David Bassanese

Betashares Chief Economist David is responsible for developing economic insights and portfolio construction strategies for adviser and retail clients. He was previously an economic columnist for The Australian Financial Review and spent several years as a senior economist and interest rate strategist at Bankers Trust and Macquarie Bank. David also held roles at the Commonwealth Treasury and Organisation for Economic Co-operation and Development (OECD) in Paris, France.

3 minutes reading time

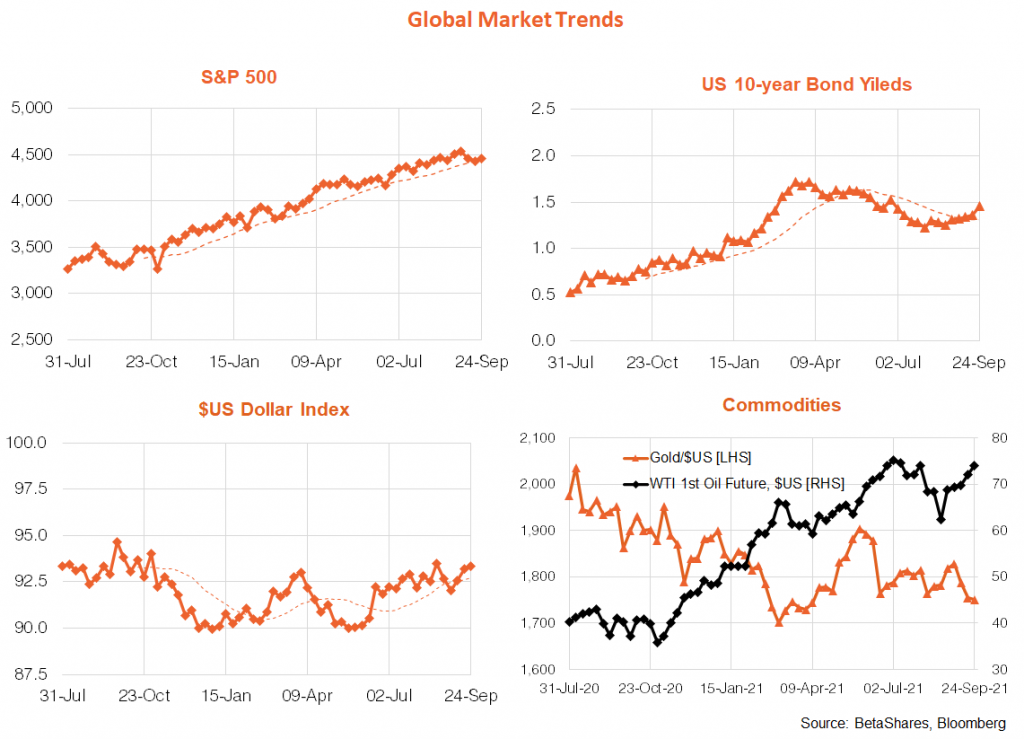

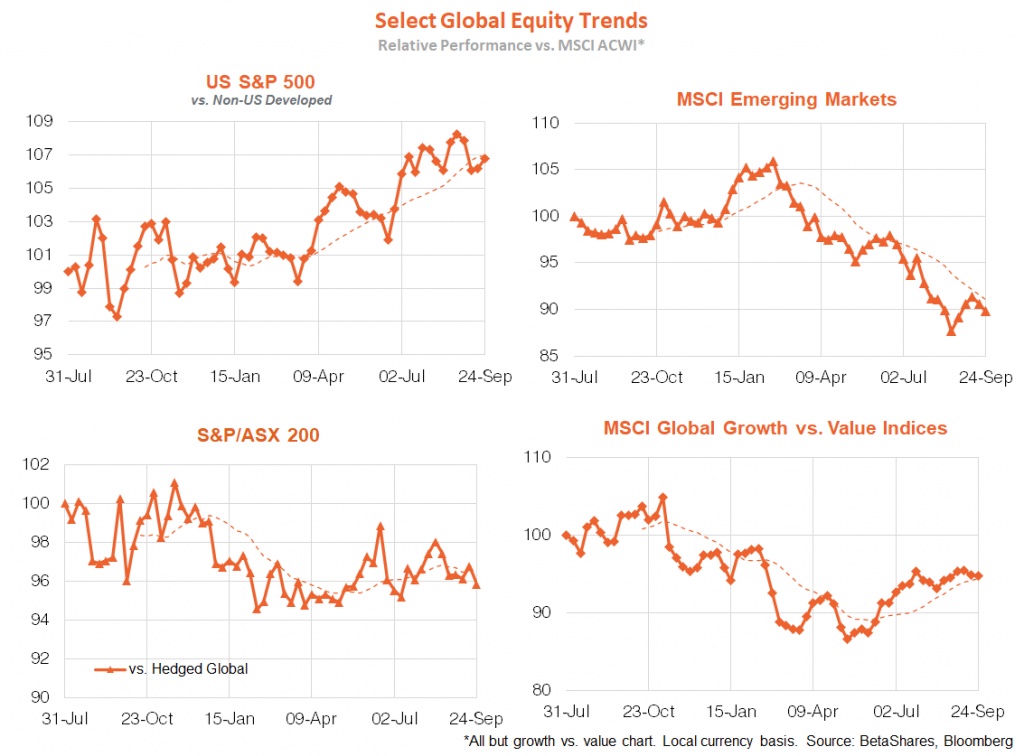

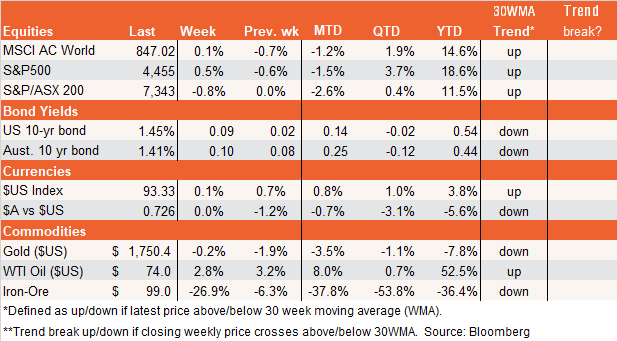

Global markets

Fair to say it was a mixed week for global equities, with Wall Street slumping initially only to then more than recover lost ground over the remainder of the week. Remarkably given a somewhat hawkish Fed meeting and lingering concerns over Evergrande, the S&P 500 ended the week up 0.5%! U.S. bond yields also legged higher, however, and yields are emerging as probably the great risk to equity markets as the countdown to Fed tapering begins. Gold remained sick while oil is showing some strength of late due to U.S. hurricane-related supply disruptions.

While the market was perhaps relieved the Fed did not immediately announce tapering, it did hint strongly that this announcement will be made at the November meeting. Fed commentary also suggests they want to wind down bond buying by mid-2022 – which is somewhat quicker than I anticipated, and suggests it may well start the taper as early as November, rather than wait until the new year. We also had a few more Fed members shift to a late 2022 expected tightening, meaning the ‘dot plots’ now show 9 of 18 Fed members expecting the first rate hike later next year. A 25bps rate hike by December 2022 is now also fully priced in by the market.

Regarding bond markets, there is a risk that U.S. 10-year yields re-test their highs earlier this year at around 1.75/1.8% in coming months, which could continue the equity market correction a while longer. My base case view, however, is that 10-year yields will still end the year sub-2%, which should limit potential damage on Wall Street to a ‘garden variety’ correction of not much more than 10% at worse. In saying this, it will be important that U.S. inflation also continues to moderate over the months ahead.

Meanwhile, last week’s Evergrande events were strange – by all accounts it did not pay its scheduled interest payment, though there was no corporate or government announcement. It still has 30 days before it it has legally defaulted – by which time we may well see government-decreed restructuring which hurts some banks and bondholders (though perhaps not suppliers or customers). Given the limited global debt exposure, markets are not (yet at least) panicking further over contagion beyond China – we’re in a cautious ‘wait and see’ mode.

