From a finance theory perspective, ‘quality’ has a particular definition and typically relates to selecting companies based on specific financial metrics such as return on equity (ROE), leverage (how much debt a company is taking on to achieve its results) and the stability of its earnings.

As we described in a prior post, investing in ‘quality’ companies has historically provided good shareholder returns over the longer term in global sharemarkets.

Intuitively, this makes sense – after all, if a company has generated consistently high profits relative to shareholder capital without taking on excessive amounts of debt, it is unsurprising that such companies have tended to generate excess returns relative to the broader market over the long run.

For example, the index that the BetaShares Global Quality Leaders ETF (ASX: QLTY) aims to track (after taking into account QLTY’s fees and costs) has outperformed the benchmark MSCI World ex Australia Index by 1.87% p.a. from 20 December 2002 to 31 August 2022.

Source: Bloomberg. Graph shows performance of QLTY’s index, being the iSTOXX MUTB Global Ex-Australia Quality Leaders Index, after taking into account QLTY’s management fee and costs of 0.35% p.a. Indices re-based to 100 as at 20 December 2002. QLTY’s inception date is 5 November 2018. You cannot invest directly in an index. Past performance is not an indicator of future performance of any index or ETF.

It stands to reason the same principles can be applied to the Australian market. BetaShares recently looked into whether ‘quality’ investing offers the potential for outperformance when applied to our own home market.

As the likes of Starbucks have found out, to be successful in Australia, one needs to customise their approach to be relevant to our particular market conditions.

Generally, we identified that substantial customisation was required to ‘off the shelf’ quality indices that were typically designed for other sharemarkets in order to meet the idiosyncrasies of the Australian sharemarket. However, with such customisations made, we found that, as expected, quality investing can be not only a profitable opportunity in our market, but also true to label. We subsequently launched the BetaShares Australian Quality ETF (ASX: AQLT).

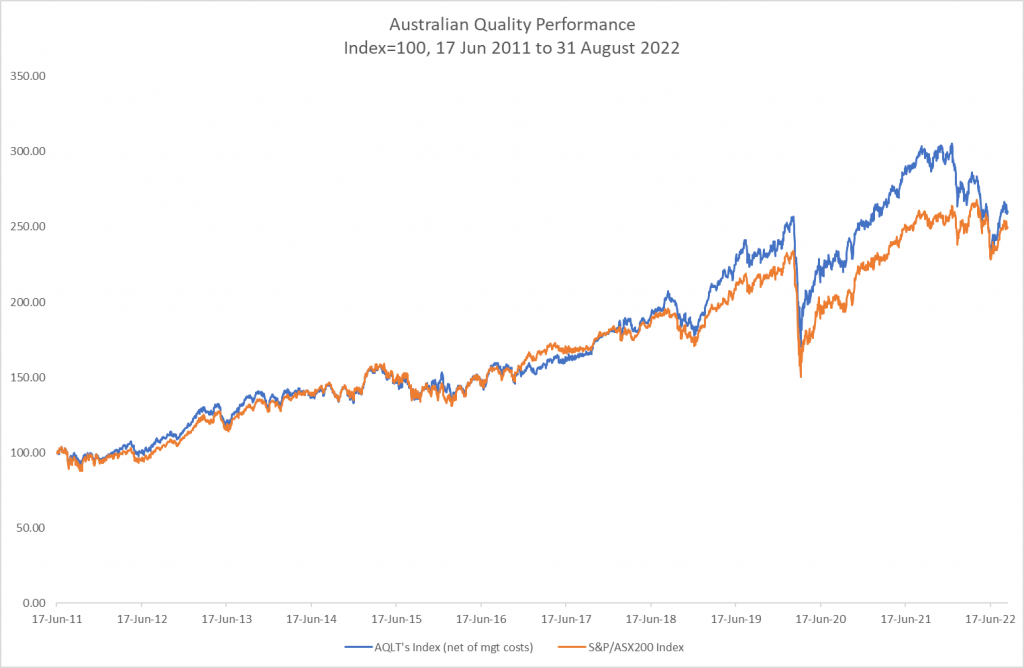

The customised quality index that AQLT aims to track (after taking into account AQLT’s fees and costs) has outperformed the S&P/ASX 200 by 0.42% p.a. over the period from 17 June 2011 (being the inception date of the index) to 31 August 2022.

