DEI: Impacts of changes to US law for companies and responsible investors

10 minutes reading time

Deep storage: Hype vs reality

Following our earlier article, “5 big trends in sustainable investing”, we present a two-part discussion on energy storage. This first article examines solutions for longer term or ‘deep’ storage solutions.

We look at why we need storage, how much we need, and the types required. We consider the different technologies and consider which are genuine solutions and what is hype.

Why do we need energy storage?

In January 2019, South Australia and Victoria experienced days of record heat. On January 24th, Adelaide endured a record temperature of 46.6ºC and across both states, air conditioning was turned to maximum output.

The Australian Energy Market Operator (AEMO) struggled to meet the demand for electricity. With several fossil fuel powered generating units in NSW and Victoria broken down or offline for maintenance, the system was stretched. As the afternoon wore on, output from solar and wind generation fell. The wholesale price of electricity, which averaged $92/MWh in December 2018, hit $14,500/MWh, and AEMO was forced to introduce load shedding. Suburbs in Melbourne and regional Victoria experienced blackouts for the first time in years1. The incident highlighted the urgent need for a rapid increase in energy storage capacity in the National Electricity Market (NEM).

Electricity demand fluctuates throughout the day, and renewable energy sources like solar and wind are intermittent. As our grid decarbonises, storage is required to balance demand and supply and maintain the integrity of the grid. Energy storage helps bridge the gap between the times when energy is generated and when it is needed, ensuring a reliable and stable power supply. The AEMO 2022 Integrated System Plan (ISP), which outlines a 30-year roadmap of the investment required to maintain secure, reliable, and affordable electricity supply through to 2050, projects a 30-fold increase in storage capacity2.

“The most pressing need in the next decade (beyond what is already committed) is for dispatchable batteries, pumped hydro or alternative storage to manage daily and seasonal variations in the output from fast-growing solar and wind generation”

AEMO 2022 Integrated System Plan

Storage technologies

The main types of energy storage technologies are:

- Pumped hydro energy storage (PHES)

- Hydrogen

- Thermal

- Gravity

- Batteries

- Lithium-ion batteries

- Redox flow batteries

These technologies vary in characteristics and cost – referred to as the levelized cost of storage (LCOS).

The main features of energy storage, and which differ between energy storage types are:

- Primary response: correcting continuous and sudden frequency and voltage changes across the network (sometimes referred to as ‘inertia’).

- Secondary response: correcting anticipated and unexpected imbalances between demand and supply.

- Tertiary response: providing supply during prolonged system stress.

- Seasonal storage: compensating for long-term supply disruption or seasonal variability in supply and demand.

Energy storage that can provide tertiary response and seasonal storage is sometimes referred to as ‘deep’ storage.

There is no perfect form of energy storage, and the energy transition will require a mix of technologies.

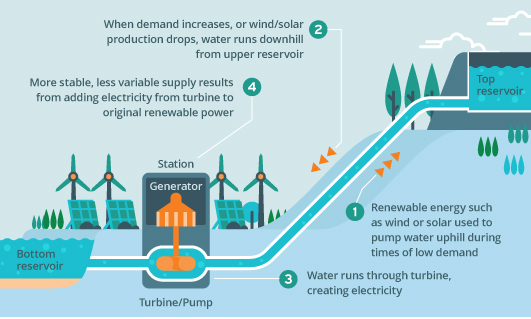

Pumped hydro

Pumped hydro energy storage (PHES) is the dominant form of energy storage, providing 92% of the capacity currently in operation. It involves pumping water uphill from one reservoir to another at a higher elevation for storage when power is cheap and in surplus, then, when power is needed, releasing the water to flow downhill through turbines, generating electricity on its way to the lower reservoir. The first PHES plant was constructed in 1907 in Switzerland.

How pumped hydro storage works

Source: ARENA

Source: ARENA

PHES is around 80% efficient as around 20% of the energy used to pump the water uphill is lost3. The cost of PHES varies depending mainly on the initial capital costs. These are highly site-specific in nature. In addition to costs relating to the acquisition and installation of pumps, turbines, generators, and transformers, are the civil engineering works needed to construct and connect the water storage reservoirs. These can be considerable depending on the geological conditions of the site.

Hohenwarte II Pumped Hydro Station, Thuringia, Germany

Source www.cleanfuture.co

PHES has a low LCOS. Relative to other forms of storage, pumped hydro has high capacity but lacks flexibility. It is not able to provide primary response but can provide secondary response and excels at tertiary response and seasonal storage.

