It’s been a wild ride for uranium equity investors in recent months. The BetaShares Global Uranium ETF (ASX code: URNM) fell 19.14% between its launch on 8 June and the end of the month, before rallying 20.33% in July.

So what’s been driving this volatility? And what’s changed in the uranium and nuclear industry in recent months? Let’s dive in.

Volatility drivers

Global equities fell hard in June, hitting their nadir on 17 June.1 Despite plenty of developments in the industry, it was predominantly the mood in broader equities markets that dictated the large sell-off and subsequent rally over the last two months.

Another example of the old saying that ‘during times of crisis, correlations go to 1.’

Uranium news

It’s been a very busy year in the nuclear industry. But in recent months, two major political announcements stand out.

On 6 July 2022, the EU Parliament voted down a proposal to exclude nuclear (and gas) power stations from the new EU green taxonomy. This means that nuclear energy can now be recognised as ‘green’ across Europe.2 This is significant as it could open up billions of Euros in investment in new nuclear capacity, and many EU members are now looking at extending reactor lives or investing in new capacity.3

In the US, the Senate passed the Inflation Reduction Act on 7 August. The goal of the Act is to control inflation and increase energy security. The bill includes US$369 billion in spending on energy and climate, and includes a range of provisions that support nuclear energy.4

Reactor life extensions, restarts, and approvals

Across Asia, Europe, and the US, nuclear reactors are seeing their lives extended, inactive reactors are being restarted, and new reactors are being approved.5

The Japanese government said in July that it hopes to restart four reactors from its largely idled fleet. Japan’s nuclear reactors were shut down following the disaster at the Fukushima Daiichi plant in 2011. While five reactors have now been restarted, progress has been slow on further restarts. If these reactors are brought online in time for the northern hemisphere winter, as planned, it would bring that total to nine.6 The longer-term goal is to have a total of 30 functional reactors in Japan.7

In April, the Chinese government approved six new reactors. In the National Development and Reform Commission’s 14th Five-Year Plan, they proposed “the steady construction of coastal nuclear power projects with an emphasis on safety”.8

In Europe, the Belgian government reached an agreement with energy provider Engie in July that would see the country’s two reactors’ lives extended by 10 years. The two reactors are due to shut down in 2025, but after a technical review, the plan is now to restart the reactors in 2026 and run them through 2036.9

Even Germany, which has long been a proponent of shutting down nuclear reactors, is flirting with the idea of extending the lives of its last remaining reactors.10

In California, the last remaining nuclear reactor at Diablo Canyon is due to be shut down in 2025. But Californian Governor Garry Newsom stated in April that he would apply for part of a US$6 billion Federal package that might allow the reactor to stay online.11

It seems the nuclear energy renaissance is alive and well.

Mine restarts

Restarting closed or idled mines shows that miners are feeling confident about the outlook for uranium pricing. Uranium giant Cameco announced in February that it would bring the McArthur River mine, the world’s largest high-grade uranium mine, back into service. McArthur River has been in care and maintenance since 2018.12

In June, the ASX-listed Boss Energy (ASX code: BOE) announced it would restart its Honeymoon uranium mine in South Australia. First production is expected in Q4 2023, and it plans to reach a rate of 2.45 million pounds p.a. within three years.13

In July, another ASX-listed uranium developer, Paladin Energy (ASX code: PDN) announced its decision to bring the Langer Heinrich Mine in Namibia back into production. The company plans first production in Q1 of 202414 and plans to produce 5.9 million pounds p.a. at peak production.15

Cameco, Boss Energy, and Paladin Energy are all holdings in the URNM portfolio.

