Cameron Gleeson

Betashares Senior Investment Strategist. Supporting all Betashares distribution channels, assisting clients with portfolio construction across all asset classes, and working alongside the portfolio management team. Prior to joining Betashares, Cameron was a portfolio manager at Macquarie Asset Management, Head of Product at Bell Potter Capital, working on JP Morgan’s Equity Derivatives desk and at Deloitte Consulting.

8 minutes reading time

- Technology

Produced in partnership with Nasdaq

The Nasdaq Next Generation 100™ (NGX™) was launched on August 24, 2020 to offer investors a new benchmark to track the same type of innovation-driven companies that are part of the Nasdaq-100® (NDX®), but residing mostly within the midcap size spectrum. The index functions as a natural complement to the Nasdaq-100, and is particularly useful as a means of gaining exposure to innovative companies listed on the Nasdaq Stock Market®, at an earlier stage of their growth journey.

Australian investors now have the opportunity to invest in the ‘rising stars’ of the Nasdaq, with the launch of Betashares Nasdaq Next Gen 100 ETF (ASX: JNDQ). JNDQ aims to track the performance of NGX (before fees and expenses).

The following discussion of NGX was written by Mark Marex, CFA, Senior Director, Nasdaq Index Research & Development.

Nasdaq Next Generation 100™ Index:

Midcap Complement to the Nasdaq-100®

The Nasdaq Next Generation 100™ (NGX™) measures the performance of the 100 largest Nasdaq-listed non-financial companies outside the Nasdaq-100 Index®. These disproportionately comprise innovative companies at a relatively early stage of their development, with the potential to become tomorrow’s leaders in a range of sectors including technology, healthcare and industrials.

Reasons to consider NGX:

-Very similar methodology to the Nasdaq-100, and no overlap

-On average, six NGX companies “graduate” into the Nasdaq-100 at each annual reconstitution

-NGX graduates have tended to outperform, on average, prior to graduation and receive much higher index weightings while in NGX than they do upon joining the Nasdaq-100

-Much lower single-company concentration in NGX than NDX (2.1% max weight as of December 31, 2023). At each rebalance, no single security weight can exceed 4%.

-Only ~32% exposure to the Technology sector (based on ICB Industry) vs. ~58% for NDX, but overall still ~80% exposure to the top 3 “new economy” sectors (Tech + Consumer Discretionary + Health Care)

-Scores highly on key measures of innovation (R&D spending, patent filings) vs. midcap benchmarks

-Substantial exposure to key investment themes driving economic growth in the 21st century

