David Bassanese

Betashares Chief Economist David is responsible for developing economic insights and portfolio construction strategies for adviser and retail clients. He was previously an economic columnist for The Australian Financial Review and spent several years as a senior economist and interest rate strategist at Bankers Trust and Macquarie Bank. David also held roles at the Commonwealth Treasury and Organisation for Economic Co-operation and Development (OECD) in Paris, France.

4 minutes reading time

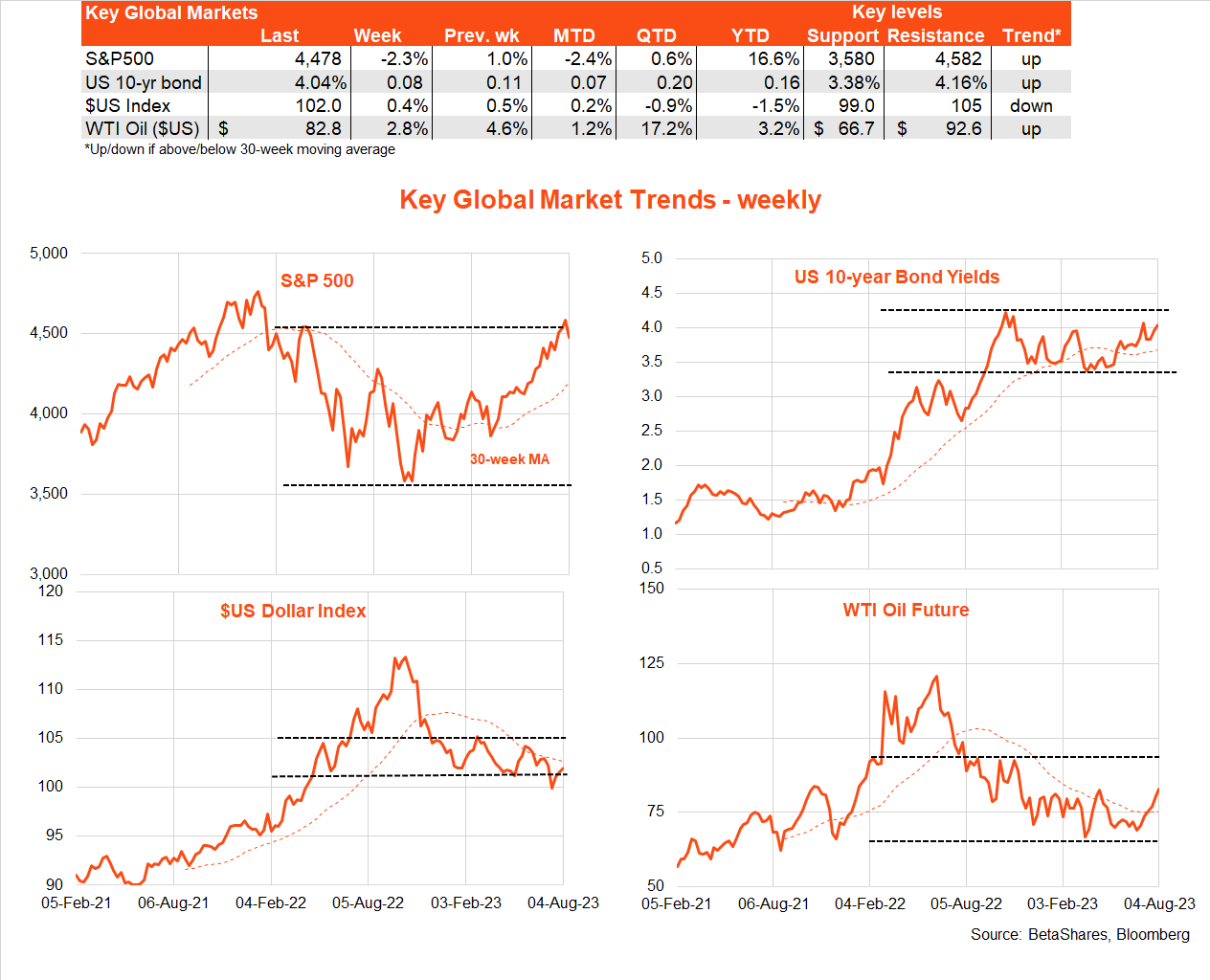

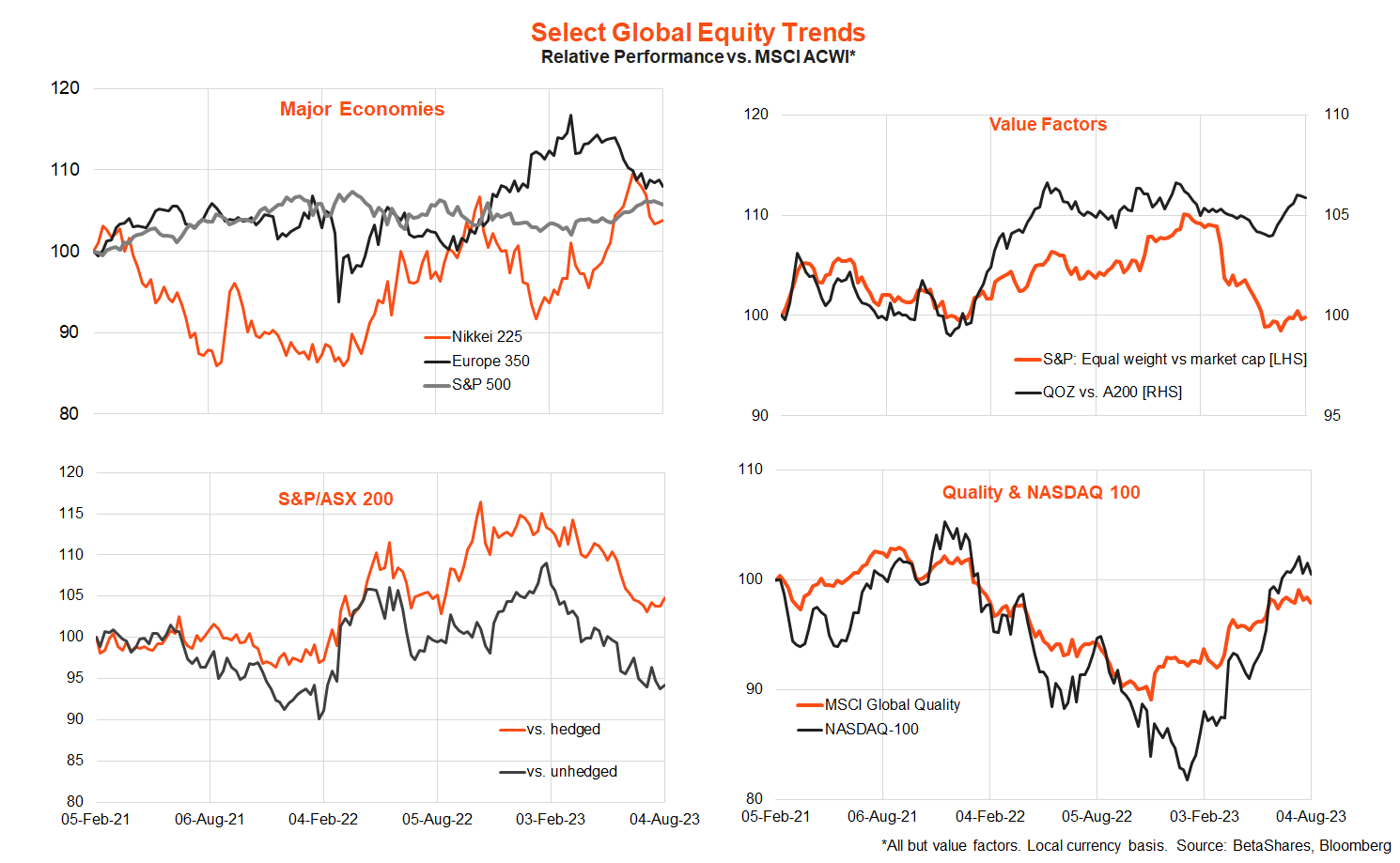

Global markets

After a strong run in recent weeks, US stocks pulled back last week due to a sharp rise in bond yields which, in turn, reflected the Fitch credit downgrade and official plans for higher US long-term public debt issuance. The US July payrolls report, meanwhile, showed moderating employment gains yet a still very low unemployment rate and firm wage growth.