Source: Bloomberg. Graph shows performance of AQLT’s index, being the Solactive Australia Quality Select Index, after taking into account AQLT’s management fee and costs of 0.35% p.a. Indices re-based to 100 as at 17 June 2011. AQLT’s inception date is 4 April 2022. You cannot invest directly in an index. Past performance is not an indicator of future performance of any index or ETF.

How to make quality work down under

AQLT’s index was designed with the specifics of the Australian market in mind. In order to do so, there was a need to customise typical ‘off the shelf’ approaches to quality investing. In particular, one must consider the significant concentration our market has to large cap companies. As many Australian investors are aware, the largest 11 companies make up close to half the weight in the S&P/ASX 200 Index.

Some of the other Australian quality indices we looked at, which apply various quality metrics to the Australian market without taking into account this concentration issue, appear to have generated returns that were driven more by the size of the companies in their portfolio than by the quality factor itself.

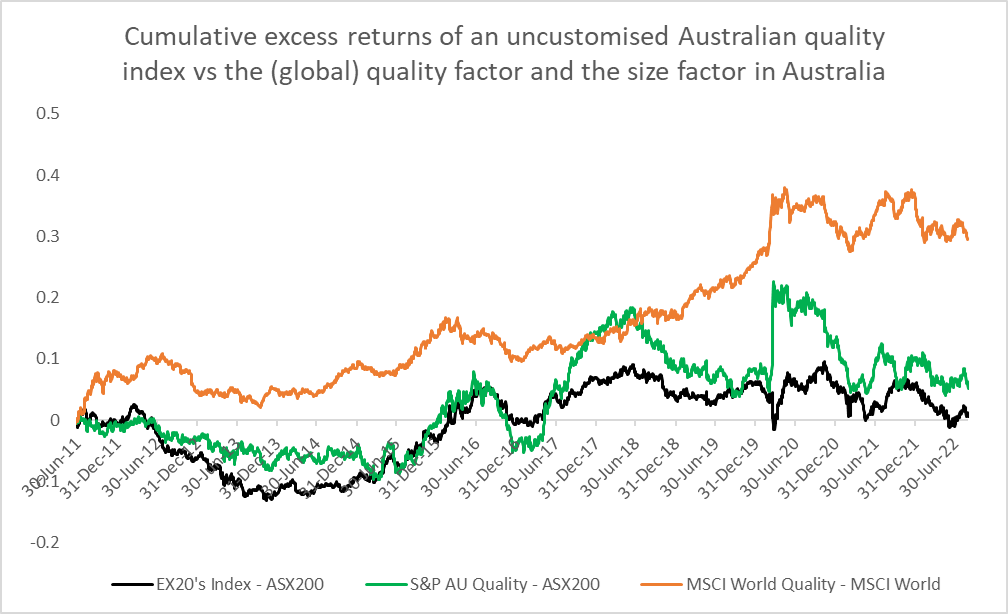

The chart below shows:

- the quality factor, as proxied by the excess returns of the MSCI World Quality Index vs. the MSCI World Index

- the size factor in Australia, as proxied by the excess returns of the index that the BetaShares Australian Ex-20 Portfolio Diversifier ETF (ASX: EX20) seeks to track (comprising the 180 largest stocks listed on the ASX after excluding the largest 20 stocks based on market capitalisation) the S&P/ASX 200 Index

- an ‘off the shelf’ (non-customised) Australian quality index (being the S&P/ASX Quality Index) vs. the S&P/ASX 200 Index.

The purpose of this analysis is to illustrate which factor has had more influence in driving the excess returns of an ‘off the shelf’ solution.

Source: Bloomberg. Graph shows index performance and does not take into account any ETF fees and costs. You cannot invest directly in an index. Past performance is not an indicator of future performance of any index or ETF.

We found that the uncustomised Australian quality index (in green) delivered excess returns more correlated with the size factor (black) than with the quality factor itself (orange) over the relevant period.