In terms of the week ahead, we get yet more commentary from the Fed with both Powell and Williams due to front the public. Markets will also keep a cautious watch over China as well as Washington’s latest debt ceiling squabble (another 11th hour deal to prevent government shutdowns still seems likely). Data wise, the U.S. August consumer deflator on Friday is expected to show some further welcome moderation in inflation pressure, with core prices rising 0.2% after a 0.3% gain in July (bringing down the annual rate from 3.6% to 3.5%).

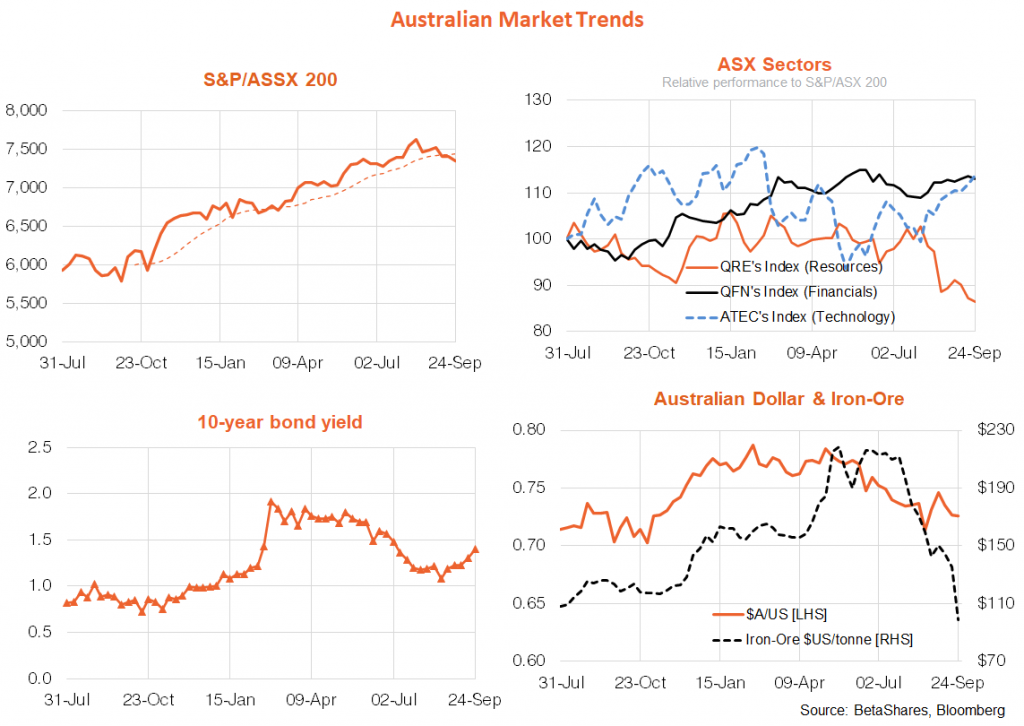

Australian market

China-related concerns led to a further collapse in iron-ore prices last week. While this hurt mining stocks, the $A was left broadly unchanged – in line with a still steady $US Index. Financials and technology retain an outperforming bias within the market, while the relative performance of resources remains downward. As we approach Fed tapering, and given China’s likely efforts to keep steel production in check (if only to clean up the sky ahead of next year’s winter Olympics!), the bias on the $A appears to the downside – I still see US68c as quite possible by year-end.

This week we get retail sales and building approvals which are both expected to show weakness, due to both lockdowns and further unwinding of earlier housing construction policy support. But the RBA is not budging either way for a while and the economic focus remains on the vaccine rollout and when Victoria/NSW can emerge from lockdown!

David is responsible for developing economic insights and portfolio construction strategies for adviser and retail clients. He was previously an economic columnist for The Australian Financial Review and spent several years as a senior economist and interest rate strategist at Bankers Trust and Macquarie Bank. David also held roles at the Commonwealth Treasury and Organisation for Economic Co-operation and Development (OECD) in Paris, France.

Read more from David.