Bitcoin and the broader crypto market stabilised last week and was down only slightly, as new developments and revelations came to light from the FTX collapse the week before.

At the time of writing, bitcoin is trading at US$16,683. Ethereum underperformed bitcoin for the week, down -1.83% vs bitcoin’s 0.21%.

Bitcoin’s market capitalisation is US$320.5B, with the total crypto market now at US$836B. Bitcoin’s market dominance is 38.35%.

| Price | High | Low | Change from previous week | |

| BTC (in US$) | $16,683 | $17,109 | $15,872 | 0.21% |

| ETH (in US$) | $1,218 | $1,284 | $1,178 | -1.83% |

Source: CoinMarketCap. As at 20 Nov. 2022. Past performance is not indicative of future performance. Performance is shown in US dollars and does not take into account any USD/AUD currency movements.

Source: Glassnode. Past performance is not indicative of future performance.

Crypto news we’re watching

Worst case of corporate failure

The new CEO of FTX, John Ray III, is known for overseeing bankruptcy and restructuring proceedings for Enron, and other prominent companies such as Nortel Networks, Pac-West Telecomm and Overseas Shipholding Group. Ray replaced Sam Bankman-Fried when FTX filed for Chapter 11 bankruptcy. He said in a court filing of FTX: “Never in my career have I seen such a complete failure of corporate controls and such a complete absence of trustworthy financial information as occurred here.”

Ray explained that companies in the FTX Group had unacceptable management practices and did not have appropriate corporate governance. In addition, many of the entities never had board meetings, had faulty regulatory oversight and concentration of control in the hands of a very small group of inexperienced individuals. He also pointed out that: “The FTX Group did not keep appropriate books and records, or security controls, with respect to its digital assets.”1

Following the FTX collapse, Australia’s Treasury has said it will open consultations with a view to implementing regulation next year. This could position Australia as a global leader in crypto regulation. The government would like to introduce custodial and exchange legislation to ensure customers do not suffer major losses similar to the FTX exchange collapse. The legislation is expected to be introduced to parliament next year. A big issue facing investors and business in Australia is custody and who is responsible for keeping the money and/or tokens secure. A spokesman for Treasurer Jim Chalmers said: “These developments highlight the lack of transparency and consumer protection in the crypto market, which is why our government is taking action to improve the regulatory frameworks while still promoting innovation.”2

Crypto industry recovery fund

CEO Changpeng Zhao (CZ) of the cryptocurrency exchange Binance announced the formation of a crypto industry recovery fund to “reduce further cascading negative effects of FTX”. CZ expressed that the industry should increase transparency and work with regulators to make the industry more robust. The recovery fund would be used to help projects that may face a liquidity crisis, but that otherwise are strong businesses. CZ invited other industry players to co-invest and said: “Crypto is not going away. We are still here. Let’s rebuild.”3

