6 considerations for buying and selling ETF

Most people know that ETFs can be bought and sold like any share on an exchange (like the ASX), through a full service or online broker. However, we often get asked if there is anything else that should be taken into account when trading ETFs.

Summary

- Like shares, ETFs can be bought and sold at any time during the ASX trading day through a stockbroker

- Once your brokerage account is established, the ASX ticker of the fund is used make a purchase or sale, without the need for any additional paperwork. This means there is no minimum investment requirement, beyond that stipulated by your broker

- There are six key tips to keep in mind before buying & selling ETFs such as understanding iNAV, liquidity, underlying market trading hours and more

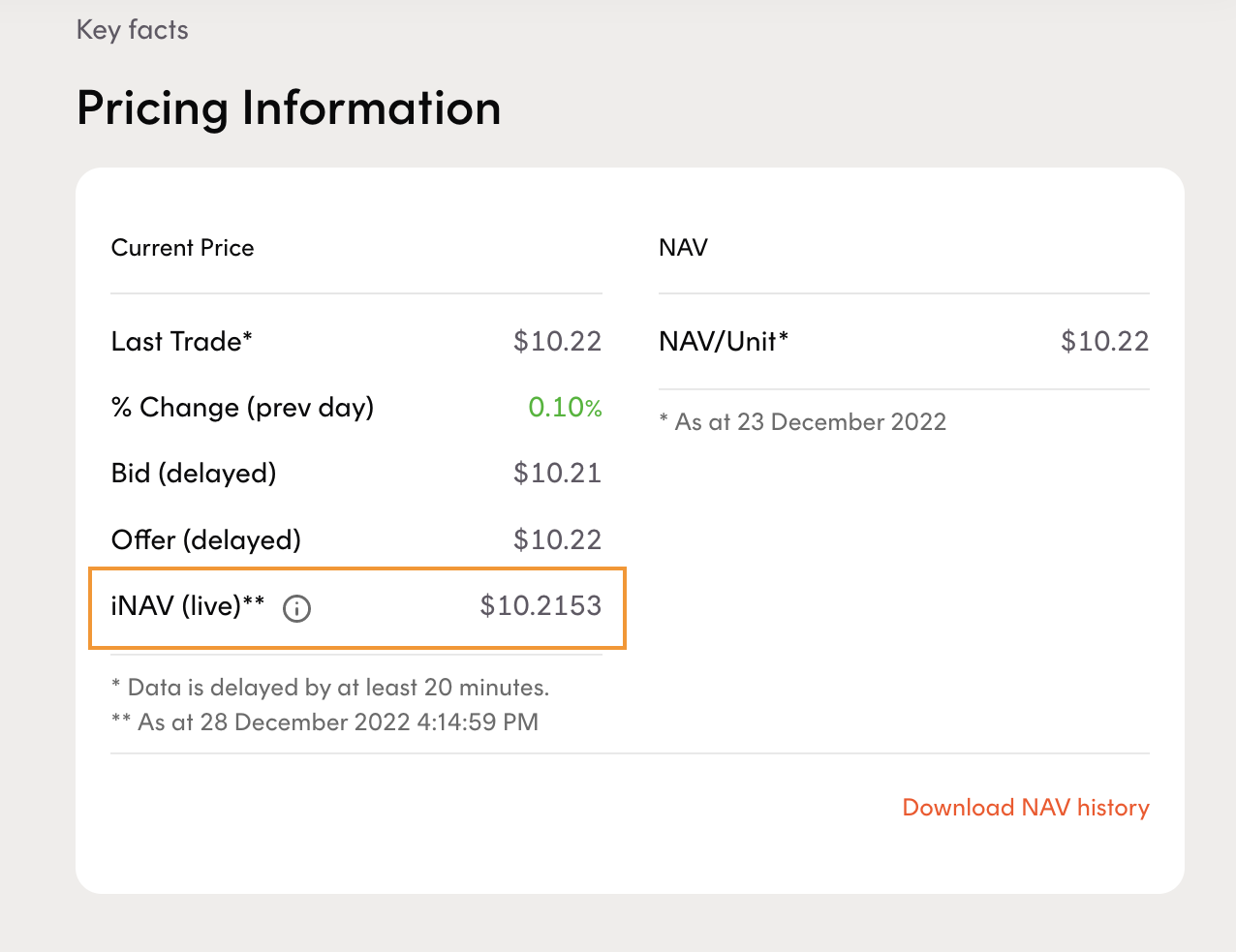

1. Always refer to iNAV when placing an order

One of the benefits of using ETFs is that you can get an estimate of the “fair value” of the fund at any point during the trading day.

This allows you to set your order at an appropriate level, near “fair value”. ETF issuers provide a real time indication of net asset value. Because this calculation changes in real time, the calculated number is normally called the “iNAV” – an abbreviation for “indicative net asset value.”

For most of Betashares ETFs, you can go directly to the Fund page on our website to look up the iNAV or alternatively use an iNAV ASX ticker.

