Bitcoin and the broader crypto market were slightly higher over the past seven days. The bitcoin price went above US$26K, less than 24 hours after asset manager BlackRock filed paperwork for a spot bitcoin ETF.

As at 18 June 2023, bitcoin was trading at US$26,579. Ethereum underperformed bitcoin over the week, down -1.41% vs bitcoin’s 3.16% gain. Bitcoin’s market capitalisation is at US$516 billion, with total crypto market cap sitting at US$1.07 trillion. Bitcoin’s market dominance is up to 48.1%.

| Price | High | Low | Change from previous week | |

| BTC (in US$) | $26,579 | $26,769 | $24,797 | 3.16% |

| ETH (in US$) | $1,729 | $1,776 | $1,624 | -1.41% |

Source: CoinMarketCap. As at 18 June 2023. Past performance is not indicative of future performance. Performance is shown in US dollars and does not take into account any USD/AUD currency movements.

Source: Glassnode. Past performance is not indicative of future performance.

Crypto news we’re watching

BlackRock files application for spot bitcoin ETF

Last Thursday, the world’s largest asset manager, with over US$9.5 trillion in assets under management, applied to the SEC for a spot Bitcoin ETF. Since 2013, many firms have applied for a Bitcoin ETF including VanEck, Ark and the world’s largest bitcoin fund, Grayscale Bitcoin Trust. All have been rejected.

The application comes at an interesting time given the regulatory climate around crypto. The SEC has cracked down on a number of exchanges and individual tokens over the last two weeks.

Eric Balchunas, Senior ETF analyst at Bloomberg, pointed out that: “BlackRock is nearly undefeated when going up against the SEC, at 575-1, with nearly every single one of its ETF applications receiving the Commission’s blessing.”1

Binance and the SEC reach agreement

Binance’s CEO, Changpeng Zhao and Binance were sued by the SEC on 5 June for allegedly artificially inflating Binance’s trading volumes, diverting customer funds, failing to restrict US customers from its platform and misleading investors about its market surveillance controls.

An agreement has been reached between the two to ensure that assets on Binance.US will be protected and remain in the US, and that users can continue to withdraw their assets from the trading platform, until the lawsuit is resolved. In addition, the agreement requires that procedures are put in place to prevent Binance Holdings officials from having access to private keys for its various wallets, hardware wallets or root access to Binance.US’s Amazon Web Services tools, the court filings showed.

A Binance spokesperson said in a statement: “Although we maintain that the SEC’s request for emergency relief was entirely unwarranted, we are pleased that the disagreement over this request was resolved on mutually accepted terms. User funds have been and always will be safe and secure on all Binance-affiliated platforms.”2

CRYP company spotlight

SEC charges Coinbase (Nasdaq: COIN)

Cryptocurrency exchange platform Coinbase Inc., currently the fifth largest holding in the Betashares Crypto Innovators ETF (CRYP) (as at 16 June 2023), was charged by the SEC, a day after Binance, for operating as an unregistered securities exchange, broker and clearing agency. There were additional charges for the unregistered offer and sale of securities in connection with its staking-as-a-service program.

As a result of Coinbase’s failure, SEC alleges that investors have been deprived of “significant protections, including inspection by the SEC, recordkeeping requirements, and safeguards against conflicts of interest, among others.”3

In a written statement, the chief legal officer and general counsel for Coinbase said: “The SEC’s reliance on an enforcement-only approach in the absence of clear rules for the digital asset industry is hurting America’s economic competitiveness and companies like Coinbase that have a demonstrated commitment to compliance.”4

