Reading time: 4 minutes

The US$5 trillion global food and agribusiness industry has a massive economic, social, and environmental footprint, representing 10% of global consumer spending and 40% of employment1.

As the global population explodes, and along with it, the requirements and demands of sustainable food production, many industries and companies will need to rise to the occasion to help tackle global food security.

Population growth

Over the last century, global population has more than quadrupled, from 1.8 billion people in 1915 to an estimated 7.9 billion as of May 20212. With increasing numbers of people surviving to reproductive age, rising fertility rates and increasing urbanisation, the UN estimates the global population will reach 9.7 billion by 2050 and could possibly peak at nearly 11 billion around 21003.

This growth, coupled with rising incomes in developing countries, will drive up global food demand and have far-reaching implications for generations to come. The Food and Agriculture Organisation (FAO) has estimated that grain production alone will need to double by 2050 if everyone is to have enough to eat in the future4.

At the same time, resource constraints will mean agricultural supply is expected to fall far short of demand over the coming decades. The McKinsey Global Institute, for example, estimates that land supply would have to increase by 250% over the next two decades in order to meet expected demand, compared with the rate at which supply expanded over the previous two decades5.

Smarter agriculture

Compounding this issue, depletion of natural resources, the impact of climate change on crops, and declining productivity gains in agriculture are expected to hinder growth in the world food supply, forcing countries to produce more with less.

This means that commercial agricultural companies worldwide will need to increase crop production not only by increasing the amount of agricultural land to grow crops on, but also by enhancing productivity and efficiency on existing agricultural lands through sustainable methods.

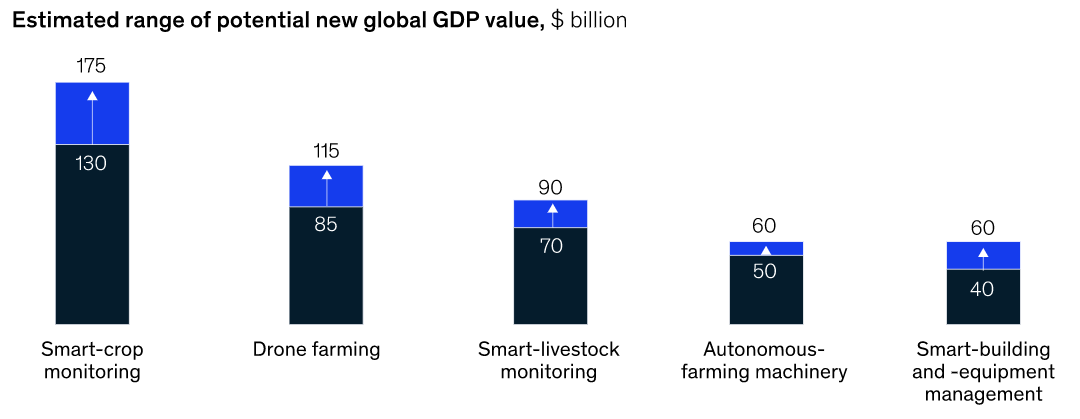

Investors and companies alike have a critical role to play in meeting this challenge—and opportunities to benefit. ‘Smart agriculture’, which helps aid the growth of the farming sector through modifying and reorienting farming systems, is expected to be a US$19 billion market by 2027, representing a compound annual growth rate (CAGR) of 13.09% from 2019 to 20276.

This sector utilises a range of technologies including sensors and actuators, information and communication technology, Internet of Things, robotics and drones, combined with current agriculture methodologies. Smart agriculture has broad applications from precision livestock farming which monitors the health and reproduction cycles of livestock, to the use of agricultural drones for crop health assessment, irrigation, spraying and field analysis, all the way to autonomous farming machinery – all of which ultimately will help increase the quantity and quality of products.

One company at the forefront of the smart agriculture sector is Kubota Corporation, a tractor and heavy equipment manufacturer based in Osaka, Japan. Japan’s first agricultural manufacturer to begin full-fledged research into smart agriculture, it has invested heavily in the utilisation of robotics and information and communications technologies to offer labour savings and higher quality production, and as a result has seen its share price appreciate 97% over the one-year period to May 20217.

Reducing waste

Whilst filling the gap between supply and demand may help resolve part of the issue of future food security, the problem is multi-faceted and presents several additional challenges, all of which need to be addressed.