A screenshot from our website showing a live iNAV of one of our funds

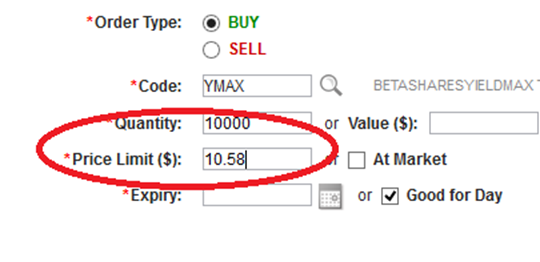

2. Always use a limit order

When placing a buy or sell order, it is recommended that you use “limit-orders” instead of a “market order”. This will ensure you are being filled at the price you have chosen after looking at the iNAV.

Because underlying markets are moving throughout the day, the iNAV can change very quickly especially in volatile markets.

When the iNAV changes, the bid/offer prices change with it and by using a market order, you risk getting filled at the price that the bid/offer has changed to. If spreads are very tight, this may be OK. But in volatile markets, spreads tend to widen and you may get filled at an unusually wide spread.

You may also run into a situation where a large order gets filled before yours, wiping out the first price level, which means your shares get filled at the next price level further away from the iNAV.

Therefore, to ensure you get the price that you want, always use limit orders.

Example of a limit order being placed for our YMAX fund

3. Be aware of underlying market trading hours

One of the determinants of ETF bid-ask spreads is the underlying market exposure. For example, if the underlying market is volatile, spreads may be wider than usual. If the underlying market is currently not trading, then market makers will have to widen the spread to account for that.

When trading in the Australian market, it is possible that the underlying will never be open (for example: U.S. equity markets), so you may not have a choice. But if you do have the option of being able to place a trade when the underlying market is open or not, always try to trade when the underlying market is also trading to ensure the best possible spread is available.

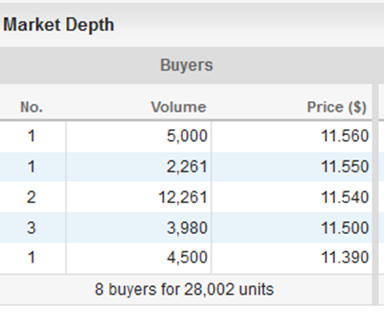

4. Volume on screen is not an indicator for liquidity

Unlike stocks and LICs, ETFs are open-ended meaning that units can be created and redeemed by the fund manager. This means an ETF can continuously issue new units if assets keep growing.

If an ETF hasn’t traded much during the day and you want to purchase or sell units, you can always do so because there is a market maker on the other side of the trade willing to buy/sell those units.

This is very different from shares and LICs as with those instruments, shares are being traded between Investor A and Investor B only.

With an ETF, units can be traded between Investor A and B or in cases when there is no Investor B, then a market maker can be expected to be on screen to buy/sell directly to Investor A. This is one of the biggest advantages of ETFs (albeit one of the least understood!)

One other point worth mentioning – if you wanted to buy or sell more units in one trade than what is reflected on screen, give Betashares a call and let us know. We will contact the market maker on your behalf, who will then increase the amount of units shown on screen so that you can buy/sell all the units you want in one trade.

ETFs are as liquid as their underlying market so if an ETF has low ‘on screen’ volume it doesn’t mean it has low liquidity.

5. Avoid trading in the first and last 10 mins of the trading day

During the first and last 10 minutes of a trading day, when markets are opening and closing, in general there’s a lot more volatility in share prices.

While stock prices are moving quickly based on movements in the market, the market maker’s spreads will be wider and the iNAV will be based on a price that can significantly move within a minute or two.

Do yourself a favour and trade the ETF when stocks have settled down, usually 10 minutes after the markets open to 10 minutes before they close.

6. The importance of ‘all in cost’ v. management fees

Some investors mistakenly look only at management fees when considering the cost of their investment. All ETFs have management fees. This is how an ETF fund manager gets paid, with the quantum of management fees usually corresponding to the level of involvement required by the Fund Manager to run the fund.

Importantly, however, investors should look at all-in total cost. An all-in cost of an ETF includes the management fee, the ‘buy-sell’ spread on the ETF and any commission charged to buy and sell.

You should also keep in mind other beneficial features of an ETF structure. For example on our suite of currency hedged commodity products, the investor will benefit from a ‘positive carry’ due to the current interest rate differential between the AUD and USD exposure being tracked.

A management fee may look much higher than an alternative, however based on the structure of the ETF, the fund itself may be earning interest greater than the actual fee resulting in a positive carry. This is beneficial as some or all of your fees may be “paid for” by other elements of the fund’s investment strategy.

Written by

Benjamin Smith

Video and Content Executive

Ben brings a unique blend of financial acumen and creative storytelling to his role. With a solid background as a portfolio analyst, Ben possesses a deep understanding of the financial markets, investment strategies, and how ETFs work.

Read more from Benjamin.