Global markets

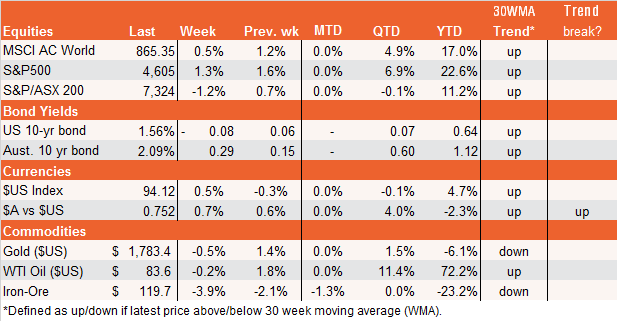

Generally solid earnings results continued to support Wall Street over the past week, as did an easing back in long-term bond yields. Hopes that President Biden’s infrastructure package might get over remaining Congressional hurdles was also a positive.

U.S. economic data was somewhat mixed, with a softer than expected 2% annualised gain in Q3 GDP (market 2.7%), but another notable drop in weekly jobless claims. The core PCE inflation indicator was thankfully a bit weaker than expected, with the annual rate easing to 3.6% from 3.7%. More worrisome was a chunky lift in the Q3 wage cost index of 1.3% (3.7% over the year) reflecting strong wage gains in sectors such as leisure and hospitality where staffing shortages remain acute.

All up, after a Delta-induced Q3 growth slowdown, the U.S. economy appears to be ramping up again but with tentative signs that the logjam in goods supply is peaking out, helped by a shift back to services. That said, stronger service demand appears to be making lingering labour constraints – with millions still not having returned to the labour force – more of a concern. The key question for the U.S. economy in the months ahead is whether labour force participation finally begins to rebound – easing labour constraints. If not, persistent wage pressure could force the Fed’s hand with tightening as early as mid-2022 (immediately after the end of bond purchases), which would likely involve a growth slowdown and potential market drop of 20% or more.

If labour supply does rebound, by contrast, 2022 could see a return to the ‘Goldilocks’ scenario of easing inflation and still good growth – which means the Fed likely won’t tighten until late 2022 or more likely in 2023. I still think Goldilocks will slay the bears in 2022 but it’s dependent on an easing in labour market pressures. And of course, when we do eventually get closer to Fed tightening, history suggests upward pressure on bond yields may well cause a PE-valuation induced market correction of around 10% or so.

In terms of the week ahead, the Fed looms large – though the formal announcement of bond tapering (with likely reductions of $US15b per month, ending the QE program by mid-2022) has been well-telegraphed and seems largely priced by the market. The other global highlight will be October U.S. payrolls on Friday, with a solid employment gain of 413k expected. As noted above, also worth watching will be labour force participation and strength in average hourly earnings.

