In the space of a few short years the ETF industry has grown exponentially, and now holds a significant place in the investment landscape.

Funds have continued to flow out of managed funds and into ETFs, and there is no sign of this changing, as a new generation of investors comes to understand the benefits ETFs offer.

However, there is still some confusion around exactly how ETFs differ from traditional, unlisted, actively-managed funds.

Summary

- ETFs and managed funds are both made up of many different assets, offering diversification for investment portfolios

- Managed funds are usually actively managed to try to outperform a benchmark index

- ETFs are mostly passively managed, as they typically aim to track a benchmark index

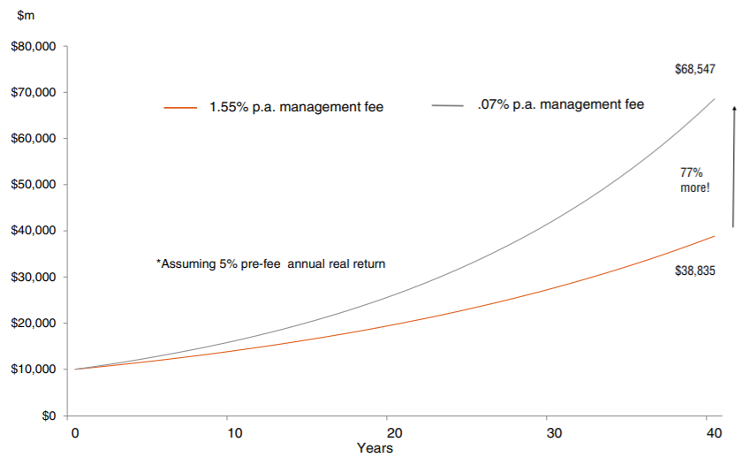

- Managed funds tend to have higher management fees to pay for the skill and experience of the fund manager vs a traditional passive ETF which aims to track the benchmark index only

| ETFs | Managed Funds | |

| Diversification | Varies depending on the fund, but generally high, typically with exposure to an entire index | Varies depending on the fund |

| Expenses and Fees | Brokerage costs; lower management fees; bid/offer spreads | Buy/sell spreads, higher management fees, performance fees may also be charged |

| Pricing | Real time, intra-day | Varies from end of day to weekly or even monthly |

| Liquidity | Generally high, intra-day | Varies significantly from high (daily) to limited liquidity in closed end structures |

| Accessibility | Buy or sell units like any share on a stock exchange such as the Australian Securities Exchange (ASX) | Usually need to apply through an adviser for the fund manager – higher administrative burden |

| Transparency of underlying portfolio | Portfolio constituents visible daily | Rarely available daily – can be opaque |

Key differences explained

ETF vs managed fund performance

Investors are increasingly comparing the performance of actively managed funds against passive options and are becoming increasingly aware of the impact on performance of the typically higher fees charged by active fund managers, relative to lower cost alternatives such as ETFs.

Active fund managers historically have not shown a great track record against their performance benchmarks.

Learn more

As more and more products are launched onto the Australian marketplace, you can diversify further into new investment strategies, new asset classes and new geographic regions – all as simply as buying a share.

To continue learning about ETFs, portfolio construction and investment strategies, visit the Education Centre.

Written by

Benjamin Smith

Video and Content Executive

Ben brings a unique blend of financial acumen and creative storytelling to his role. With a solid background as a portfolio analyst, Ben possesses a deep understanding of the financial markets, investment strategies, and how ETFs work.

Read more from Benjamin.