Reading time: 4 minutes

Most investors choose to spread their investment funds across several asset classes, with two of the most important being equities and fixed income (bonds).

One of the main reasons for allocating a portion of your portfolio into fixed income, rather than investing 100% into equities, is diversification, and the lower volatility that can result from being invested in two asset classes whose returns typically do not share strong positive correlation.

However, significant movements in interest rates can increase the volatility of bond prices, which can work against this goal.

With this in mind, Betashares has recently launched the HCRD Interest Rate Hedged Australian Investment Grade Corporate Bond ETF , which significantly reduces the interest rate risk of a portfolio of corporate bonds, while still offering an attractive income stream. HCRD is the first ETF in Australia to offer interest-rate hedged exposure to a portfolio of bonds.

Bond pricing recap

The yield on a fixed income investment primarily reflects two risks:

- interest rate risk, and

- credit risk.

Government bonds are regarded as ‘risk-free’, meaning they do not involve credit risk.

Corporate bond yields are affected by both the risk-free interest rate, and also by credit risk, which refers to their additional risk over and above a risk-free (government) bond.

Credit risk includes liquidity risk (the risk that the corporate bond might be harder to sell or involve higher transaction costs than a government bond of the same maturity) and, to a lesser extent, the risk that the issuer of the bond will default on its obligations. This risk will be reflected in the ‘credit spread’ – the spread (or margin) above the risk-free yield to compensate for taking on credit risk.

Investors are naturally attracted by the higher yield that is usually available from corporate bonds than from government bonds, but must also take into account the higher risk.

Bond volatility

Back to volatility – the thing that most fixed income investors would generally prefer to be lower rather than higher.

While corporate bonds are affected by both interest rate risk and credit risk, it is interest rate risk that has historically been the contributor to the majority of volatility in performance.

So how can an investor remove or reduce interest rate risk?

One way is to invest in floating rate bonds. The interest these bonds pay is periodically adjusted in line with changes in government interest rates.

Another is to invest in very short-term fixed income investments, whose value is affected far less than long-term bonds by interest rate movements.

The problem with both these options is that their yields typically reflect much lower credit spreads than is available on longer term corporate bonds. In other words, reducing interest rate risk in this way typically comes at the cost of also reducing the returns that are the main reason for investing in corporate debt.

How to reduce interest rate risk

In developing HCRD, our aim was to enable investors to benefit from the attractive yields offered by long-term corporate bonds, but with lower interest rate risk.

HCRD invests in a portfolio of investment grade corporate bonds, obtaining this exposure by investing in the CRED Australian Investment Grade Corporate Bond ETF .

HCRD also uses bond futures contracts to substantially reduce interest rate risk.

Bond prices and yields move inversely. This means an increase in interest rates typically leads to a fall in the value of bonds, and vice versa. However, the bond futures position will move in the opposite way. A short bond futures position should benefit when interest rates rise, offsetting, at least partially, a decline in the capital value of the bonds.

Conversely, a fall in yields will typically, but have a negative impact on a short futures position.

The overall result is that the movement in bond prices will be substantially offset by the movement in the futures position, leading to lower volatility and overall capital variability.

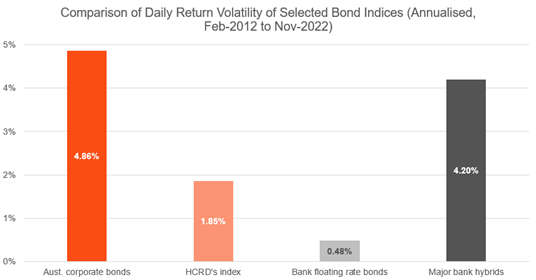

The chart below compares the volatility of HCRD’s index with other selected indices representative of Australian corporate bonds (with interest rate risk unhedged), Australian bank floating rate bonds, and Australian major bank hybrids.

Source: Bloomberg, Betashares. Australian corporate bonds represented by Solactive Australian Investment Grade Corporate Bond Select TR Index. Bank floating rate bonds represented by Solactive Australian bank Senior Floating Rate Bond Index, Major bank hybrids represented by Solactive Australian banking Preferred Shares Index. Index performance prior to an index’s ‘live date’ is back-tested by the index provider using the index methodology at ‘live’ date. You cannot invest directly in an index. Past performance, whether actual or back-tested, is not indicative of future performance.

With mitigated interest rate risk, investors in HCRD gain ‘purer’ exposure to an attractive part of the credit curve. HCRD targets the 5-10 year part of the credit curve which historically has offered good roll-down benefits and is currently offering a attractive yield. HCRD’s income, paid monthly, is expected to exceed income paid on cash, term deposits, and senior floating rate notes.

Other benefits of HCRD, derived from its exposure to CRED’s bond portfolio, include:

- Exposure to a range of corporate issuers – HCRD offers exposure to long-term investment grade bonds from a range of corporate issuers from different industries, providing potential diversification benefits from floating rate fixed income exposures, which typically are heavily weighted to financial sector issuers.

- Intelligent investment approach – The bonds in HCRD’s portfolio are selected based upon expected returns rather than debt outstanding, seeking to avoid the shortcomings of traditional debt-weighted indices and provide higher returns.

Investors can consider using HCRD in a portfolio as:

- a core part of a fixed income allocation;

- a complement or alternative to composite or government bond investments; or

- a complement to cash or floating rate bond allocations.

Learn more about the HCRD Interest Rate Hedged Australian Investment Grade Corporate Bond ETF .

This article mentions the following funds

Written by

Betashares ETFs