Nasdaq Next Gen 100: Pipeline for Nasdaq-100 Graduates

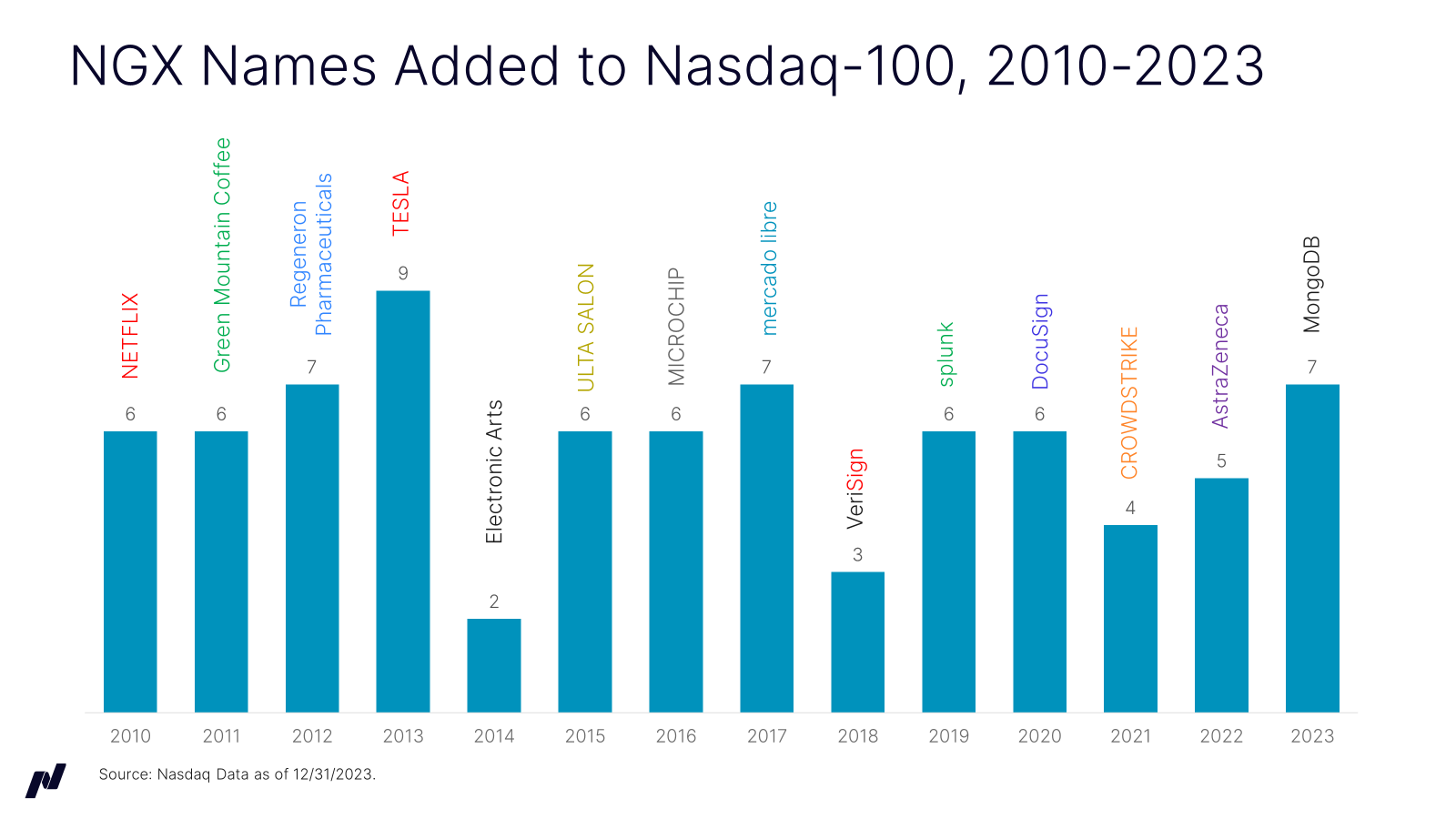

Since 2010, a total of 80 NGX constituents have ‘graduated’ into the Nasdaq-100. Some well-known examples are Netflix in 2010, Tesla in 2013, DocuSign in 2020, CrowdStrike in 2021, and AstraZeneca in 2022. Most recently, MongoDB – a leading database platform developer with a market cap in excess of $30B – graduated from NGX into NDX on December 18, 2023. Its total return in the 12 months leading up to graduation was just over 100%.

Looking at the full history of NGX graduates, a compelling argument comes into focus for adding exposure to these names before they’re added to NDX: their performance has tended to be much better in the 12 months leading up to graduation (72.4% median, 82.3% average) than in the 12 months following graduation (11.0% median, 12.8% average). Their weights also drop precipitously as they exit one index and enter another. The largest NGX constituents tend to top out at around a 2-3% weighting (hard cap at 4%), while the smallest NDX constituents can be weighted as low as 0.10%. Thus a compounding effect is observed, wherein the most successful NGX companies have outperformed and have done so at higher weights, driving overall index performance higher. Upon joining NDX, they have tended to (initially) underperform – but at such low weights so as not to exert a measurable downward impact on index performance.

