David Bassanese

Betashares Chief Economist David is responsible for developing economic insights and portfolio construction strategies for adviser and retail clients. He was previously an economic columnist for The Australian Financial Review and spent several years as a senior economist and interest rate strategist at Bankers Trust and Macquarie Bank. David also held roles at the Commonwealth Treasury and Organisation for Economic Co-operation and Development (OECD) in Paris, France.

5 minutes reading time

- Global

Global markets

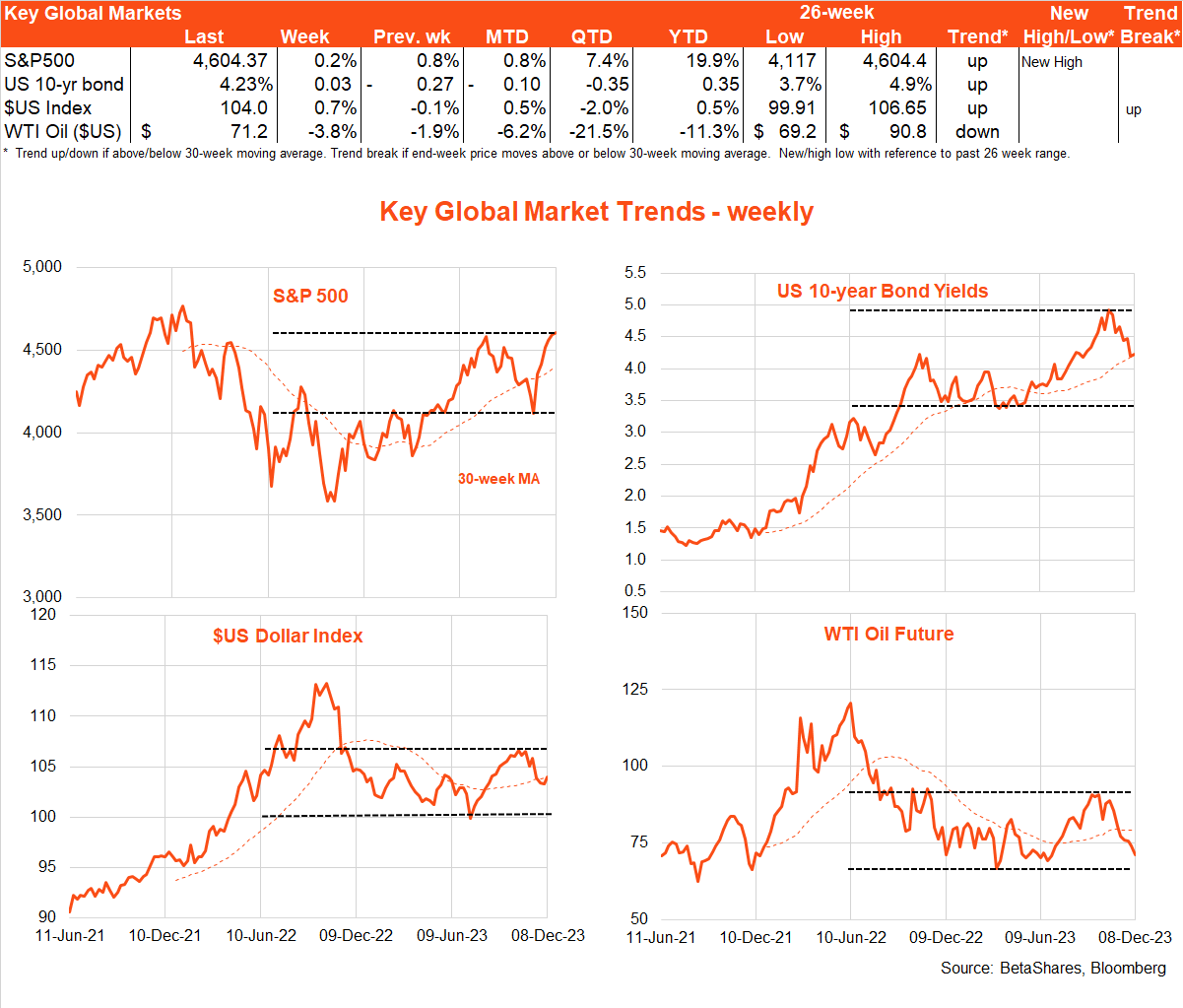

Global equities inched ahead for a sixth week in a row and bond yields edged higher as both equity and bond markets took a breather after strong gains over the past month. Underlying the renewed caution, markets may well be questioning the aggressiveness of the rate cuts now priced into the US market by early 2024 – especially given Friday’s solid employment report.