On-chain metrics

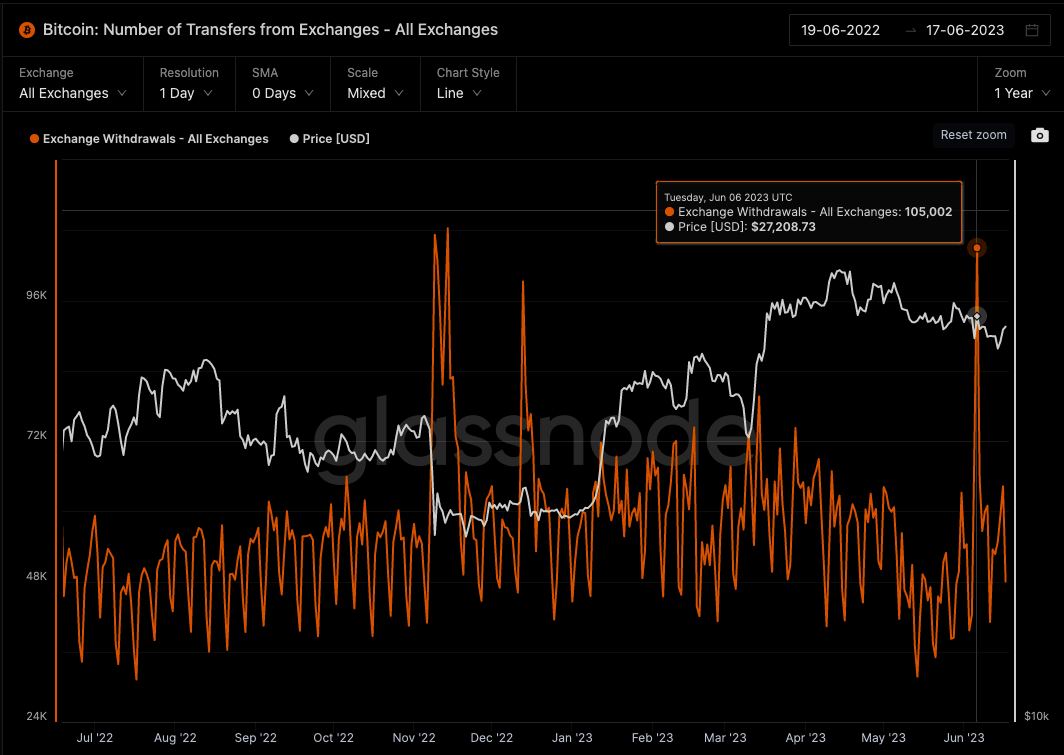

Bitcoin (BTC): Number of Transfers from All Exchanges

This metric shows the total count of transfers from exchange addresses i.e. the number of on-chain withdrawals from exchanges.

According to data from Glassnode, as at 6 June 2023, the number of transfers from exchanges hit YTD highs as the SEC charged crypto exchanges Binance and Coinbase.

Source: Glassnode. Past performance is not indicative of future performance.

This metric shows the percent drawdown of the asset’s price from the previous all-time high.

Based on data from Glassnode, as at 17 June, the drawdown from the all-time highs sits at -61.4%, having rebounded from lows of over -75% back in November 2022.

Source: Glassnode. Past performance is not indicative of future performance.

Altcoin news

Over the week to 18 June, one of the largest movers within the Top 50 was Fantom (FTM), with an increase of over 14.2%. According to the Fantom Foundation website, Fantom is a fast, high-throughput open-source smart contract platform for digital assets and dApps. Currently, over 200+ dApps are already deployed on Fantom.5

Possibly helping push FTM higher was a tweet by the Fantom Foundation that “the proposal to reduce the validator staking requirement on Fantom has passed. Moving forward, nodes will require only 50,000 FTM to participate in network consensus, broadening the accessibility of running a validator.”

Investing in crypto assets or crypto-focused companies is not suitable for all investors and should only be considered by investors who (i) fully understand their features and risks or after consulting a professional financial adviser, and (ii) who have a very high tolerance for risk and the capacity to absorb a rapid loss of some or all of their investment. Any investment in crypto assets or crypto- focused companies should only be considered as a very small component of an investor’s overall portfolio.

References:

1.https://decrypt.co/145000/blackrock-bitcoin-etf-real-deal

2. https://www.reuters.com/technology/urgent-binance-sec-strike-deal-move-all-us-customer-funds-wallet-keys-back-2023-06-17/3. https://www.sec.gov/news/press-release/2023-1024.https://www.cnbc.com/2023/06/12/coinbase-sued-by-sec-over-alleged-unregistered-securities.html5. https://fantom.foundation/

Past performance is not indicative of future performance.

Off the Chain is published every 2nd Tuesday. It provides the latest news on bitcoin and the rest of the crypto market, along with analysis and insights into the world of crypto.

It provides general information only and is not a recommendation to invest in any crypto asset, crypto-focused company or investment product.

This article mentions the following funds

Written by

Justin Arzadon

Director, Adviser Services & Head of Digital Assets.

C4 Certified Bitcoin Professional (CBP) and Blockchain Council Certified Bitcoin Expert™ with over 18 years’ experience in the ETF market. Passionate about the future of money.

Read more from Justin.

1 comment on this

Blockchain & Cryptocurrencies is a revolutionary tech and this is vital part of our future global digital economy powered by web 4.0 + AI + Blockchain & Crypto. That’s why this tech will keep developing and evolving, we already have interoperable blockchains able to communicate and transmit transactions, instead of legacy isolated blockchains of the past… The adoption rate is faster than the internet adoption of the 1990s. This tech can provide banking, fin tech and other services and much more at the fraction of a price. This is truly revolutionary and innovative tech and it will only grow. By 2030 the total crypto market cap will be $10+ Trillion.