As of December 31, 2023, 39 of the current 100 companies in the Nasdaq-100 had graduated from the Nasdaq Next Generation 100 Index at some point over the past 14 years (based on simulated backtest and live results). Collectively they represent 19.4% of the Nasdaq-100’s index weightings.

NGX Companies Score Highly on Innovation Metrics vs. Other Midcap Benchmarks

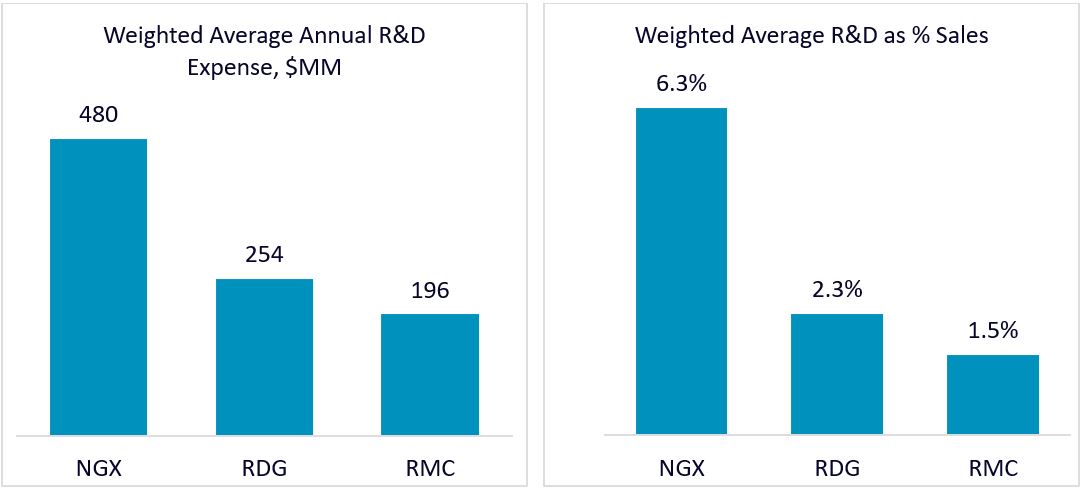

Just as the Nasdaq-100 has consistently scored better than large cap benchmarks like the S&P 500 on innovation metrics such as R&D spending, patent contribution ratios and patent portfolio valuations, so too has the Nasdaq Next Generation 100 outperformed its midcap competitor benchmarks on all of these measures. Compared to the Russell Mid Cap Growth Index (RDG), NGX constituents spent 90% more on R&D on a weighted average basis, and 2.7 times as a percentage of sales, in the most recent trailing four quarters of data as of December 31, 2023. Compared to the broader Russell Mid Cap Index (RMC), NGX companies spent nearly 2.5 times more on R&D on a weighted average basis, and 4.1 times as much as a percentage of sales.

