Navigating an evolving threat landscape

4 minutes reading time

Recently, an AFR article coined quality ‘the stock market’s last free lunch’.

The piece explores what so many investors have observed over the past 30 years in equity markets. That investing in quality companies, those with reliable earnings, high returns on equity and low levels of debt, has led to fairly persistent long-term outperformance over various market cycles – defying efficient market hypotheses.

Whilst the quality factor has proven to generate additional returns over the long run within Global Equities, there is a common misconception that you cannot build a core portfolio of Australian Equities with a reliable exposure to quality attributes.

“But investing in quality companies isn’t that easy. In Australia, the issue for large-cap investors is that there simply isn’t the depth of quality stocks to gain a reliable exposure to this attribute.” – AFR article

We agree that quality investing is a very sound approach and has delivered above market long term returns, however we take a different view regarding quality investing in Australia.

We believe the enhanced index tracked by the AQLT Australian Quality ETF can provide reliable exposure to the quality factor while solving for the smaller pool of high quality large-cap companies available in Australia.

In seeking a portfolio of Australian companies with high exposure to the quality factor, AQLT still holds the largest companies on the ASX (currently the 12 companies that account for ~50% of Australia’s market capitalisation). However, AQLT’s index weights these large cap companies by their quality rather than their market capitalisation.

For example, AQLT is overweight Macquarie relative to its market capitalisation, a bank that has had consistently higher profitability over the past decade compared to the ‘big 4 banks’ and maintains exposure to but is underweight the ‘big 4 banks’ when compared to the ASX200.

AQLT’s index then screens the remainder of the ASX, selecting only the highest quality companies and allocating their portfolio weights accordingly.

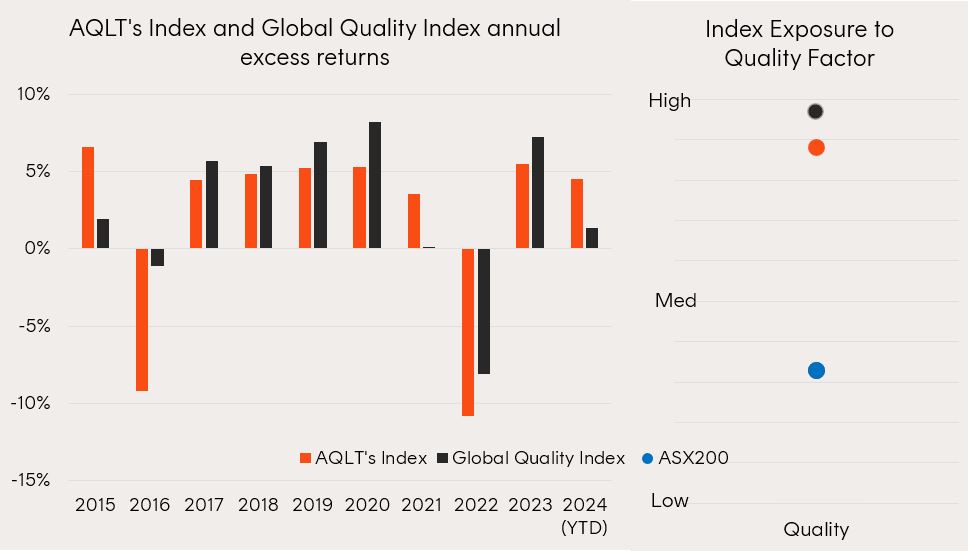

The resulting broad market Australian equities portfolio has shown a high correlation of returns to global quality factor indices and has a similar exposure to the quality factor.

In each of the last 10 calendar years, when quality has outperformed market cap weighted indices in global equities AQLT’s approach to quality has also outperformed market cap weighted indices in Australian equities.

Source: Bloomberg, Morningstar. Chart shows excess index performance of Solactive Australia Quality Select Index (AQLT’s Index) versus S&P/ASX200, excess index performance of iSTOXX MUTB Global Ex-Australia Quality Leaders 150 Index (Global Quality Index) versus MSCI World ex Australia (AUD) over the past 10 years including 2024 year to 31 March. Index performance does not include any fees or costs. AQLT’s management fees are 0.35% p.a. Factor exposure per Morningstar Direct. You cannot invest directly in an index. Past performance is not an indicator of future performance.

