4 minutes reading time

Week in review

With the tailwind of a good recent US CPI result, global equities tried hard to continue the rally last week – but ended down in the face of the unrelenting headwind of hawkish Fed commentary. Most Fed officials who spoke last week conceded the US central bank would likely raise rates by ‘only’ 0.5% next month – following multiple 0.75% rate increases – but that the peak Fed funds rate next year is still likely to be around 5%. And rates could go higher still if the economy continues to display as much resilience to rate hikes as it has done to date. One way or another, Fed officials still seem to think the US economy needs to slow and the unemployment rate needs to rise – whether that reality is fully priced into the stock market is far from clear. Indeed, oil prices slumped 10% last week on fears of slowing global economic growth.

That said, it is also apparent the US inflation has likely passed its peak. Goods inflation has slowed notably. What has held US CPI inflation up in recent months is an acceleration in service sector inflation, which in turn largely reflects growth in rents – which in turn reflects the lagged impact of pre-Fed tightening housing market strength. As is the case in Australia, there’s an argument the Fed could afford to wait to see if inflation falls without a recession, especially if inflation expectations remains reasonably anchored. Of course, a big difference between Australia and the US is that a similarly low sub-4% unemployment rate is creating much more wage inflation (and hence possible further upward pressure on service sector inflation) in the latter than the former. But if we get one or two more benign US CPI results the debate over whether the Fed should “wait and see” may well intensify.

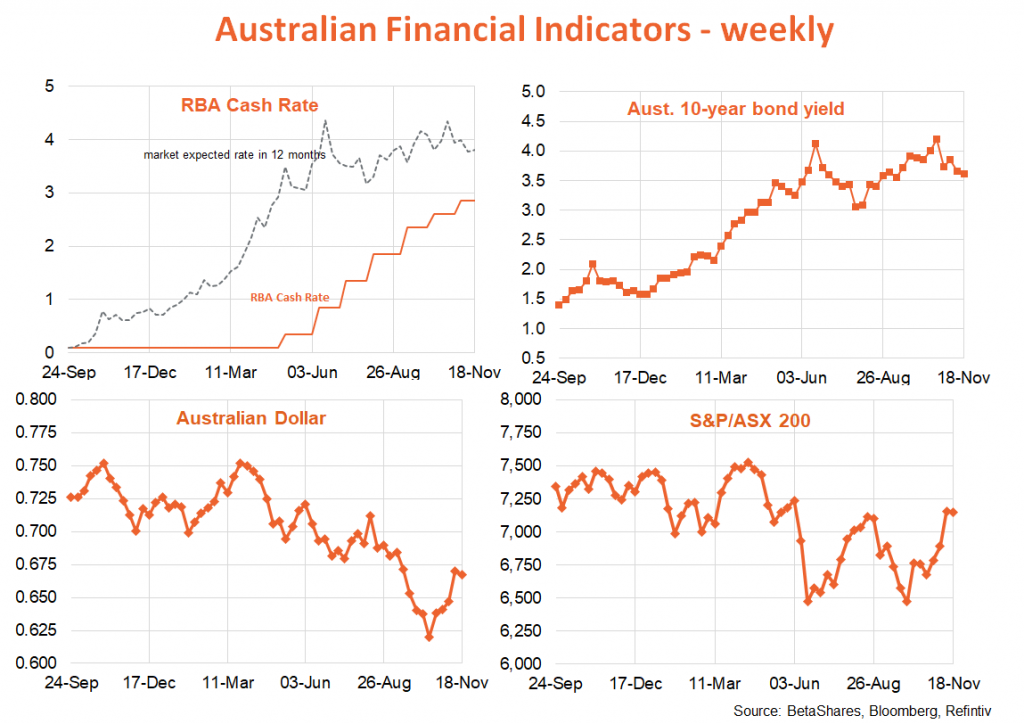

In Australia, data remained fairly mixed and consistent with yet another 0.25% RBA rate hike next month. The September quarter wage price index rose a slightly more than expected 1.0% (market 0.9%), with private sector wages up 1.2%. That said, the chunky wage gain last quarter in part reflected the 5% increase in minimum award wages given to the 20% of the workforce that rely on them. If we strip that out, underlying wage growth still appears fairly dormant, despite the persistent ‘business liaison’ to the RBA suggesting significant gains.

Of course, wage growth could still accelerate, with news last week of another 32K gain in local jobs and a drop in the unemployment rate to 3.4%.

Week ahead

It will be a fairly event-light week globally, with the main highlight being minutes of the recent Fed meeting on Wednesday. With Fed commentary so prevalent these days, the minutes are unlikely to tell us much that we don’t already know in terms of Fed thinking. Also of interest will be reports on the strength of US consumer spending in Black Friday sales – one of the biggest US spending days of the year.

In Australia, there’s no data of note, with the local highlight being a speech on the economy by RBA Governor Phil Lowe on Tuesday evening. Again, with RBA commentary so prevalent of late, it’s hard to see what new insight the Governor could possibly provide – apart from potentially hinting at a pause in rates at the December policy meeting. While that’s possible, it is not my base case.