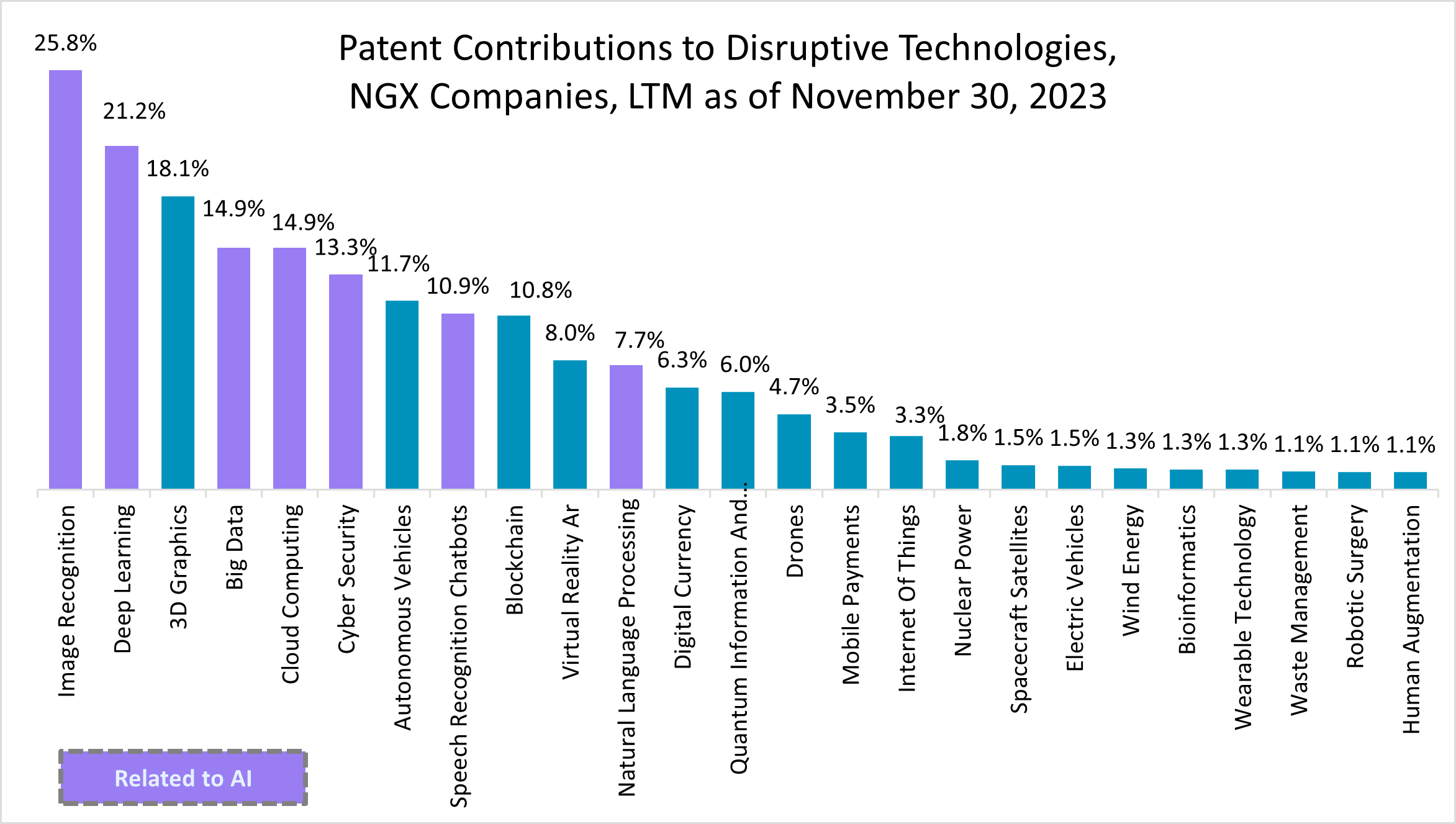

Compared to midcap benchmarks from S&P and Russell, Nasdaq Next Generation 100 constituents also tend to be more active in filing patents across various areas of disruptive technology, on average. Around half of the index registered disruptive tech patent activity over the most recent 12-month period ending November 30, 2023, nearly three times the rate for the S&P Midcap 400 Index.

Overall, given its fairly modest size in terms of number of companies and associated market caps, NGX punches well above its weight in terms of patent contributions to a number of important disruptive tech areas including several that are closely tied to Artificial Intelligence, such as Image Recognition (26% of all patents filed across ~20,000 publicly listed companies), Deep Learning (21% patent contribution), and Big Data (15%).