Snowy 2.0 a ‘nation building project’

Those familiar with the ABC Television comedy series Utopia, will know that the three most expensive words in the English language are ‘nation building project’. Snowy 2.0 was an ambitious plan announced in 2017 as a centrepiece of the Federal Government’s climate change policy. However, ‘Florence’, one of three large tunnel boring machines employed to dig the 27 kilometres of tunnels linking Talbingo and Tantangara reservoirs, quickly became stuck in soft, wet conditions for which it was not adequately equipped4.

Snowy 2.0 perfectly highlights the potential risks associated with large scale pumped hydro projects. Originally costed at between $3.8 billion and $4.5 billion and scheduled for completion by 2024, Snowy 2.0 is now expected to cost over $12 billion and is not scheduled for completion until the end of 20285.

Fortunately, most PHES projects do not incur the problems of Snowy 2.0. Since 2010 the world has added 37 GW of PHES capacity with China leading the way6. The Australian National University (ANU) has identified 1,500 sites in Australia suitable for PHES projects, most without the geological complexity of Snowy 2.07.

Snowy 2.0 has a design capacity for 350,000 MWh of energy storage. How much deep storage we need is a matter of debate. After all, in Australia the length of time the sun doesn’t shine and the wind doesn’t blow is usually measured in minutes or hours, not typically days, weeks or months.

According to highly respected ANU Professor Hugh Saddler, rather than high risk mega projects like Snowy 2.0, smaller PHES schemes, designed to operate on a daily cycle and located closer to population centres, reducing the need for expensive transmission and distribution infrastructure, ‘may well provide a more effective, lower cost option8.

In the wake of the troubles besetting Snowy 2.0, the Queensland Government is reported to be having second thoughts about its own PHES megaproject, the $14.2 billion Borumba project being developed near Gympie. The only successful PHES project developed in Australia in the last 40 years has been the Kidston pumped hydro project in north Queensland, where Genex Power is using an old open pit gold mine to build a 250MW, eight hour pumped hydro project that remains on time and on budget9.

Green hydrogen

Green hydrogen can be produced from water using electrolysis. That hydrogen can be stored, and later burned or used to power a fuel cell. Alternatively, hydrogen can be stored as ammonia, which can be used as a fuel or converted back into hydrogen by ‘cracking’.

Green hydrogen is substantially more expensive than ‘grey’ hydrogen, which is made from natural gas. Consequently, green hydrogen projects, like Woodside’s proposed H2OK project in Oklahoma, rely on substantial government subsidies to stack up financially. Under the US Inflation Reduction Act, a production tax credit of $3/kg is being offered to green hydrogen producers. Recently, a letter signed by 18 organisations, including the Union of Concerned Scientists, expressed concerns that unless properly regulated, the production of green hydrogen could lead to a substantial increase in emissions10.

Woodside’s Planned H2OK Project Oklahoma USA

Source: Woodside

Green hydrogen suffers from two major drawbacks; lack of efficiency and lack of energy density. We discuss this further in our paper: Hopium: the siren song of green hydrogen. Since then, reports continue to be published forecasting substantial declines in the cost of manufacturing green hydrogen, which tend to ignore the physical properties of the hydrogen molecule, and substantial increases in green hydrogen demand, which tend to ignore the significantly lower cost of competing technologies.

However, there are signs the hydrogen bubble is bursting. A recent white paper by Boston Consulting Group and Oxford Global Projects, aimed at hyping hydrogen’s potential, revealed that while 5.6% of proposed hydrogen for energy projects by number made it into production, this represented only 0.2% by volume11.

Large green hydrogen projects simply don’t get past feasibility. The economics of using renewable energy to manufacture expensive hydrogen, which would then need to be stored and possibly transported before being burnt to generate electricity, with waste heat and efficiency losses at every step of the process, simply does not stack up.

There may be valid uses for green hydrogen, such as manufacturing green steel and replacing grey hydrogen in the manufacture of agricultural fertilisers, but energy storage is not one of them.

Thermal storage

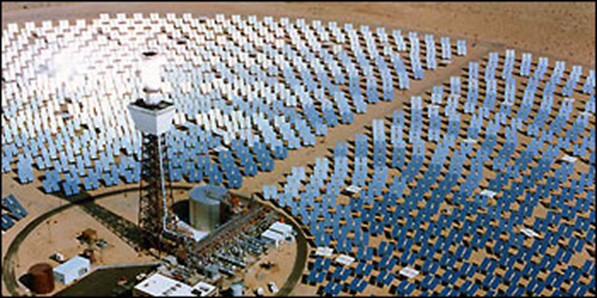

Solar Two Project Mojave Desert

Source: National Renewable Energy Laboratory

Thermal storage covers a range of different technologies that store energy as heat in a material (medium), which is later converted into electricity. While various mediums, including aluminium, basalt, and silicon, are in various stages of research or development, molten salt is the most technologically advanced.

