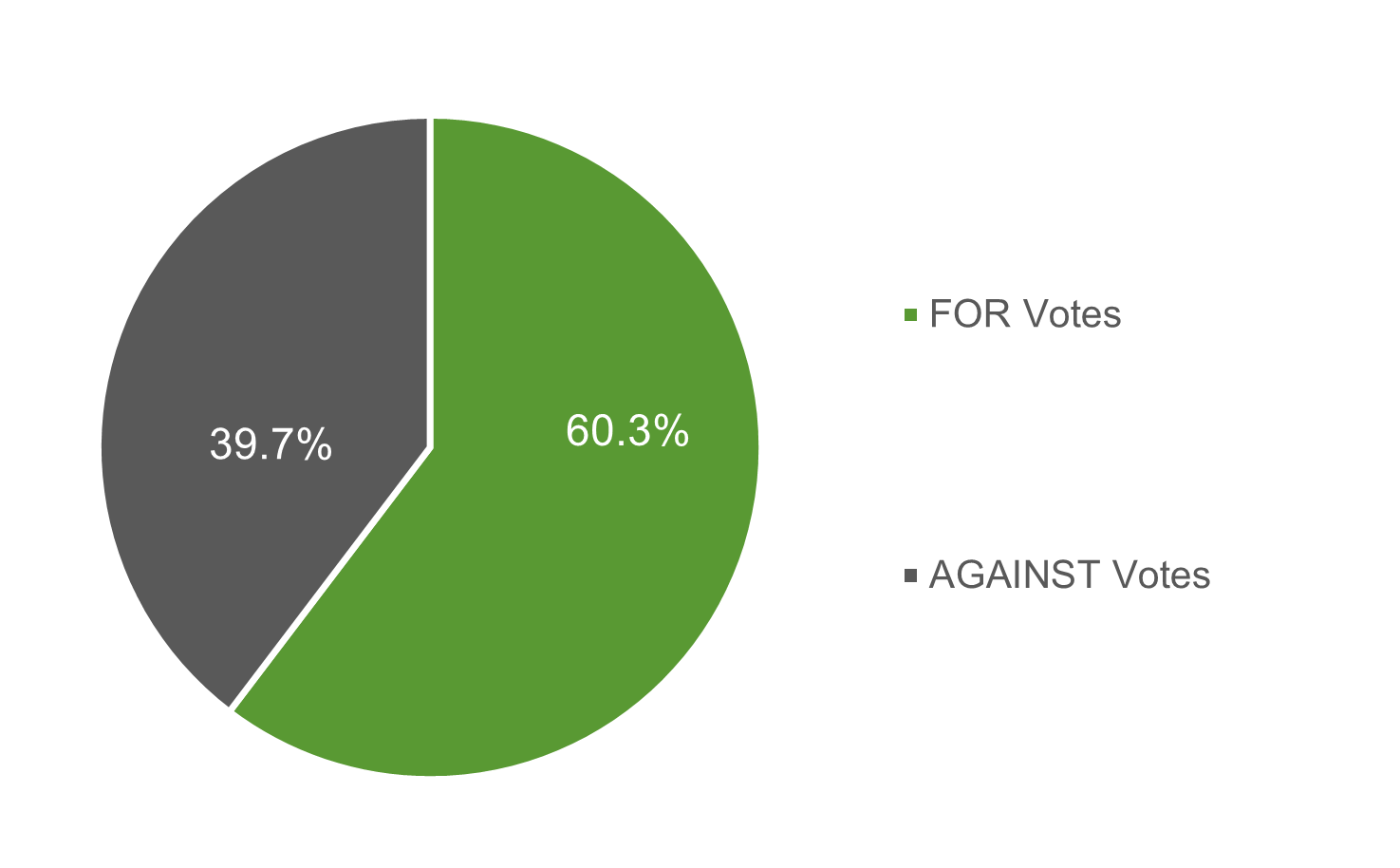

Across Betashares’ range of ethical and impact ETFs1, we voted at 77 shareholder meetings in the quarter ending 31 December 2023 on 469 individual proposals. We voted FOR 283 times and AGAINST 186 times.

