For many SMSF investors, generating income from your SMSF investments is vital to ensuring that retirement can be enjoyed in the way you dreamed. Reliable income, meeting minimum drawdown requirements, and the quest for franking credits aren’t just necessities—they’re integral to your financial well-being.

This is where ETFs come into play, serving as a cost-efficient and convenient resource for income-seeking SMSF investors. They offer products tailored to deliver regular distributions, enhance franking credits, and ease the often-daunting task of tax reporting so that you can enjoy your retirement.

In this special report, we’ll guide you step by step through the strategic process of assembling an income-focused portfolio. And because every rose has its thorns, we’ll also spotlight a risk that every SMSF member should have etched on their slate.

But first, let’s demystify four asset classes, each of which can provide SMSF investors with reliable ETF-generated income.

Equity income

Australians have long been attracted to equities for their dividend yields and franking credits, but there’s more to equity income than just buying blue chip stocks for their dividends.

Some strategies involve selling options to boost income and potentially lower volatility. Others aim to ‘harvest’ dividends and franking credits by regularly rebalancing into companies that are expected to pay a dividend in the months ahead.

Why equity income?

- Equity income can provide an attractive income stream from a portfolio of equities, often with distributions paid monthly or quarterly.

- Some strategies may offer tax advantages, such as franking credits, helping investors maximise their after-tax returns.

- Investors may benefit from potential appreciation in the value of the underlying stocks.

Examples of equity income funds:

Hybrids

Hybrids have elements of both bonds and shares, and sit somewhere in between the two for levels of risk and return. They’re typically issued by corporations, and in Australia, banks are by far the most common issuer.

Individual hybrids can be complex. For this reason, a professional investment manager can be helpful in navigating this asset class.

Why hybrids?

- Hybrids generally offer a higher level of income than shares or fixed income, with a greater level of capital stability than shares.

- They can offer franking credits, improving after-tax returns.

- Betashares’ hybrid funds pay distributions monthly.

Examples of hybrid funds:

Fixed income

Fixed income plays a key role in investors’ portfolios, providing income and defensive attributes. It also offers diversification benefits for investors with equities in their portfolio. Investing in fixed income is essentially buying debt, which the borrower needs to pay back, with interest. Depending on the credit worthiness of the borrower, and the length of time until the money is paid back, the yield may be higher or lower.

Why fixed income?

- Fixed income typically offers a higher level of capital stability than equities.

- Some types of fixed income, particularly long-term government bonds, may offer a negative correlation to equities. This means that the value of the bonds increases as share prices fall, helping to smooth out volatility.

- It offers a consistent, and more predictable income compared to share dividends, with distributions paid monthly or quarterly.

Examples of fixed income funds

Cash

For investors relying on their investment portfolio for income, cash is king. It offers flexibility, liquidity, and certainty.

“If cash is so great, why don’t I just put everything in cash?”, I hear you ask. Well, cash has historically produced lower returns than other asset classes over the long term. But cash is still a reliable option for managing short-term needs.

The good news for investors is that cash is currently offering the best rates in more than a decade.

Why cash?

- Regular income with high levels of capital stability

- Low risk

Examples of cash funds

-

AAA

Australian High Interest Cash ETF

Note: An investment in AAA is not the same as a deposit with a bank. An investment in AAA does not receive the benefit of any government guarantee.

How the sequence of returns impacts balances

Investing for income requires a different mindset an approach to accumulating your nest egg.

For example, during the accumulation phase, volatility can be beneficial for long-term returns, allowing investors to purchase assets at a lower price. But once you’re drawing down on investments, volatility – particularly during the early phases – can have a serious impact on how long your money lasts. This is known as ‘sequencing risk’.

It’s easiest to understand this by working through a hypothetical example.