As evident in the chart set below, the S&P 500 touched a new 6-month high, while the still rangebound $US flipped back above its 30-week moving average.

Key global highlights last week only further confirmed what is now the ‘soft landing’ base case for the US economy.

Job openings fell by more than expected in October (8.7m job openings versus market expectations of 9.3m), while Friday’s payrolls report revealed continued good employment growth without runway wage inflation. The US added another 199k to the payrolls last month, while the unemployment rate ticked back down to 3.7% from 3.9%. Despite this strength, annual growth in average hourly earnings held steady at 4% – still arguably a touch high but at least in line with market expectations.

Further supporting the emerging Goldilocks scenario for 2024, oil prices dropped another 3.8% last week with markets losing confidence that OPEC will be able to support prices by reigning in supply. Also supporting global disinflation is China’s ongoing sluggish economy and return to modest consumer price deflation.

Key highlights this week include Tuesday’s US consumer price index (CPI) inflation report for November, which is expected to show a further gradual easing in inflation.

Headline CPI rises are expected to be flat, helped by lower fuel prices, which will edge down annual inflation from 3.2% to 3.1%. Core inflation (i.e. excluding food and energy) is expected to remain firm, with a 0.3% monthly gain which would keep annual core inflation steady at 4.0%.

In terms of core prices, while goods and housing inflation are expected to moderate further, of particular interest will be the degree to which services sector inflation remains sticky. That said, even if service inflation does remain high, there’s still the possibility of a good overall outcome if the moderation in goods and housing inflation is sufficiently great.

The other key global highlight this week will be Wednesday’s Fed meeting, at which rates are likely to remain firmly on hold once again. The key issue at the meeting – and subsequent press conference – will be the degree to which the Fed maintains the pretence of a tightening bias or more clearly moves to a neutral or even easing policy bias.

My expectation is that Fed chair Powell will once again push back against expectations for early rate cuts in 2024, though concede that rates may well have at least peaked. Indeed, the strength of Friday’s payrolls report might embolden Powell into attempting another ‘hawkish hold’ – whereby he leaves rates on hold though maintain a tightening policy bias. If so, that could give both equity and bond markets a further excuse to take profits following the strong rally since mid-October.

