Last month, I wrote a post introducing the concept of active asset allocation, something I am seeing my clients starting to implement a lot more in recent times. In this post for the BetaShares Academy, I continue this theme, and describe some of the benefits that active asset allocation can generate for portfolios. I also look at some theory which has attempted to quantify the benefits that active asset allocation potentially makes to a portfolio (spoiler alert: it’s a lot more than you think!).

Asset Allocation can provide several benefits to portfolios that cannot be achieved through investing in only one asset class. These benefits may include:

- Absolute Return: Different asset classes perform differently in various types of markets. As such, the asset allocator has an ability to outperform in both rising and falling markets. For example, an investor could have used asset allocation to potentially reduce losses in the GFC by overweighting cash or bonds, or could have enhanced returns in the rally from March 2009 by overweighting international equities such as the US.

- Increased Alpha: Stock valuations within an asset class are traditionally far more efficient than asset class valuations as stocks are often over-researched and “over-broked”, reducing the alpha generation opportunities in stocks relative to asset classes.

- Diversification and Risk Reduction: Adding uncorrelated or low-correlated assets diversifies portfolios, potentially reducing risk and volatility.

Quantifying the Asset Allocation Value Add

An investment paper written in 2000 by Ibbotson and Kaplan asked and answered several specific questions regarding asset allocation, one of which was:

“What portion of the return level is explained by asset allocation policy?”

i.e. If a portfolio returned 10% in a year, how much of that 10% return could be explained by the asset allocation of the portfolio rather than the stock/bond picking of the portfolio? Is it 50%? 70%? The answer they arrived at was actually closer to 100%!!

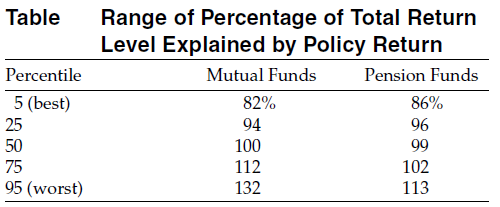

Source: “Does Asset Allocation Policy Explain 40, 90, or 100 Percent of Performance”, Ibbotson & Kaplan, 2000. This research studied US mutual and pension funds between 1988 and 1998.

As you can see in the table above, asset allocation is tremendously important to overall return, a finding that is consistent with numerous academic studies. The study indicates that for the top 5% of Mutual Fund portfolio managers, asset allocation explained 82% of their portfolio return, with stock/bond picking therefore accounting for ~18% of the total return. So if the return for that year was say 10%, asset allocation provided 8.2% return and stock/bond picking a further 1.8% of return. So clearly stock picking CAN add value, but this research shows it is not the MAIN source of a portfolio’s return. For a 50th Percentile manager, asset allocation explained 100% of the return. This means that this manager effectively gave back any gains from picking winners by picking a loser at some other point over the year, leaving only their asset allocation decisions to add value.

For the 95% Percentile manager (bottom 5% of managers), the asset allocation explained 132% of the portfolio return. This means that if the manager in this example returned 10% for the year, they effectively made 13.2% return from asset allocation and lost 3.2% from bad stock/bond picks to give a total return of 10%. Certainly some compelling statistics in this study for why asset allocation is important!

Formerly Managing Editor at Livewire Markets. Passionate about investments, markets, and economics.

Read more from Patrick.