Molten salt storage works by concentrating solar energy, typically using a solar tower that concentrates the sun’s rays from an array of flat movable mirrors called heliostats. The salt melts at a temperature of 131ºC and is then pumped through the solar tower to increase it to a temperature of 566ºC or higher. That heated salt then can be stored in an insulated tank. When electricity is needed, the hot molten salt is used to create superheated steam, which drives a conventional turbine generator.

There are over 50 solar thermal plants in operation around the world or in various stages of development12. The largest is the Cerro Dominador Thermal Plant in Chile, completed in 2021. The plant can provide 17.5 hours of storage at 110 MW. The plant’s owner declared insolvency in 2022 and was acquired by Cox Energy in August 202313.

The levelised cost of electricity from solar thermal is estimated by Lazard at US$141/MWh, making it significantly more expensive than commercial scale solar or wind combined with battery storage14.

Gravity storage

Gravity batteries work by using renewable energy to raise a heavy object, and then generating electricity by lowering the object to power a generator. Typical of projects is the Lifted Weight Storage (LWS) system developed by Energy Vault. It uses a multi-headed crane to store energy by stacking heavy blocks into a tower. Energy is generated by lowering the blocks back to the ground, with the motors functioning as generators.

Energy Vault Pilot Project, Switzerland

Source: Energy Vault

The economics of gravity storage are uncertain. Prototypes are around 60% energy efficient but larger projects may achieve around 80% efficiency15 – comparable to smaller pumped hydro projects.

Gravity storage has little prospect of significant scale benefits. LWS projects will likely need at least some degree of tailoring to site-specific requirements, so the potential for material economies of scale benefits, as seen with Li-ion batteries, is unlikely.

Conclusion

The build out of low-cost solar and wind renewable electricity generation requires substantial investment in energy storage. Some deep storage is required for ‘dark and still’ periods when solar and wind output is less than demand for an extended period. However, AEMO modelling shows that building enough wind and solar to meet the energy needs of winter is likely to be more efficient, on estimated technology costs, than building less wind and solar but more seasonal storage16.

Pumped hydro represents reliable and cost-efficient technology that can help address supply and demand imbalances. The focus should be on smaller projects built closer to areas of demand rather than ambitious, and risky, megaprojects. Other technologies, while interesting, are more expensive and unlikely to scale.

In part two, we will explore commercial scale battery technologies which provide the greatest potential for growth, as we build the energy grid of the future.

1. https://www.energycouncil.com.au/analysis/can-the-nem-stand-the-heat/

2. https://aemo.com.au/-/media/files/major-publications/isp/2022/2022-documents/2022-integrated-system-plan-isp.pdf?la=en

3. https://www.eesi.org/papers/view/energy-storage-2019

4. https://www.abc.net.au/news/2023-10-23/snowy-hydro-sinkhole-toxic-gas-tunnelling-four-corners/102995568

5. https://www.afr.com/companies/energy/snowy-works-to-free-florence-at-12b-mega-project-20230901-p5e18q

6. https://www.statista.com/statistics/1304113/pumped-storage-hydropower-capacity-worldwide/

7. https://reporter.anu.edu.au/all-stories/extra-1500-pumped-hydro-sites-could-bolster-energy-grids

8. https://reneweconomy.com.au/why-is-pumped-hydro-in-australia-not-used-very-much-40561/

9. https://reneweconomy.com.au/worlds-biggest-standalone-grid-says-pumped-hydro-too-hard-all-in-with-battery-storage/

10. https://www.hydrogeninsight.com/policy/us-could-spend-more-than-100bn-on-hydrogen-subsidies-that-actually-increase-emissions-if-regulations-are-weak/2-1-1409964

11. https://www.bcg.com/publications/2023/five-strategies-for-optimizing-ptx-projects

12. https://en.wikipedia.org/wiki/List_of_solar_thermal_power_stations

13. https://www.pv-magazine.com/2023/08/03/cox-energy-finalizes-acquisition-of-abengoa/

14. https://www.lazard.com/media/2ozoovyg/lazards-lcoeplus-april-2023.pdf

15. https://www.energyvault.com/products/g-vault

16. https://aemo.com.au/-/media/files/major-publications/isp/2022/2022-documents/2022-integrated-system-plan-isp.pdf?la=en