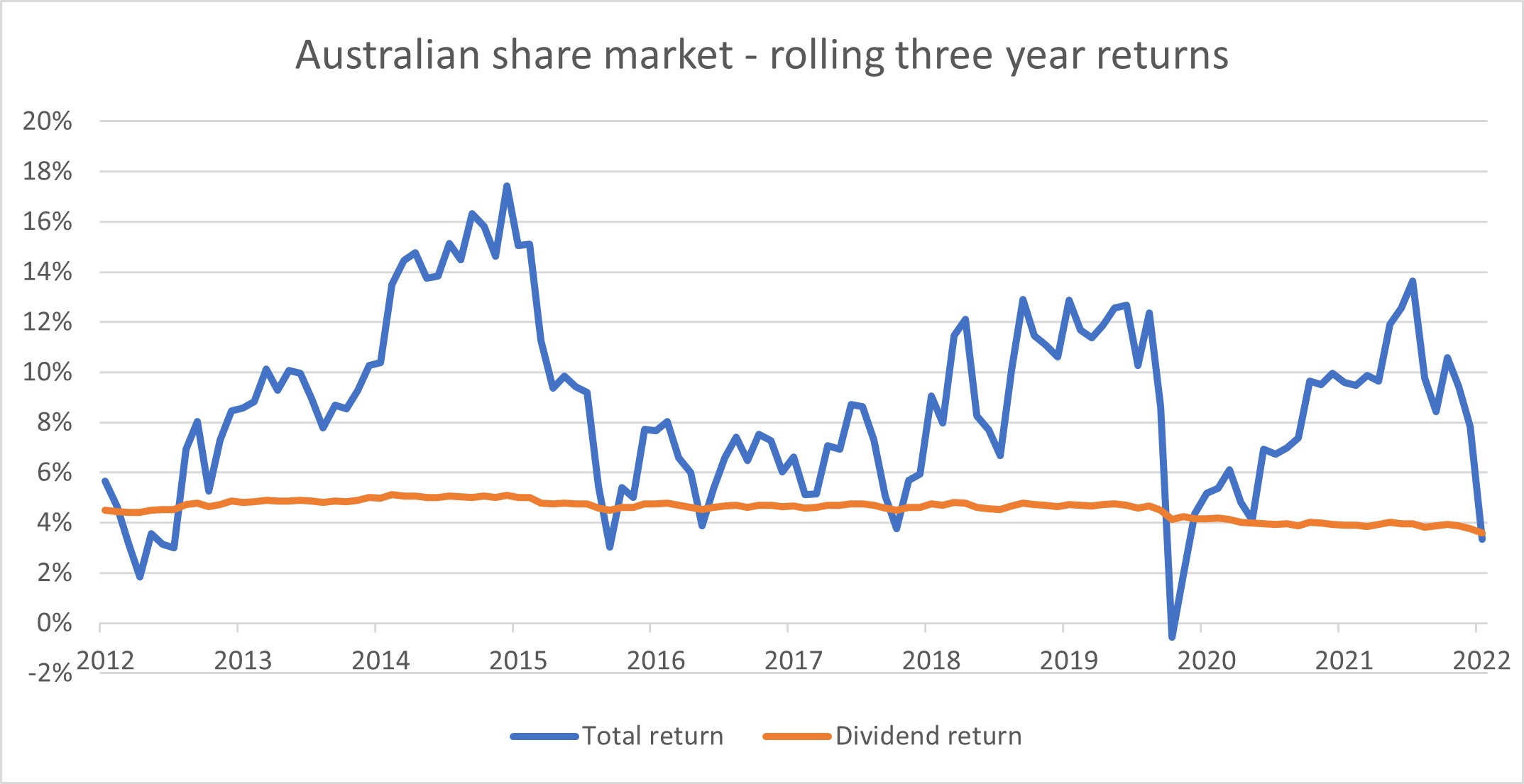

Dividend exchange-traded funds (ETFs) offer investors the opportunity to generate attractive income in today’s low-yield, high-inflation environment.

Not only can dividend ETFs provide investors with relatively attractive yields, but some strategies intentionally seek to grow income above the rate of inflation.

In this article, we’ll explore the world of dividend ETFs and what to look for before investing in these products.

Key takeaways

- Dividend ETFs aim to invest in companies that are expected to pay high, reliable and/or growing income streams.

- Dividend ETFs can invest in a range of different types of assets, including Australian shares, international shares and Real Estate Investment Trusts (REITs).

- Distributions can be paid monthly, quarterly, semi-annually, or annually.

- ETF issuers do not keep dividends as performance fees – they are generally paid out to investors as distributable income.

What is a dividend ETF?

First, the basics. How do dividend ETFs work exactly? And what’s the difference between ETFs that pay distributions versus “dividend ETFs”?

While it’s true many ETFs pay distributions, the term “dividend ETF” refers to a broad category of funds that employ strategies specifically focused on generating income from equities, as opposed to ETFs that invest in value or growth stocks.

Most dividend ETFs traded on the ASX aim to achieve one or more of these goals:

- Track an index made up of, or actively select, companies that are expected to pay high, reliable and/or growing income streams.