Equity themes

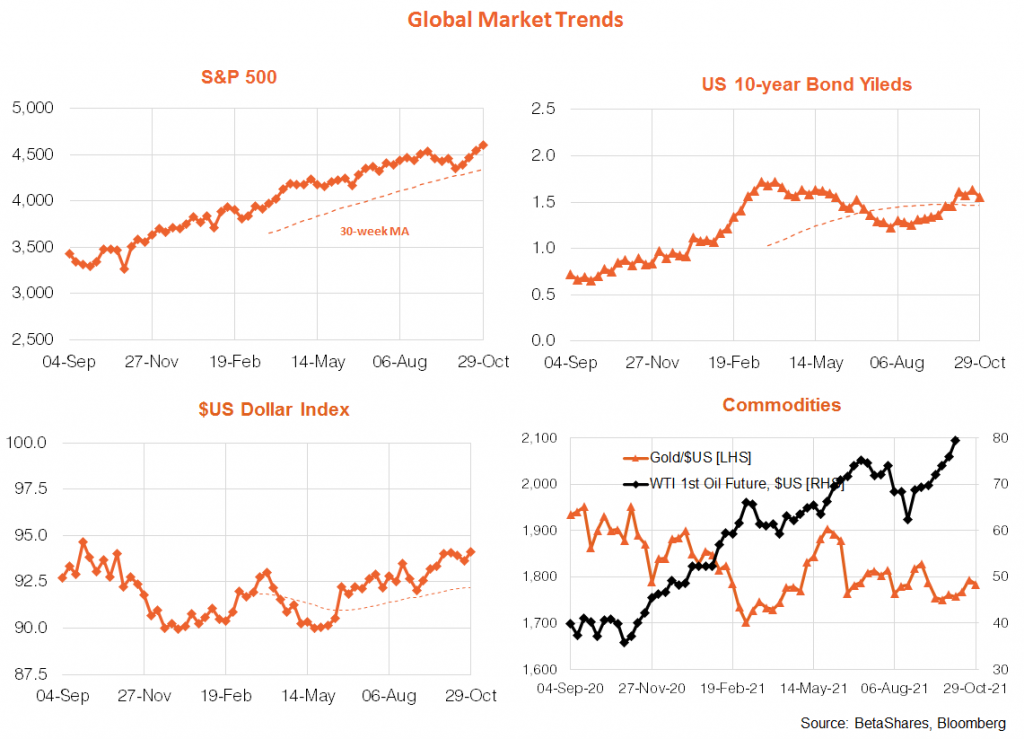

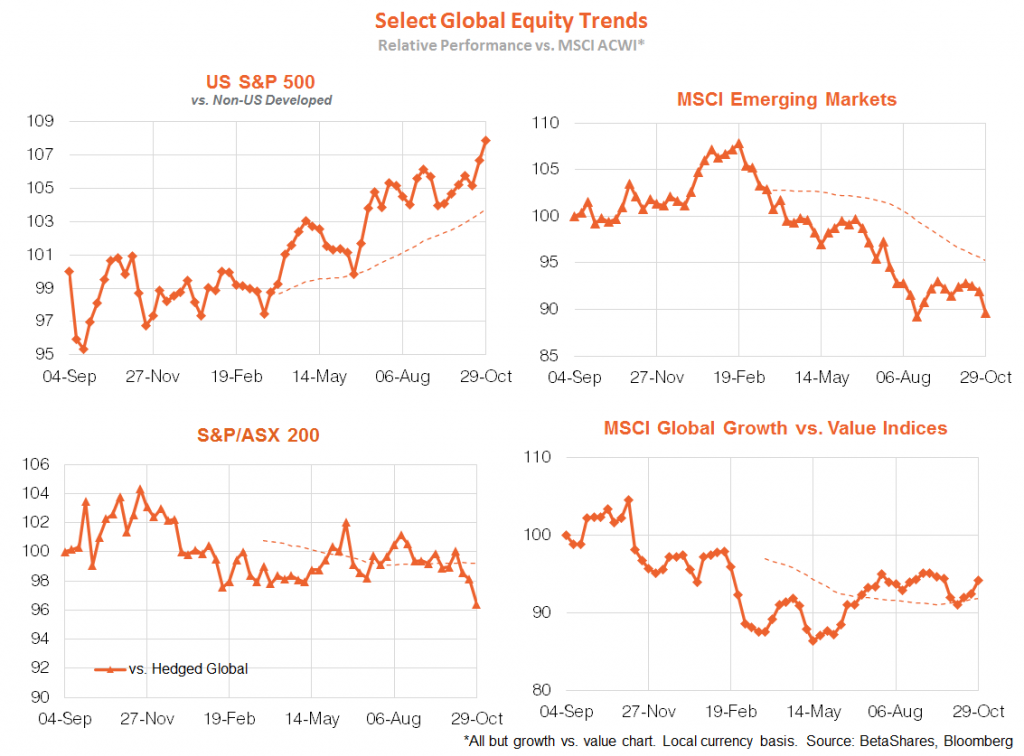

Growth beat value again last week, with the U.S. market also handily outperforming other markets. That means the U.S. relative performance trend is still up, with value and emerging markets (and Australia) not yet convincingly displaying an outperforming bias. It’s fair to describe growth vs. value as in an unresolved tug of war, likely in turn dependent on the path of bond yields.

