Ethical Diversified Balanced ETF

Overview

Fund objective

DBBF aims to provide exposure to a cost-effective, multi-asset class portfolio, for investors whose priority is investing in a way that aligns with their values. DBBF seeks to balance income and capital growth returns over the long term, and targets an allocation of 50% defensive assets (Australian and international bonds), 50% growth assets (Australian and international shares).

Fund strategy

DBBF is built using Betashares’ true-to-label, RIAA-certified1 ethical ETFs – which combine positive climate leadership screens with a broad set of ESG criteria. DBBF provides exposure to a passive blending of asset classes, including Australian and global shares and bonds, according to its strategic asset allocation.

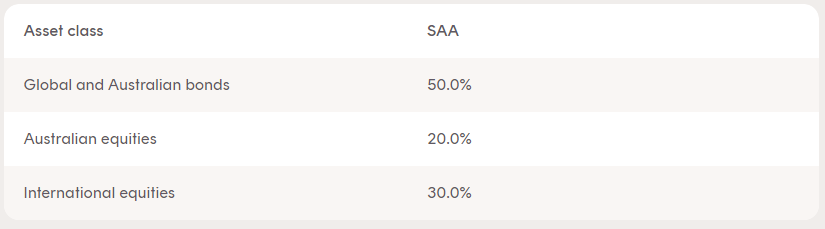

The Fund’s SAA is as follows:

If at the end of a calendar quarter the asset class weightings have deviated from the above SAA weightings by more than 2%, the Fund’s asset allocation will be rebalanced.

DBBF has been designed to suit investors with a ‘medium’ tolerance for risk, with an investment timeframe of at least 5 years.

Benefits

All-in-one, true to label ethical solution

DBBF is built using Betashares’ true-to-label, RIAA-certified1 ethical ETFs – which combine positive climate leadership screens with a broad set of ESG criteria.

Diversified, multi-asset class exposure

DBBF provides all-in-one exposure to a range of asset classes, including equity and fixed income securities across Australian and global markets.

Cost-effective

Management fees of just 0.39% p.a.1 – (or $39 for every $10,000 invested per year).

There are risks associated with an investment in DBBF, including asset allocation risk, market risk, currency risk, underlying ETFs risk and index tracking risk. Investment value can go up and down. An investment in the Fund should only be made after considering your particular circumstances, including your tolerance for risk. For more information on risks and other features of the Fund, please see the Product Disclosure Statement and Target Market Determination, both available on this website.

Invest in DBBF with Betashares Direct

RIAA

Certification

|

Key facts

Profile

| Units outstanding* (#) | 1,283,034 |

|---|---|

| Management fee and cost** (p.a.) | 0.39% |

| Distribution frequency | Quarterly |

| Distribution reinvestment plan (DRP) | Full or partial participation available |

| Issuer | Betashares Capital Ltd |

| Registry | MUFG Corporate Markets |

| Domicile | Australia |

* As at 3 July 2025

**Certain additional costs apply. Please refer to PDS.

Pricing information

| Current price | |

|---|---|

| Last trade* | |

| % Change (prev day) | |

| Bid (delayed) | |

| Offer (delayed) | |

| * Data is delayed by at least 20 minutes. | |

| NAV | |

|---|---|

| NAV/Unit* | $26.36 |

| * As at 3 July 2025 | |

Past performance is not indicative of future performance. Please refer to "Fund returns after fees" for additional information regarding performance/return information.

Trading information

| ASX code | DBBF |

|---|---|

| Bloomberg code | DBBF AU |

| IRESS code | DBBF.AXW |

| Market makers | BNP Paribas Financial Markets SNC |

Index information

| Index | N/A |

|---|---|

| Index provider | N/A |

| Index ticker | N/A |

| Bloomberg index ticker | N/A |

Performance

Fund returns after fees (%)

| Fund | |

|---|---|

| 1 month | 0.90% |

| 3 months | 4.74% |

| 6 months | 2.70% |

| 1 year | 9.24% |

| 3 year p.a. | 9.45% |

| 5 year p.a. | - |

| 10 year p.a. | - |

| Since inception p.a. | 4.33% |

| Inception date | 15-Dec-20 |

Past performance is not an indicator of future performance. Returns are calculated in Australian dollars using net asset value per unit at the start and end of the specified period and do not reflect brokerage or the bid ask spread that investors incur when buying and selling units on the ASX. Returns are after fund management costs, assume reinvestment of any distributions and do not take into account tax paid as an investor in the Fund. Returns for periods longer than one year are annualised. Current performance may be higher or lower than the performance shown.