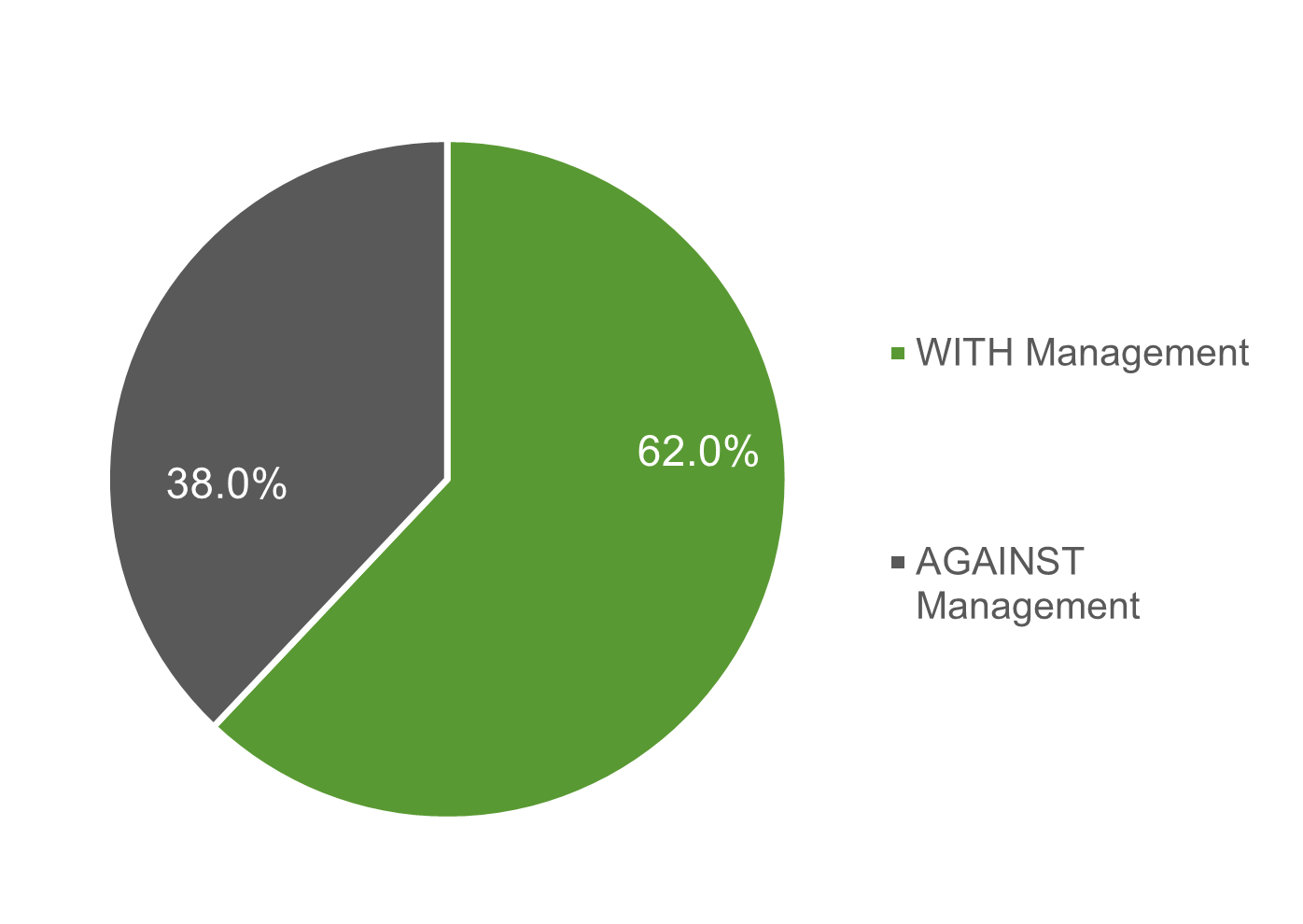

We voted WITH management 291 times and AGAINST management 178 times.

Among the proposals, we supported a shareholder proposal at Sysco Corporation in favour of reducing or eliminating the use of gestation crates in the pork supply chain as shareholders would benefit from increased transparency on the company’s policies and practices related to animal welfare and the reduction of issues relating to animal welfare in the company’s supply chain.

Engagement activity

Engagement activity over the quarter was focused on supply chain sustainability, biodiversity, fossil fuel financing and human rights issues.