Supply and demand

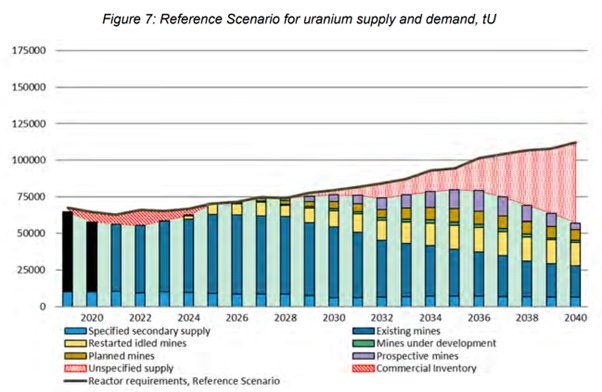

Perhaps the most widely publicised model of supply and demand in the uranium industry is published by the World Nuclear Association. The 52-page report is available for free online. It was published in 2021, so may not account for some recent developments.

The image below summarises some of the conclusions of the report. It’s worth noting that for mines to be restarted and built, prices need to be high enough for them to be economically viable. Therefore, there are many assumptions and estimates built into the model.

Source: World Nuclear Association Nuclear Fuel Report 2021.

The image shows that while there is a shortfall between supply and demand over the period of 2019 to 2024, this gap is expected to be filled by “commercial inventory” – the stocks sitting with nuclear utilities and fuel processors. As idled mines begin restarting, equilibrium is projected to return to the market between 2025 and 2028.

From 2029 onwards, as demand is expected to rise, a gap appears. This would need to be filled by “unspecified supply”. The World Nuclear Association explains unspecified supply as “the material that will fill the gap between identified supply sources and requirements for the various fuel cycle components.”16

Getting exposure: how to invest in uranium

The BetaShares Global Uranium ETF (ASX Code: URNM) is the first uranium-focused ETF traded on the ASX. It provides exposure to a portfolio of global companies involved in the mining, exploration, development and production of uranium, modern nuclear energy, or companies that hold physical uranium or uranium royalties.

URNM, aims to provide a cost-effective and easily accessible way to gain exposure to companies involved in the uranium industry.

| There are risks associated with an investment in URNM, including market risk, sector concentration risk, international investment risk and regulatory risk. For more information on the risks and other features of URNM, please see the Product Disclosure Statement. |

1. Source: Bloomberg, BetaShares. Based on the MSCI ACWI.

2. https://earth.org/gas-and-nuclear-turn-green-eu-taxonomy/

3. https://www.wsj.com/articles/the-global-nuclear-comeback-green-energy-fossil-fuels-supply-climate-mandates-power-generation-11658170860

4. https://world-nuclear-news.org/Articles/US-Senate-passes-single-biggest-climate-investment

5. https://www.wsj.com/articles/the-global-nuclear-comeback-green-energy-fossil-fuels-supply-climate-mandates-power-generation-116581708600

6. https://www.reuters.com/business/energy/japan-hopes-restart-4-more-nuclear-reactors-by-winter-2022-07-15/

7. https://www.wsj.com/articles/the-global-nuclear-comeback-green-energy-fossil-fuels-supply-climate-mandates-power-generation-11658170860

8. https://world-nuclear-news.org/Articles/China-approves-construction-of-six-new-reactors

9. https://www.politico.eu/article/belgium-reaches-tentative-deal-with-engie-on-extension-of-nuclear-reactors/

10. https://finance.yahoo.com/news/german-nuclear-plants-could-run-124945773.html

11. https://www.latimes.com/environment/story/2022-04-29/california-promised-to-close-its-last-nuclear-plant-now-newsom-is-reconsidering

12. https://www.cameco.com/businesses/uranium-operations/canada/mcarthur-river-key-lake

13. Boss Energy ASX Release dated 1 June 2022. Accessible here: https://www2.asx.com.au/markets/trade-our-cash-market/announcements.boe

14. Paladin Energy ASX Release dated 19 July 2022. Accessible here: https://www2.asx.com.au/markets/company/pdn

15. https://www.paladinenergy.com.au/langer-heinrich-mine/

16. https://world-nuclear.org/getmedia/9a2f9405-1135-407a-85c8-480e2365bee7/nuclear-fuel-report-2021-expanded-summary.pdf.aspx

This article mentions the following funds

Formerly Managing Editor at Livewire Markets. Passionate about investments, markets, and economics.

Read more from Patrick.