Australian market

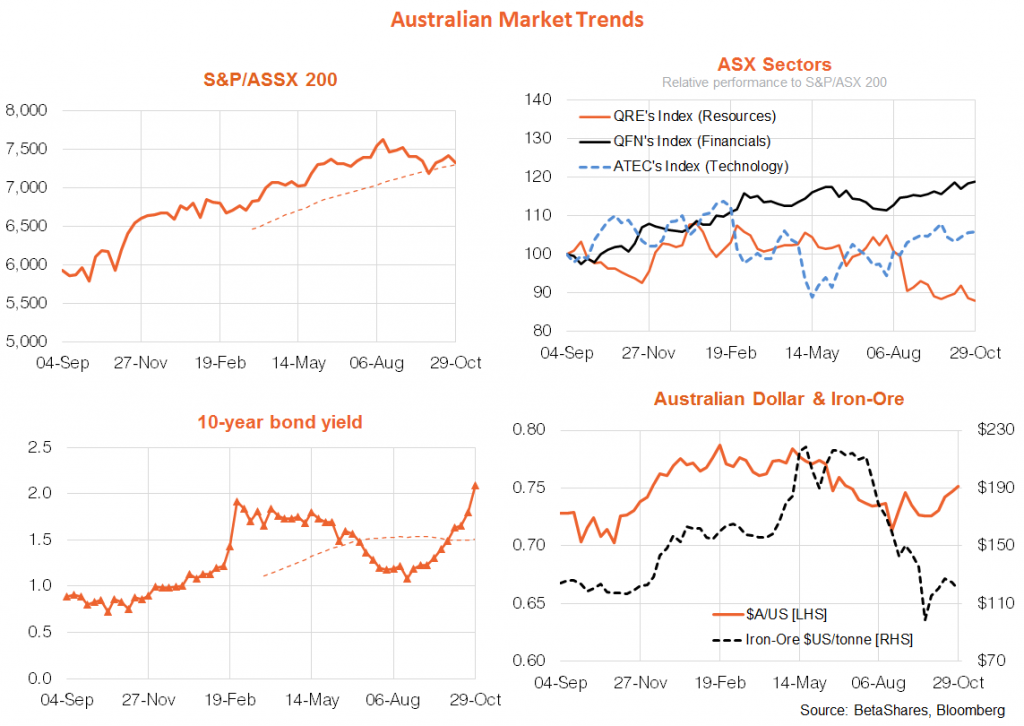

The big local development last week was the higher than expected trimmed mean CPI outcome, with annual growth pushing up to 2.1%. Although in large part this appears to reflect the same supply bottlenecks afflicting the world (especially with local wage growth still fairly subdued), it does mean that annual underlying inflation will likely now hold at or above 2% over 2022, undermining the RBA’s case to leave rates on hold until 2024.

Indeed, the RBA also gave up last week on trying to holding the yield on 3-year bonds at 0.1% – which in turn led to an upside explosion in yields of 40bps over the week. This likely means the RBA will jettison its yield curve control policy at Tuesday’s policy meeting. I suspect it will simply revert to less precise language – suggesting rates will remain on hold for as long as it takes to get a meaningful sustained lift in wage growth. After inching higher for most of the week, the local equity market took the lurch higher in yields on Friday especially badly, dropping 1.4%.

To my mind, due to benign wage growth, it still seems unlikely the RBA will raise rates next year and in any case most likely not before the Fed – despite the aggressive rate hikes now priced into the market. That suggests there’s value in local bonds – especially compared to those globally, and our equity market may recover some lost ground once the RBA provides better clarity on its policy outlook. Apart from Tuesday’s RBA policy meeting, there’s also the RBA’s updated set of forecasts in Friday’s quarterly Statement on Monetary Policy. Rising bond yields have not helped the local equity market in recent months, which has pulled back even as the U.S. market has scaled new heights.

But provided Wall Street holds up, our market should also soon start to grind higher again, albeit likely with a continued underperforming bias – not helped by weaker iron-ore prices and a potential slowing in credit growth due to heightened regulatory scrutiny of the home lending market. I have long held the view of local equity market underperformance.