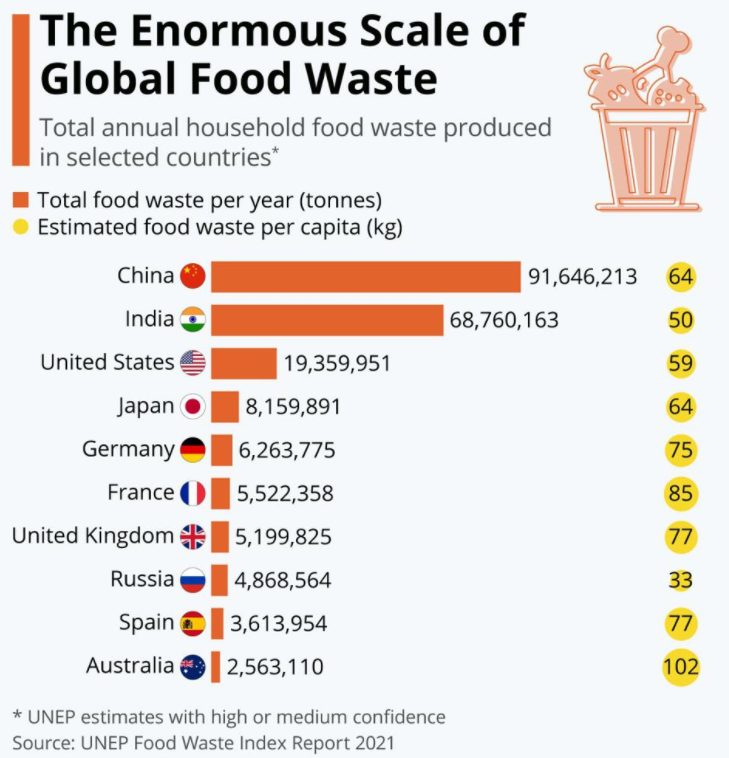

One of the most important, if not the most important, ways to get more from less is to reduce food waste. An estimated 1.3 billion tonnes of food is wasted globally each year, or one third of all food produced for human consumption8.

In high income economies, most of the waste is either at the farm, where products are discarded because they do not meet quality specifications, or because of over-production. In developing markets, on the other hand, most food waste happens due to inefficiencies in the logistics process, such as inadequate processing infrastructure. In particular, lack of modern cold storage systems means that food often is discarded before it gets to the end consumer.

Reducing food waste, however, presents a unique and attractive investment opportunity. Companies such as Thermo King (subsidiary of Trane Technologies TT (NSYE)), which is a market leader in the development of logistical refrigeration technologies that keep transported food and perishables safe and fresh, have seen their solutions applied to areas across the supply chain.

Tomra, a Norwegian company which designs and manufactures sensor-based sorting machines and post-harvest solutions for the food industry, has seen 8,000 units of its technology installed around the world inspecting and processing millions of individual product pieces per hour.

How to gain exposure

The food and agribusiness supply chain comprises a wide range of companies, from suppliers of agricultural machinery, seeds, and logistical equipment to technology providers for precision agriculture – all of which will need to rise to the occasion and adapt in order to help meet global food production requirements in the future.

Investors looking to gain exposure to this sector can consider FOOD Global Agriculture Companies ETF – Currency Hedged , which provides cost-effective exposure to a diversified portfolio of the world’s leading agriculture companies in a single ASX trade. FOOD’s portfolio currently includes Kubota Corporation.

ERTH Climate Change Innovation ETF provides exposure to a broad range of climate change solutions, including companies involved with sustainable food or water efficiency, such as Trane Technologies (parent of Thermo King) and Tomra, which will play an important part in enhancing the productivity and efficiency of existing agricultural resources through sustainable methods.

| There are risks associated with an investment in FOOD and ERTH, including market risk, international investment risk, sector risk and concentration risk, as well as non-traditional index methodology risk (for ERTH). The funds’ returns can be expected to be more volatile (i.e. vary up and down) than a broad global shares exposure, given their concentrated sector exposure. Each fund should only be considered as a component of a diversified portfolio. For more information on risks and other features of each fund, please see the Product Disclosure Statement, available at www.betashares.com.au. |

1. https://www.mckinsey.com

2. https://www.worldometers.info/world-population/

3. https://www.un.org/en/global-issues/population

4. Cited in https://www.db.com/cr/en/concrete-Agricultural-investments-for-more-productivity-and-sustainability.htm

5. https://www.mckinsey.com

6. Cited in https://www.globenewswire.com/news-release/2021/01/18/2159868/0/en/Statistics-Report-Global-Smart-Agriculture-Market-Size-Value-Will-Reach-USD-19-625-Million-By-2027-Facts-Factors.html

7. https://finance.yahoo.com/quote/KUBTY/. Past performance is not indicative of future performance.

8. http://www.fao.org/news/story/en/item/196402/icode/

Written by

Betashares ETFs