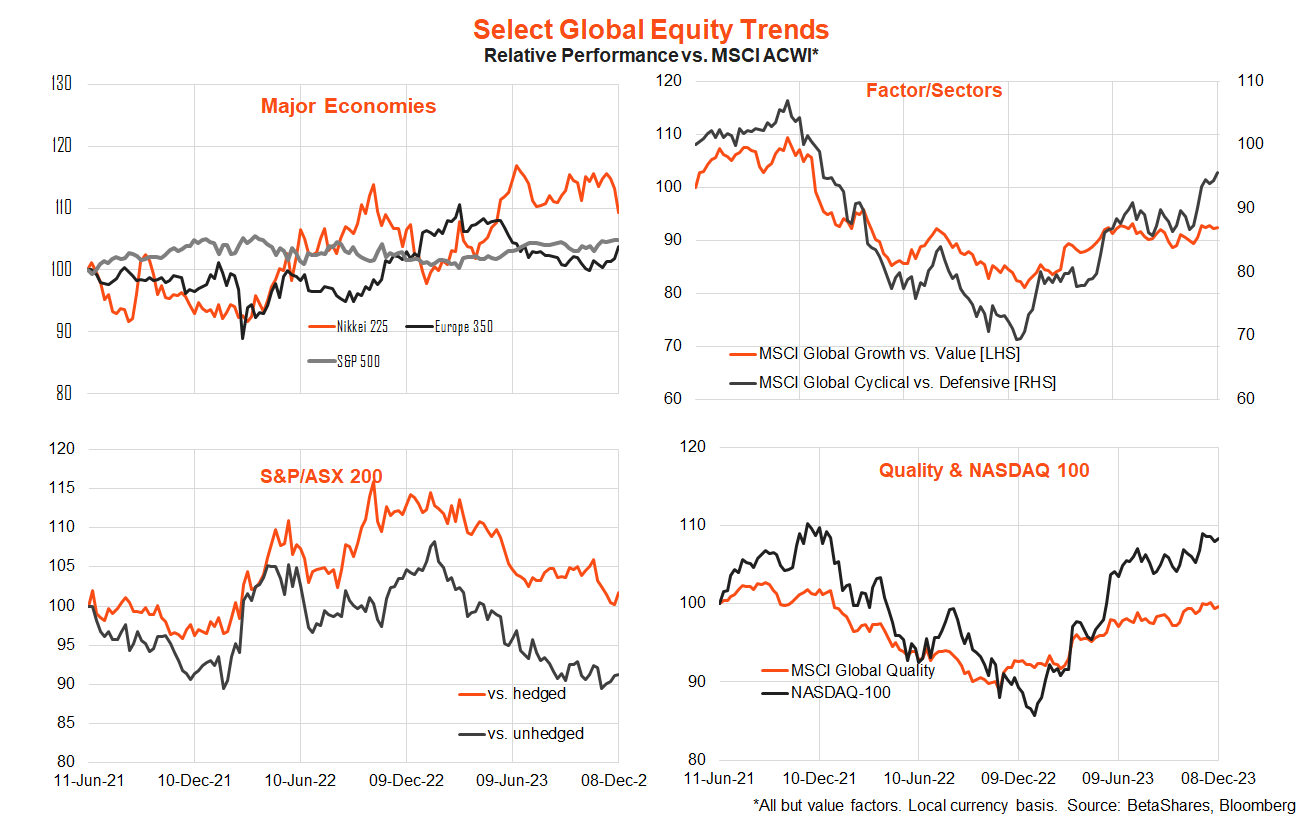

In terms of global equity trends, cyclicals are now starting to leave defensive sectors behind, while the relative strength of Japan appears to be wilting under the influence of recent Yen strength (or $US weakness!). Australia is still lagging while the relative performance of the NASDAQ-100 and global quality continues to grind higher.

That said, the relative performance of global growth versus value overall has been fairly flat since mid-year. While in the growth area technology stocks have done well, industrials and consumer discretionary has been less market beating. In value, meanwhile, financials have been holding up well even as energy has weakened.