All up, however, I suspect the rise in bond yields due to both Fitch and higher debt issuance will prove a flash in the pan however, yields eased back somewhat over the remainder of the week. The main driver of yields is likely to remain the pace of US disinflation and Fed policy. If the Fed has truly finished raising rates, and the next move in rates is likely down in 2024, then it’s hard to see long-term bond yields rising much beyond current levels. Indeed, last week’s sell-off could represent an 11th-hour buying opportunity to load up on duration.

On this score, we’ll get an important update on US consumer and producer price inflation this week. Both the headline and core CPI indices are expected to lift by a relatively benign 0.2%. This would be consistent with annual core inflation easing from 4.8% to 4.7% though, due to a very low result this time last year, annual headline inflation would nonetheless tick back up to 3.2% from 3.0%. Barring any upside surprises, these results would be consistent with the Fed remaining on hold at the September policy meeting.

China will also provide updates on consumer and producer price inflation this week. Unlike in the US, China’s economic recovery has stalled somewhat and it is battling deflation rather than inflation. Markets, however, continue to take soft Chinese data in their stride – as it only seems to raise expectations that a large stimulus package will be announced eventually.

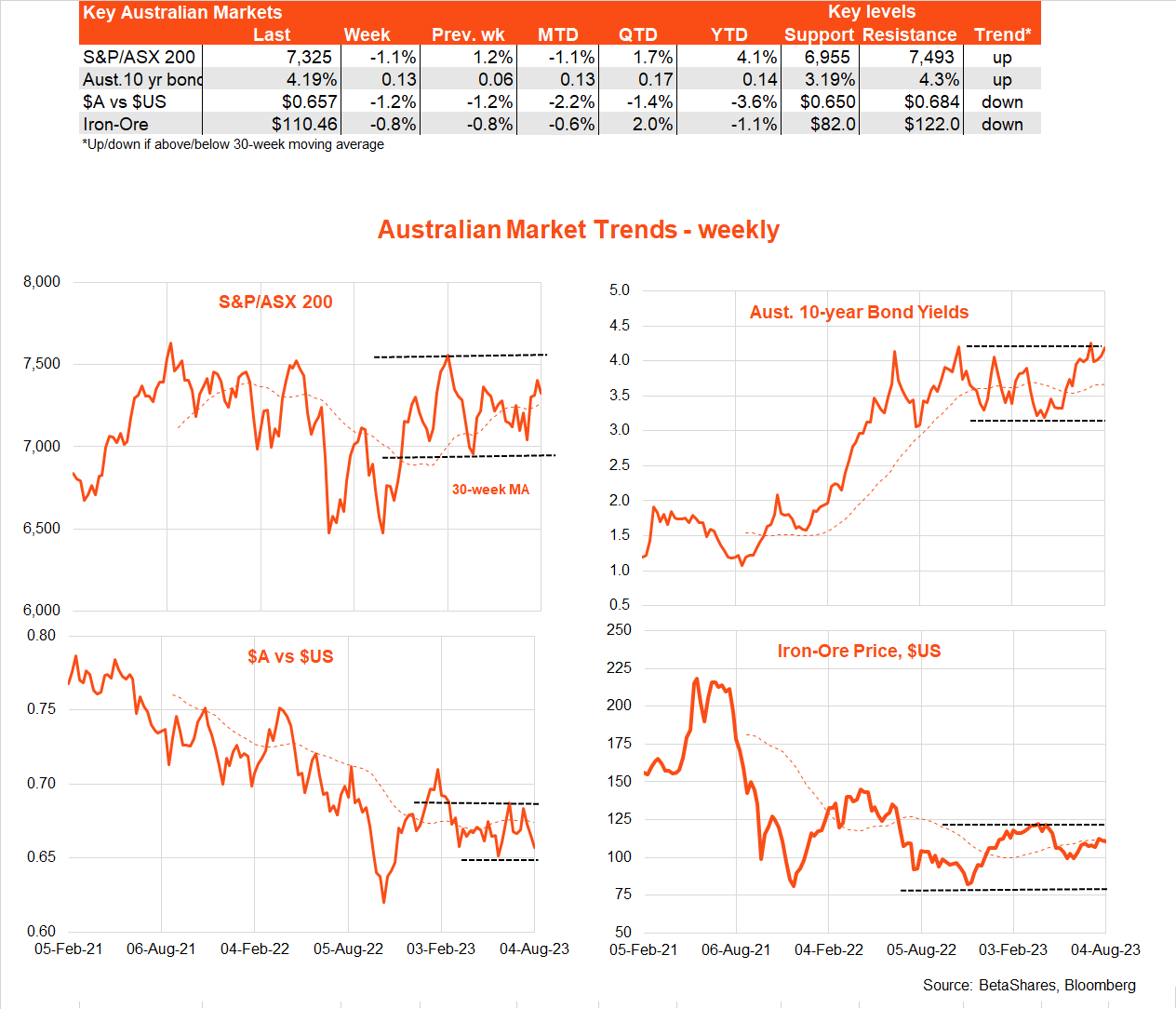

Australian market

After a challenging few months, the RBA finally did what I expected last week, keeping rates on hold for the second month in a row. Although the RBA is keeping its finger on the trigger, waning global inflationary forces plus a weakening in local consumer spending likely means we’re either at the end – or at least close to the end – of the tightening cycle.

The RBA quarterly statement on Friday contained few new surprises, with a continued expectation of a modest 1% increase in the unemployment rate over the coming year which is expected to help bring inflation back with the 2-3% target band by H2′ 25. It’s a similar outlook to the US Fed – like the markets, both central banks reckon only a soft landing is required to deal with inflation.

