After halting its weekly losing skid the previous week, bitcoin and the rest of the crypto market could not make it two in a row. Over the weekend, crypto got crushed and finished the week much lower. At the time of writing, bitcoin is trading at US$27,586.

Ether continued to underperform bitcoin returning -18.12% vs bitcoin’s -7.20% over the week.

Bitcoin’s market cap fell to $525.9B, while the total crypto market sits at $1.11T. Bitcoin’s market dominance increased to 47.6%

| Price | High | Low | Change from previous week | |

| BTC (in US$) | $27,586 | $31,693 | $27,266 | -7.20% |

| ETH (in US$) | $1,468 | $1,915 | $1,436 | -18.12% |

Source: CoinMarketCap. As at 12 June 2022. Past performance is not indicative of future performance. Performance is shown in US dollars and does not take into account any USD/AUD currency movements.

Source: Glassnode. Past performance is not indicative of future performance.

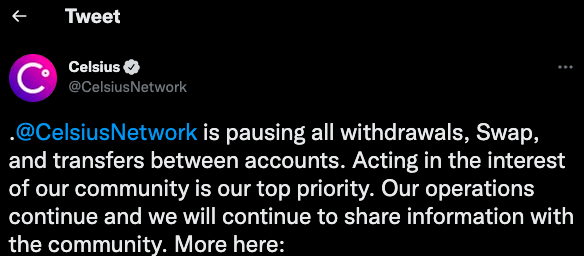

Update: Over the last 24 hours to 9am Jun 14th, bitcoin and the crypto market generally suffered a mini collapse. Bitcoin suffered its worst price drop in over a year and was down another 16%, hitting a low 0f $22,592, with altcoins faring worse. The move took place as equities markets sold-off sharply in the U.S. and news broke that crypto platform and lender Celsius had halted all transfers and withdrawals. More on this developing news next week.

News we’re watching

Merchants surveyed plan to enable crypto payment

A recent survey conducted by Deloitte. in collaboration with PayPal titled ‘Merchants getting ready for crypto’, which polled a sample of 2,000 senior executives at retail organisations with annual revenues ranging from below $10 million to over $500 million across the U.S., found that the majority of merchants surveyed plan to enable crypto payments. The survey was completed within a two week period in December, 2021. Survey respondents were optimistic about digital currencies in the consumer market, reporting broad agreement that accepting digital currency payments is already a point of differentiation, and are expecting to see broad near-term adoption. The report details: “More than 85% of the organisations are giving high or very high priority to enabling cryptocurrency payments, while roughly 83% are doing the same for stablecoins.”1

Building a better mousetrap

One of the largest financial firms in the world, Citadel is reportedly getting into bitcoin and cryptocurrencies by building a crypto trading marketplace with Virtu Financial with the help of Fidelity Investments and Charles Schwab. The product is early in development but could be available late this year or early next year. An unidentified source told the website Coindesk: “The current crypto market structure is deficient and inhibits wider adoption from a lot of investors, which is what Citadel Securities’ trading consortium is addressing. It’s more of a crypto trading ecosystem or marketplace than an exchange. It’s going to take on the exchanges by building a better mousetrap.” A spokesperson for Schwab, commented: “We know there is significant interest in this cryptocurrency space and we will look to invest in firms and technologies working to offer access with a strong regulatory focus and in a secure environment.”2

App to allow access to decentralised and traditional finance

One of the largest crypto exchanges by total volume in Australia, Swytfx, and share trading and superannuation platform Superhero announced a merger to create a “$1.5 billion financial services giant.” The merger will allow customers to access through an app both decentralised and traditional finance by enabling investment in crypto, retirement funds and equities, according to a statement. “The proposed merger represents a significant step for both businesses in terms of their evolution from disruptive tech players into a single, major financial institution that can grow across domestic and international markets,” Swyftx co-founder, Alex Harper, said.”3

On-chain metrics

Bitcoin (BTC): Percent Supply in Profit

Percent Supply in Profit shows the percentage of circulating supply in profit, i.e. the percentage of existing coins whose price at the time they last moved was lower than the current price. This metric is interesting to look at as it helps investors gain fundamental insights into the current state of the market, understand investor sentiment, or model the value of BTC. It answers the question ‘how much of Bitcoin’s circulating supply is in profit or loss — and to what extent?’

Looking at data from on-chain analytics company Glassnode, the percentage supply in profit is at 52.9%, its lowest level since March,2020. Almost half the network are currently sitting on losses and surely weighing on investor sentiment and mood for bitcoin..

Source: Glassnode. Past performance is not indicative of future performance.

