David Bassanese

Betashares Chief Economist David is responsible for developing economic insights and portfolio construction strategies for adviser and retail clients. He was previously an economic columnist for The Australian Financial Review and spent several years as a senior economist and interest rate strategist at Bankers Trust and Macquarie Bank. David also held roles at the Commonwealth Treasury and Organisation for Economic Co-operation and Development (OECD) in Paris, France.

6 minutes reading time

Growth vs defensive assets

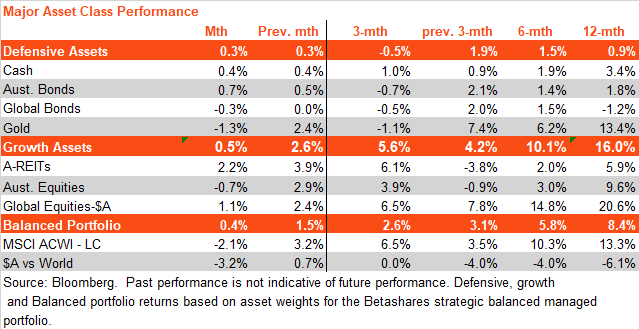

Using underlying asset class returns, the Betashares strategic balanced risk benchmark portfolio returned 0.4% in August after a 2.6% gain in July.

Growth assets returned 0.5%, marginally beating the 0.3% return from defensive assets. Growth assets have outperformed solidly over the past 12 months.

Defensive assets

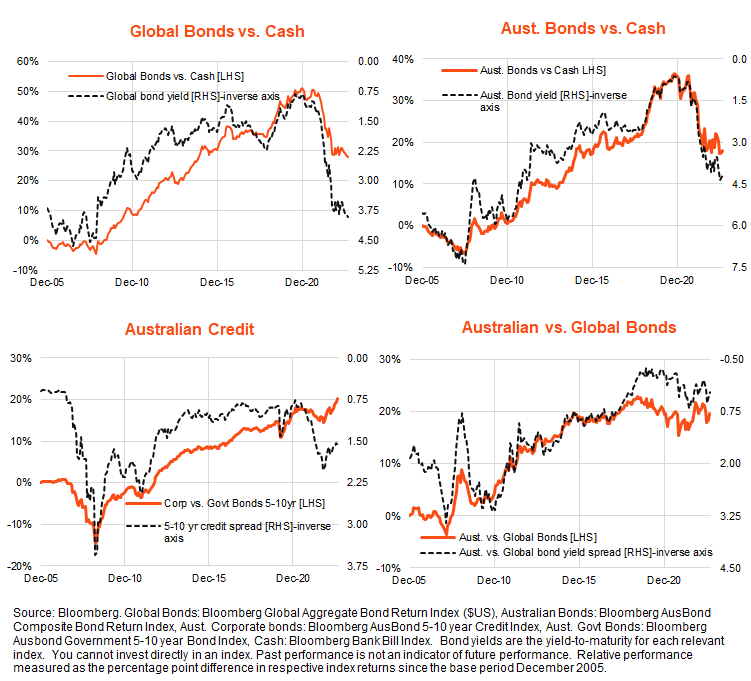

Global bond yields rose further in August as resilient economic growth reduced the risk of rate cuts by early next year. US 10-year bond yields rose 0.15% to 4.11%, while the yield-to-maturity for the Bloomberg Global Aggregate Bond Index rose 0.06% to 3.91%. As a result, global bond returns declined by 0.3%, marginally underperforming the 0.4% return on cash.

Australian bonds performed somewhat better in August, with local 10-year government bond yields declining by 0.03% to 4.03% and the yield on the Bloomberg Australian Composite Bond Index declining by 0.11% to 4.19%. Soft local inflation effectively priced out the risk of one further RBA rate hike this year. The Bloomberg Australian Composite Bond Index returned 0.7% – beating cash and global bonds.

As evidenced in the chart set below, bond yields have broadly stabilised so far this year after a large rise during 2022, resulting in bond returns stabilising relative to cash returns. The relative performance of Australian vs global bonds has remained in a choppy sideways range, while corporate bonds have tended to outperform – in line with a narrowing in credit spreads and “risk-on” sentiment evident since the equity market bottom late last year.

With central banks likely close to the end of their tightening cycles – at least in Australia and the US – prospects are good for fixed-rate bond outperformance relative to cash in the coming months.