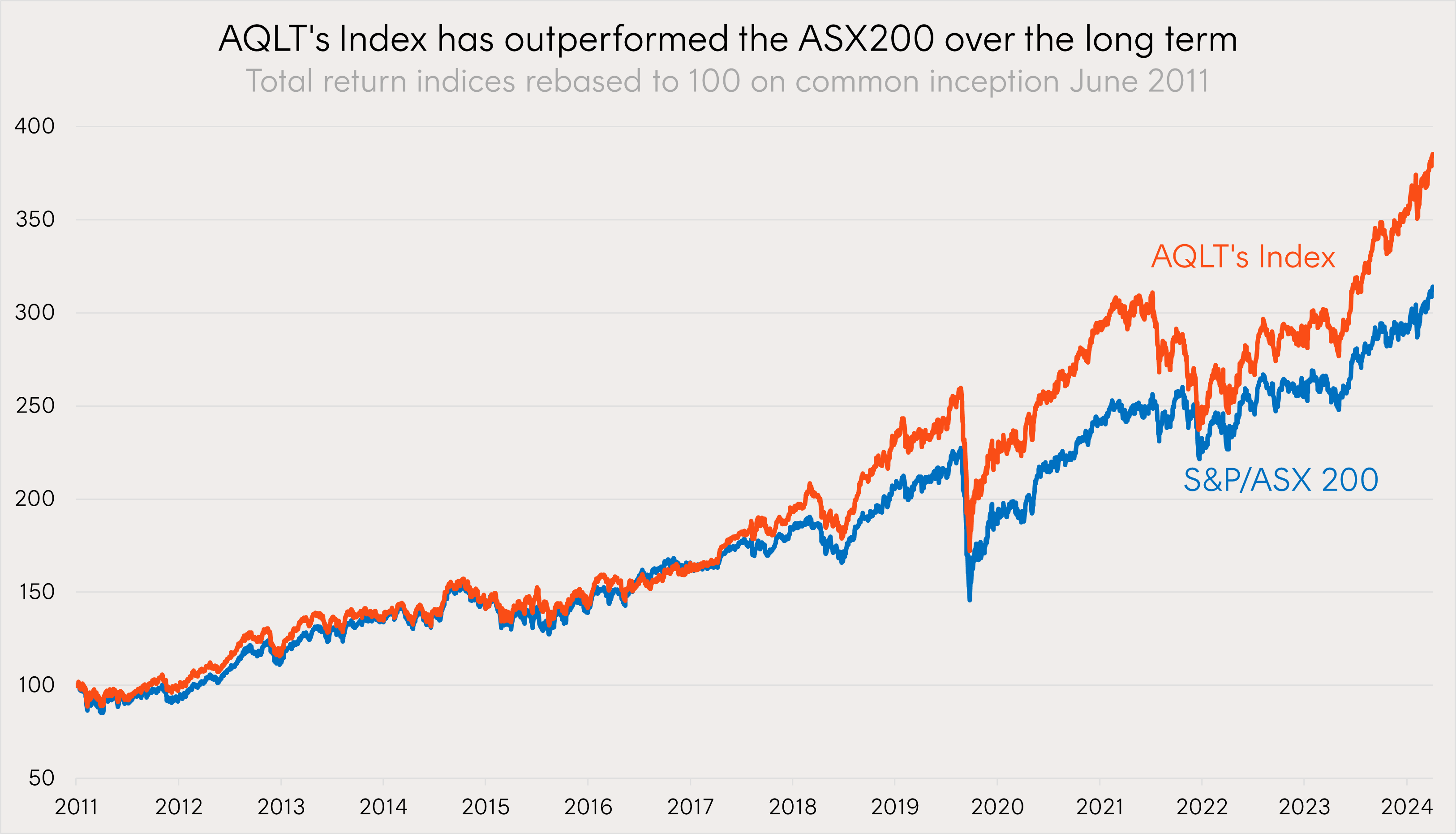

Importantly, just like in global equities, AQLT’s quality approach has also provided long-term outperformance over the benchmark, the S&P/ASX200.

Source: Bloomberg, Morningstar. Since common inception June 2011 to September 2024.

While a simplified Australian quality index may not match an investor’s expectation of quality, taking a more thoughtful approach, like AQLT’s Index, can help achieve the desired results.

Last year, a year in which the quality factor once again shone brightly globally, AQLT was the best performing broad market Australian equities ETF returning 17.42%. Again in 2024, AQLT has outperformed the benchmark S&P/ASX200 by 7.20% to the end of Q2 (and on average by 3.65% p.a. since fund inception in April 2022).

AQLT can be used in a diversified portfolio as a core Australian equities allocation. Alongside existing low-cost passive Australian ETFs, AQLT can improve portfolio diversification and fundamentals. AQLT may also be suitable as a replacement for higher cost active managers.

There are risks associated with an investment in AQLT, including market risk, and non-traditional index methodology risk. Investment value can go up and down and Betashares does not guarantee the performance of the Fund. An investment in the Fund should only be made after considering your client’s circumstances, including their tolerance for risk. For more information on risks and other features of the Fund, please see the Product Disclosure Statement and Target Market Determination, both available here.