We met with Tesla to discuss a range of issues including workplace safety. This followed reports by German news outlet, Stern, that emergency services were called to Tesla’s Berlin-Brandenburg gigafactory 250 times in 2022. Undercover investigators reported a lack of instruction, protective equipment, and pressure to produce as the apparent reasons for the high-volume of accidents. In addition to the injuries to workers, Stern also claimed that there have been 26 environmental accidents since the factory opened2.

One of the leading complaints voiced by Tesla workers pertains to poor working conditions and safety hazards, with some citing extreme workloads stemming from staff shortages and overly ambitious production targets.

Tesla rejected these claims, saying that workers received training on necessary safety measures, as well as protective clothing. Tesla claims that the plant was subject to regular checks by local authorities and that safety measures were being respected. Tesla did not address the specific claims regarding the number of accidents at the plant.

We continued our engagement with representatives of the Climate Bonds Initiative (CBI) over the Woolworths Green Bond. We expressed our view that the Woolworths Green Bond’s use of proceeds, which are predominately allocated to building leases, was not consistent with the CBI Low Carbon Buildings Criteria of the Climate Bond Standard.

We engaged with the International Finance Corporation (IFC) to clarify how its Green Equity approach is applied to existing clients and their financing of new coal projects. In 2023, IFC updated its lending rules to restrict equity clients from financing new coal projects3. However, grey areas remain where the IFC allows equity clients to underwrite bonds for coal developers and allows clients to finance industrial projects that are powered by dedicated coal plants. It is also unclear whether the “no new coal” rule is applied to the corporate financing of existing coal industry clients.

A report by Inclusive Development International, Recourse and Trend Asia has alleged that IFC is indirectly backing dozens of new coal projects throughout Asia. They claim that IFC is exposed to 68.3 gigawatts of coal-fired power capacity either in the form of newly operational plants that have come online since 2019, projects that are currently planned, or plants that are under construction. This coal capacity is spread across 39 projects in China, Indonesia, and Cambodia. IFC is supporting these projects through investments in third party financial intermediaries4.

When questioned about these investments, IFC said that they cannot comment on the portfolios of financial intermediary clients due to confidentiality agreements.

We engaged with BMW AG based on reports that one of its cobalt suppliers has been accused of poor working conditions at its mining facilities[5]. In its response, BMW said that they carry out regular audits on suppliers to verify their compliance with the company’s social and environmental standards. In this specific instance, BMW has initiated an investigation into the matter and has been having ongoing discussions with the supplier.

We engaged with the Inter-American Development Bank (IDB) based on reports that it was lending to Pronaca, one of the largest companies in Ecuador to set up a new facility for pig and poultry farming. According to reports, air and water pollution caused by the waste from farms owned by Pronaca has impacted local indigenous communities6.

In its response, the IDB said that it conducted extensive due diligence on Pronaca and its operations prior to approving the loan. During the due diligence phase, IDB concluded that the approved project did not impact lands and natural resources subject to traditional ownership, there was no physical relocation of indigenous communities from traditional lands and there was no significant impact on critical or culturally relevant land or resources relating to indigenous communities.

Expand your investment knowledge

Keep updated and subscribe to content that matters to you.

1. Being Betashares Global Sustainability Leaders ETF (ASX: ETHI), Betashares Australian Sustainability Leaders ETF (ASX: FAIR) and Betashares Climate Change Innovation ETF (ASX: ERTH).

2.https://www.telegraph.co.uk/world-news/2023/09/28/tesla-amputation-union-germany-grnheide-injured-burns-cars/

3.https://www.banktrack.org/article/ifc_announces_it_will_stop_clients_funding_new_coal_projects

4.https://www.inclusivedevelopment.net/wp-content/uploads/2023/09/Blowing-Smoke.pdf

5.https://europe.autonews.com/environmentemissions/automaker-sources-cobalt-ev-batteries-morocco-and-australia

6.https://news.mongabay.com/2023/08/ecuador-pig-poultry-farm-pollution-sparks-protest-amid-idb-ifc-loans/

Ex Suncorp, Russell Investments, QIC and Mercer. Past Director of the Investment Management Consultants Institute (IMCA) and Management Committee of the Investor Group on Climate Change (IGCC)

Read more from Greg.