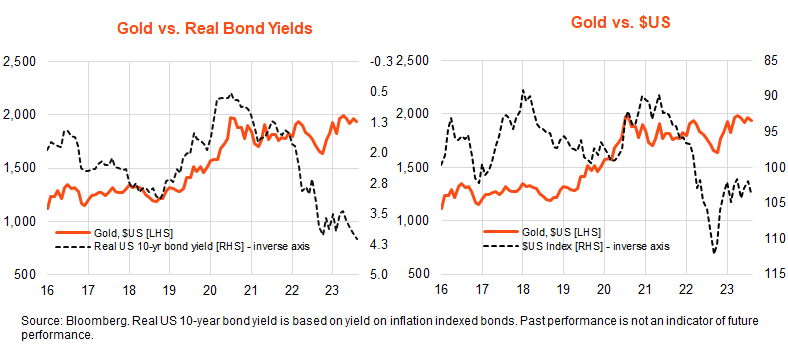

USD gold prices fell 1.3% in August, not helped by higher global bond yields and a firmer US dollar. Gold performance has inversely tracked that of bond yields and the US dollar in the past year. Gold prices weakened over 2022 as bond yields and the US dollar rose, then recovered when both eased from late last year. Accordingly, the rise in bond yields and stablisation of the US dollar has checked the rise of gold yields in recent months.

An eventual easing in bond yields and potentially weaker US dollar (due to improving risk sentiment) bodes well for a resumption of gold strength in the coming months, notwithstanding further likely declines in global inflation.

Growth assets

After defying the lift in bond yields earlier this year, global equities finally relented in August, with the MSCI All Country World Equity Index down 2.1% in local currency terms. Due to weakness in the AUD, however, global equities returned 1.1% in unhedged AUD terms.

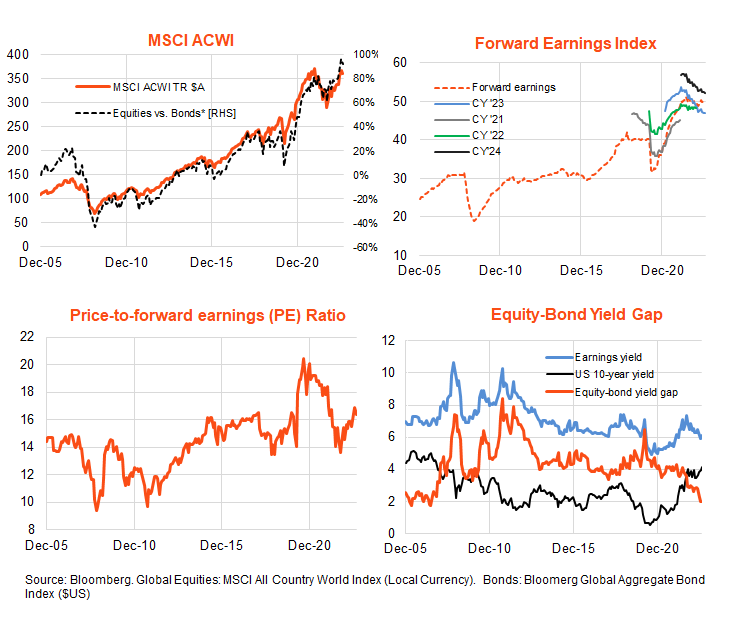

August’s equity decline reflected a pull-back in valuations, with the price-to-forward earnings ratio easing 2.8% from 16.9 to 16.4. After flattening out from mid-2022, forward earnings have started to inch higher in recent months – reflecting a levelling out in earnings growth and the higher level of earnings expected in 2024.

Despite the pullback in price-to-earnings ratios, the global equity risk premium of 2% is the lowest since June 2007. This reflects the fact that the market’s rebound since late last year has reflected a rebound in price-to-earnings ratios – with broadly flat forward earnings – while bond yields have yet to fall all that much.

With global inflation falling despite resilient economic growth, the risk of a central bank-induced global recession is easing, which suggests the bear market low in global stocks was indeed made late last year. That said, the very tight equity risk premium leaves stocks still vulnerable to at least a correction, due to either a downside growth and/or upside inflation scare, for example.