- Exceed the yield offered by the broad market (for example, the S&P/ASX 200 or S&P 500 benchmarks).

- Deliver a level of income growth that’s higher than an important financial indicator such as the Consumer Price Index (CPI).

What can dividend ETFs invest in?

Depending on the fund, dividend ETFs will invest in either one or a combination of the following asset classes:

- Australian shares

- International shares

- Real Estate Investment Trusts (REITs)

- Infrastructure securities

How do ETFs generate income?

The best way to look at ETFs in the context of dividends is that they are simply a ‘conduit’ that seek to pass income.

- Collect dividends paid by underlying companies, as well as other earnings, such as income from writing options (depending on the ETF).

- Pass those earnings to unitholders on a periodic basis as cash, or reinvest those distributions via a distribution reinvestment plan (DRP), depending on the unitholder’s preference.

- Publish periodic statements detailing the components of distributions for unitholders.

How often do ETFs pay distributions?

The frequency of ETF payments depends on the issuer and the fund. They usually vary between:

- Monthly

- Quarterly

- Semi-annually

- Annually.

All Betashares’ dividend ETFs remit distributions either monthly or quarterly, which can benefit investors who are seeking income payments more frequently than most ASX companies, which typically pay dividends only twice a year.

Similar to individual companies, each dividend ETF sets an ex-distribution date, a record date, and a payment date. These dates determine who receives the distribution and when it gets paid.

Tip: Betashares’ distribution timetable for all ETFs can be found here.

What happens to an ETF’s unit price when distributions are paid?

Like shares, an ETF’s unit price usually falls by the same amount as the distribution to be paid to reflect the fact that new investors are not entitled to that payment.

For example, if an ETF announces a final distribution amount of $1 and trades at $20 per unit immediately before the ex-distribution date, then the unit price of the fund can be expected to fall to $19 on that date (all else being equal).

How is income from an ETF treated?

A distribution from an ETF represents your share of the income earned by a fund and will be taxed depending on your individual circumstances.

Where things become a bit different with ETFs is because they’re structured as unit trusts, rather than as companies, the distributions they provide can potentially be split across several different categories including:

- Dividend income

- Franking credits

- Realised capital gains

- Interest income

- Foreign income

This is because ETFs invest in many securities and potentially across different asset classes, meaning they collect different types of income from their underlying holdings. Capital gains may also be generated due to periodic rebalancing or sale of assets.

If you manage your own ETF portfolio, the income components required to complete your tax return will be shown in the annual tax statement posted to you or available to download from the registry website associated with each particular ETF.

For Betashares ETFs, the registry is Link Market Services.

Do ETF issuers keep dividends as performance fees?

Absolutely not!

One of the misconceptions we often come across is that ETF issuers pocket dividends for themselves, which is simply not the case.

It’s important to remember that one of the main factors in determining whether an ETF pays distributions to unitholders is if the underlying holdings themselves pay income to the fund.

Why consider dividend ETFs?

Here are a few reasons why dividend ETFs can have a place in a diversified portfolio:

As with any investment, there are risks to consider with dividend ETFs:

How do dividend ETFs identify the companies to invest in?

So, what is it exactly that these funds do to identify and invest in the companies that pay reliable and attractive income?

Most dividend ETFs traded on the ASX combine one or more of the following core elements when determining which securities to include:

Case study – Betashares Global Income Leaders ETF

Let’s examine how the underlying index of a specific ETF practically applies screening criteria.

The INCM Global Income Leaders ETF sees to track the performance of the NASDAQ Global Income Leaders Index (before fees and expenses), whose constituents include 100 high-yielding companies screened across developed markets outside Australia.

At a high level, the index sets the following eligibility criteria for inclusion:

- Have a market capitalisation of at least US$1 billion for US components and $500 million for non-US components.

- Have positive earnings over the trailing 12-month period.

- Have made regular dividend payments for each of the past three consecutive years.

- Have a dividend payout ratio that doesn’t exceed 80%.

- Not exceed prescribed volatility thresholds.

How to select dividend ETFs

Now that we better understand how dividend ETFs pick stocks, how should investors select a dividend ETF? Consider the following factors during your research:

Ready to start your dividend investing journey with Betashares?

Hopefully by now, you have a grasp of how dividend ETFs work. Take a peek at our selection of both active and passive dividend ETFs to see if they could form part of your income toolkit. When you’re ready to invest, you’ll need to create a brokerage account (if you don’t already have one). Prior to making a purchase, check out the 9 things to know before investing in ETFs.

-

INCM

Global Income Leaders ETF

-

RINC

Betashares Martin Currie Real Income Fund (managed fund)

-

EINC

Betashares Martin Currie Equity Income Fund (managed fund)

-

QFN

Australian Financials Sector ETF

-

UMAX

S&P 500 Yield Maximiser Fund (managed fund)

-

YMAX

Australian Top 20 Equity Yield Maximiser Fund (managed fund)

-

HVST

Australian Dividend Harvester Fund (managed fund)

Formerly Managing Editor at Livewire Markets. Passionate about investments, markets, and economics.

Read more from Patrick.