Australian markets

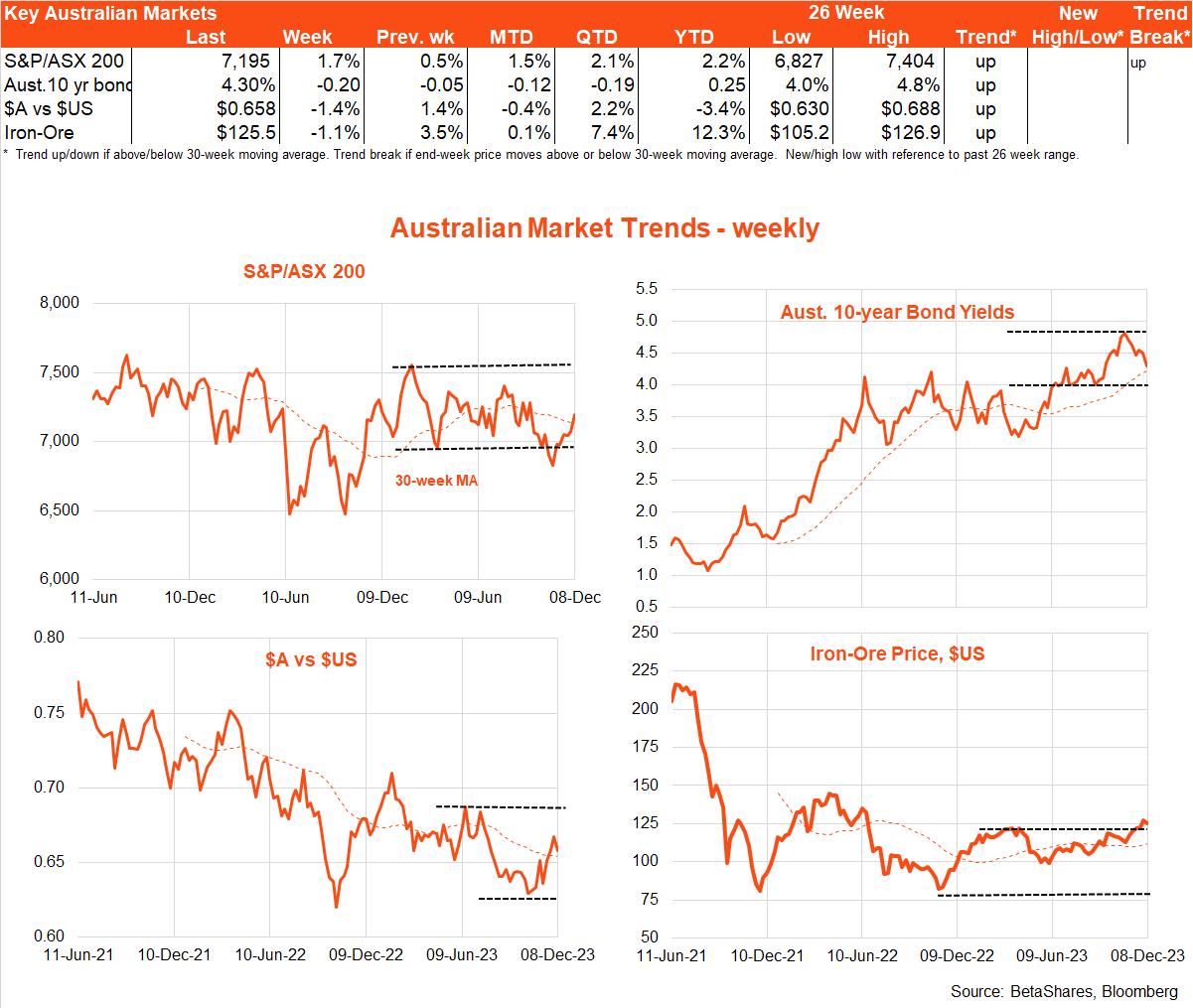

As widely expected, the RBA left rates on hold last week though retained a modest tightening bias. There is still a chance of another rate hike in February if the Q4 CPI in late January is uncomfortably high.

How high? Judging by the RBA’s recent policy reactions, anything high enough that would cause them to revise up their inflation forecasts. The RBA currently expects both headline and trimmed mean annual inflation to slow to 4.5% in the December quarter – which would require quarterly price increases for both of no more than 1% (compared to 1.2% for both in the September quarter). So a repeat of last quarter’s 1.2% gain (and possibly even 1.1%) – which I do not expect – would likely have the RBA hiking in February, but not otherwise.

In other key news last week, Q3 GDP growth was only 0.2% – or a bit softer than the market’s 0.4% expectation. Consumer spending remains weak – as expected – though there was also a fall back in business investment following the end of enhanced tax concessions at financial year end. Not helping household income or spending was the winding back of the temporary low and middle income tax offset (LMITO) that had been left in place for several years.

Key local highlights this week include the NAB monthly business survey tomorrow and the November labour market report on Thursday.

Business confidence has remained remarkably resilient this year despite the consumer slowdown – no doubt helped by the rebound in immigration and the infrastructure boom. Employment is expected to be fairly flat, however, after October’s blockbuster 55k gain – with the unemployment rate edging up to 3.8% from 3.7%. If so, it will confirm the long-anticipated labour market slowdown is gaining traction – which could have the RBA think twice about raising rates early next year even if the Q4 CPI is stubbornly firm.

Have a great week!

David is responsible for developing economic insights and portfolio construction strategies for adviser and retail clients. He was previously an economic columnist for The Australian Financial Review and spent several years as a senior economist and interest rate strategist at Bankers Trust and Macquarie Bank. David also held roles at the Commonwealth Treasury and Organisation for Economic Co-operation and Development (OECD) in Paris, France.

Read more from David.