NGX Thematic Exposures

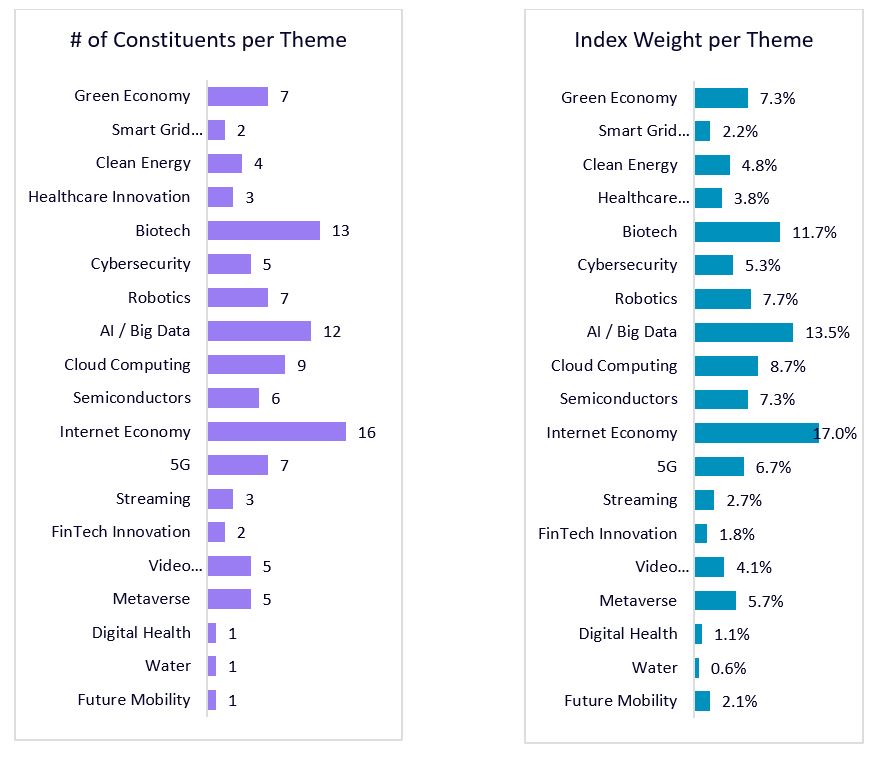

Reinforcing the idea that NGX provides significant exposure to some of today’s most important innovation-oriented investment themes is the simple analysis of the index’s overlap with various thematic indexes that Nasdaq (or, in a few cases, competitor index providers) maintains to provide more targeted one-off exposure. As of December 31, 2023, 12 of the index’s constituents were also featured in one or more of Nasdaq’s AI indexes, representing 13.5% of NGX index weight. Internet Economy was overall strongest with 16 overlapping constituents and 17% of index weight.

NGX Sector Exposures: Less Concentrated in Tech than NDX, Similar Exposure to ‘New Economy’

The Nasdaq Next Generation 100 is overweight on Technology, Health Care, and Consumer Discretionary compared to S&P Midcap 400 and Russell Mid Cap Growth. Despite having substantially less Tech exposure than the Nasdaq-100, the combined weighting across these three ‘new economy’ sectors is similar at approximately 78%, vs. 84% for NDX as of December 31, 2023. It is underweighted across most other sectors relative to broader midcap benchmarks, just as NDX is vs. large cap. There is no exposure to Financials by design, just like the Nasdaq-100.

NGX Offers Investors a Natural Midcap Complement to NDX Exposure

With its similar, derived methodology, the Nasdaq Next Generation 100 Index offers a straightforward, logical complement to the Nasdaq-100, one of the most tracked indexes in existence and a leader in growth and innovation. With its natural exposure to predominantly midcap companies, and less dramatic weightings toward Technology as a sector, it also provides diversification to existing investors in Nasdaq-100 tracking products. Its tighter range of constituent market caps ensures both less concentration at the top end of the spectrum, and more meaningful allocations to typically faster-growing, newer additions to the index at the bottom end. With a similarly high level of R&D intensity, a meaningful subset of Nasdaq Next Generation 100 companies are often in a position to graduate into the ranks of the Nasdaq-100.

-

JNDQ

Nasdaq Next Gen 100 ETF

Sources: Nasdaq Global Indexes, FactSet, Bloomberg.

