth, offering exposure to domestic and international equities and fixed income securities.

Keeping core costs low

While you can’t control the markets, you can control the costs of constructing and maintaining your portfolio.

Spending less on management fees and brokerage means more of your investment’s return can flow to you, allowing more money to be reinvested and increasing your earnings potential.

Not only do passive ETFs charge low fees, but they also tend to have lower portfolio turnover, which reduces the underlying transaction costs and associated taxes, particularly when compared to actively managed funds.

SMSF investors seeking to lower core portfolio costs might wish to consider the Betashares Australia 200 ETF (ASX: A200) as a core Australian equities allocation, or the Betashares Australian Investment Grade Corporate Bond ETF (ASX: CRED) as a core fixed income allocation.

Investing involves risk. The value of an investment and income distributions can go down as well as up. Before making an investment decision you should consider the relevant Product Disclosure Statement, available at www.betashares.com.au, and your particular circumstances, including your tolerance for risk, and obtain financial advice. An investment in any BetaShares Fund should only be considered as a component of a broader portfolio.

Written by

Holly Morgan

Content Manager