On-chain metrics

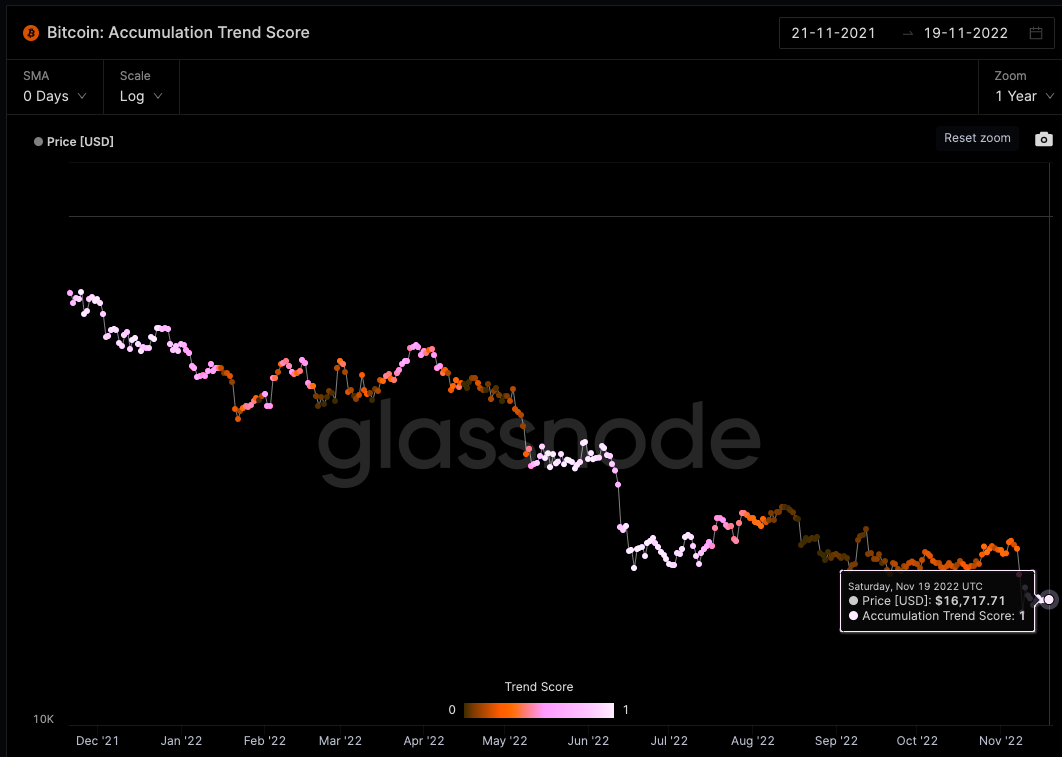

Bitcoin (BTC): Accumulation Trend Score

This metric is an indicator that reflects the relative size of entities that are actively accumulating coins on-chain in terms of their BTC holdings. The scale of the Accumulation Trend Score represents both the size of the entities’ balance (their participation score), and the amount of new coins they have acquired/sold over the last month (their balance change score). An Accumulation Trend Score of closer to 1 indicates that on aggregate, larger entities (or a big part of the network) are accumulating, and a value closer to zero indicates they are distributing (or not accumulating). This provides insight into the balance size of market participants, and their accumulation behaviour over the last month.

According to data from Glassnode, since 9 November, the score has been 1 or very close to 1, indicating that larger entities (or a big part of the network) are taking the opportunity to accumulate bitcoin at multi-year price lows.

Source: Glassnode. Past performance is not indicative of future performance.

Bitcoin (BTC): Number of Addresses with Balance ≥ 1

This metric shows the total the number of unique addresses holding at least 1 coin.

According to the data on Glassnode, entities with at least 1 BTC reached an all-time high. The number has increased by 31,592 since 7 November. HODLers’ resolve appears to remain strong despite the severe drawdown facing some of the most price-insensitive traders.

Source: Glassnode. Past performance is not indicative of future performance.

Altcoin news

In altcoin news, Trust Wallet Token (TWT), a Top 50 token, rose over 19% over the seven days following the FTX Exchange collapse. The token powers self-custody crypto wallet Trust Wallet, which has soared as users fled exchanges. Fueling the token’s rally was Binance CEO, Changpeng Zhao, who tweeted about the importance of self-custody and prompted users to use the Trust wallet. Binance acquired Trust Wallet in 2018. The Trust Wallet website claims you can store all your coins and tokens in a single, secure mobile wallet. The app supports 65 blockchains and 4.5M+ assets.4

Investing in crypto assets or companies servicing crypto-asset markets should be considered very high risk. Exposure to crypto assets involves substantially higher risk when compared to traditional investments due to their speculative nature and the very high volatility of crypto-asset markets.

Investing in crypto assets or crypto-focused companies is not suitable for all investors and should only be considered by investors who (i) fully understand their features and risks or after consulting a professional financial adviser, and (ii) who have a very high tolerance for risk and the capacity to absorb a rapid loss of some or all of their investment.

Any investment in crypto assets or crypto- focused companies should only be considered as a very small component of an investor’s overall portfolio.

1. https://www.ft.com/content/7e81ed85-8849-4070-a4e4-450195df08d7

4. https://trustwallet.com/assets/

Off the Chain is published every Tuesday. It provides the latest news on bitcoin and the rest of the crypto market, along with analysis and insights into the world of crypto.

It provides general information only and is not a recommendation to invest in any crypto asset, crypto-focused company or investment product.

Written by

Justin Arzadon

Director, Adviser Services & Head of Digital Assets.

C4 Certified Bitcoin Professional (CBP) and Blockchain Council Certified Bitcoin Expert™ with over 18 years’ experience in the ETF market. Passionate about the future of money.

Read more from Justin.