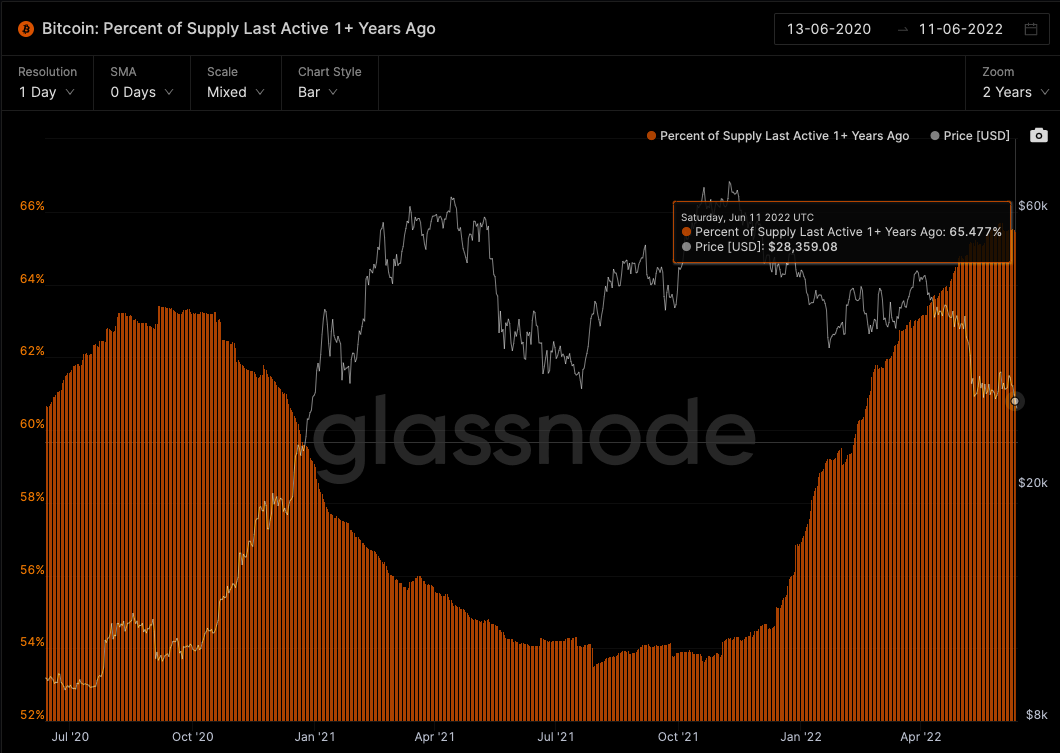

Bitcoin (BTC): Percent Supply Last Active 1+ Years

Percent of Supply Last Active 1+ Years Ago shows the percent of circulating supply that has not moved in at least 1 year. Bitcoin that has not moved in 1+ years could be considered ‘illiquid’ even though it would still be considered as part of the circulating supply. The higher the illiquid supply, the less selling pressure there can be on the network, which is considered positive in the long-term.

BTC is off over 60% from its ATH but long-term holders have continued to sit tight. Investors holding BTC for at least 1 year has continued to grow and sits at an all-time high of 65.47%.

Source: Glassnode. Past performance is not indicative of future performance.

Altcoin news

Top 25 altcoin, Chainlink (LINK) returned -7.65% which was better than most, in the last seven days. Driving the performance was the announcement of the upcoming implementation of staking for LINK. DeFi is one of the most popular sectors in the crypto ecosystem and staking allows for passive income opportunities on your coins held regardless of the day-to-day price action.

LINK is the decentralised oracle network that provides important off-chain information needed for the proper functioning of smart contracts. According to its website: “Chainlink enables smart contracts on any blockchain to leverage extensive off-chain resources, such as tamper-proof price data, verifiable randomness, keeper functions, external APIs, and much more.”4

|

Investing in crypto assets or companies servicing crypto-asset markets should be considered very high risk. Exposure to crypto assets involves substantially higher risk when compared to traditional investments due to their speculative nature and the very high volatility of crypto-asset markets. Investing in crypto assets or crypto-focused companies is not suitable for all investors and should only be considered by investors who (i) fully understand their features and risks or after consulting a professional financial adviser, and (ii) who have a very high tolerance for risk and the capacity to absorb a rapid loss of some or all of their investment. Any investment in crypto assets or crypto- focused companies should only be considered as a very small component of an investor’s overall portfolio. |

1. https://www2.deloitte.com/content/dam/Deloitte/us/Documents/technology/us-cons-merchant-getting-ready-for-crypto.pdf

2. https://www.coindesk.com/business/2022/06/09/virtu-sees-crypto-market-making-opportunity-has-little-confidence-in-incumbents-ceo-says/

3. https://www.businessnewsaustralia.com/articles/crypto-exchange-swyftx-and-trading-app-superhero-announce–1-5-billion-merger.html

4. https://chain.link/

Off the Chain will be published every Tuesday, and provide the latest news on bitcoin and the rest of the crypto market along with analysis and insights into the world of crypto.It provides general information only and is not a recommendation to invest in any crypto asset, crypto-focused company or investment product.

This article mentions the following funds

Written by

Justin Arzadon

Director, Adviser Services & Head of Digital Assets.

C4 Certified Bitcoin Professional (CBP) and Blockchain Council Certified Bitcoin Expert™ with over 18 years’ experience in the ETF market. Passionate about the future of money.

Read more from Justin.

2 comments on this

great idea pls

Chainlink is an awesome critical infrastructure crypto project with huge potential. Chainlink is the most popular and utilized decentralized blockchain oracle network built on Ethereum. The network is intended to be used to facilitate the transfer of tamper-proof data from off-chain sources to on-chain smart contracts. Without Chainlink oracle there won’t be fully working integrated smart contacts and this crypto project should be getting more attention and definitely deserves also to be in top 10. There are lots of potential utilization and use cases in future of this innovative technology from finance and banking to medical field, logistics, supply chain and distribution. The future digital economies web3.0 and beyond will run on similar + AI powered projects, the potential is immense!