Inception date refers to the inception of the Fund's current investment strategy. Prior to the inception date, the Fund traded under a different investment strategy, and was subject to different management costs. Information about the Fund's performance prior to the current strategy inception date is available on request by emailing [email protected] or calling 1300 487 577.

Asset allocation

| Australian Bonds | 30.4% |

|---|---|

| International Bonds | 19.8% |

| Australian Equities | 20.7% |

| International Equities | 29.2% |

* As of 30 June 2025

Country allocation

| Australia | 51.0% |

|---|---|

| United States | 23.3% |

| Germany | 4.9% |

| France | 3.6% |

| Snat | 3.0% |

| Netherlands | 2.8% |

| Japan | 2.1% |

| Italy | 1.7% |

| Canada | 0.7% |

| Other | 6.8% |

* As of 30 June 2025

Distributions

Frequency and yield

| Distribution frequency | Quarterly |

|---|---|

| 12 mth distribution yield* | 3.5% |

*As at 30 June 2025. Yield is calculated by summing the prior 12-month per unit distributions divided by the closing NAV per unit at the end of the relevant period. Yield will vary and may be lower at time of investment. Past performance is not indicative of future performance.

You can elect DRP by logging into MUFG’s Investor Centre. Once you are logged in, please proceed to the 'Payments and Tax' tab and select 'Reinvestment Plans'.

Recent distributions

| Ex Date | Record Date | Payment Date | Distribution Unit ($) | Annual Distribution Return (%) (1) |

|---|---|---|---|---|

| 1-Jul-25 | 2-Jul-25 | 16-Jul-25 | $0.219586 | 2.48% |

| 1-Apr-25 | 2-Apr-25 | 16-Apr-25 | $0.1016 | 3.72% |

| 2-Jan-25 | 3-Jan-25 | 17-Jan-25 | $0.171802 | 4.00% |

| 1-Oct-24 | 2-Oct-24 | 16-Oct-24 | $0.101468 | 4.18% |

| 1-Jul-24 | 2-Jul-24 | 16-Jul-24 | $0.546914 | 3.92% |

| 2-Apr-24 | 3-Apr-24 | 17-Apr-24 | $0.098903 | 3.40% |

| 2-Jan-24 | 3-Jan-24 | 17-Jan-24 | $0.167816 | 3.34% |

| 2-Oct-23 | 3-Oct-23 | 17-Oct-23 | $0.084777 | 3.53% |

| 3-Jul-23 | 4-Jul-23 | 18-Jul-23 | $0.372253 | 3.12% |

| 3-Apr-23 | 4-Apr-23 | 20-Apr-23 | $0.082917 | 3.23% |

| 3-Jan-23 | 4-Jan-23 | 18-Jan-23 | $0.216297 | 2.51% |

| 1-Jul-22 | 4-Jul-22 | 18-Jul-22 | $0.449529 | 2.07% |

| 1-Apr-22 | 4-Apr-22 | 20-Apr-22 | - | 3.58% |

| 4-Jan-22 | 5-Jan-22 | 19-Jan-22 | $0.088952 | 4.14% |

| 1-Oct-21 | 4-Oct-21 | 18-Oct-21 | - | 6.26% |

| 1-Jul-21 | 2-Jul-21 | 16-Jul-21 | $0.854681 | 6.81% |

| 1-Apr-21 | 6-Apr-21 | 20-Apr-21 | $0.04732 | 3.97% |

| 16-Dec-20 | 17-Dec-20 | 12-Jan-21 | $0.65065 | 4.09% |

| 1-Oct-20 | 2-Oct-20 | 16-Oct-20 | $0.070697 | - |

| 1-Jul-20 | 2-Jul-20 | 16-Jul-20 | $0.164988 | - |

| 1-Apr-20 | 2-Apr-20 | 20-Apr-20 | $0.105705 | - |

1 This is the annual distribution return to the end of the relevant distribution date. The distribution return reflects the contribution to total investment return made by the Fund's distributions. Distribution return is calculated as the total return less the growth return. Total return is calculated as the percentage change in a continuing investor's interest in the Fund assuming reinvestment of all distributions back into the Fund (and no other application or withdrawal), net of ongoing fees. Growth return is the Fund's return excluding distributions, net of ongoing fees. Past performance is not indicative of future performance.

Announcements

ASX Announcements: DBBF

Payment notice information

NRWT & fund payments

| Document | Date |

|---|---|

| 2025-03 | |

| 2024-12 | |

| 2024-09 | |

| 2024-06 | |

| 2024-03 |