The correlation of the uncustomised quality index with the size factor is a consequence of the high concentration of the Australian sharemarket into a small number of very large cap stocks. Given the far greater number of small and mid-cap stocks in the Australian sharemarket, the vast majority of the stocks selected for an uncustomised quality index inevitably will be of a smaller size than a benchmark market cap-weighted index.

Bearing this in mind, the index AQLT aims to track takes the important step of introducing a size component (or, in other words, being market capitalisation-aware), which is generally not considered in uncustomised quality indices.

Acknowledging size is a significant factor in Australia. AQLT’s index breaks the investment universe into two groups:

- a large cap group (the top 50% of the Solactive Australia 200 Index by market cap), and

- a mid-small cap group (the bottom 50% of the Solactive Australia 200 Index by market cap).

It then selects, ranks and weights the highest quality companies within each group. By having equal representation of both market cap groups within a quality framework, the index is able to deliver a more ‘true-to-label’ quality exposure within the Australian marketplace

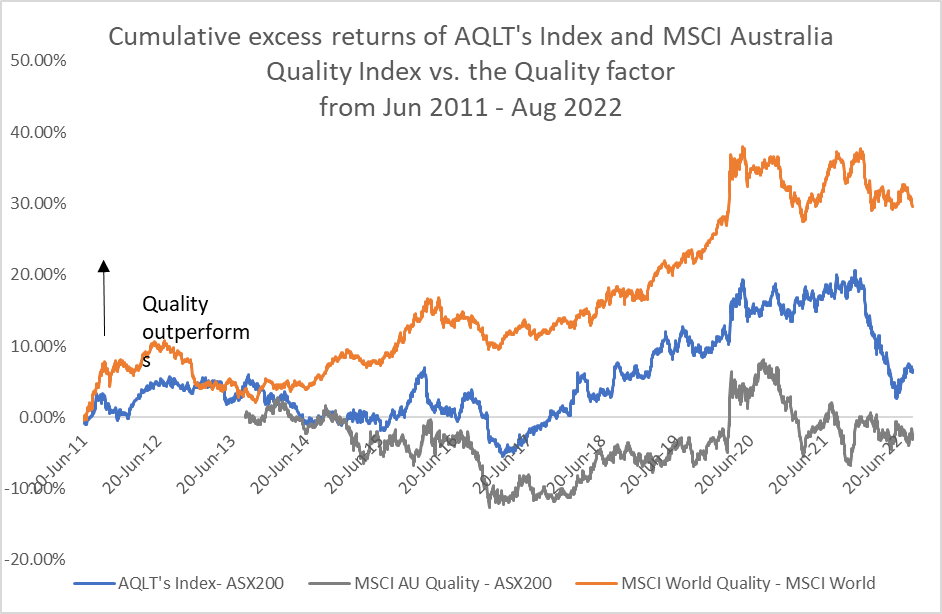

Source: Bloomberg. Graph shows index performance and does not take into account any ETF fees and costs. You cannot invest directly in an index. Past performance is not an indicator of future performance of any index or ETF.

Not only has AQLT’s index net of fees delivered excess returns relative to the S&P/ASX200 Index over the longer term, but also the profile of those excess returns has been better aligned with the quality factor itself over the relevant period. Of course, it’s important to remember past performance isn’t indicative of future performance of any index or ETF.

Conclusion

AQLT’s investment strategy seeks to replicate the quality factor in the Australian market, even though our market has less breadth and depth of companies than global markets. AQLT’s index is customised to reflect the specific dynamics of the Australian market, and by doing so, aims to provide investors with a ‘true to label’ Australian quality exposure that may be suited to investors seeking the potential for outperformance relative to market-cap weighted benchmarks over the longer term.

| There are risks associated with investment in AQLT, including market risk and non-traditional index methodology risk. An investment in AQLT should only be considered as a component of a broader diversified portfolio. For more information on risks and other features of AQLT, please see the Target Market Determination and Product Disclosure Statement, available at www.betashares.com.au. |

Written by

Thong Nguyen

Head of Equities

Thong is responsible for the portfolio management function and product innovation at Betashares. He is a CFA Charter holder and sits on the Betashares Investment Committee as well as the Selection Committee for ASX:ROYL.

Read more from Thong.