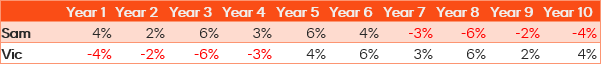

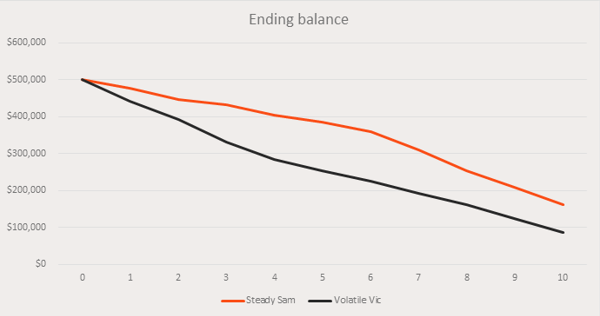

In our first case, Steady Sam received six years of positive returns first, followed by four years of negative returns at the end of the 10-year period. Volatile Vic gets the reverse – four years of negative returns, followed by six years of positive returns. At face value, the returns for Sam and Vic below appear to be the same over the full decade.

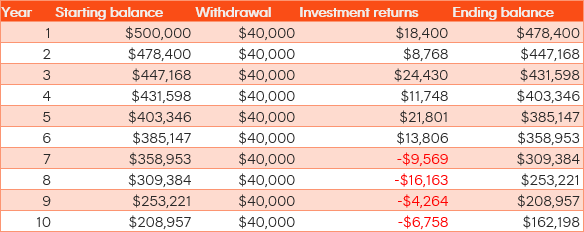

Now let’s see what happens for our hypothetical investors when they receive these returns while drawing down on their capital. Let’s assume that for both cases, the starting balance is $500,000, and $40,000 is withdrawn each year. Here’s what Sam’s returns look like after 10 years.

Steady Sam

The sum of the investment returns over the period was $62,198 – enough to cover more than one and a half years of withdrawals.

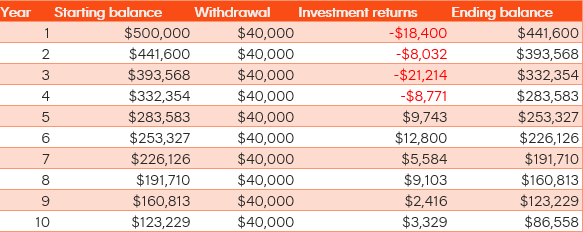

Now let’s see how Vic’s case turns out.

Volatile Vic

In this case, the sum of the investment returns was -$13,442. That’s right, a negative total return!

So what’s going on here? Even though the percentage returns in both cases sum to 10% over the full period, the sequence is important. Because the balance was higher in the earlier years, those earlier years have a bigger impact on the outcome.

This is the essence of sequencing risk.

Investing with buckets

One popular strategy that aims to manage the risks investors face during drawdown is called a ‘bucket strategy’. This strategy involves splitting your funds into three ‘buckets’:

- Cash. This typically contains a year or more living expenses, and possibly an ‘emergency fund’ for unexpected expenses.

- Fixed income. As the cash bucket depletes, attention shifts to fixed income, this bucket aims for stability, but is less conservative than the cash bucket. It’s generally anchored with high quality government and corporate bonds, but may include a modest allocation to hybrids or lower grade bonds.

- Growth. Investment doesn’t end at retirement. For people aged 60 today, life expectancy is 24 years for males and 27 years for females1, allowing more than two decades for investment. As such, growth investments may still form an important part of a retirement investment strategy. Growth investments typically include shares, and may include property or other growth assets.

The goal is to fund living expenses from the cash bucket, along with any distributions or dividends from the other buckets.

If the cash bucket gets low, it can be topped up by selling down assets in either the second or third bucket, depending which has performed best recently. This acts as a form of rebalancing, allowing investors to get back to their target allocations.

Keep it simple

Running an SMSF during retirement phase is complex. ETFs offer investors an opportunity to simplify their investment process, while also providing tax reports that can make life easier for trustees. That means more time to kick back and enjoy your hard-earned retirement!

An investment in the above funds involves risk, which may include (fund specific) market risk, interest rate risk, international investment risk and index tracking risk. For more information on risks and other features of the funds, please see the respective Product Disclosure Statement (PDS) and Target Market Determination, both available on www.betashares.com.au.

Formerly Managing Editor at Livewire Markets. Passionate about investments, markets, and economics.

Read more from Patrick.