Of course, weak consumer spending could still result in a deeper downturn. Indeed, we also learnt last week that real retail sales fell by 0.5% in the June quarter – the third quarterly decline in a row. Sales weakness reflected both the ongoing downward pressure on real incomes along with the post-COVID rebalancing of consumer spending toward non-retail services. Home buyers, however, remain determined – with CoreLogic revealing national house prices rose a further 0.7% in July, to be 4% up from their lows in February.

The main local data this week will be National Australia Bank’s monthly business survey tomorrow. Of late the survey has pointed to moderating economic conditions, albeit from above-average levels, with lingering labour shortages and wage/cost pressures.

Have a great week!

| Top events of the past week | Comment |

| US credit downgrade and boosted debt issuance | US bond yields rose over the week reflecting both the Fitch rating downgrade and the US Treasury’s announcement of increased long-term debt issuance. Yields eased back somewhat later in the week after an initial surge. |

| Solid US payrolls | Although the July gain in US employment was modestly weaker than expected, the unemployment rate ticked down to 3.5% and average hourly earnings growth was a bit higher than expected. |

| RBA pause/RBA Quarterly Statement | The RBA left rates on hold for the second month in a row following a better-than-expected Q2 CPI result in the previous week. The quarterly statement modestly lowered growth and inflation forecasts for 2023. |

| Key events to watch this week | Comment |

| US CPI and PPI | Key consumer and produce price reports will provide an update on the pace of US disinflation. |

| China CPI and PPI | Unlike in the West, China is experiencing mild consumer and producer price deflation. These reports will provide updates on whether price declines are levelling out or continuing. |

| NAB Australian Business Survey | A monthly update on Australian business conditions and wage/price pressure. |

David is responsible for developing economic insights and portfolio construction strategies for adviser and retail clients. He was previously an economic columnist for The Australian Financial Review and spent several years as a senior economist and interest rate strategist at Bankers Trust and Macquarie Bank. David also held roles at the Commonwealth Treasury and Organisation for Economic Co-operation and Development (OECD) in Paris, France.

Read more from David.