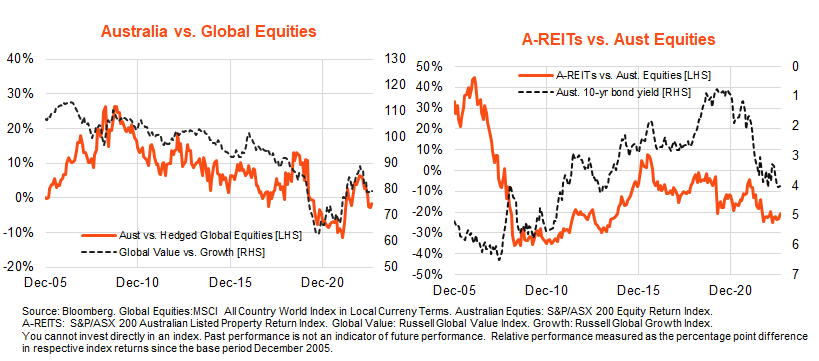

Australian equities held up a little better than (local currency valued) global equities in August, with the S&P/ASX 200 returns down 0.7%. That said, Australian equities have broadly underperformed global equities in recent months, in line with the global outperformance of growth/technology exposures compared to resources/value.

The relative Australian-global equity performance outlook is mixed – while declining global bond yields could favour ongoing outperformance of global equities due to their growth/technology exposure, global “soft landing” hopes might also see relatively cheap value markets such as Australia enjoy catch-up performance.

Listed property produced another positive return of 2.2% in August, likely supported by steadier local bond yields, though relative performance against the broader market remains under downward pressure. Notwithstanding some structural headwinds – such as reduced office vacancy rates – history suggests listed property should outperform once bond yields begin to decline on the back of expected RBA rate cuts.

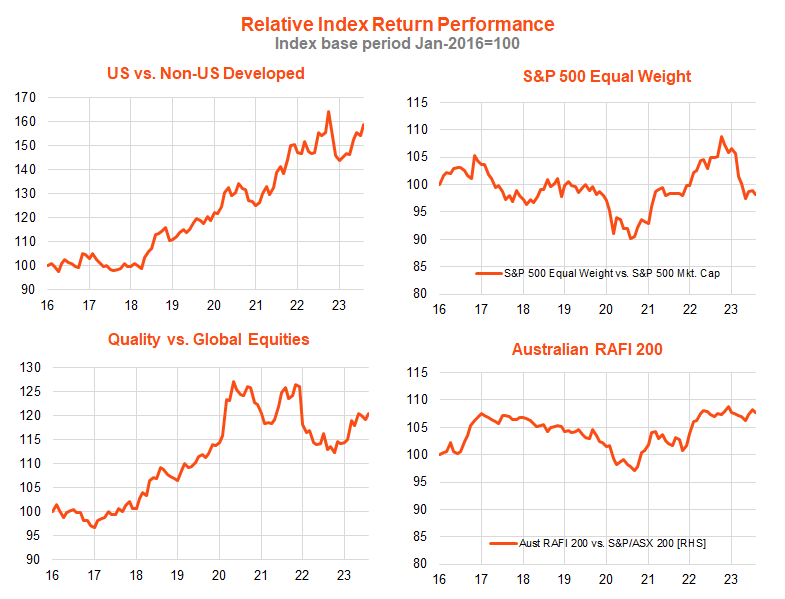

Global equity themes

Technology, quality, and US market themes have broadly tended to outperform since the global equity recovery from late 2022. That said, with hopes for a global soft landing increasing in recent months, a modest broadening in returns has been evident in recent months, with the relative performance of S&P 500 Equal Weight and Australia RAFI 200 indices stabilising against their market cap-weighted counterparts. Global quality and the US market continue to broadly outperform.

Source: Bloomberg. Indices: US: S&P 500. Non-US Developed: MSCI World, ex-US. Global Equities: MSCI ACWI. Quality: iSTOXX MUTB Global Ex-Australia Quality Leaders Index AUD Hedged. You cannot invest directly in an index. Past performance is not an indicator of future performance.

Source: Bloomberg. Indices: US: S&P 500. Non-US Developed: MSCI World, ex-US. Global Equities: MSCI ACWI. Quality: iSTOXX MUTB Global Ex-Australia Quality Leaders Index AUD Hedged. You cannot invest directly in an index. Past performance is not an indicator of future performance.

Further information on the complete range of Betashares exchange traded products can be found here.

David is responsible for developing economic insights and portfolio construction strategies for adviser and retail clients. He was previously an economic columnist for The Australian Financial Review and spent several years as a senior economist and interest rate strategist at Bankers Trust and Macquarie Bank. David also held roles at the Commonwealth Treasury and Organisation for Economic Co-operation and Development (OECD) in Paris, France.

Read more from David.