There are risks associated with an investment in JNDQ, including market risk, country risk, currency risk and medium-sized companies risk. Investment value can go up and down. For more information on risks and other features of the Fund, please see the Product Disclosure Statement and Target Market Determination available at www.betashares.com.au.

Betashares Capital Ltd (ABN 78 139 566 868 AFSL 341181) (“Betashares”) is the issuer of the Fund. The information in this article is issued by Betashares, is general only, is not personal advice, and is not a recommendation to buy units or adopt a particular strategy. It does not take into account any person’s financial objectives, situation or needs. Any person wishing to invest should read the relevant PDS and TMD from www.betashares.com.au and obtain financial advice in light of their individual circumstances.

Nasdaq®, Nasdaq Next Generation 100 Index® and Nasdaq-100 Index® are registered trademarks of Nasdaq, Inc (which with its affiliates is referred to as the “Corporations”) and are licensed for use by Betashares. The Fund is not issued, endorsed, sold or promoted by the Corporations. The Corporations make no warranties and bear no liability with respect to the Fund. The Corporations make no recommendation to buy or sell any security or any representation about the financial condition of any company. The information contained above is provided for informational and educational purposes only, and nothing contained herein should be construed as investment advice, either on behalf of a particular security or an overall investment strategy. Statements regarding Nasdaq-listed companies or Nasdaq proprietary indexes are not guarantees of future performance. Actual results may differ materially from those expressed or implied. Past performance is not indicative of future results. Investors should undertake their own due diligence and carefully evaluate companies before investing. ADVICE FROM A SECURITIES PROFESSIONAL IS STRONGLY ADVISED.

Supporting all Betashares distribution channels, assisting clients with portfolio construction across all asset classes, and working alongside the portfolio management team. Prior to joining Betashares, Cameron was a portfolio manager at Macquarie Asset Management, Head of Product at Bell Potter Capital, working on JP Morgan’s Equity Derivatives desk and at Deloitte Consulting.

Read more from Cameron.

5 comments on this

I would like to get more exposure to the US market, but I have lost a lot on BETASHARES ASIA TECHNOLOGY TIGERS ETF (I’m currently 30% down). So I’m hesitant to invest in BETASHARES NASDAQ. Am I missing something?

Hi Laurie,

Importantly, these two funds offer different exposures with ASIA being an emerging market exposure. ASIA aims to track the performance of an index (before fees and expenses) comprising the 50 largest technology and online retail stocks in Asia (ex-Japan). While NDQ aims to track the performance of the Nasdaq 100 Index (before fees and expenses), which is comprised of the 100 of the largest non-financial companies listed on the Nasdaq market. Both investments come with risks so you should read the relevant product disclosure statement and, if necessary, speak to a financial adviser before making an investment decision.

In regards to ASIA specifically, over the last couple of years China’s economy has struggled with issues such as a property crisis, high youth unemployment and falling foreign investor confidence. The following article (https://www.betashares.com.au/insights/will-china-kill-its-golden-geese-a-deep-dive-into-the-betashares-asia-technology-tigers-etf-asia/) provides further insights into ASIA’s performance and discusses the impact that Chinese regulatory restrictions imposed in late 2020 had on ASIA. Namely, how a range of Chinese tech companies faced new rules and scrutiny by Chinese authorities.

I hope this helps!

Regards,

Dina

You might be missing some dollars.

Laurie, ASIA is a very different beast – it’s heavily weighted to chinese tech companies that have been suffering since early 2021 as a result of chinese government crack downs and a sluggish economy that is weighed down by their property sector. This is the reason your investment in ASIA has tanked. It has nothing to do with it being a Betashares product.

Hi Health, regarding ASIA it is still to do with Betashares as they are managing the funds and responsible for good returns . Chinese economy and other issues were well known to everyone and that’s what the fund managers should have reshuffle the portfolio ?